Best Cash on Cash Return Investments

Why Airbnb Tops the List

- The average real return on global houses from 1870 to 2015 was 7.05% compared to 6.89% for equities. The return includes home value appreciation and rental income.

- Among the many rental options, short-term rental gives the highest average return with flexibility. However, it’s high risk and requires more managing.

I was a software developer in London, and whenever we had tea, our favorite conversation was about how we could “graduate” from the company by investing well. This pursuit led me to explore various investment opportunities, and Airbnb properties consistently stood out as one of the most promising avenues.

In the world of real estate, investors are constantly seeking the best cash on cash return investments. Among the various options available, Airbnb has emerged as a standout choice for many savvy investors. This article delves into why Airbnb properties offer some of the best cash on cash return investments and how you can maximize your earnings through this platform.

Typical Real Estate Investing Strategies

Typical Real Estate Investing Strategies

- BRRRR (Buy, Rehab, Rent, Refinance, Repeat)

- Buy and flip: Quick profit

- Buy and hold: Proven to work

- Long-term rental: Easiest to manage

- Mid-term rental: Higher return than long-term rental, with minimal managing

- Multifamily: Higher return than long term rental, with minimal managing

- Short-term rental: Highest cash on cash return

- Wholesaling

What is Cash on Cash Return

What is Cash on Cash Return

This number tells you how much of your initial investment you will get back in the first year.

The formula is:

Cash on Cash Return = Annual Pre – Tax Cash FlowTotal Cash Invested

Cash on Cash Return = Total Cash Invested Annual Pre – Tax Cash Flow

Where:

- APTCF = (GSR + OI) – (V + OE + AMP)

- GSR = Gross scheduled rent

- OI = Other income

- V = Vacancy

- OE = Operating expenses

- AMP = Annual mortgage payments

Why Real Estate Investing?

Why Real Estate Investing?

Housing has been the best-performing asset class in history according to research tracking various assets over 145 years. Better than stocks. This was documented going back to 1870 in a 2017 paper from the Federal Reserve Bank of San Francisco titled The Rate of Return on Everything, 1870-2015. The average real return on global housing from 1870 to 2015 was 7.05% compared to 6.89% for equities. The housing return also came with a substantially lower standard deviation – meaning less risk. Then, let’s see why “Airbnb” is the best if you want to get the highest return.

Why Airbnb Properties Offer the Best Cash on Cash Return Investments

Why Airbnb Properties Offer the Best Cash on Cash Return Investments

Higher Rental Income Potential

Airbnb properties typically generate higher rental income compared to traditional long-term rentals. Short-term rental rates are often significantly higher on a nightly basis, allowing property owners to command premium prices during peak seasons or events. This increased income can significantly boost the cash on cash return.

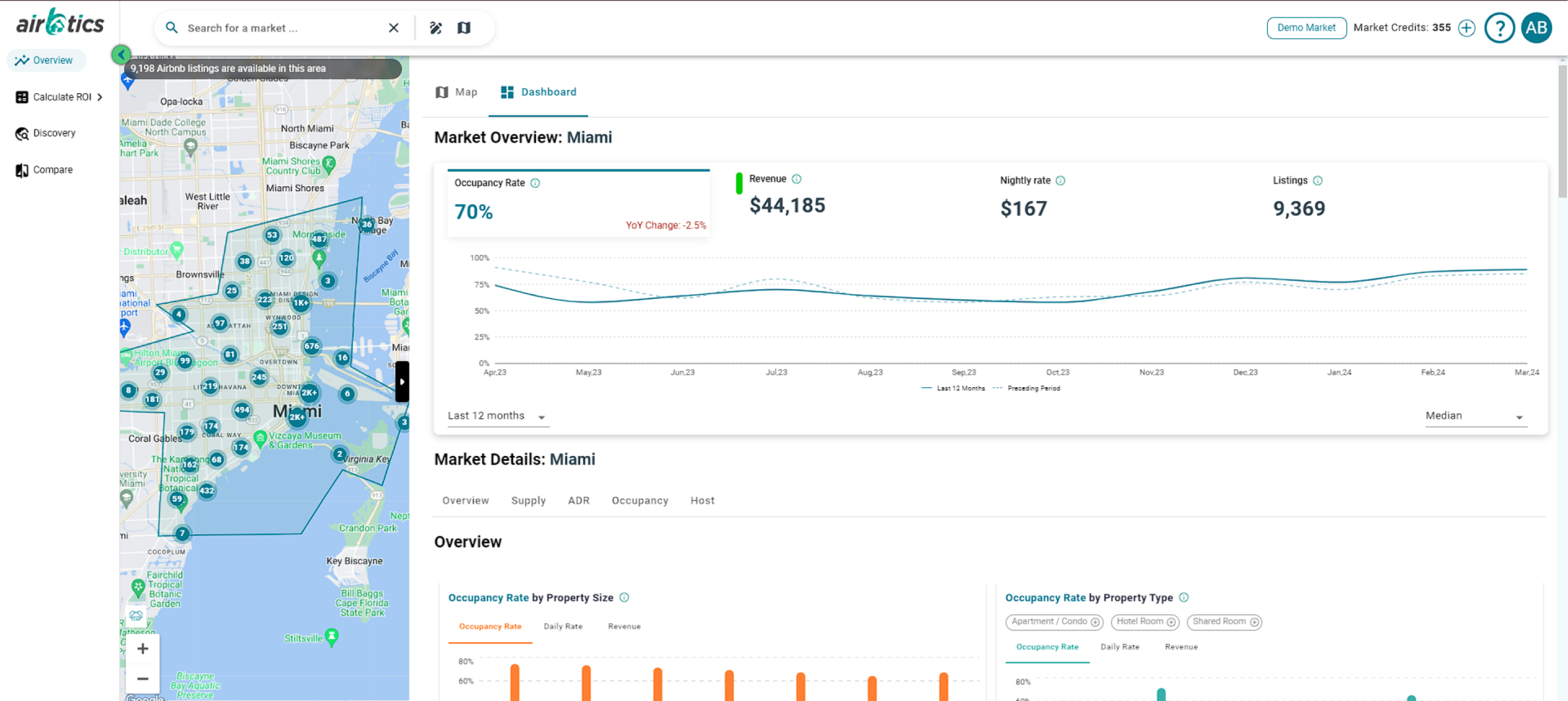

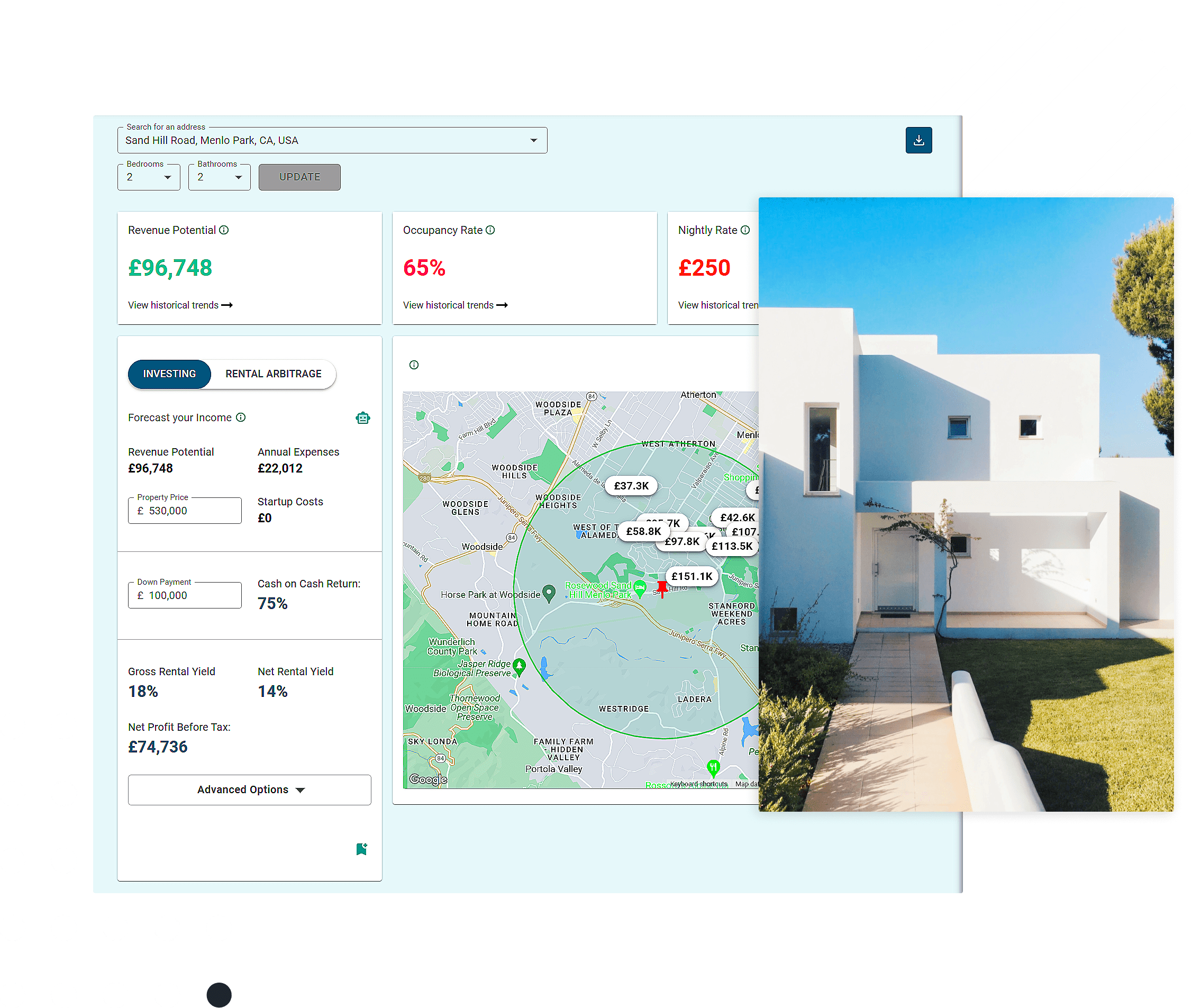

Pro tip! Use Airbtics to estimate how much you can earn by doing an Airbnb.

Flexibility in Using Own Property

One good reason to opt for short-term rentals is if you want to use the property occasionally. For instance, I bought a property in London because I want to visit every summer. If I rented it out on a long-term lease, I would have to spend most of my rental income on hotel stays or Airbnb accommodations during my 2-3 month visits to London.

Tax Benefits

Investing in Airbnb properties can come with attractive tax benefits. Expenses related to the property, such as maintenance, cleaning, and property management fees, can often be deducted from rental income, reducing the overall tax burden and improving the net cash flow. Additionally, depreciation deductions can further enhance the cash on cash return.

How to Maximize Your Cash on Cash Return with Airbnb

How to Maximize Your Cash on Cash Return with Airbnb

Choose the Right Location

The location of your Airbnb property is crucial. Before starting, use market intelligence software like Airbtics to see how much your property can earn on Airbnb.

Optimize Your Listing

An appealing and well-optimized Airbnb listing can attract more guests and command higher rates. Invest in professional photography, write compelling descriptions, and ensure your property stands out with unique features or amenities.

Maintain High Standards

Guest reviews play a critical role in the success of an Airbnb property. Providing excellent customer service, maintaining a clean and well-maintained property, and responding promptly to guest inquiries can lead to positive reviews and repeat bookings, enhancing your cash on cash return.

Utilize a Cash on Cash Return Calculator

Using a cash on cash return calculator can help you accurately estimate the potential return on your Airbnb investment. These tools take into account various factors such as rental income, expenses, and financing costs to provide a clear picture of your investment’s profitability.

Airbnb Calculator

Instantly see your Airbnb’s estimated revenue with the leading Airbnb profit calculator in the short-term rental industry. Discover your Airbnb earnings potential.

🏆What is a Good Cash on Cash Return?

50% is a realistic number that you can aim for.

Many short-term rental investors aim to recoup their initial investment within 18-24 months. Here’s how the numbers typically look:

Investors achieve around a 20% net rental yield. While this is a high figure, it’s attainable through high occupancy rates, premium daily rates, and special amenities like hot tubs, coupled with professional photos and top-notch listings.

For example, if an investor spends $500k to buy a property with a 20% downpayment ($100k) and an additional $50k for furnishing, the total initial investment would be $150k. With a 20% net rental yield, the first-year profit would be $30k. This setup would allow the investor to recover their initial investment in about 18 months, resulting in a cash on cash return rate of approximately 60%.

Conclusion

When it comes to the best cash on cash return investments, Airbnb properties stand out for their potential to generate high rental income, flexibility in pricing, and lower vacancy rates. By strategically investing in the right location, optimizing your listing, and maintaining high standards, you can maximize your cash on cash return and achieve significant profitability with Airbnb. professionally, understanding these dynamics is key.