Purchasing a property investment in Spain is a complex task and it requires a lot of analysis. In this article, we’ll feature the various kinds of mortgages in Spain, upfront & ongoing costs of investment property, taxes, and other fees that you should consider. Learn how you can strategize property investment in Spain & make an informed decision!

Variable-rate Mortgages

The benefits of variable interest rates include taking advantage of low rates and more Spanish mortgage options. The interest rate is adjusted with the Euro Interbank Offered Rate (Euribor), which has been in negative territory since 2015. The disadvantage is not knowing how much your monthly mortgage payments will be in the long term because interest rates can rise.

Fixed-rate Mortgages

This type of mortgage is less risky since you will know exactly how much your monthly repayments are for the entire duration of the mortgage. You are also protected from future interest rate increases because the rate is fixed. This mortgage product became more popular with Spanish homebuyers in 2020 because it offers more security in uncertain markets. On the other hand, you will pay more to borrow the money when interest rates are low.

Mixed-interest-rate Mortgages

As the name suggests, this type of mortgage uses both a fixed and a variable rate. Most of these mortgages fix the rate for five years and then automatically convert it into a variable mortgage. Spanish lenders rarely offer this option.

Interest-only mortgages

Interest-only mortgages are less popular than other types of mortgages in Spain. Only residents can take out this type of mortgage, which allows you to pay off just the interest for the first term of the mortgage. While you can save money on your monthly repayments with an interest-only mortgage, you will often pay more in the long run, as it takes a lot longer to pay off the entire amount.

Non-euro mortgages

It’s very unusual for a Spanish bank to provide a loan in a currency other than euros. Although it’s a way of saving costs on the exchange rate, the Spanish bank might charge you more for the benefit of paying in your home currency.

Spanish mortgages for seniors

If you are a Spanish resident over 65 and receive a pension, you can retire in Spain and apply for a Spanish mortgage to buy a home. One product that can benefit expats is a Lifetime Loan. It allows senior residents of Spain to release equity from their homes and convert it into cash. Through this, a mortgage against the property that doesn’t need to be repaid within the property owner’s lifetime.

How to apply for a Spanish mortgage?

Cajas or banks are often offered by Spanish mortgages and are sold directly by lenders or mortgage brokers. Here are some of the requirements that you will need:

1. Spanish tax ID number (for foreigners)

Primarily, you need to get a tax ID – also known as NIE (Número de Identificación de Extranjeros). This can be applied at your local Spanish consulate.

Some of the documents that you will need to get an NIE are:

- A completed EX-15 form

- Supporting document (s) to show why you need an NIE

- Copy of passport & original passport

- Two passport-sized photos

- €9-12 fee to submit tax form 790

2. Proof of employment or income

3. A pre-agreement with the seller

4. Proof that the property tax is paid to date

5. Details of your current debts and mortgages

6. Copies of all your existing property deeds (in Spain and other places)

7. Records of your current assets

8. Any prenuptial agreements (if applicable)

How does Spanish mortgage work?

- The average mortgage in Spain has an interest rate of 2.25% for variable-rate mortgages & 2.8% for fixed-rate mortgages.

- You will need a minimum deposit of 30% of the property’s purchase price.

- The maximum debt to income (DTI) ratio is around 35-40% including the mortgage payment.

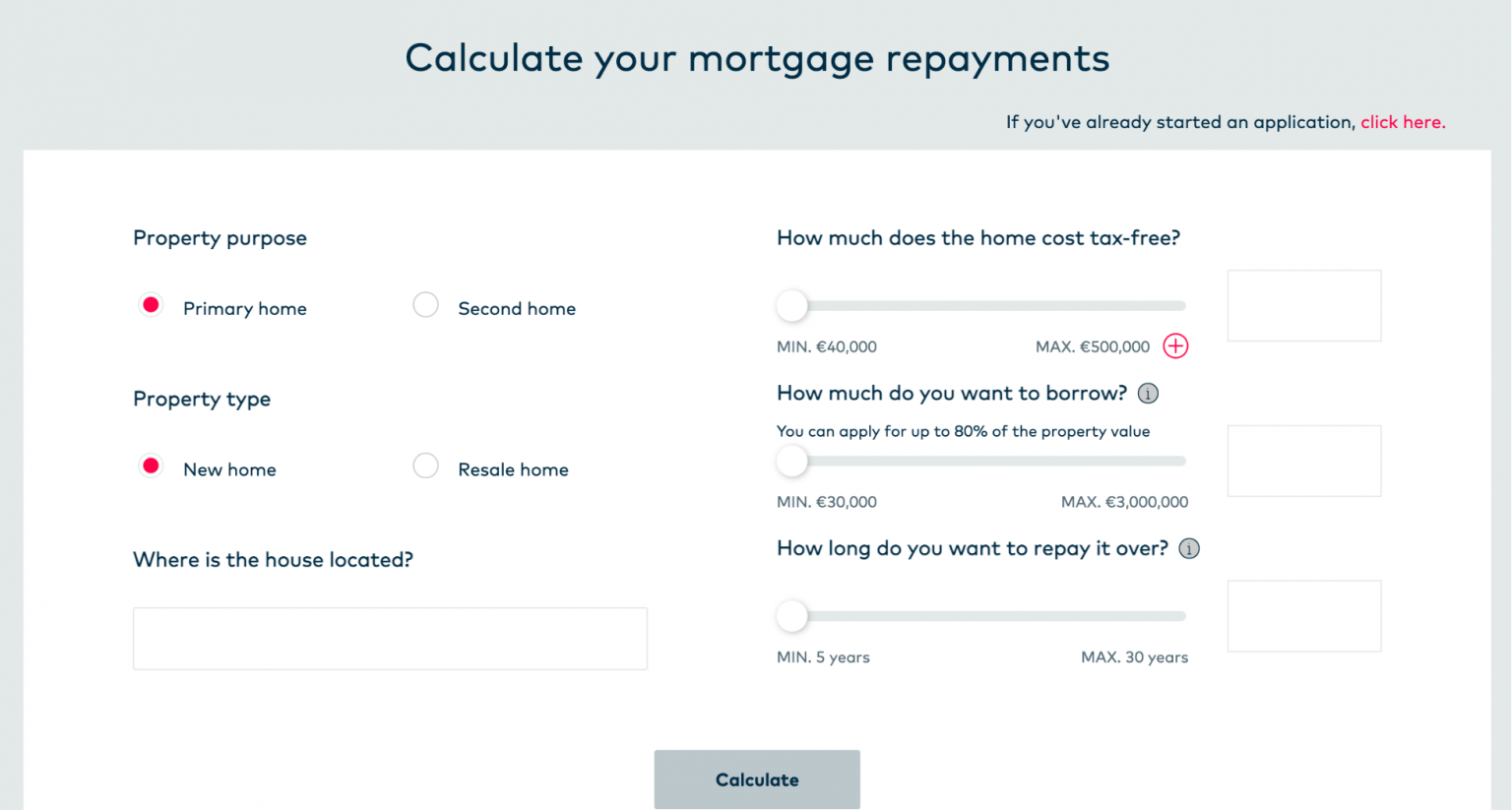

In addition to this, you can easily calculate how much the approximate monthly payment for your mortgage is using an online mortgage calculator.

Costs of Investment Property

Now that you have familiarized yourself with the kinds of mortgages, the next step is to learn more about the costs of investment! The average price of houses currently on the market is €250,000. The sale price of 80% of the properties is between €65,000 and € 1,050,000.

The average per m² in Spain is €1,322 / m² (price per square meter). Here is a summary breakdown of the entire costs that you will need to consider in order to invest in Spain:

| Average Property Prices in Spain | |

|---|---|

| House | Prices |

| 4 Rooms | €320,000 |

| 5 Rooms | €430,000 |

| Flats | Prices |

| 2 Bedrooms | €140,000 |

| 3 Bedrooms | €146,000 |

Source: Real Advisor Spain

UPFRONT COSTS:

1. Stamp Duty (Impuesto Sobre Actos Juridicos Documentados: AJD)

- Refers to a tax on notarial acts implemented through different Autonomous Regions. Depending on the area, the amount can vary from 0.5% – 1.5%.

2. Notary’s Office (Tariffs)

- Regulated by the Spanish government, tariffs are expenses that should be considered when buying a property – whether it is new or used. The prices vary depending on your preferred property but usually cost around €600 – €875.

3. Land Registry Fees

- Once the documents have been notarized, it is important to take note that registering your deeds may depend on the property’s price. According to Spain’s 2022 tax research, it costs around €400 – €650.

4. Sales-related Taxes

- As for expenses and taxes on the purchase of a new home, the most important tax is VAT – which amounts to 10% based on the property’s value. For instance, it would mean 10,000 euros in the case of a 100,000-euro home and 25,000 in a 250,000-euro home.

- Taxes in the Canary Islands is at 6.5% (IGIC-Impuesto General Indirecto Canario).

- For public housing, VAT can be up to 4%, but it varies depending on the Autonomous Community and the type of social housing in question.

- A second tax must be added to VAT: the Documented Legal Acts (IAJD). This tax will be paid by the buyer and will depend on each autonomous community.

- If you purchase a second-hand property, it is mandatory to pay for ITP (Transfer of Assets Tax in Spain), which costs between 4% – 10% depending on your autonomous community.

ONGOING COSTS:

1. Repayment mortgage is one of the ongoing costs that you have to consider. Usually in a series of monthly payments, this refers to paying both the capital that was lent and the interest accrued.

- The maximum notification time a bank can require for repayment mortgage is one month.

- It is important to know that simply paying off the debt is not the final step in canceling a Spanish mortgage. You must ask your bank to issue the notarial deed of cancellation (escritura de cancelación de hipoteca). Then, you should present this to the land registry yourself or have a lawyer (administration office) do it.

Here is a brief summary of mortgage costs in Spain:

- Variable-rate mortgage fees:

0.25% in the first three years

0.15% in the first five years

- Fixed-rate mortgage fees:

2% in the first ten years

1.5% after ten years

2. Agency fees vary based on your property’s percentage price. Although this is an optional expense, the approximate cost is €300.

TOTAL EXPENSES & TAXES

Let’s talk about the price comparisons for new & second-hand housing in Spain. It’s important to note that the exact figure will depend on the value of your preferred property & autonomous community.

For instance, if you are planning to purchase a property for €15,000 in Barcelona, here is the total expenses & taxes that you will need to consider:

| EXPENSES | FEES | NEW HOUSING | SECOND-HAND HOUSING |

|---|---|---|

| Notary Fees | €750 | €750 |

| Registration Fees | €365 | €365 |

| Management Expenses | €300 | €300 |

| VAT + IAJD | €17,250 | (not applicable) |

| ITP | (not applicable) | €15,000 |

| TOTAL: | €18,675 | €16,425 |

What is a good cash return / net rental yield?

You can generate good cash flow from your residential investment property by either renting out long-term or short-term. On the other hand, some hosts who don’t want to purchase a property would opt for rental arbitrage in Spain.

For the long-term rental, you’ll rent out your property for a minimum of 12 months. There’s very little maintenance to do and you’ll need to visit the property on a quarterly basis to do inspections & other similar errands.

However, if you are after high return investments such as over 10% net rental income, running a short-term rental is what you need to consider. By doing short-term rental, you need to target somewhere between 10 – 25% net rental yield, and 20-50% cash return during the first year.

Airbtics is designed to showcase accurate data for simulating cash returns using the ultimate Airbnb Calculator. Choose to stand out among your competitors & try Airbtics!