Hawaii’s beautiful scenery and sweet climate have made it to the record of being one of the most visited states in America. With over 9.4 million visitors, property investors have been eyeing great property deals and the Airbnb business has been a great source of income. In order for future hosts to successfully start an Airbnb business in Hawaii, it’s important to learn about its legality, step-by-step process, and most of all – profitability!

In this article, we featured Airbnb regulations in Hawaii, along with the new Airbnb laws in O’ahu. Continue reading and learn more about the Airbnb laws in Hawaii.

Is Airbnb legal in Honolulu, Hawaii?

To cut the story short, yes – Airbnb is legal in Hawaii! While short-term regulations have been regulated since 1989 in the City & County of Honolulu in Hawaii, there have been recent restrictions and upcoming regulations. Here’s what you need to know before you invest in an Airbnb in Honolulu:

1. Based on Bill 41 (21) CD2, or Ordinance 22-7, the registration for new short-term rentals has been temporarily suspended until further notice.

2. Only the hosts with a registration number are able to publish listings on the platform.

How much can I make by running an Airbnb in Honolulu?

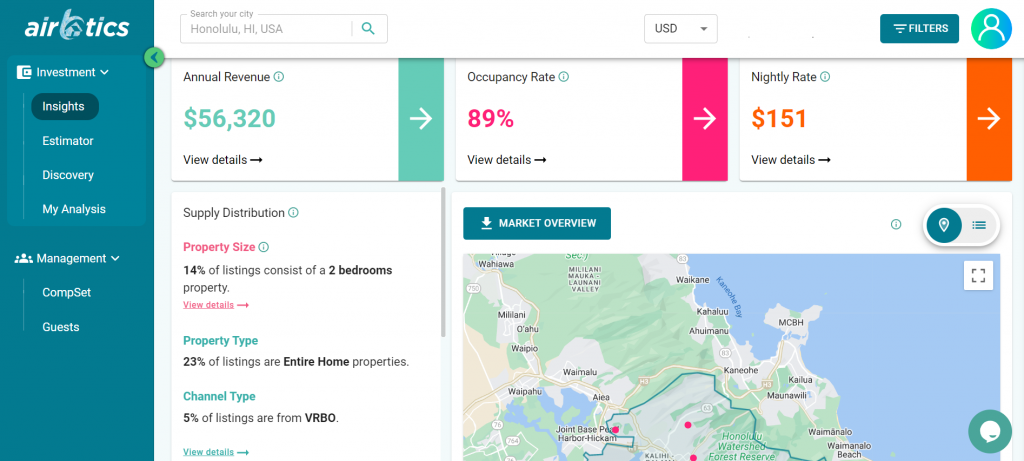

Currently, there are 3,664 Airbnb listings in Honolulu, with 90% of entire houses earning up to $4,886 a month. The Average Occupancy Rate in Honolulu is 89% and the average daily rate is $151. According to vacation rental market analytics source Airbtics, a 2-bedroom apartment in Honolulu can make up to $47,987 annually. Check out our Airbnb Profit Calculator!

New Short-term Rental Laws in Honolulu

- Ordinance 22-7 (Bill 41) limits rental bookings lasting fewer than 90 days to designated areas and will take effect on October 23, 2022.

- Vacation rentals in designated resort areas, including Ko Olina, Turtle Bay, and parts of Waikiki are NOT included in Ordinance 22-7.

- Non-conforming use certificates (NUCs) must comply with the new annual renewal after their existing renewal period expires.

- All STRs must provide registration or NUC number & tax map key on advertisements.

- Any advertisement of a rental or dwelling unit that is not a registered STR may not include daily or less than three-month rental rates and must include the statement: “this property may not be rented for less than 90 consecutive days. Rental prices will not be reduced or adjusted based on the number of days the rental is actually used or occupied.”

New Rules for Vacation Rentals in Oahu, Hawaii

Since the announcement of the City & Council of Honolulu regarding Ordinance 22-7, many vacation rental owners and hosts have filed lawsuits against the said law.

- According to Bill 89, also known as Ordinance 19-18, there will be a limit on Bed and Breakfasts (B&Bs) on the island. Specifically, no more than 0.5% of the total number of dwelling units in each regional area on O‘ahu can be used as B&Bs.

- The new laws also dictate that new B&B owners can rent two bedrooms to guests. The business owners are also expected to reside at home with guests by law.

Hosts & Property investors in Hawaii

Since the announcement of the City & Council of Honolulu regarding Ordinance 22-7, many vacation rental owners don’t see the point of calling it a “short-term rental” business because of the minimum 90-days law. According to one of the local real estate agents in the area, they had to return lease arbitrages in Waikiki to the lessor because there are way too many hotels and STRs are being overlooked.

Conclusion

To summarize, knowing the Airbnb rules & its potential profit in Honolulu is still important before investing in an Airbnb within the area. While gauging the personal experiences of various local hosts should also be considered in your decision-making process, accurate data should still be the foundation of your investment.

In my personal opinion, the biggest advantage of running a short-term rental is high return! I’ve talked to hundreds of Airbnb hosts over the past years and frequently met hosts making 15 – 30% gross rental yields, and 10-20% net. It’s also fun to do!