I first used AirDNA back in 2019 to find the most profitable London boroughs for my Airbnb Arbitrage business.

I first used AirDNA back in 2019 to find the most profitable London boroughs for my Airbnb Arbitrage business.

Investing in short-term rental is buying the most stable asset (which is housing) with rental profit twice higher than traditional rentals.

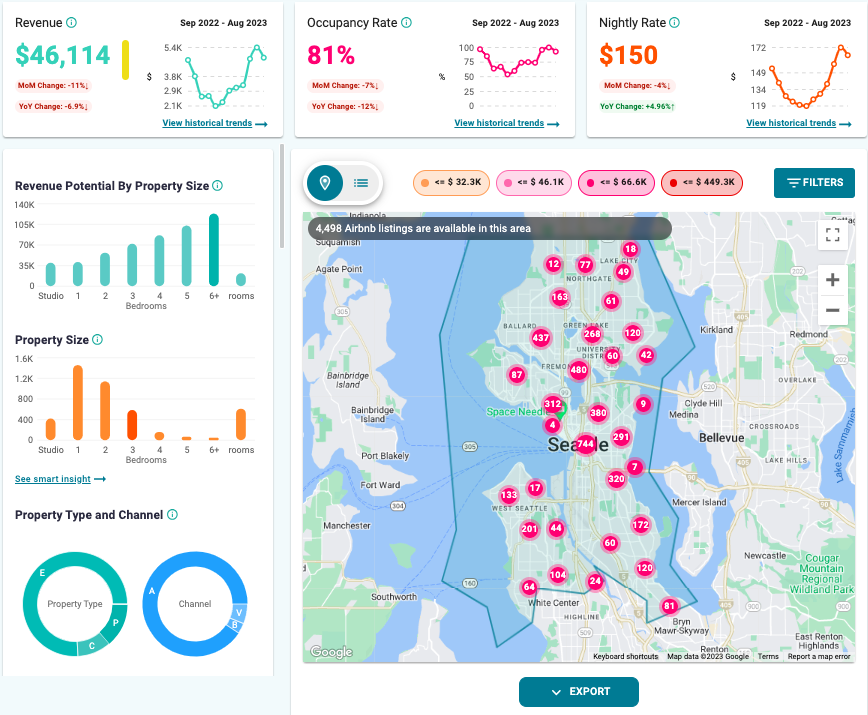

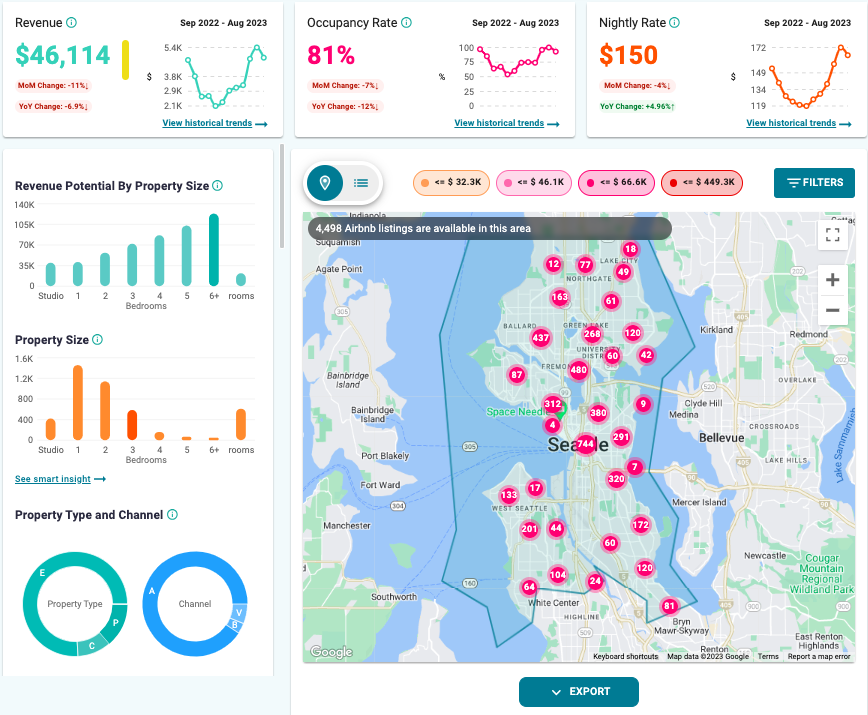

I’ve analyzed the profitability of 12 US Airbnb markets. The primary factor is how much you will make in 10 years from an average short-term rental investment in a market. I discovered markets from 350% return in 10 years to 150% return.

How to Short Term Rental Analysis to Find Profitable Airbnb Markets with 425%+ 10-Year Returns [For Property Investors] Residential property investment is one of the lowest-risk investments. But did you know you can achieve a 10% net rental yield by listing your property on Airbnb? By combining property appreciation and high cash flow, you can […]

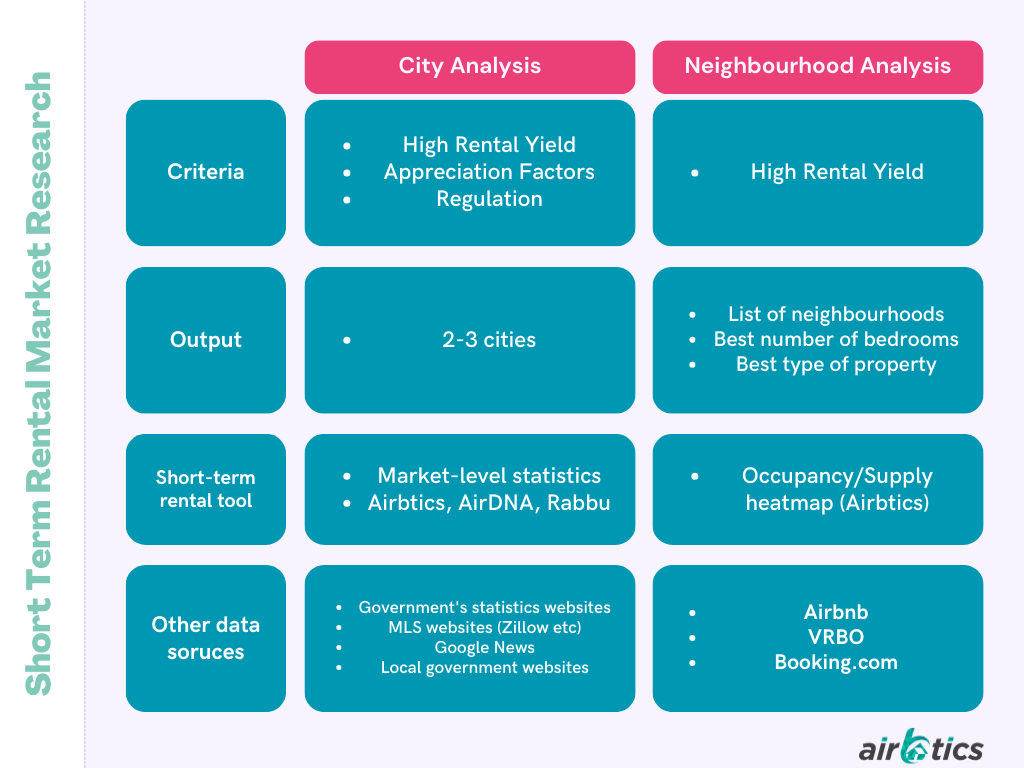

Beginner friendly! This is the complete Airbnb market research guide for property investors. 1. City analysis (high rental yield, appreciation, and regulations) 2. Neighborhood analysis

Instantly See An Average Airbnb Occupancy Rate Discover 30+ Airbnb statistics of any city worldwide! Estimate What Is Occupancy Rate? It is the percentage of nights booked among the available nights on an Airbnb listing. How can you find the average occupancy rate of your market? How to find Airbnb Occupancy Rates? Simply enter an […]

4 steps to have a successful first Airbnb arbitrage property. What is Airbnb arbitrage? You rent a property from a landlord, furnish it, and list it on Airbnb. You earn more than what you pay to the landlord.

Learn how you can get Airbnb historical data within specific markets and their common use cases from this article! Home > Resources > Guides > 3 Companies Providing Airbnb Historical Data. (+Top use cases) Guides 3 Companies Providing Airbnb Historical Data. (+Top use cases) Learn how you can get Airbnb historical data within specific markets and […]

5 Markets – Standard Plan Deal for New Users: Before $149 | Black Friday Coupon: BF2022 Only for $299 Get full access to 5 regions’ data for only $99 for a limited time. The dashboard presents a region’s emerging markets and simulates cash returns using an Airbnb income calculator, along with weekly data updates, and […]

30 Markets – Enterprise Plan Deal for Existing Users: Before $599 | Black Friday Coupon: Only for $299 Full dashboard access to 30 markets with 12 months of historical data of up to 600,000 short-term rentals. Consult with our team for an exclusive property sourcing service giving you at least 5 high-income potential property deals […]