Purchasing a property investment in Italy is a complex task and it requires a lot of analysis. In this article, we’ll feature the various kinds of mortgages in Italy, upfront & ongoing costs of investment property, taxes, and other fees that you should consider. Learn how you can strategize property investment in Italy & make an informed decision!

Fixed rate

Provides the same interest rate for the entire duration of the loan. The rate is established during the signing of the contract and is calculated on the basis of the Eurirs European reference rate (also known as IRS: Interest Rate Swap), which is disseminated daily by the European Banking Federation.

Variable rate

Refers to an interest rate that varies, therefore increases or decreases, based on the trend of the Euribor. The reference interbank rate for this type of loan is fixed by the European Banking Federation.

Mixed rate

This type of mortgage is a flexible choice of interest rate that depends on the conditions agreed upon at the signing of the loan. It is possible to decide whether you can start with a fixed rate and then change it to a variable one or vice versa. The installment amount will be based on the fixed rate period which generally ranges from 2 – 5 years. This type of loan offers the borrower the possibility to change the rate once or more times during the course of the contract.

Constant variable rate installment

This type of mortgage allows you to choose a variable rate without affecting the amount of the installment which will remain fixed for the entire time of the contract, but the duration of the contract can be changed.

How to apply for a mortgage in Italy?

The process of choosing and obtaining a mortgage in Italy can seem complex and obscure. Here are some of the requirements that you will need:

1. Mortgage Application

Once you have selected your preferred bank, all parts of the loan application must be completed as precisely as possible. The mortgage application, prepared in the form of a questionnaire, usually contains standard information. This includes the following:

- Personal data of the applicant or applicants for the loan

- Complete address – indicate whether your current home is rented, owned or with third parties

- Personal data of family members or dependents

- Current occupation (if an employee: a certificate of employment, monthly net income, and annual net income documents should be declared)

2. The Preliminary Feasibility opinion

The data and requests contained in the application allow the bank to express an initial feasibility opinion on the loan transaction. The feasibility of the operation, and therefore the granting of the requested sum, generally depends on the contribution of several elements including:

- The net income of the applicant and his family members (family unit) derived from the tax return

- The value of the property subject to the loan

- Technical / legal suitability of the property to be sold

- Presence of additional guarantees given by third parties

Once all the data above have been presented, the bank will be able to express its own “feasibility opinion;” which, if positive, starts the next phase consisting in requesting documentation.

How do Italian mortgages work?

- As of April 2022, Italy’s bank lending rate is at 1.2%.

- A fixed rate mortgage in Italy reaches cost levels of between 2.5% and 2.8%

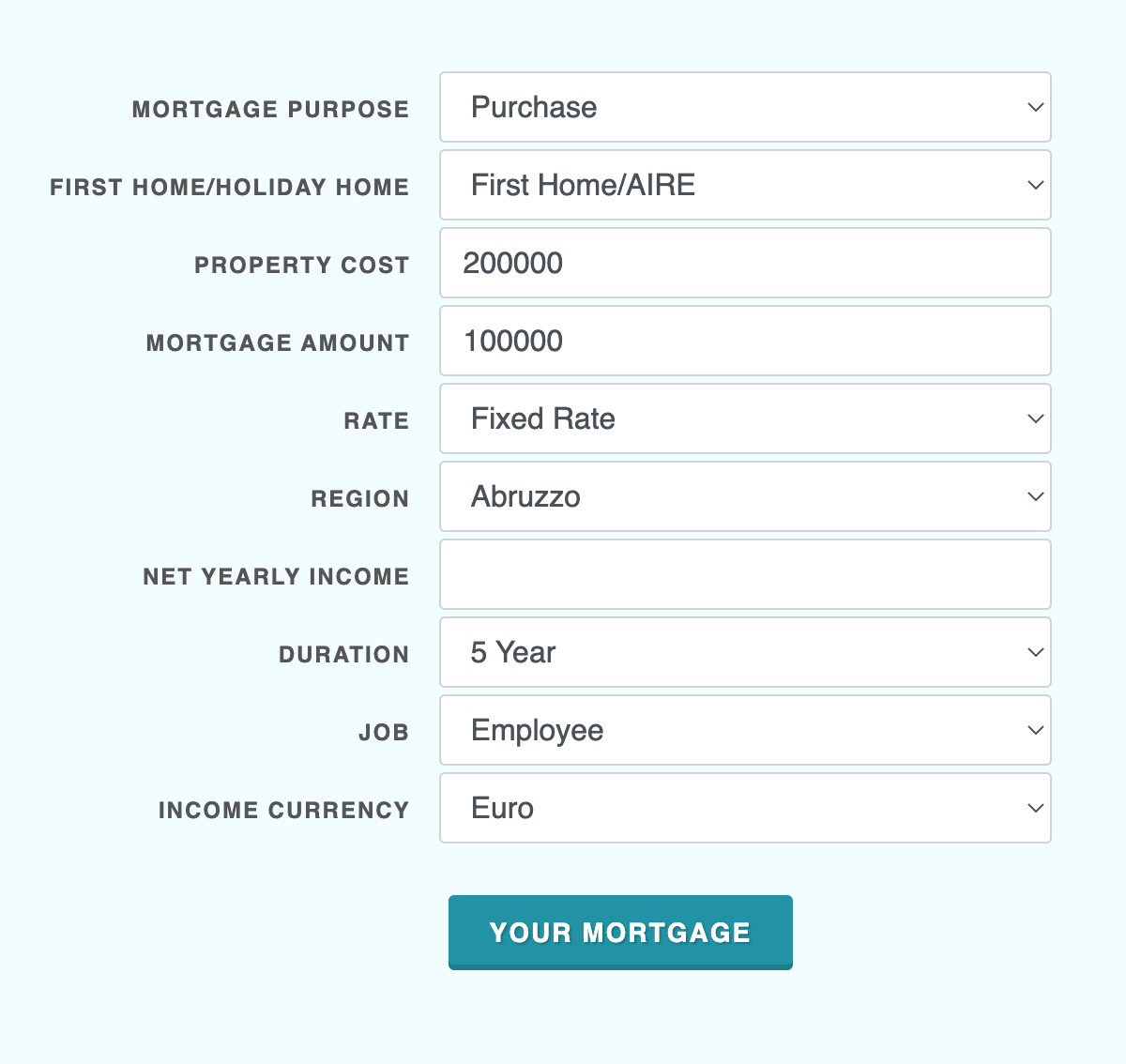

In addition to this, you can easily calculate how much the approximate monthly payment for your mortgage is using an online mortgage calculator in Italy.

Costs of Investment Property

Now that you have familiarized yourself with the kinds of mortgages, the next step is to learn more about the costs of investment! The current average price of houses on the market is €2,848 per square meter.

As of June 2022, the asking price for rental properties was the highest in the Lombardia region, with €15,300 per month per square meter. The lowest average asking prices instead, were in the Umbria region, with only €6,810 per month per square meter, the lowest value nationally. Here is a summary breakdown of the entire costs that you will need to consider in order to invest in Italy:

| Average Property Prices in Abruzzo | |

|---|---|

| For sale (per square meter) | For rent (per square meter) |

| €1,292 | €7,79 |

| Average Property Prices in Liguria | |

| For sale (per square meter) | For rent (per square meter) |

| €2,522 | €10,03 |

Source: Immobiliare Italy

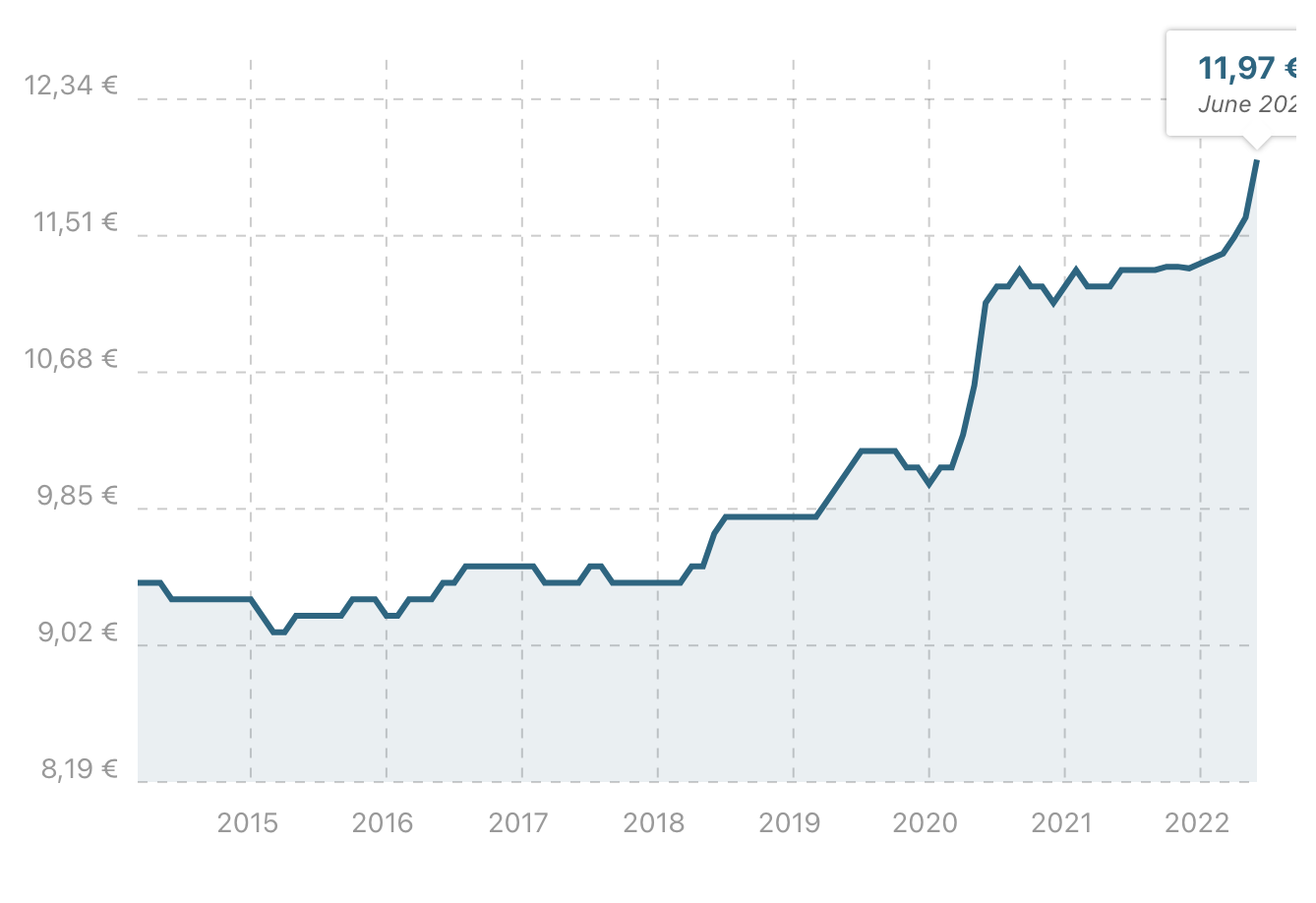

Relatively, residential rental properties in Italy increased 5.93% compared to June 2021 (€11,30 monthly per square meter). Over the past 2 years, the average price in Italy has reached its peak in the month of June 2022, with a value of €11,97 per square meter.

UPFRONT COSTS:

1. Agency Fees

The standard agency fee in Italy is 3% of the purchase price plus VAT (currently 22%). The real estate agent must register your purchase contract with a registration fee of €200,00 plus a registration tax of 0,5% on the warranty down payments (or deposits) and tax stamps which are a minimum of €32,00.

The registration tax will be deducted from the registration tax on the final deed.

2. Notary Fees

The cost of the Notary is borne by the buyer and is a state-controlled fee for their services to oversee registering the public contract of your house purchase. The Notary costs between €1500 – €3000 depending on the cost of your house.

3. IVA (Value Added Tax)

All the above services are subject to IVA (VAT or Sales Tax) currently charged at 22%.

4. Geometra Survey (Conveyancing Fees)

Geometra is paid by you to check both the legal and structural state of the house. The structural part of Geometra’s survey is very basic. If you require a full building survey then this would be an extra fee, paid to a licensed structural engineer or the Geometra.

The price for this kind of structural survey is typically between €500–700, but could be more so it always good to get a quote. The Geometra then writes the preliminary contract and does the conveyancing.

ONGOING COSTS:

1. IMU Municipal Property Tax (Imposta Municipale)

- You only have to pay this Italian tax if your house is a second home, rather than your main residence. It is calculated at 7.6% of the cadastral land value of the property, although it can be slightly more or less depending on the specific region you live in.

2. TASI Indivisible Services Tax (Tassa sui Servizi Indivisibili)

- This tax is a kind of council tax levied on public services such as street lighting and road maintenance, but you don’t have to pay if your house in Italy is your main residence.

If you rent it out on a long-term basis, you have to pay 70–90% of it, while the rest is paid by the tenant, but if you let it for short periods as a holiday rental, you are responsible for the whole tax. It is worked out as between 1% and 3.3% of the property’s cadastral value, depending on the municipality it’s in.

3. Home insurance

- For a house in Italy as with anywhere else, it’s always advisable to have home and contents insurance. The rates charged by Italian insurance providers are usually about €180 – €380 yearly, depending on the features of your house.

What is a good cash return/net rental yield?

You can generate good cash flow from your residential investment property by either renting out long-term or short-term. Looking into a more detailed guide for property investment in Italy can definitely help you decide which path you should take.

For the long-term rental, you’ll rent out your property for a minimum of 12 months. There’s very little maintenance to do and you’ll need to visit the property on a quarterly basis to do inspections & other similar errands.

However, if you are after high return investments such as over 10% net rental income, running a short-term rental is what you need to consider. By doing short-term rental, you need to target somewhere between 10 – 25% net rental yield, and 20-50% cash return during the first year.

Airbtics is designed to showcase accurate data for simulating cash returns using the ultimate Airbnb Calculator. Choose to stand out among your competitors & try Airbtics!