Best Places in Alabama for Airbnb: Where to invest in rental properties near Birmingham?: Investing in the best places to Airbnb near Birmingham, Alabama can help you to achieve the desirable financial freedom. Learn more here!

Home > Resources > Airbnb Investment >

Best Places in Alabama for Airbnb: Where to invest in rental properties near Birmingham?

Best Places in Alabama for Airbnb: Where to invest in rental properties near Birmingham?

Investing in the best places to Airbnb near Birmingham, Alabama can help you to achieve the desirable financial freedom. Learn more here!

- Last updated on

- August 18, 2023

Key Takeaways

- Birmingham’s stable economy, growing population, and cheap cost of living have helped plenty of Airbnb hosts & investors to generate a nice rental income.

- Learn the top reasons why buying a property investment in Alabama can become a financially rewarding experience for investors.

- Get a glimpse of the most lucrative neighborhoods and nearby cities in Birmingham, AL while discovering their Airbnb data and recommended property sizes.

Introduction

You must have heard the melody of Sweet Home Alabama, right? But there’s much more about this beautiful state than the chorus of this song. Alabama is a land full of rich history, culture, and offers plenty of adventures!

Among the major cities of Alabama, we can find the most populous metropolitan area, Birmingham, which is bordered by the imposing Appalachians. Birmingham is a charming city filled with entertaining experiences. This is one of the main reasons why visitors come back without hesitation.

In this blog, we’ll open the doors for you to discover the best places to invest in Airbnb near Birmingham, Alabama. We also noted some of the advantages that real estate investors can have when buying a rental property in this location. Interested in learning more? Then continue reading.

Why should you consider investing in rental properties in Alabama?

Investing in short-term rentals in Alabama is an excellent plan since you can achieve financial freedom. This city also offers a variety of opportunities to real estate investors.

Yet, there’s an important question – what kind of advantages does this state offer to real estate investors? Check out some of the top reasons why you should consider investing in Alabama’s real estate market:

Strong economy & low unemployment rate

Alabama is an innovative state with a healthy economy that is mainly driven by industries like real estate, manufacturing, healthcare, aerospace, and tourism. The state’s GDP reached $206.9B in 2022 as confirmed by IBISWorld. In addition to this, the unemployment rate in the state is currently 2.5%, which is lower than the national average.

If we dive deeper, we can find that the metropolitan area of Birmingham is home to many big corporations like Regions Financial Corporation, Coca-Cola Bottling Company, and Brasfield & Gorrie. These companies provide a great number of great job opportunities that make young professionals relocate to the city.

Affordable cost of living

The state of Alabama enjoys a strong & diverse economy and its population is steadily growing. On top of that, the state also has one of the lowest property taxes in the US. Considering this, its rental market experiments a strong demand.

Alabama’s overall cost of living is lower than the national average and in most cities, the median housing price is also cheaper. For example, in major cities like Birmingham, the median house value is $95K, $127K in Montgomery, and $168K in Mobile.

Rich history and plenty of leisure options

Alabama is a state that blends history, culture, and adventures together with fantastic natural surroundings while great music plays in the background. So it’s understandable that over 28M people visit the city every year.

From interesting museums to great restaurants, beaches and mountains, Alabama surely has something for everyone. In fact, it has a great location as it is bordered by the Gulf of Mexico in the southern area while the northern parts of the state are mostly mountainous as it’s flanked by the Appalachian mountains.

Is Airbnb Profitable in Birmingham, AL?

Wondering if Airbnb real estate investments are worth it? Don’t worry because Airbtics confirms that investment properties in Birmingham are certainly beneficial!

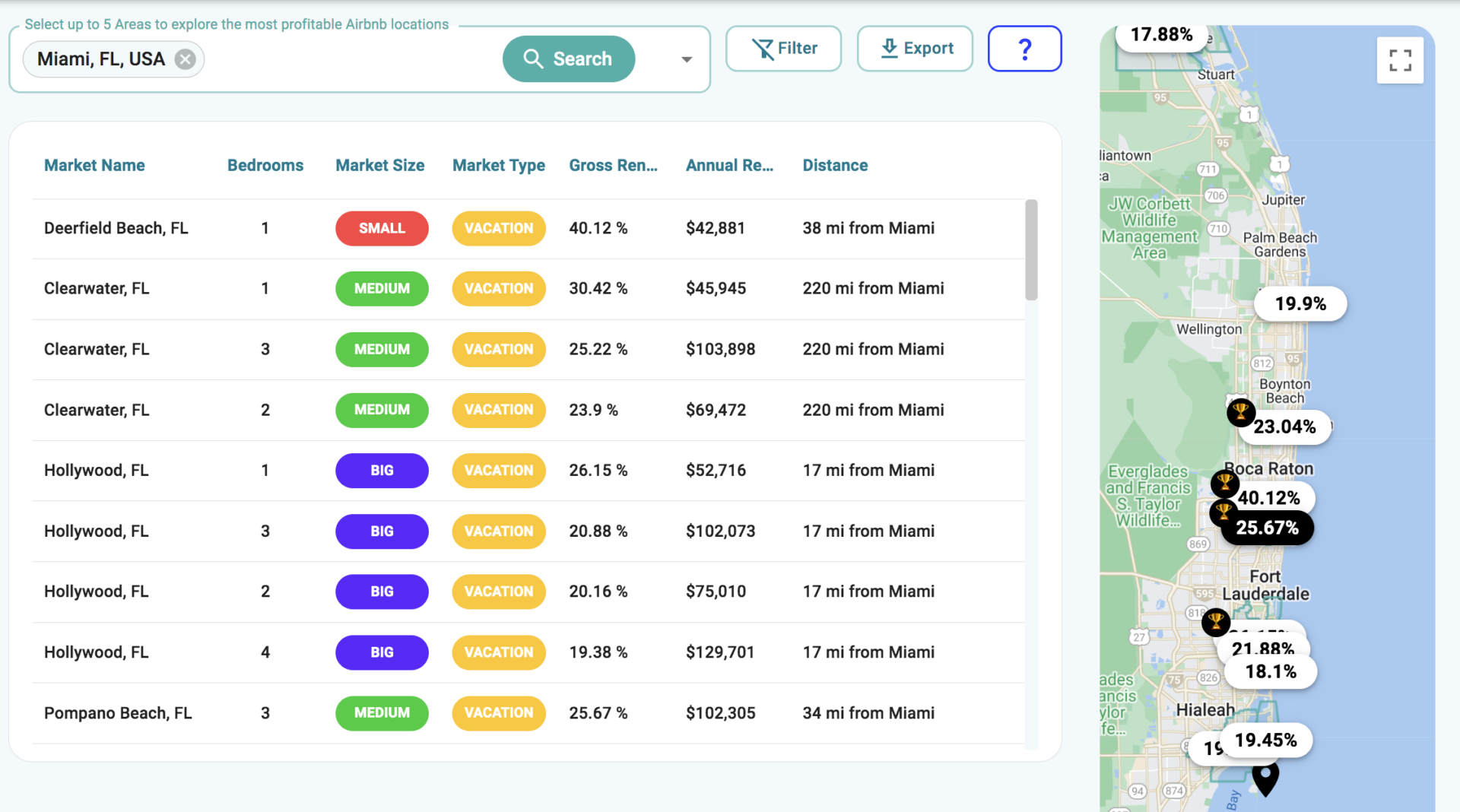

It also shows that the nearby areas in Alabama can be a great way to generate a good rental income. But don’t go too fast because analyzing factors like the ideal property type and location are essential to generate high profitability.

Based on Airbtics’ data, an Airbnb host can earn up to $63,020 with an average occupancy rate of 60% for managing a 4-bedroom property in Birmingham.

Source: Airbtics Dashboard

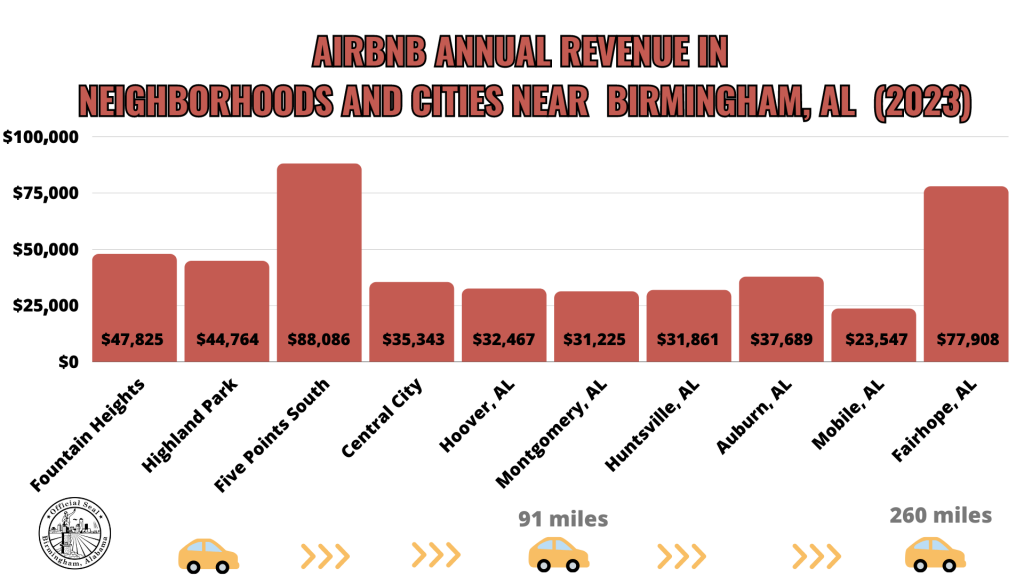

Top Locations to Invest in Rental Properties around Birmingham, Alabama

Birmingham is the largest metropolitan area in the state of Alabama, which is divided into 23 communities and has over 99 designated neighborhoods. Considering this, it can be challenging to choose the right location for your rental property.

Check out the best neighborhoods and nearby cities in Birmingham, Alabama, that are highly recommended for starting an Airbnb business:

|

|||||

|---|---|---|---|---|---|

| Location | Number of Airbnb Listings | Best Number of Bedrooms | Median Property Price | Airbnb Annual Revenue | GRY |

| Fountain Heights, Birmingham | 28 | 2 Bedrooms | $125,000 (2 BD) | $47,825 | 38.26% |

| Highland Park, Birmingham | 39 | 2 Bedrooms | $229,000 (2 BD) | $44,764 | 19.55% |

| Five Points South, Birmingham | 105 | 4 Bedrooms | $484,900 (4 BD) | $88,086 | 18.17% |

| Central City, Birmingham | 36 | 1 Bedroom | $239,900 (1 BD) | $35,343 | 14.73% |

| Hoover, AL (10 mi away) | 64 | 2 Bedrooms | $160,000 (2 BD) | $32,467 | 20.30% |

| Montgomery, AL (91 mi away) | 176 | 2 Bedrooms | $115,000 (2 BD) | $31,225 | 27.15% |

| Huntsville, AL (101 mi away) | 344 | 3 Bedrooms | $185,000 (3 BD) | $31,861 | 17.22% |

| Auburn, AL (110 mi away) | 122 | 2 Bedrooms | $205,000 (2 BD) | $37,689 | 18.38% |

| Mobile, AL (257 mi away) | 231 | 1 Bedroom | $110,000 (1 BD) | $23,547 | 21.41% |

| Fairhope, AL (260 mi away) | 98 | 2 Bedrooms | $275,000 (2 BD) | $77,908 | 28.85% |

Airbnb Location

Airbnb Dataset

- Total Number of Airbnb Listings: 28

- Best bedroom size: 2 bedrooms

- Median property price (2 bedrooms): $125,000

- Airbnb Annual revenue: $47,825

- Gross rental yield: 38.26%

- Total Number of Airbnb Listings: 39

- Best bedroom size: 2 bedrooms

- Median property price (2 bedrooms): $229,000

- Airbnb Annual revenue: $44,764

- Gross rental yield: 19.55%

- Total Number of Airbnb Listings: 105

- Best bedroom size: 4 bedrooms

- Median property price (4 bedrooms): $484,900

- Airbnb Annual revenue: $88,086

- Gross rental yield: 18.17%

- Total Number of Airbnb Listings: 36

- Best bedroom size: 1 bedroom

- Median property price (1 bedroom): $239,900

- Airbnb Annual revenue: $35,343

- Gross rental yield: 14.73%

- Distance from Birmingham: 10 miles

- Total Number of Airbnb Listings: 64

- Best bedroom size: 2 bedrooms

- Median property price (2 bedrooms): $160,000

- Airbnb Annual revenue: $32,467

- Gross rental yield: 20.30%

- Distance from Birmingham: 91 miles

- Total Number of Airbnb Listings: 176

- Best bedroom size: 2 bedrooms

- Median property price (2 bedrooms): $115,000

- Airbnb Annual revenue: $31,225

- Gross rental yield: 27.15%

- Distance from Birmingham: 101 miles

- Total Number of Airbnb Listings: 344

- Best bedroom size: 3 bedrooms

- Median property price (3 bedrooms): $185,000

- Airbnb Annual revenue: $31,861

- Gross rental yield: 17.22%

- Distance from Birmingham: 110 miles

- Total Number of Airbnb Listings: 122

- Best bedroom size: 2 bedrooms

- Median property price (2 bedrooms): $205,000

- Airbnb Annual revenue: $37,689

- Gross rental yield: 18.38%

- Distance from Birmingham: 257 miles

- Total Number of Airbnb Listings: 231

- Best bedroom size: 1 bedroom

- Median property price (1 bedroom): $110,000

- Airbnb Annual revenue: $23,547

- Gross rental yield: 21.41%

- Distance from Birmingham: 260 miles

- Total Number of Airbnb Listings: 98

- Best bedroom size: 2 bedrooms

- Median property price (2 bedrooms): $275,000

- Airbnb Annual revenue: $77,908

- Gross rental yield: 28.85%

Source: Airbtics Dashboard

Summary

In conclusion, Birmingham offers a few profitable neighborhoods, but there are also a variety of cities in Alabama offering interesting investment opportunities. Investors are usually keen on discovering these as they provide good rental yields and revenue. On top of that, the housing market in Alabama is fairly affordable compared to other states in the country.

While knowing the top areas to buy a rental property in Alabama is a great way to start your journey, it’s always important to analyze all metrics carefully. Thus, you should go ahead and check the Airbnb markets in other profitable US cities!

Moreover, we recommend you to take advantage of the digital era and step up to the next level by making use of the best analytics tools to boost your earnings. Check our Airbnb income calculator and stand among your competitors now!

Short-Term Rental Data

Short-Term Rental Data

-

Quick Links

Keep Reading

Annual Airbnb Revenue in Bonita springs florida, USA

Bonita Springs, Florida| Airbnb Market Data & Overview | USA Bonita Springs, Florida Airbnb Market Data & Overview USA Is it profitable to do Airbnb …

Annual Airbnb Revenue in Ocean city new jersey, USA

Ocean City, New Jersey| Airbnb Market Data & Overview | USA Ocean City, New Jersey Airbnb Market Data & Overview USA Is it profitable to …

Annual Airbnb Revenue in Kittery maine, USA

Kittery, Maine| Airbnb Market Data & Overview | USA Kittery, Maine Airbnb Market Data & Overview USA Is it profitable to do Airbnb in Kittery, …

Annual Airbnb Revenue in Rockville maryland, USA

Rockville, Maryland| Airbnb Market Data & Overview | USA Rockville, Maryland Airbnb Market Data & Overview USA Is it profitable to do Airbnb in Rockville, …

Annual Airbnb Revenue in Middletown connecticut, USA

Middletown, Connecticut| Airbnb Market Data & Overview | USA Middletown, Connecticut Airbnb Market Data & Overview USA Is it profitable to do Airbnb in Middletown, …

Annual Airbnb Revenue in Clifton new jersey, USA

Clifton, New Jersey| Airbnb Market Data & Overview | USA Clifton, New Jersey Airbnb Market Data & Overview USA Is it profitable to do Airbnb …