DSCR Calculator

Instantly See Your Rental Property's Estimated DSCR

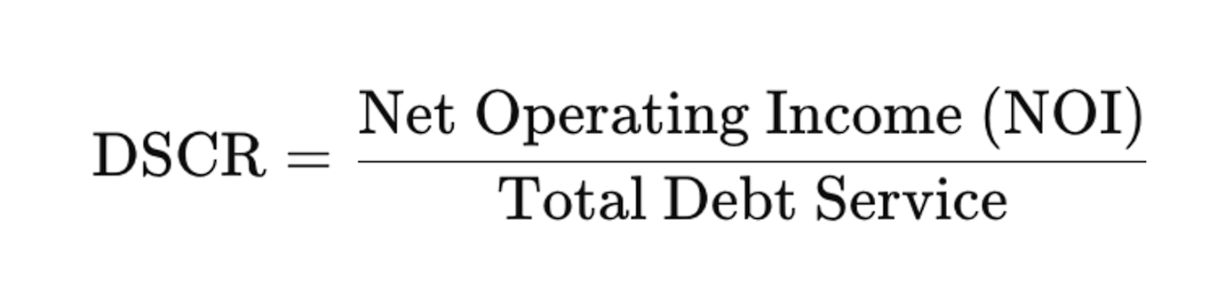

DSCR Definition, Formula, and Example

DSCR Definition, Formula, and Example

DSCR (Debt Service Coverage Ratio) is a financial metric used to evaluate a property's ability to generate enough income to cover its debt obligations. It’s widely used by lenders to assess the risk of financing a real estate investment.

What is a good DSCR in real estate?

Generally, 1.5 DSCR is often seen as good for real estate investors, but it depends on the specifics of the market and your investment strategy.

For short-term rental strategy, 2.0 DSCR is considered high.

One common reason to go for low DSCR is to invest in a real estate with high appreciation potential. DSCR could be below 1, meaning your cashflow is negative, but some investors still choose to keep the property to sell at a higher price in the future.

To evaluate a DSCR, you also need to consider the property's appreciation factor, risks, and opportunity cost.