Is Airbnb legal in Burnaby?

The answer is yes! Using platforms like Airbnb to rent your property is permissible in Burnaby.

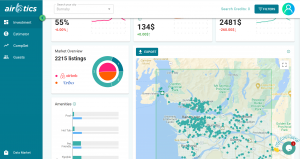

Currently, there are 1,978 Airbnb listings in Burnaby, with 51,7% of entire houses earning up to $2,481 a month, 4,3% managed by professionals, and 42,9% managed independently. Apart from complete houses, Burnaby’s Airbnb offerings include 8,7% of private rooms. According to short-term rental market data source Airbtics, a 2-bedroom apartment in Burnaby can make up to $30,540 each year.

Here we will provide some useful information that can help you better understand the Burnaby Airbnb Rules.

Short-Term Rentals Laws

Burnaby has implemented new short-term rental restrictions aimed at ensuring long-term housing supply and minimizing disruptions to local neighborhoods. The new laws also allow homeowners to supplement their income through an increasing tourist industry.

The Burnaby City Council amended the following:

- Burnaby Zoning Bylaw,

- Business Licence Bylaw,

- The Business Licence Fees Bylaw,

- A bylaw notice enforcement bylaw

to create a program for Burnaby residents who want to run a short-term rental business out of their primary property.

Burnaby Airbnb rules

- As a short-term rental property, the owner may only list his or her primary residence.

- In rental units, additional suites, and flex units, short-term rentals are not authorized.

- A short-term rental property can accommodate up to four unrelated visitors or six members of the same family at any same time; and

- The homeowner may rent the primary house for a maximum of 90 nights a year, 28 of which may include the entire house.

The initial cost of starting Airbnb in Burnaby

Having an Airbnb listing can be a good way to make extra money, but being a host comes with its own set of problems. Offering a short-term rental comes with several expenses. It may affect your mortgage, as well as taxes and cleaning fees.

It is a good idea to consider all these prospective costs and real estate variables before diving in. We’ll go over some of the most typical and surprising expenditures associated with being an Airbnb host, such as:

Airbnb service fees

Airbnb hosts share the first cost you might expect. Once you get a reservation, Airbnb charges a 3% service fee. This may not seem like much, but if you rent your house on Airbnb many times a year, this cost can add up.

Supplies Needed

Your rented property will need fresh bedding, towels, linens, toilet paper, soap, and other amenities. To make your rental feel more like home, you’ll want to stock the fridge and pantry with at least a few foodstuffs.

It’s a good idea to secure your property with external cameras such as a video doorbell and hardwired or Wi-Fi weatherproof exterior cameras. Installing four higher-quality video cameras will set you back roughly $1,200.

Cleaning expenses

Cleaning is, of course, required when renting your house on Airbnb. While cleaning supplies are inexpensive, expect to spend several hours cleaning, vacuuming, mopping, and tidying up. You’ll need to use a cleaning service if you don’t want to do the work or won’t be available to do it. Each cleaning session might cost you more than $200.

You can pass these costs on to your guests in the form of an increased rental price or by adding a separate cleaning fee to your rental listing.

Insurance protection

Insurance coverage is the most expensive component of renting your house on Airbnb. You may be able to rent your house without having to buy extra coverage or incur extra costs if you have existing home insurance. But, you must notify your insurer in advance and get approval. For an extra fee, you may need to add a rider or endorsement to your existing policy.

The Airbnb Host Guarantee covers you for up to $1 million in damages to your home caused by your visitors (besides the security deposit). Yet, this coverage isn’t comprehensive. Wear and tear, personal liabilities, jewels, securities, cash, pets, collectibles, and rare artwork are all excluded.

Expenses of starting a business

For tax advantages, some experts tell incorporating your company. You may be able to protect your assets if sued by forming a corporation or limited liability company (LLC) as well as receive tax benefits from doing so.

But, depending on the state you live in, the charges of incorporating might be quite significant.

Mortgage expense

If you plan to refinance your home’s mortgage, renting out your home via Airbnb may cost you money. Because of this, your rental income may not be taken into account when refinancing your home. This would have an impact on your debt-to-income ratio, which could lead to a higher interest rate on your new loan.

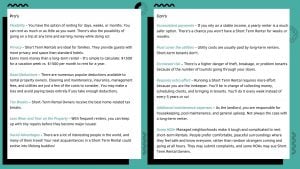

Pros and Cons of running Airbnb in Burnaby

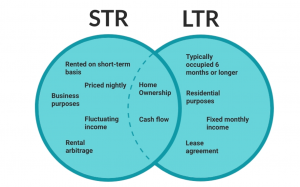

Short-term rentals are vacation rental properties rented out on a short-term basis to guests, like hotels. This form of rental helps guests to feel more at ease and “at home” because the properties are typically designed in this manner.

A long-term rental is the most common sort of rental property utilized for residential purposes. This sort of rental property is usually protected by a long-term lease agreement with more binding terms than a short-term rental. Renting out their homes for a higher price than their mortgage allows them to generate regular income regardless of the market. Because it is more traditional and well-known, most people are more familiar with this sort of rental property.

Now that we’ve defined vacation rentals and long-term rental properties, let’s look at each component of rental properties that explains both the benefits and drawbacks of a short-term or long-term rental.

Best areas to invest in Burnaby

There are some obvious places that come to mind when thinking of Burnaby like Brentwood, Maywood and Lochdale. But two of the best areas for investment top our list. The first one is:

1. Burnaby Heights

According to our Airbtics Dashboard, Burnaby Heights is the top market to invest in Short-term Rentals. There are currently 4,820 Airbnb listings. Monthly revenue for most properties is more than $2,053/month with occupancy being more than 50%.

2. Metrotown

According to our Airbtics Dashboard, Metrotown is the second top market to invest in Short-term Rentals. There are currently 5,022 Airbnb listings. The monthly revenue for most properties is more than $2,045/month with occupancy being more than 50%.

Conclusion

If you’ve made it this far, you’re thinking of starting an Airbnb.

We’ve been assisting folks like you, who are first-time Airbnb hosts. We don’t provide consulting since we aren’t experts in running Airbnb businesses; but, we do provide useful data to Airbnb hosts.

You may use the Airbtics dashboard to figure out how much money you can make doing Airbnb in your city. Unlike other online Airbnb income calculators, it will provide you with a lot more useful information, such as

-which neighborhood to target,

-which amenities are in high demand,

-what is the market’s historical performance,

-what are the occupancy rates of a two-bedroom house,

-should I do a two-bedroom house or a three-bedroom house?

In that case, the tool might be too complex for you, visit our tutorials – With the data dashboard, you can get meaningful and actionable insights.

Well, if you are new, there are many Airbnb host communities on Facebook. Type “Airbnb host” in the Facebook search, and you’ll see plenty of active communities where you can get help from experienced Airbnb hosts.

To see full data of Burnaby– Click Here