Top 7 Airbnb Loans & How to Finance

Short-term Rentals

Buying a short-term rental property can be a rock-solid investment. You get the stability of

owning a home, one of the most reliable asset classes, plus the chance to make a profit by essentially running a small business. It’s the best of both worlds!

Most folks use traditional mortgages to buy properties they plan to list on Airbnb, and this works just fine as long as you stick to local short-term rental regulations. However, there are some good reasons to look into short-term rental financing instead.

🎯 Here are a few:

- Higher Loan Amounts: Lenders who focus on short-term rentals understand the earning potential of these properties and may offer bigger loans based on expected rental income.

- Faster Approval and Funding: These lenders often have quicker approval processes, which means you get your money faster.

- Industry Knowledge and Better Support: Specialized lenders know the short-term rental market well and can offer valuable advice and support.

- Projected Rental Income Consideration: These loans take your potential rental income into account, which can help you qualify for a larger loan.

✍️ Ready to explore your options? Here’s a list of some top short-term rental loan providers:

Top 7 Airbnb Financing Providers

Visio Lending

Visio Lending is a go-to for many Airbnb hosts. They offer loans tailored for rental properties with competitive rates and flexible terms.

Google Review: 4.1 (137)

Host Financial

Host Financial specializes in vacation rental financing. They understand the unique needs of short-term rental investors and offer loan products that fit those needs perfectly.

LendingOne

LendingOne offers loans for real estate investors, including those buying short-term rentals. Their process is smooth and they fund quickly.

Google Review: 3.9 (70)

Kiavi (formerly LendingHome)

Kiavi provides competitive rates and flexible terms for property investors, including those focusing on short-term rentals.

Google Review: 4.1 (306)

Better Mortgage

Better Mortgage has a straightforward online application, competitive rates, and clear terms. They cater to various real estate investors, including those financing short-term rental properties.

Easy Street Capitals

Easy Street Capitals is a boutique investment firm specializing in personalized wealth management solutions for high-net-worth individuals and families.

Google Review: 4.17(177)

KRAM capital

Google Review: 3.0(2)

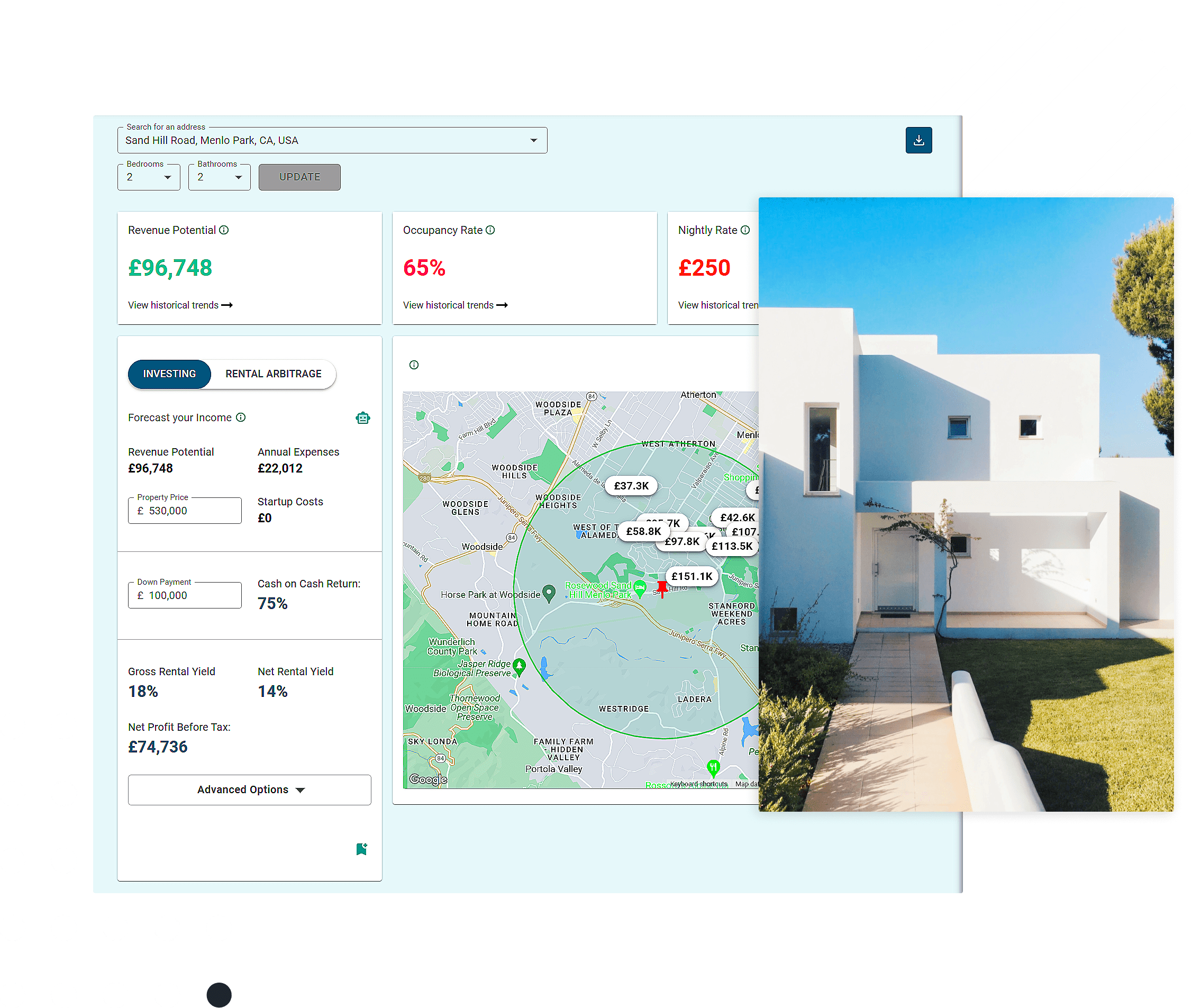

✍️ Did you know that Airbtics works with certain lenders to help them project short-term rental revenue? Try out our Airbnb Calculator to see how much a property would earn!

Airbnb Calculator

Instantly see your Airbnb’s estimated revenue with the leading Airbnb profit calculator in the short-term rental industry. Discover your Airbnb earnings potential.

🎯 5 Important Considerations

- Interest Rates: Shop around for the best rates. A small difference can save you a lot of money in the long run.

- Loan Terms: Check the length of the loan and the repayment schedule. Make sure it fits your financial plans and rental income.

- Fees and Costs: Be aware of any additional fees, such as origination fees, appraisal fees, and closing costs.

- Customer Support: Good customer service is crucial. Choose a lender known for being helpful and responsive.

- Approval Time: If you need to act fast in a competitive market, consider the approval time.

Conclusion

Investing in a short-term rental property can be a smart move, especially if you pick the right loan. Specialized short-term rental loans can give you the flexibility, support, and higher loan amounts you need to succeed.