What Is Cash Flow in the Short-Term Rental Industry?

In the Airbnb rental industry, cash flow is defined as the amount of money left

over each month

after you collect your rental income and pay all expenses associated with managing a short-term

rental business. For a vacation rental host or property investor, this means taking your gross

revenue from nightly bookings, cleaning fees, and any upsells and then subtracting the operating

costs such as Airbnb’s service fee, cleaning costs, utilities, maintenance, property management,

insurance, and taxes.

Why Should You Invest in Positive Cash Flow Airbnb Rentals Only?

Positive cash flow means your property is generating profit and

can cover both operating costs and financial obligations.

Negative cash flow, on the other hand, signals that expenses are exceeding

income, which may indicate issues with pricing, occupancy, or cost management.

Tracking cash flow is one of the most important ways to measure the profitability and long-term

sustainability of a short-term rental business.

How to Calculate the Cash Flow on a Vacation Rental Property

Calculating the cash flow of an Airbnb rental property can be done by following these steps:

- Estimate gross income: Multiply the average nightly rate by the

occupancy

rate

and number of days in a month. Add any additional income such as cleaning fees, parking,

experiences, or upsells.

- Account for platform fees: Deduct Airbnb or other OTA service

fees, usually

around 3-15% depending on the platform.

- Subtract operating expenses: Include cleaning costs, utilities,

supplies,

maintenance, HOA dues, insurance, and property taxes.

- Factor in management fees: If you use a property manager, subtract

their

commission (commonly 10-30% of revenue).

- Calculate net cash flow: Subtract total expenses from gross

income. The

result

is your monthly cash flow.

Positive cash flow means your property is generating profit each month, while negative cash flow

signals that expenses are outweighing your earnings.

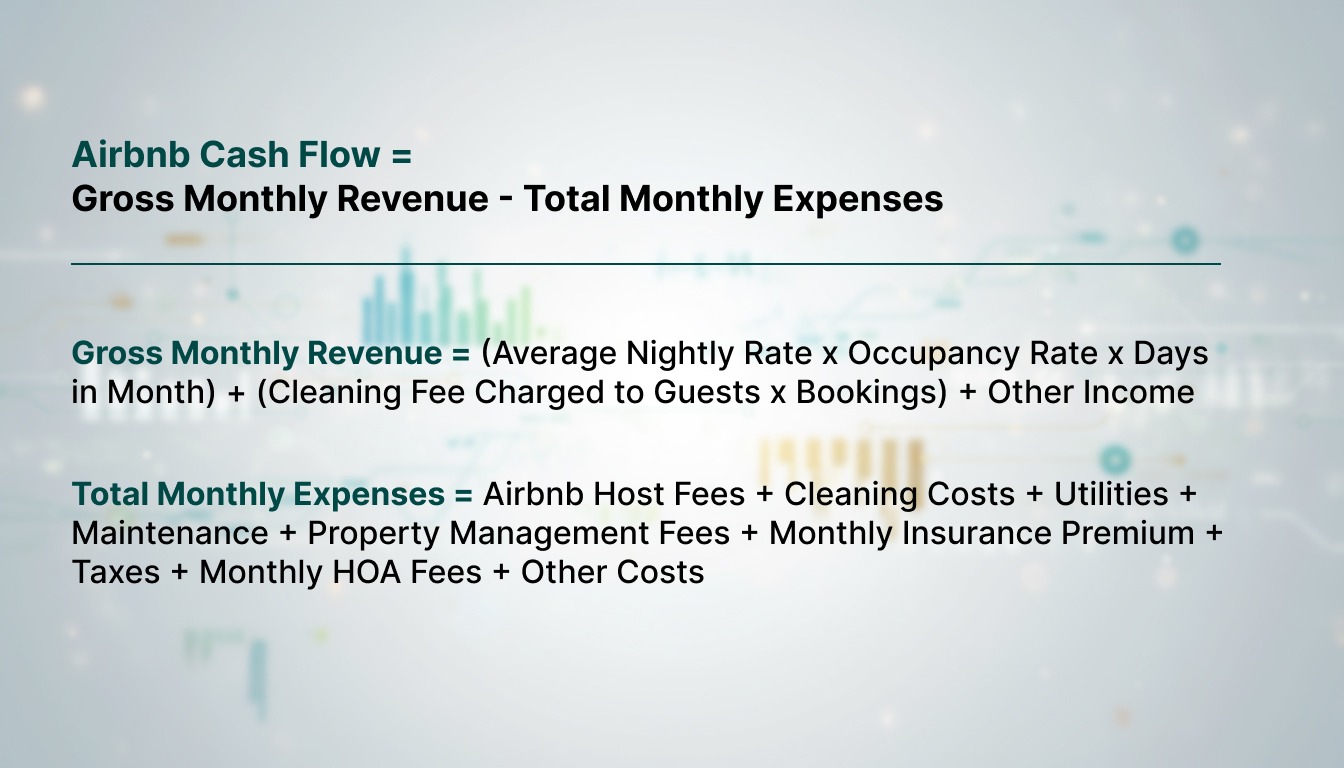

Cash Flow Formula

The formula investors can use to calculate the cash flow of a short-term rental property is:

Airbnb Cash Flow = Gross Monthly Revenue - Total Monthly Expenses

Where

- Gross Monthly Revenue = (Average Nightly Rate x Occupancy

Rate x Days in Month) + (Cleaning Fee Charged to Guests x Bookings) + Other Income

- Total Monthly Expenses = Airbnb Host Fees + Cleaning Costs

+ Utilities + Maintenance + Property Management Fees + Monthly Insurance Premium + Taxes +

Monthly HOA Fees + Other Costs

Cash Flow Calculation Example

Let's go through an example of calculating the cash flow of an Airbnb rental property to make things

clearer.

A vacation rental property is listed for an average daily rate (ADR) of $300 and gets 10 2-day

bookings. The cleaning fee is $60/booking, and there are no extra fees. The property is listed on

Airbnb, so the host fee is 3%, and other monthly expenses amount to $2,200.

Using the vacation rental cash flow formula:

Gross Monthly Revenue = $300 x 10 x 2 + $60 x 10 = $6,600

Total Monthly Expenses = $6,600 x 3% + $2,200 = $2,398

Airbnb Cash Flow = $6,600 - $2,398 = $4,202

So, the cash flow of this short-term rental property is $4,202 per month, which is a strong positive

cash flow.

What Is an Airbnb Rental Cash Flow Calculator?

A cash flow calculator is an Airbnb analytics tool that helps investors and hosts quickly and

accurately estimate the expected cash flow of a property they own or plan to buy without the need

for tedious manual calculations. In this way, you can ensure positive cash flow investments.

Why Airbtics Has the #1 Airbnb Rental Property Cash Flow Calculator

Airbtics offers a free cash flow calculator that helps investors confidently predict the cash flow

of any Airbnb property around the world prior to purchasing it. While eliminating the need for Excel

spreadsheets prone to human error, this calculator provides positive cash flow vacation rental

property investments.

To maximize the accuracy of the Airbtics' rental cash flow calculator, you can combine it with the

power of the Airbtics' short-term rental data to estimate the cash flow of any vacation rental

worldwide.

How Does the Best Cash Flow Calculator for Airbnb Rental Investors Work?

Using the Airbtics' short-term rental property calculator is easy. All you have to

do is to:

- Enter the revenue data for the property.

- Fill in the cost numbers.

- Click "Calculate".

The input data includes:

- Daily rate

- Occupancy rate

- Days available

- Cleaning fee

- Number of bookings

- Extra fees (cleaning fees, pet fees, extra guest fees, etc.)

- Monthly mortgage payment

- Platform fees

- Cleaning costs

- Insurance

- Taxes

- Utilities

- Guest supplies

- Property management fees

- Other costs

The output is the monthly cash flow you can expect from the Airbnb rental property.

Key Benefits of the Top Cash Flow Calculator

The main advantages of using the Airbtics' free cash flow calculator for Airbnb rental properties

include:

Quick Profitability Check

Instantly see whether a property is likely to generate positive cash flow before you commit.

Data-Driven Accuracy

Leverage Airbtics' market insights on occupancy and nightly rates for realistic revenue

projections.

Expense Transparency

Understand the impact of Airbnb fees, cleaning, utilities & management costs on your bottom

line.

Scenario Testing

Adjust inputs like nightly rate or occupancy to compare best- and worst-case outcomes.

Investment Confidence

Make smarter purchase decisions by basing them on projected returns, not guesswork.

Time Savings

Skip manual spreadsheets and get clear cash flow estimates in seconds.

How to Invest in Positive Cash Flow Airbnb Rental Properties

Finding positive cash flow real estate investments to list on Airbnb goes through the following

steps:

- Find a top-performing market using the Airbtics.

- Locate a profitable submarket by looking at key performance data metrics.

- Identify the optimal property type, property size, and amenities.

- Confirm positive cash flow with the help of the Airbtics' Airbnb cash flow

calculator.