Home > Resources > Airbnb Rules >

Airbnb Rules in Vancouver is a comprehensive guide to give you an idea about the regulations and get you started with your journey.

- Last updated on

- July 11, 2023

Is Airbnb legal in Vancouver?

The answer is yes! Vancouver has a bylaw that prohibits renting rooms for fewer than 30 days, but it is (obviously) rarely enforced given the prevalence of Airbnb.

Currently, there are 824 Airbnb listings in Vancouver, with 50,3% of entire houses earning up to $2,870 a month, 2,6% managed by professionals, and 35,6% managed independently. Apart from complete houses, Vancouver’s Airbnb offerings include 3,6% of private rooms. According to vacation rental market data Airbtics, a 2-bedroom apartment in Vancouver can make up to $35,748 each year.

Here we will provide some useful information that can help you better understand the Airbnb Rules in Vancouver.

Short-Term Rentals Law

When it comes to the short-term rental license in Vancouver, the most important rule is that the home be your principal house. That is, you must spend at least 180 days of the year in it.

A homeowner must have both a license and approval from the strata body to rent out a room or the whole house. A legal habitation must also meet certain safety requirements, such as fire safety.

Airbnb rules in Vancouver

All short-term rental operators must have a business license and disclose their license number in all online postings and advertisements.

The rules for vacation rentals in Vancouver are as follows.

Permitted

- Only operates from your major residence – the home where you live, as an owner or renter, and use for bills, identification, taxes, and insurance.

- Secondary homes or basement suites if the operator lives there full-time and it is their principal residence.

Not Permitted

- In ancillary buildings (such as a garage, art studio, trailer, or boat) or Rental 100 buildings.

- Residences that are subject to the Empty Homes Tax (the tax applies to homes that aren’t the owner’s primary residence or aren’t rented for an extended period of time). Airbnb, a prominent short-term home rental service, offers both homeowners and visitors new options.

Reference| Airbnb.co

Pros and Cons of running Airbnb in Vancouver

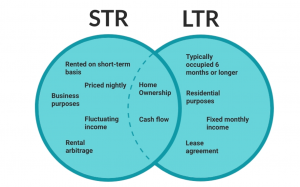

Short-term rentals are vacation rental properties rented out on a short-term basis to guests, like hotels. This form of rental helps guests to feel more at ease and “at home” because the properties are typically designed in this manner.

A long-term rental is the most common sort of rental property utilized for residential purposes. This sort of rental property is usually protected by a long-term lease agreement with more binding terms than a short-term rental. Renting out their homes for a higher price than their mortgage allows them to generate regular income regardless of the market. Because it is more traditional and well-known, most people are more familiar with this sort of rental property.

Now that we’ve defined vacation rentals and long-term rental properties, let’s look at each component of rental properties that explains both the benefits and drawbacks of a short-term or long-term rental.

Pros

Flexibility – You have the option of renting for days, weeks, or months. You can rent as much or as little as you want. There’s also the possibility of going on a trip at any time and earning money while doing so!

Privacy – Short-Term Rentals are ideal for families. They provide guests with more privacy and space than standard hotels.

Earns more money than a long-term rental – It’s simple to calculate: $1500 for a vacation week vs. $1500 per month to rent for a year.

Good Deductions – There are numerous popular deductions available to rental property owners. Cleaning and maintenance, insurance, management fees, and utilities are just a few of the costs to consider. You may make a loss and avoid paying taxes entirely if you take enough deductions.

Tax Breaks – Short-Term Rental Owners receive the best home-related tax breaks.

Less Wear and Tear on the Property – With frequent renters, you can keep up with tiny repairs before they become major issues!

Social Advantages – There are a lot of interesting people in the world, and many of them travel! Your next acquaintances in a Short-Term Rental could evolve into lifelong buddies!

Cons

Inconsistent payments – If you rely on a stable income, a yearly renter is a much safer option. There’s a chance you won’t have a Short-Term Renter for weeks or months.

Must cover the utilities – Utility costs are usually paid by long-term renters. Short-term tenants don’t.

Increased risk – There is a higher danger of theft, breakage, or problem tenants because of the number of tourists going through your doors.

Requires extra effort – Running a Short-Term Rental requires more effort because you are the innkeeper. You’ll be in charge of collecting money, scheduling clients, and bringing in tenants. You’ll do it every week instead of every 5 years or so!

Additional maintenance expenses – As the landlord, you are responsible for housekeeping, pool maintenance, and general upkeep. Not always the case with a long-term renter.

Some HOA– Managed neighborhoods make it tough and complicated to rent short-term Rentals. People prefer comfortable, peaceful surroundings where they feel safe and know everyone, rather than random strangers coming and going at all hours. They may submit complaints, and some HOAs may sue Short-Term Rental Owners.

Conclusion

If you’ve made it this far, you’re thinking of starting an Airbnb.

We’ve been assisting folks like you, who are first-time Airbnb hosts. We don’t provide consulting since we aren’t experts in running Airbnb businesses; but, we do provide useful data to Airbnb hosts.

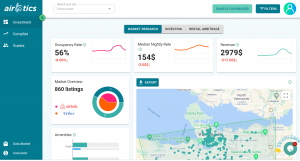

You may use the Airbtics dashboard to figure out how much money you can make doing Airbnb in your city. Unlike other online Airbnb income calculators, it will provide you with a lot more useful information, such as

- which neighborhood to target,

- which amenities are in high demand,

- what is the market’s historical performance,

- what are the occupancy rates of a two-bedroom house,

- should I do a two-bedroom house or a three-bedroom house?

In that case, the tool might be too complex for you, visit our tutorials – With the data dashboard, you can get meaningful and actionable insights.

Well, if you are new, there are many Airbnb host communities on Facebook. Type “Airbnb host” in the Facebook search, and you’ll see plenty of active communities where you can get help from experienced Airbnb hosts.

To see full data of Vancouver– Click Here

FIND STATS FOR YOUR CITY – CLICK HERE

Short-Term Rental Data

Short-Term Rental Data

-

Quick Links

Annual Airbnb Revenue in Hudson new york, USA

Hudson, New York| Airbnb Market Data & Overview | USA Hudson, New York Airbnb Market Data & Overview USA Is it profitable to do Airbnb …

Annual Airbnb Revenue in South charleston west virginia, USA

South Charleston, West Virginia| Airbnb Market Data & Overview | USA South Charleston, West Virginia Airbnb Market Data & Overview USA Is it profitable to …

Annual Airbnb Revenue in Elizabethtown kentucky, USA

Elizabethtown, Kentucky| Airbnb Market Data & Overview | USA Elizabethtown, Kentucky Airbnb Market Data & Overview USA Is it profitable to do Airbnb in Elizabethtown, …

Annual Airbnb Revenue in El cajon california, USA

El Cajon, California| Airbnb Market Data & Overview | USA El Cajon, California Airbnb Market Data & Overview USA Is it profitable to do Airbnb …

Granada Airbnb Rules

Table of Contents Add a header to begin generating the table of contents Is Airbnb legal in Granada? Don’t worry, Airbnb is legal in Granada! …

Annual Airbnb Revenue in Durant oklahoma, USA

Durant, Oklahoma| Airbnb Market Data & Overview | USA Durant, Oklahoma Airbnb Market Data & Overview USA Is it profitable to do Airbnb in Durant, …