Discover key tips on housing options, costs, and safety for international students. Learn how to find comfortable, budget-friendly accommodations during your exciting study abroad journey.

Category: All About Airbnb

If you’re a digital nomad, you probably love the freedom to travel, bouncing between cities, co-working cafés, and new experiences. But after a while, it’s natural to want something a little more permanent. A base. A home you return to every year.

Find the best housing options for international students. Compare dorms, shared flats, and other choices to fit your budget and lifestyle while studying abroad.

Why Tech Bros Are Investing in Airbnb’s

Why Tech Bros Are Investing in Airbnb’s

This article will explain the steps and legal requirements for buying a villa in Bali, including what foreign buyers need to know before making an investment. Home > Resources > Airbnb Investment > Airbnb Investment This article will explain the steps and legal requirements for buying a villa in Bali as a foreign investor. Can You […]

Toronto’s population is growing fast, and with the housing crisis, property prices keep climbing, especially when more people want to buy than sell. This keeps the city’s real estate market super strong. Even during the recession, Toronto’s unemployment rates remained relatively low, and rental prices were stable. This is because the city has fantastic economic […]

Ever wondered how to tap into renting out property in the vacation rental industry without the significant financial burden of owning real estate? You’re not alone. Many investors are turning to creative solutions to launch their vacation rental properties with minimal start-up costs.

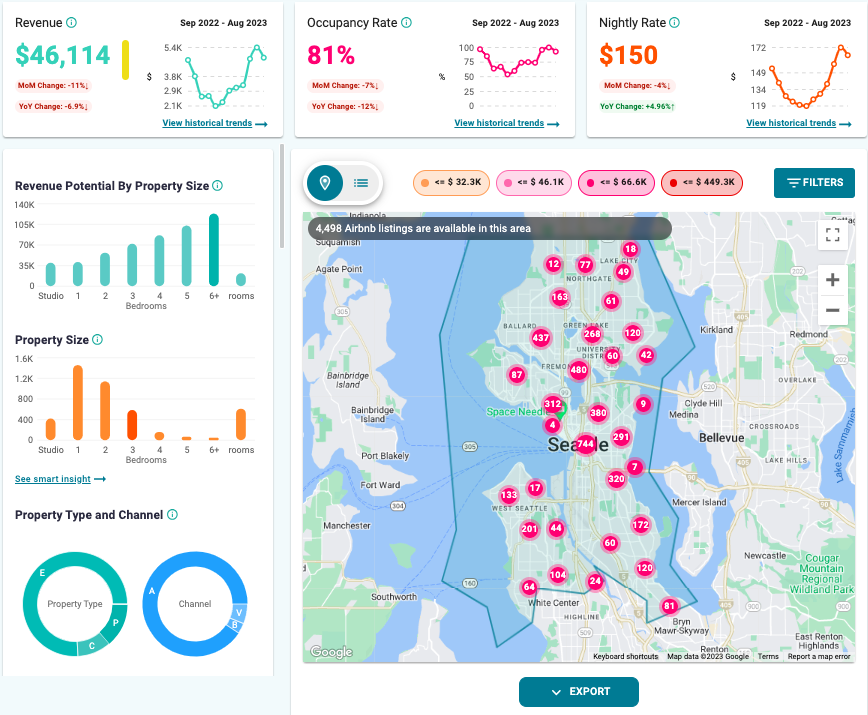

I first used AirDNA back in 2019 to find the most profitable London boroughs for my Airbnb Arbitrage business.

Investing in short-term rental is buying the most stable asset (which is housing) with rental profit twice higher than traditional rentals.