The impact of COVID-19 has been quite severe in the last few months on the vacation rental industry. There was a significant number of cases reported in some cities that reversed the predicted drop of Airbnb bookings there. It has been observed that there is a reduction in the short term stays compared to the long term stays.

If you have been wondering how COVID-19 has impacted the bookings in major cities, and what can be expected in the upcoming months, then this will be a great article for you. Here, we will be particularly comparing the impact of the pandemic on Berlin with respect to Seoul, Milan, and Taipei.

Germany missed the chance they had, in February 2020

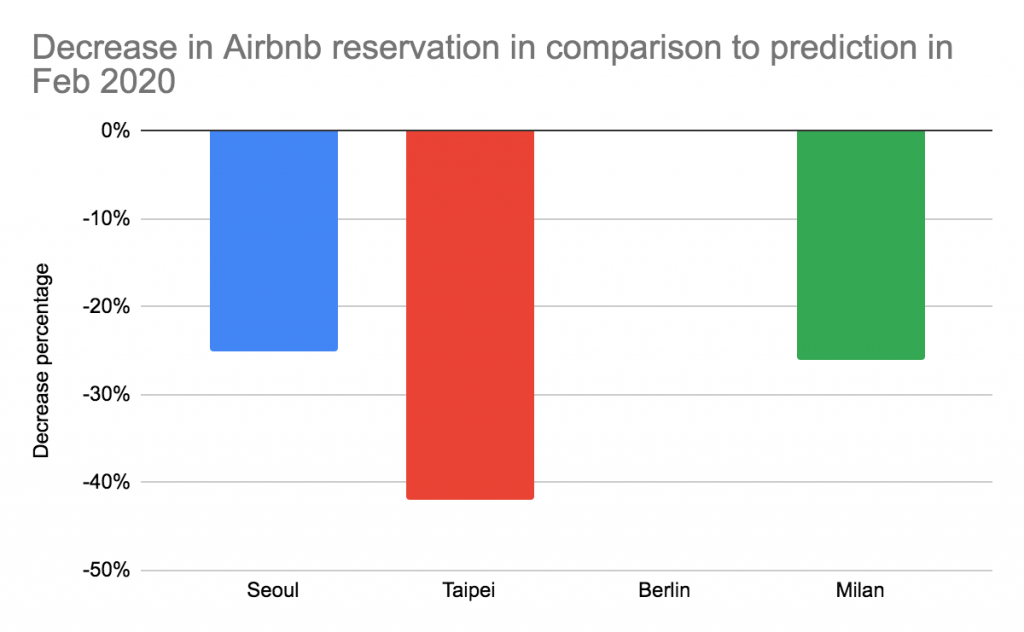

The number of Airbnb bookings was measured in the month of Oct, Nov, and Dec of 2018 as well as 2019. This percentage difference of 2018-19 was used to predict the number of bookings if there was no impact of the COVID pandemic in the cities.

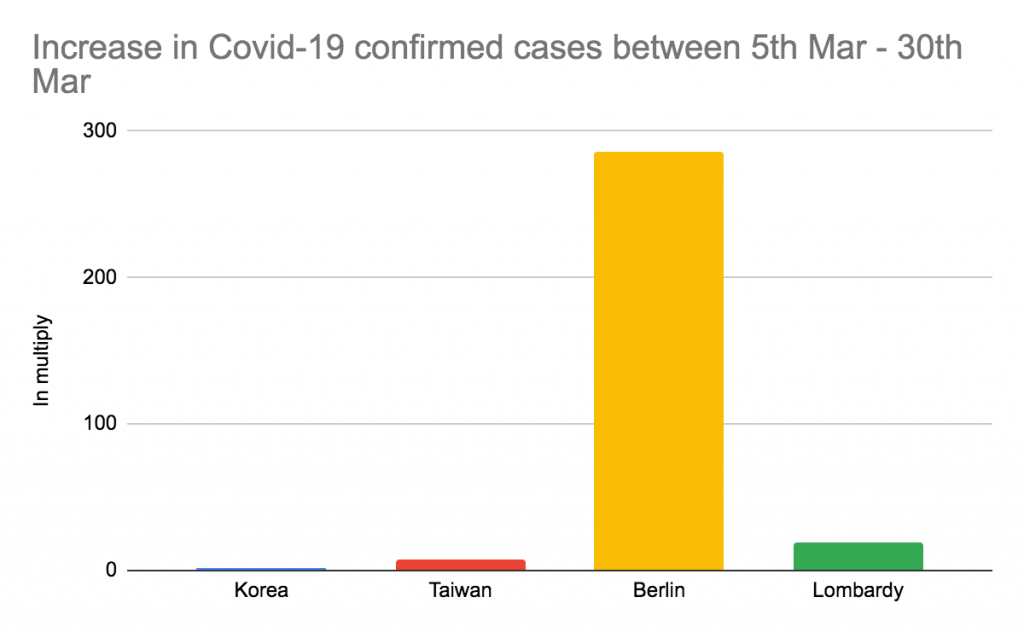

It was observed that Seoul, as well as Milan, experienced a fall of about 25% bookings in 2020 Feb, and Taipei suffered from a 42% drop. On the other hand, Berlin had a normal Airbnb booking rate because people still traveled, and this was a good indicator of the surge of covid19 confirmed cases in March.

But the scenario has completely changed owing to the COVID -19 pandemic. There were 300 multiplied confirmed cases in Berlin between 5th March and 30th March.

Germany and Italy are worst hit by the pandemic and so is their Airbnb bookings:

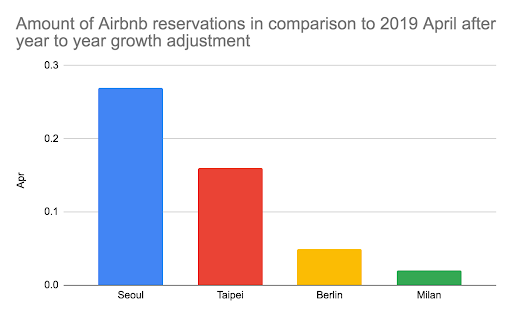

In Seoul and Taipei, there were almost negligible new confirmed COVID cases in April. At the same time, Germany and Italy are the countries which are worst hit by the pandemic. This is the reason why we do not find any significant Airbnb activity in Berlin and Milan when Taipei is seen to perform the best among these four in the month of April.

After the year to year growth adjustment, Seoul is seen to have the maximum number of bookings. The decreasing order of bookings for the other cities includes Taipei, Berlin, and finally Milan.

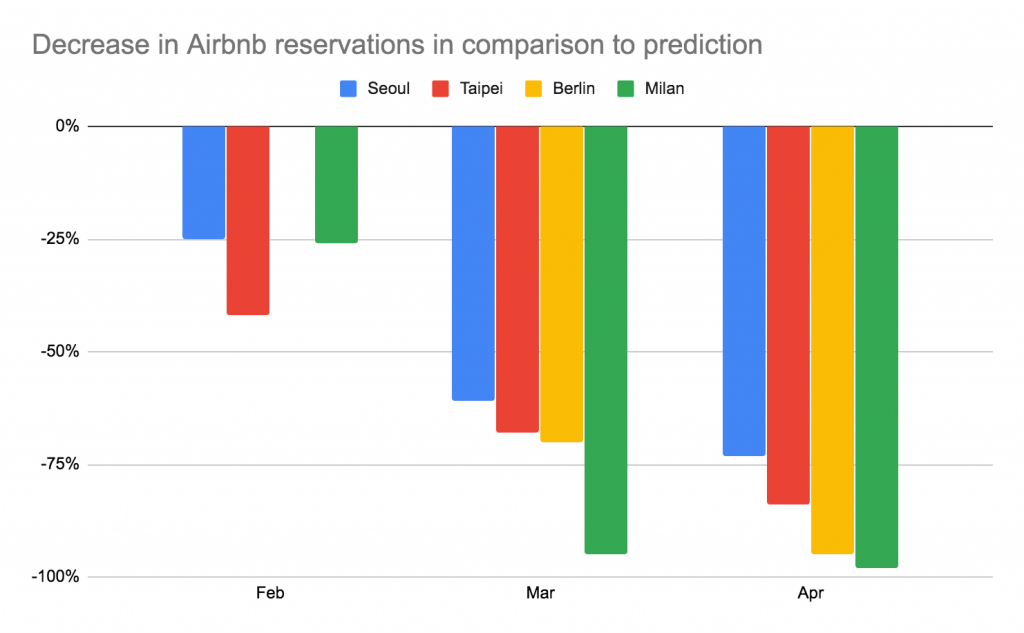

The comparative analysis of predicted occupancy rate versus the actual rate in February, March, and April:

The global pandemic Covid-19 has affected the Airbnb bookings significantly as discussed below:

- Seoul was expected to have a 25% fall in the bookings in February which rose to 61% in March and 73% in the month of April.

- Taipei, as discussed earlier, was predicted to see a drop in Airbnb bookings by 42% in February but in March, there was a 68% drop and 84% drop in April.

- For the month of February, Milan was thought to witness a 26% drop in the bookings but it was 95% in March and rose to 98% in April.

- Compared to all the above cities, Berlin which had no drop in bookings in February witnessed a 70% drop in March and 95% in April.

Booking rates have fallen, still, the scenario is not that depressing:

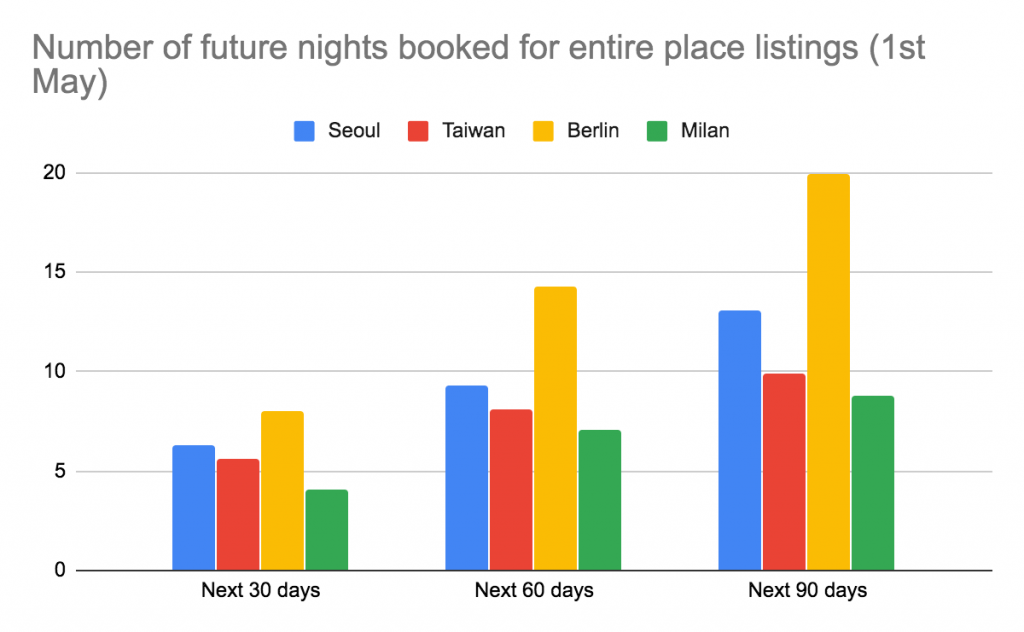

Despite the above falling rates for booking, the future doesn’t seem to be depressing. This is because the number of future nights booked in Berlin for May is highest among the other cities, i.e Seoul, Taipei, and Milan. This portrays a good occupancy rate for the month of May which is expected to rise higher compared to the typical listings even though there is a good portion of mid-terms stays on Airbnb.

If we consider the case of Milan, this city and Northern Italy were the COVID-19 entry points for the European continent. Even though this has resulted in a major setback, short term rental markets will rebound quickly in case of successful containment.

Conclusion

The current impact of the COVID-19 demands changing the strategies for thriving in the short term rental industry. This necessitates analyzing the current data thoroughly as it will help in better planning for the business once the crisis gets contained. The demand has not completely stopped, it is just that its form has changed, i.e Airbnb is becoming a good option for travelers to seek medium as well as long term stays. Despite the low expectations of such vacation rental hosts, they open for business for all intents and purposes.

Stay Insightful

Airbtics is the short-term and vacation rental market research platform. We help rental hosts, property investors, realtors to understand the rapidly changing rental market by providing insights via our web service.

If you have any further questions about the case study, please contact us at [email protected].

All the data here without explicit references are sourced and processed by our technologies.

References

All the above Airbnb related data are retrieved from Airbnb Research Tool.

Covid related data are retrieved from CoronaVirusApp.