How much can I make on Airbnb?

A simple way to estimate your Airbnb revenue is by multiplying the year-round occupancy rate and

your average daily rate of 10 Airbnb listings in your area. If they charge $150/night on average and

achieve a 70% occupancy rate, it's fair for you to assume that you will make around $150*0.70*365,

which is $38,325 before expenses and taxes.

Airbnb Occupancy Rate x Average Daily Rate x 365 = Your Airbnb Revenue

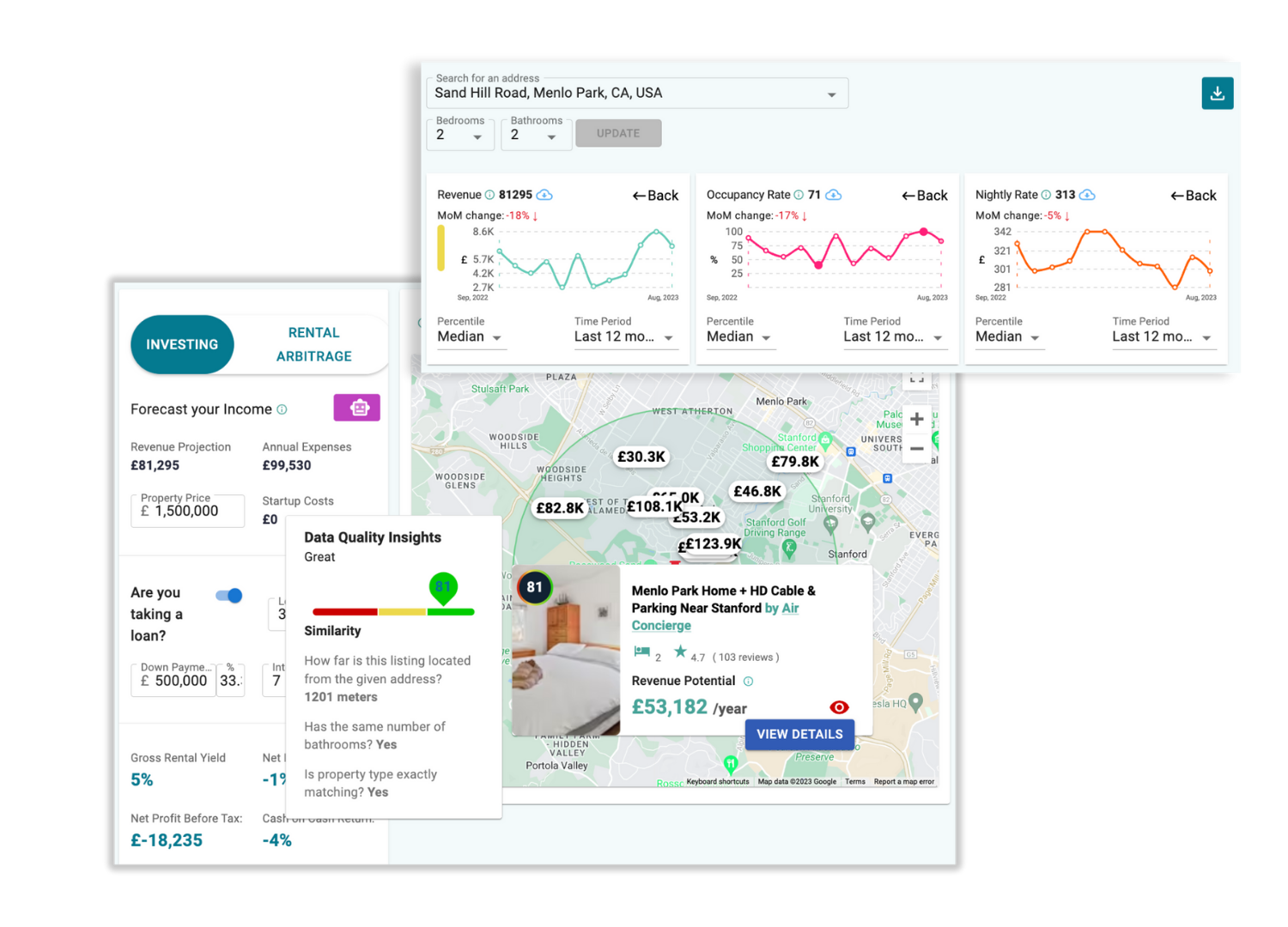

Enter any address on earth to access the following data points for free with full transparency:

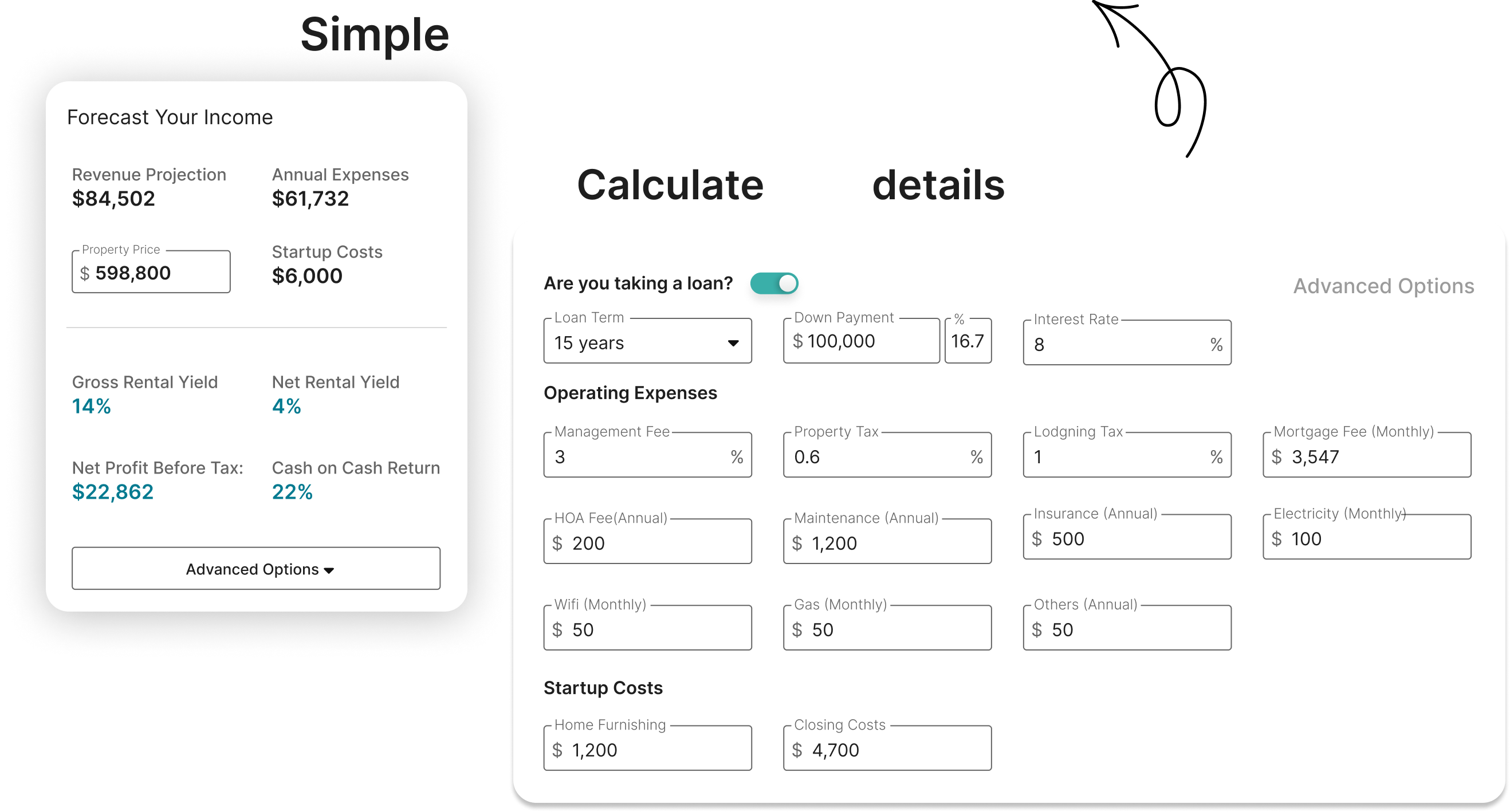

Currently, there is a lack of good STR (short-term rental ) calculators in the market, and the ones

that are available do not clearly show how they calculated the numbers. If you want to know how much

can you make on Airbnb, then use Airbtics' free Airbnb calculator to get a full transparent

computation of your potential Airbnb earnings based on 10 to 40 comps.

We believe that making data-based decisions should be easy and accessible for you. Whether you're an

Airbnb host, property manager, property investor, estate agent, or anything in between, access

valuable data most relevant to you and your business.