Investing in short-term rental is buying the most stable asset (which is housing) with rental profit twice higher than traditional rentals.

- Last updated May 7, 2024

Investing in short-term rental is buying the most stable asset (which is housing) with rental profit twice higher than traditional rentals. Considering buying a short-term rental property? You are at the right blog.

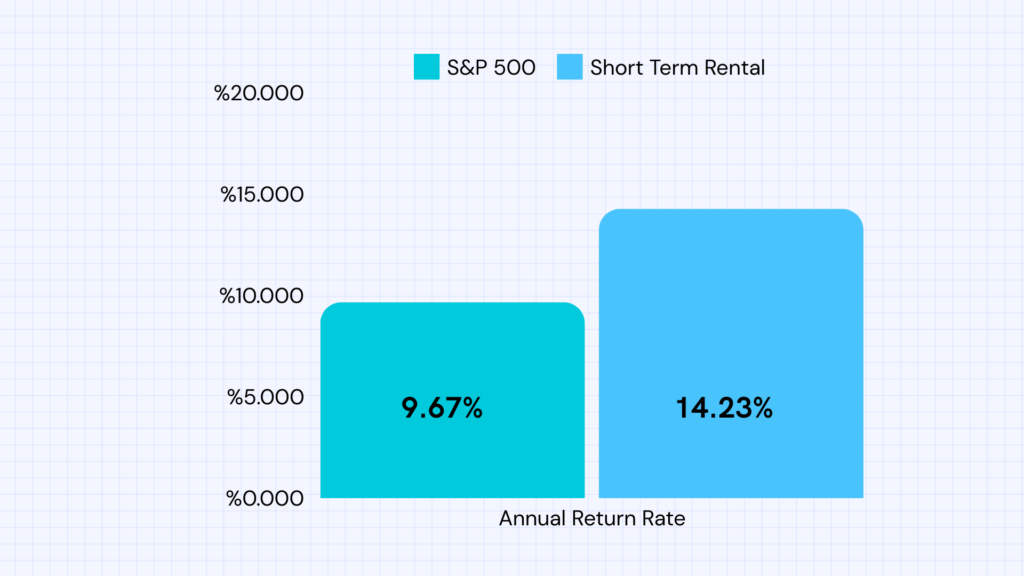

Housing has been the best-performing asset class in history, according to research tracking various assets over 145 years. Better than stocks. This was documented going back to 1870 in a 2017 paper from the Federal Reserve Bank of San Francisco titled The Rate of Return on Everything, 1870-2015. The average real return on global housing from 1870 to 2015 was 7.05% compared to 6.89% for equities. The housing return also came with a substantially lower standard deviation – meaning less risks.

However, real estate has some unique limitations, making it impossible for any individual investor to access safe and high returns. Foremost, the paper assumed that you invested in 16 countries at the same time, and managed the properties efficiently without any gaps in long-term tenants. Sounds easy, right? But here’s a little secret: Individual investors can compensate for the lower rate of return by investing in short term rentals. Even just renting out as a short-term rental for 5 years can compensate for your average return. Let’s analyze why short term rental investment has incredibly good return with low risk.

Airbnb Profitability Analysis in Savannah, GA (Example)

It is important to note that the real estate return includes both the asset’s price increase and the net rental income. Each makes up about half of the total return according to the research.

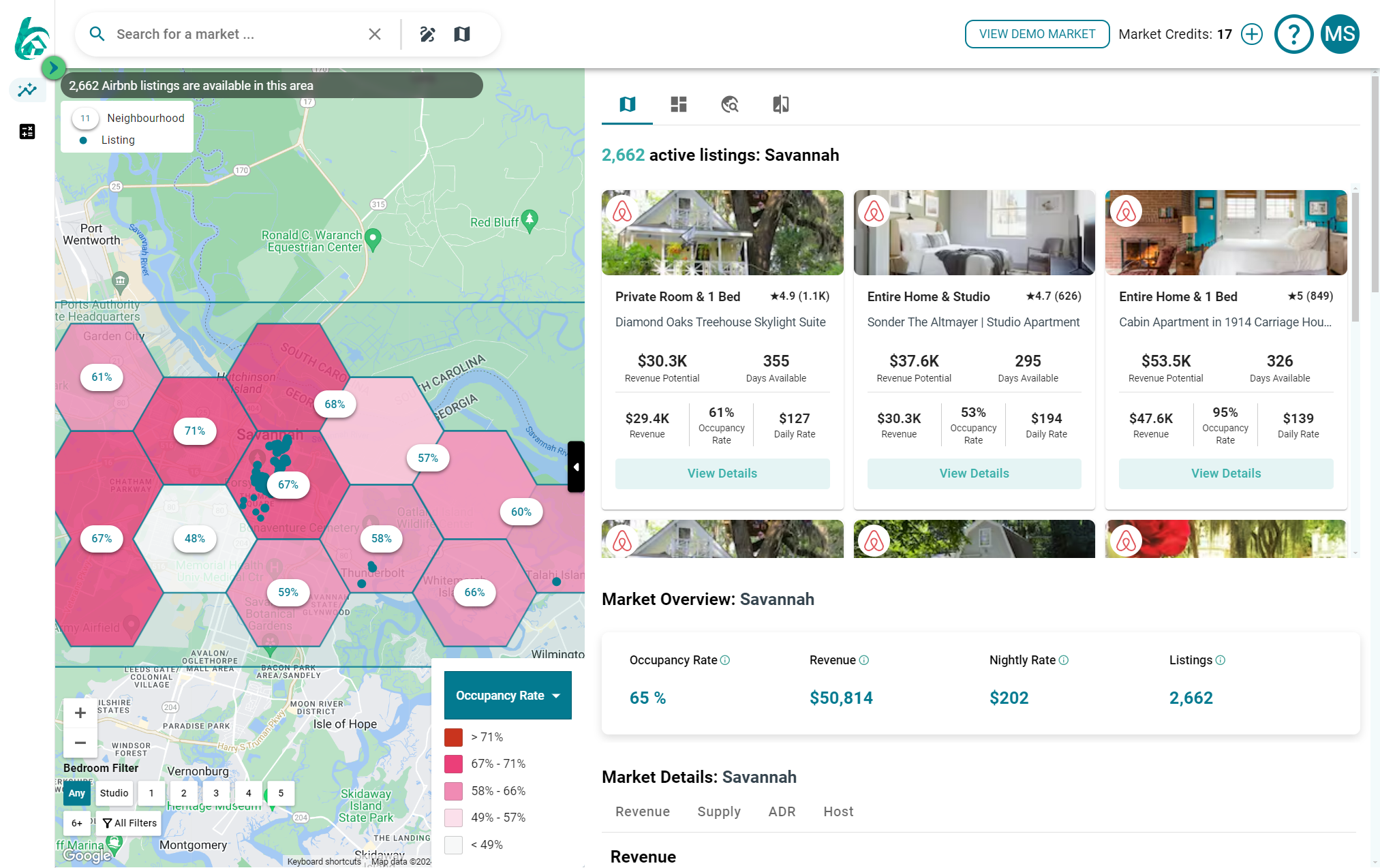

For instance, consider Savannah, GA, where the average home price in 2023 stood at $199,950. Factoring in additional costs such as closing fees and maintenance expenses, investors face an initial investment of $205,950. However, adept management of a short-term rental property can yield substantial profits, often surpassing those of traditional long-term leases.

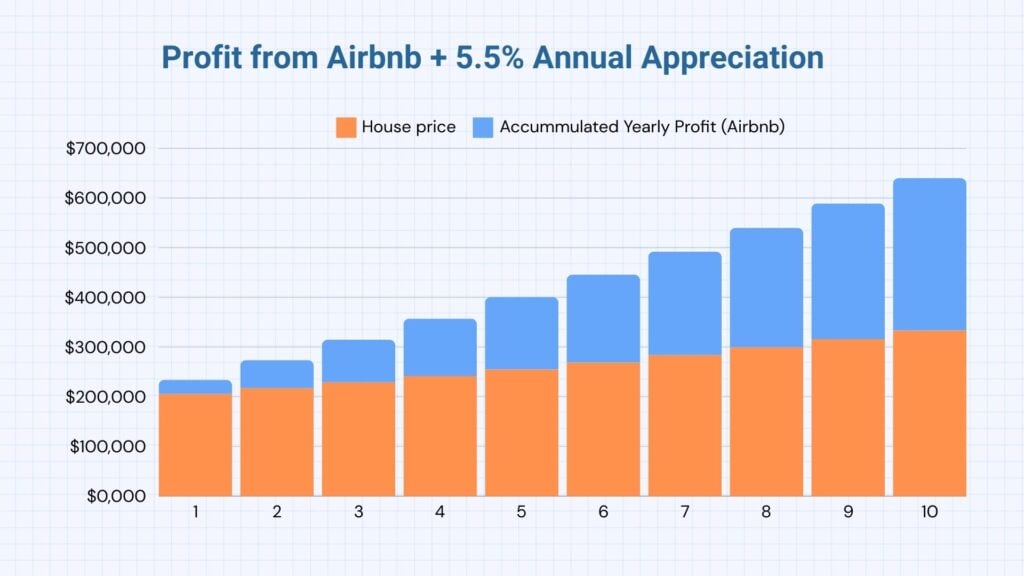

Taking a conservative approach, assuming a modest annual property appreciation rate of 5.5%, investors can anticipate an average annual return of 9.28% after a decade. Compare this to the S&P 500’s 9.67% average annual return during a similar period. However, the real game-changer lies in Airbnb rentals. With an average 1-bedroom Airbnb fetching $42,632 annually, albeit with higher maintenance costs, investors can enjoy a monthly profit boost of $863, translating to an impressive 12.01% rate of return. Moreover, strategic management can push this figure even higher, reaching up to 13.63% for top-performing listings (Applied estimated revenue of top 25% Airbnb listings in Savannah) or potentially 14.23% for properties acquired below market value (20% BMV).

(The return looks something like this)

What’s incredible about buying a short term rental property is this – There are so many variables you can control. Unlike investing in stocks, you can manage your property better for better returns. Unlike stocks, you can also find investment properties lower than market value.

Mitigating Risks in Short-Term Rental Investments

Despite its promises, investing in short-term rentals does not come without risks. Regulatory uncertainties, such as city-imposed restrictions or bans on short-term rentals, can disrupt income streams. However, even in adverse scenarios, the underlying asset’s value tends to appreciate steadily, offering a buffer against regulatory upheavals. Additionally, the potential underperformance of property values can be mitigated through diversification across markets, leveraging the lower correlation between real estate markets compared to stocks.

Can you manage your Airbnb remotely?

How can you manage internationally or in different countries? This is, in fact, easier than many think, and it’s a common practice nowadays. The smart lock allows guests to check in without you. You can manage door lock settings remotely just from your mobile phone. For maintaining the property, you can use a platform like Turno to find local cleaners for your Airbnb. Once things are set up right, visiting the property once a year can be enough for you to get year-round bookings.

Find out how much you can make on Airbnb with analytics!

If short-term rentals sound like a cool idea, why don’t you spend 2 minutes using Airbnb Analyzer to check the average occupancy rate of your markets? It’s all free!

If you don’t see good numbers in your market, you can identify other lucrative markets. You can use the heatmap feature to locate the most profitable areas and types of properties.