Manchester Airbnb Rules is a complete guide that will provide you with an overview of the guidelines and get you started on your journey!

Home > Resources > Airbnb Rules >

Manchester Airbnb Rules is a complete guide that will provide you with an overview of the guidelines and get you started on your journey!

- Last updated on

- August 16, 2023

Is Airbnb legal in Manchester?

Don’t worry, Airbnb is legal in Manchester! Manchester is the largest metropolitan area in the north of England, and it remains an important regional city, but it has lost the extraordinary vitality and unique influence that put it at the forefront of the Industrial Revolution.

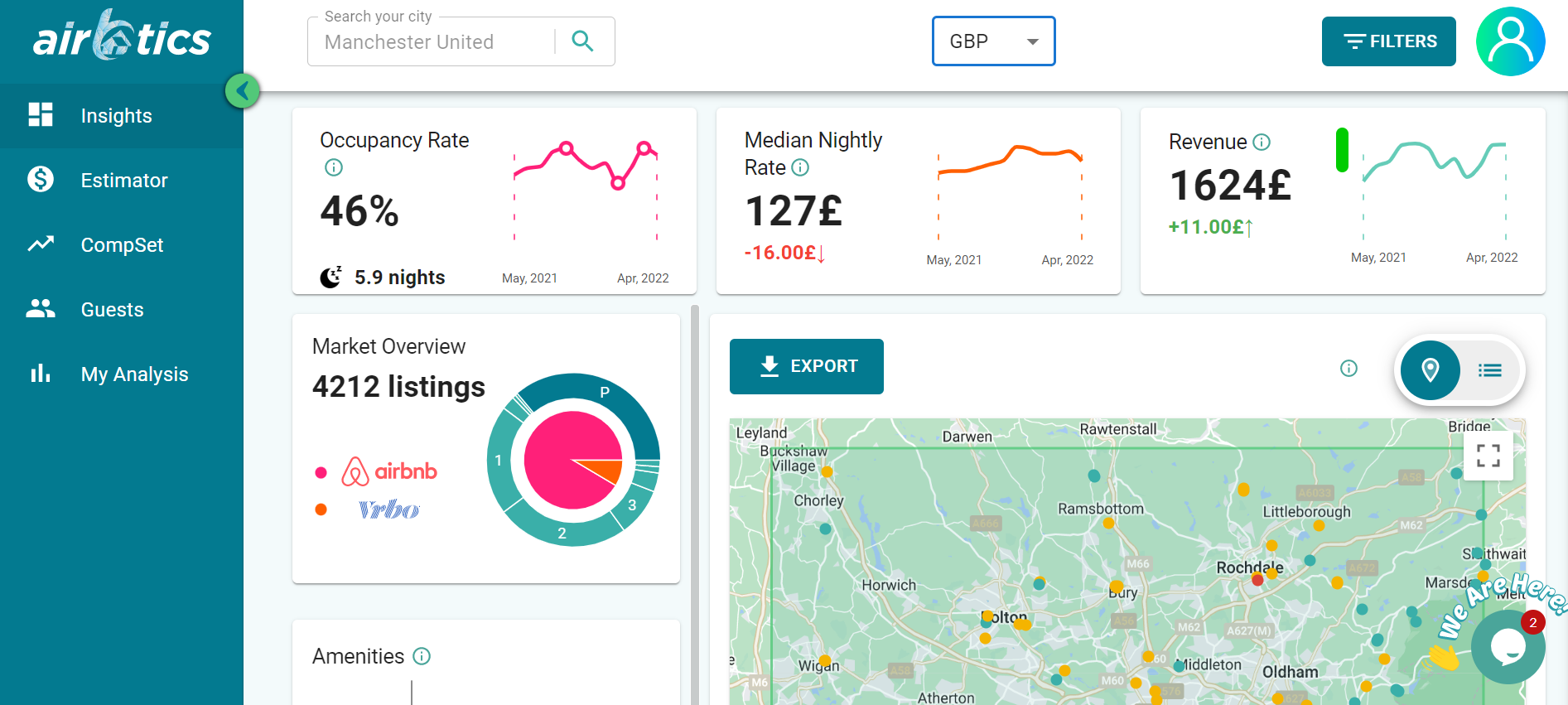

Currently, there are 3853 Airbnb listings in Manchester, with 45% of entire houses earning up to £2,289 a month, 37% managed by professionals, and 63% managed independently. Apart from complete houses, Manchester’s Airbnb offerings include 36% of private rooms and 18% of apartments(condos). The average occupancy rate in Manchester is 46% and the median daily rate is £127. According to short-term market data source Airbtics, a 2-bedroom apartment in Manchester can make up to £36,144 each year.

Short-term rentals policy in Manchester

- 90-day limit (without a permit) similar to London

- Compliance to Board of Health regulations and Fire – Department safety measures (fire/smoke alarms and CO monitors)

- Name of a local authorized agent who can act on behalf of the owner in the absence of the owner in the case of any problems, violations or emergencies

- Agreement to maintain a guest registry showing the name of each guest and the night(s) of their stay

Short-term rental policy in the UK

- The letting must NOT be for longer than 31 continuous days. A period of longer than 31 days is deemed to be a ‘long’ stay.

- The let property needs to be made available for rent for at least 210 days in a tax year.

- The rental needs to be actually let for at least 105 days of that tax year, for periods shorter than 31 days at a time.

Pros and Cons of running Airbnb

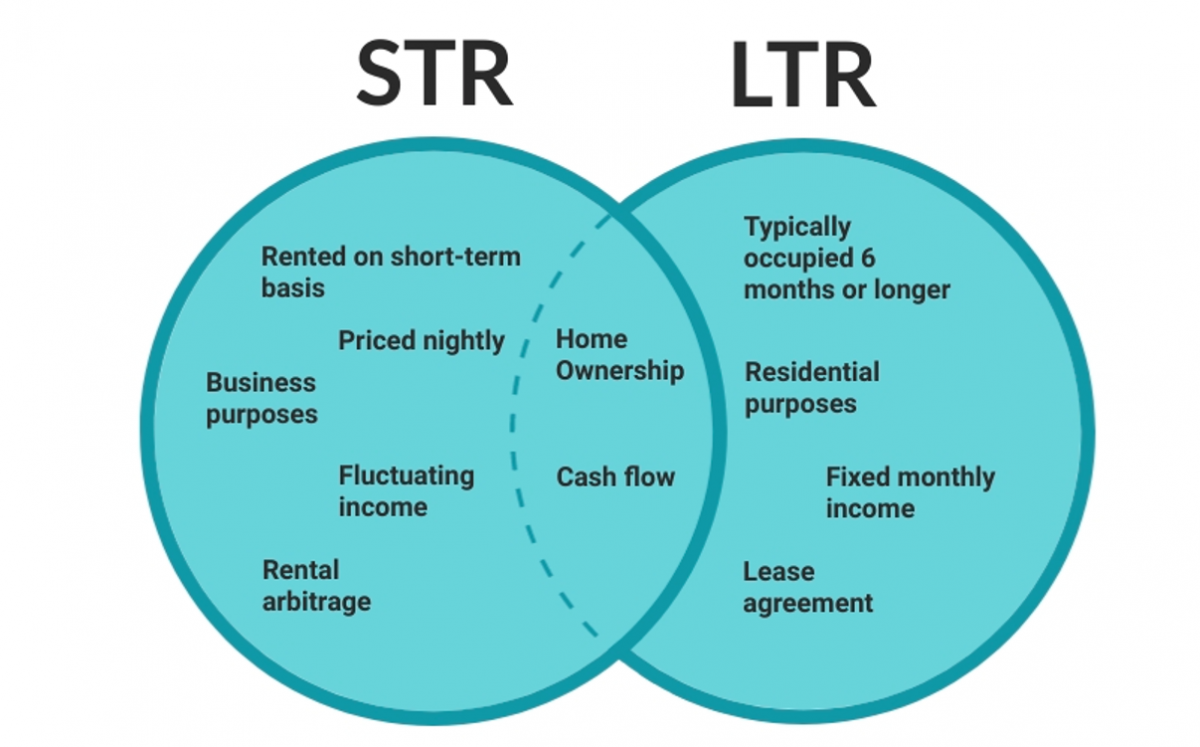

Short-term rentals are vacation rental properties rented out on a short-term basis to guests, like hotels. This form of rental helps guests to feel more at ease and “at home” because the properties are typically designed in this manner.

A long-term rental is the most common sort of rental property utilized for residential purposes. This sort of rental property is usually protected by a long-term lease agreement with more binding terms than a short-term rental. Renting out their homes for a higher price than their mortgage allows them to generate regular income regardless of the market. Because it is more traditional and well-known, most people are more familiar with this sort of rental property.

Now that we’ve defined vacation rentals and long-term rental properties, let’s look at each component of rental properties that explains both the benefits and drawbacks of a short-term or long-term rental.

Pros

1. Flexibility – You have the option of renting for days, weeks, or months. You can rent as much or as little as you want. There’s also the possibility of going on a trip at any time and earning money while doing so!

2. Privacy – Short-Term Rentals are ideal for families. They provide guests with more privacy and space than standard hotels.

3. Earns more money than a long-term rental – It’s simple to calculate: £1500 for a vacation week vs. £1500 per month to rent for a year.

4. Good Deductions – There are numerous popular deductions available to rental property owners. Cleaning and maintenance, insurance, management fees, and utilities are just a few of the costs to consider. You may make a loss and avoid paying taxes entirely if you take enough deductions.

5. Tax Breaks – Short-Term Rental Owners receive the best home-related tax breaks.

6. Less Wear and Tear on the Property – With frequent renters, you can keep up with tiny repairs before they become major issues!

7. Social Advantages – There are a lot of interesting people in the world, and many of them travel! Your next acquaintances in a Short-Term Rental could evolve into lifelong buddies!

Cons

1. Inconsistent payments – If you rely on a stable income, a yearly renter is a much safer option. There’s a chance you won’t have a Short-Term Renter for weeks or months.

2. Must cover the utilities – Utility costs are usually paid by long-term renters. Short-term tenants don’t.

3. Increased risk – There is a higher danger of theft, breakage, or problem tenants because of the number of tourists going through your doors.

4. Requires extra effort – Running a Short Term Rental requires more effort because you are the innkeeper. You’ll be in charge of collecting money, scheduling clients, and bringing in tenants. You’ll do it every week instead of every 5 years or so!

5. Additional maintenance expenses – As the landlord, you are responsible for housekeeping, pool maintenance, and general upkeep. Not always the case with a long-term renter.

6. Some HOA – Managed neighborhoods make it tough and complicated to rent short-term Rentals. People prefer comfortable, peaceful surroundings where they feel safe and know everyone, rather than random strangers coming and going at all hours. They may submit complaints, and some HOAs may sue Short-Term Rental Owners.

Conclusion

If you’ve made it this far, you’re thinking of starting an Airbnb.

We’ve been assisting folks like you, who are first-time Airbnb hosts. We don’t provide consulting since we aren’t experts in running Airbnb businesses; but, we do provide useful data to Airbnb hosts.

You may use the Airbtics dashboard to figure out how much money you can make doing Airbnb in your city. Unlike other online Airbnb income calculators, it will provide you with a lot more useful information, such as

- which neighborhood to target,

- which amenities are in high demand,

- what is the market’s historical performance,

- what are the occupancy rates of a two-bedroom house,

- should I do a two-bedroom house or a three-bedroom house?

Well, if you are new, there are many Airbnb host communities on Facebook. Type “Airbnb host” in the Facebook search, and you’ll see plenty of active communities where you can get help from experienced Airbnb hosts.

Short-Term Rental Data

Short-Term Rental Data

-

Quick Links

Annual Airbnb Revenue in Edinburg virginia, USA

Edinburg, Virginia| Airbnb Market Data & Overview | USA Edinburg, Virginia Airbnb Market Data & Overview USA Is it profitable to do Airbnb in Edinburg, …

Annual Airbnb Revenue in West valley city utah, USA

West Valley City, Utah| Airbnb Market Data & Overview | USA West Valley City, Utah Airbnb Market Data & Overview USA Is it profitable to …

Subarrendamiento en Airbnb en Murcia

Estas interesado en conseguir la independencia financiera por medio de un ingreso pasivo? Te damos un aviso: no necesitas ser dueño de una propiedad como …

Annual Airbnb Revenue In Stockholm Sweden

Stockholm| Airbnb Market Data & Overview | Sweden Stockholm Airbnb Market Data & OverviewSweden Is it profitable to do Airbnb in Stockholm, Sweden? What is …

Annual Airbnb Revenue in Islington, UK

Islington| Airbnb Market Data & Overview | UK Islington Airbnb Market Data & Overview UK Is it profitable to do Airbnb in Islington, UK? What …

Annual Airbnb Revenue in Lake arbor maryland, USA

Lake Arbor, Maryland| Airbnb Market Data & Overview | USA Lake Arbor, Maryland Airbnb Market Data & Overview USA Is it profitable to do Airbnb …