Is Airbnb legal in Denia?

Don’t worry, Airbnb is legal in Denia! Denia is a delightful cosmopolitan town located along the Mediterranean coastline, where the sun shines almost all year. This place is a historical coastal city in the province of Alicante, Spain, on the Costa Blanca halfway between Alicante and Valencia.

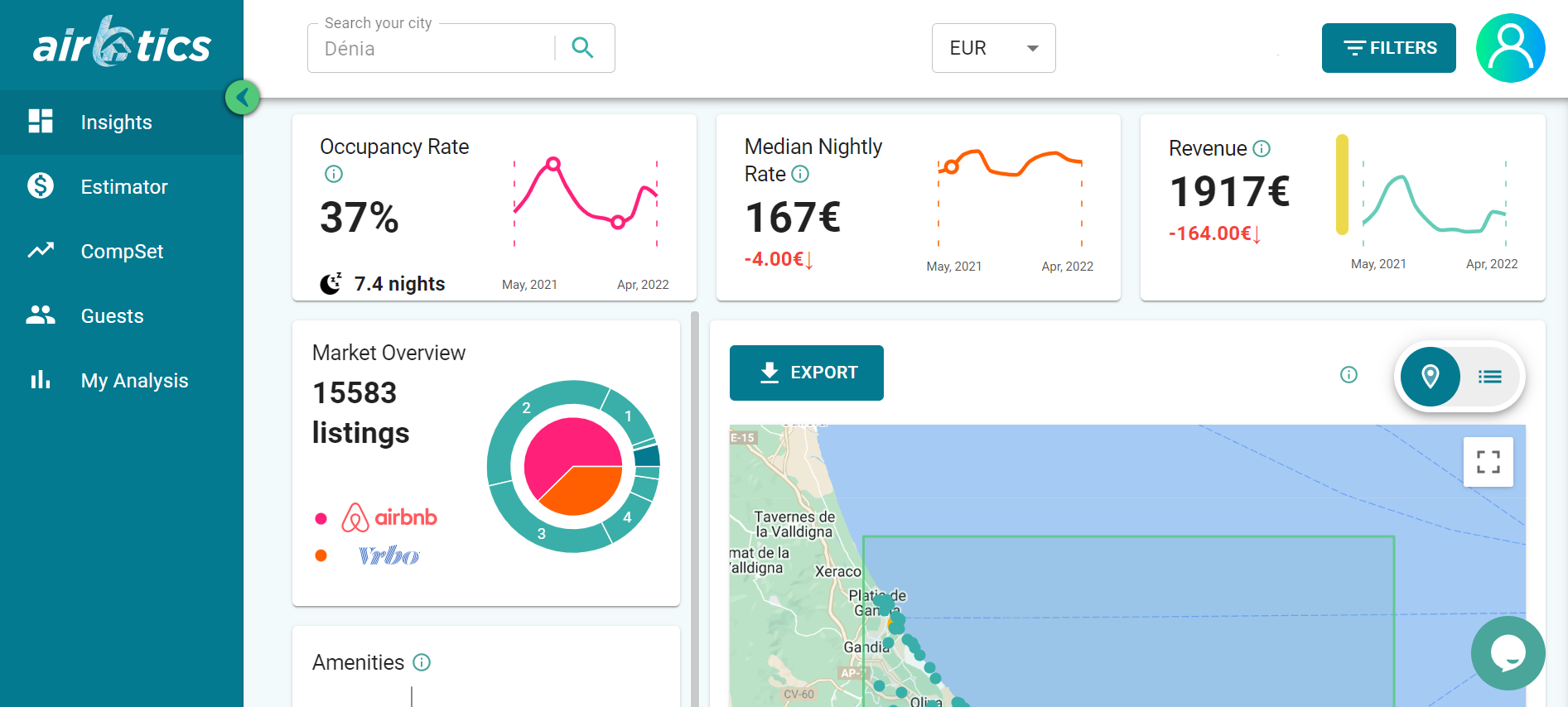

Currently, there are 9715 Airbnb listings in Denia, with 82% of entire houses earning up to €2,071 a month, 50% managed by professionals, and 50% managed independently. Apart from complete houses, Denia’s Airbnb offerings include 4% of private rooms and 14% of apartments(condos). Average Occupancy Rates in Denia is 37% and average daily rate is €167. According to short-term rental market data source Airbtics, a 2-bedroom apartment in Denia can make up to €15,348 each year.

Short-term rental policy in Denia

– Submit a Responsible Declaration for the intent of STR (tourist accommodation)

– Required to have an Occupancy License to operate

– Register your short-term holiday rental online or apply in the local office districts

– Must obtain a VFT number (legal registration) to confirm legal operation of short-term business

– Similar to Alicante & Benidorm (Valencian Community)

Spain’s General Legislations

A licence to operate is required for:

– Short-term detached house rentals with hotel services (B&B).

– Flats located in building complexes for tourists, where the entire building or complex is used for this service, must be managed by professional service providers.

A licence is no longer required for:

– Short-term detached house rentals with no hotel services (cleaning only).

– Long-term flat or home rentals (for terms over 1–2 months). Flats that are not in tourist complexes can only serve as long-term rentals in regions that don’t issue licences.

Short-term rental policy in Spain

– A Tourist Use House License is required to offer apartments for tourists.

– No minimum or maximum term for short-term contracts (no longer than 11 months)

– For non-resident landlord: liable to pay Income tax (25%)

– Certificate of Occupancy issued when the building is commissioned (Cédula de Ocupación or Cédula de Habitabilidad)

– Pay rental income tax at a rate of 24% for non-resident

– The minimum renting period of 12 months. If you terminate your contract before the first six months, you will have to pay the remaining months of the year’s contract– Similar to Madrid, Barcelona, and Valencia

Pros and Cons of running Airbnb

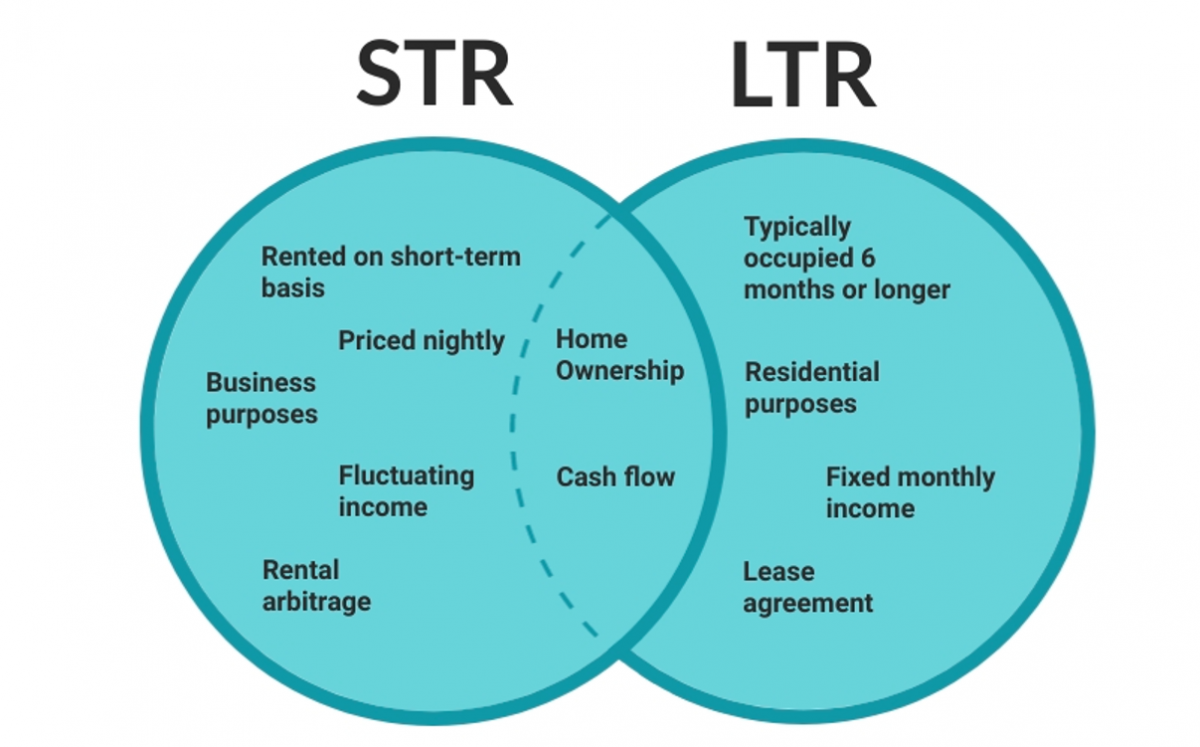

Short-term rentals are vacation rental properties rented out on a short-term basis to guests, like hotels. This form of rental helps guests to feel more at ease and “at home” because the properties are typically designed in this manner.

A long-term rental is the most common sort of rental property utilized for residential purposes. This sort of rental property is usually protected by a long-term lease agreement with more binding terms than a short-term rental. Renting out their homes for a higher price than their mortgage allows them to generate regular income regardless of the market. Because it is more traditional and well-known, most people are more familiar with this sort of rental property.

Now that we’ve defined vacation rentals and long-term rental properties, let’s look at each component of rental properties that explains both the benefits and drawbacks of a short-term or long-term rental.

Pros

1. Flexibility – You have the option of renting for days, weeks, or months. You can rent as much or as little as you want. There’s also the possibility of going on a trip at any time and earning money while doing so!

2. Privacy – Short-Term Rentals are ideal for families. They provide guests with more privacy and space than standard hotels.

3. Earns more money than a long-term rental – It’s simple to calculate: €1500 for a vacation week vs. €1500 per month to rent for a year.

4. Good Deductions – There are numerous popular deductions available to rental property owners. Cleaning and maintenance, insurance, management fees, and utilities are just a few of the costs to consider. You may make a loss and avoid paying taxes entirely if you take enough deductions.

5. Tax Breaks – Short-Term Rental Owners receive the best home-related tax breaks.

6. Less Wear and Tear on the Property – With frequent renters, you can keep up with tiny repairs before they become major issues!

7. Social Advantages – There are a lot of interesting people in the world, and many of them travel! Your next acquaintances in a Short-Term Rental could evolve into lifelong buddies!

Cons

1. Inconsistent payments – If you rely on a stable income, a yearly renter is a much safer option. There’s a chance you won’t have a Short-Term Renter for weeks or months.

2. Must cover the utilities – Utility costs are usually paid by long-term renters. Short-term tenants don’t.

3. Increased risk – There is a higher danger of theft, breakage, or problem tenants because of the number of tourists going through your doors.

4. Requires extra effort – Running a Short Term Rental requires more effort because you are the innkeeper. You’ll be in charge of collecting money, scheduling clients, and bringing in tenants. You’ll do it every week instead of every 5 years or so!

5. Additional maintenance expenses – As the landlord, you are responsible for housekeeping, pool maintenance, and general upkeep. Not always the case with a long-term renter.

6. Some HOA – Managed neighborhoods make it tough and complicated to rent short-term Rentals. People prefer comfortable, peaceful surroundings where they feel safe and know everyone, rather than random strangers coming and going at all hours. They may submit complaints, and some HOAs may sue Short-Term Rental Owners.

Conclusion

If you’ve made it this far, you’re thinking of starting an Airbnb.

We’ve been assisting folks like you, who are first-time Airbnb hosts. We don’t provide consulting since we aren’t experts in running Airbnb businesses; but, we do provide useful data to Airbnb hosts.

You may use the Airbtics dashboard to figure out how much money you can make doing Airbnb in your city. Unlike other online Airbnb income calculators, it will provide you with a lot more useful information, such as

– which neighborhood to target,

– which amenities are in high demand,

– what is the market’s historical performance,

– what are the occupancy rates of a two-bedroom house,

– should I do a two-bedroom house or a three-bedroom house?

Well, if you are new, there are many Airbnb host communities on Facebook. Type “Airbnb host” in the Facebook search, you’ll see plenty of active communities where you can get help from experienced Airbnb hosts.