How to Calculate Cash on Cash Return in Real Estate

To calculate the cash on cash return of a rental property, follow this step-by-step approach:

- Determine the annual rental income.

- Calculate the annual operating expenses.

- Get the annual loan payments.

- Subtract the annual operating expenses and the annual loan payments from the annual rental

income to get the annual pre-tax cash flow.

- Add up the total cash invested including the down payment, closing costs, and upfront

renovations.

- Divide the annual pre-tax cash flow by the total cash invested and multiply by 100 to get the

cash on cash return as a percentage.

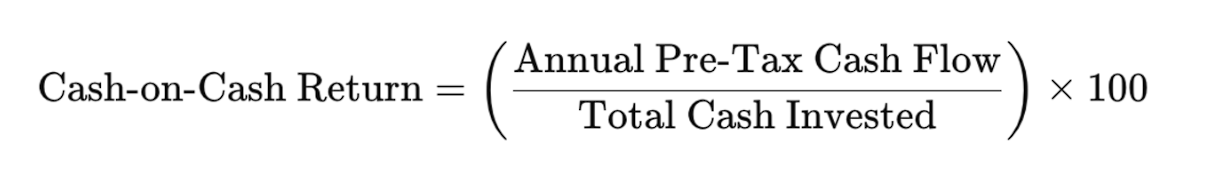

Calculating cash on cash return for real estate properties is done using the following formula:

Cash on Cash Return Formula

Cash on Cash Return Equation

Cash on Cash Return = ((Annual Pre - Tax Cash Flow) / Total Cash Invested) × 100%

Where

- Annual pre-tax cash flow refers to the total income generated from the property

over

the course of a year (including rental income and other potential sources of revenue)

minus the net operating expenses and annual mortgage payments.

- Total cash invested presents all cash investments in the property including the

down

payment, closing costs, and repairs.

As you can see from the formula, calculating cash on cash return is not easy as it requires

multiple steps. Moreover, to be successful, you need to rely on accurate, up-to-date sources of

real estate and rental data.

To make things clearer, let's take a look at a real-time example:

Cash on Cash Return Calculation Example

Let's look at two examples: 1) With financing and 2) Without financing.

Example 1:

An investor buys a property priced at $500,000 with a $100,000 down payment. He pays

$20,000 in closing costs and initial repairs. The rental income is $3,500/month. The monthly

operating costs are $500, and the monthly mortgage payment is $1,300.

- Annual Pre-Tax Cash Flow = (12 × $3,500) - (12 × $500) - (12 × $1,300) = $20,400

- Total Cash Invested = $100,000 + $20,000 = $120,000

- Cash on Cash Return = ($20,400 / $120,000) × 100% = 17%

So, the property has a CoC return of 17% if the investor uses financing.

Example 2:

The investor buys the property all in cash and spends $18,000 in closing costs and renovations.

The monthly rental income is $3,500, and the operating expenses are $500/month.

- Annual Pre-Tax Cash Flow = (12 × $3,500) - (12 × $500) = $36,000

- Total Cash Invested = $500,000 + $18,000 = $518,000

- Cash on Cash Return = ($36,000 / $518,000) × 100% = 6.95%

So, the rental property generates a CoC return of 6.95% if the investor buys it in cash.

This example clearly shows that the method of financing has a major impact on the cash on

cash return of a rental property.