What Is RevPAR ?

RevPAR, or Revenue per Available Rental, is a key performance

metric in the hospitality industry in general and the short-term rental business in specific which

measures how effectively a property generates revenue.

It combines the average daily rate (ADR) and the occupancy rate to

provide a comprehensive picture of revenue performance across both booked and unbooked nights.

RevPAR Definition

RevPAR is defined as a property’s revenue per available rental. RevPAR is calculated by dividing

revenue by the number of available listings. Alternatively, it can also be calculated by multiplying

the average daily rate (ADR) by the occupancy rate.

Why Is RevPAR Important?: Understanding Revenue per Available Rental

RevPAR is one of the most important performance metrics for Airbnb investors, hosts, and managers as

it reflects the overall income potential of a property. As the revenue per available rental

incorporates the average daily rate and the occupancy rate, it accounts for both pricing and

vacancy, giving a more complete understanding of STR performance.

By tracking RevPAR, you can:

- Compare properties of different sizes and locations to choose the most

profitable investment opportunity.

- Identify trends in demand and pricing in the local market to adjust your

revenue management strategy.

- Make smart pricing and marketing decisions.

- Benchmark your property against competitors in the area.

With tools like Airbtics’ RevPAR calculator, you can easily and quickly calculate revenue per

available rental to find opportunities to increase your Airbnb revenue and ROI.

What Is a Good RevPAR?

There isn’t a single, universal number that qualifies as a good RevPAR. A good revenue per available

rental value depends on multiple factors including:

- Market and sub-market

- Property type and size

- Amenities

- Target guest persona

- Seasonality

Generally speaking, a higher RevPAR indicates better short-term rental performance

as you are able to make more money per single rental. However, what’s considered good varies widely.

For example, a RevPAR of $100-$120 might be considered excellent in a suburban market, while it is

insufficient to yield strong returns in a hot, urban market, where the average RevPAR might exceed

$200.

To determine if your RevPAR is good, you should:

- Compare your performance to averages in the local market using the Airbtics’ RevPAR

calculator

- Benchmark by property type and number of rooms

- Track and analyze seasonal trends to set realistic expectations

Ultimately, a good RevPAR is one that exceeds the market averages, grows steadily over time, covers

your operating costs, aligns with your investment goals, and provides strong ROI.

How to Calculate RevPAR

To calculate RevPAR for a portfolio or a market, you have to go through the following steps:

- Calculate the total revenue over the time period under investigation (week, month, or year).

- Calculate the total number of listings available over the studied time period.

- Divide the total revenue by the number of listings.

Calculating the RevPAR of a single property is done by following these steps:

- Calculate the average daily rate (ADR).

- Calculate the Airbnb occupancy rate.

- Multiply the ADR by the occupancy rate.

RevPAR Formula

The formula used to calculate RevPAR for a portfolio or a market is:

RevPAR = Total Revenue / Total Number of Listings Available

The RevPAR formula for a single property is:

RevPAR = ADR x Occupancy Rate

While the RevPAR calculation formula includes only a couple of variables, it is not always easy to

calculate. You need to have access to solid, reliable short-term rental data to be able to calculate

total average daily rate and occupancy accurately. To simplify the process and make results highly

accurate, use a RevPAR calculator.

RevPAR Calculation Example

To gain a better understanding of the RevPAR formula, let’s take a look at a specific real-life

example.

A vacation rental is listed for 25 nights per month and earns a revenue of $5,000.

Applying the first RevPAR formula:

RevPAR = $5,000/25 = $200

The same property has an average nightly price of $250 and an occupancy rate of 80%.

Using the second RevPAR formula:

RevPAR = $250 x 80% = $200

In both cases, the RevPAR is $200, which means that the host made $200 per night over the course of

the month, whether booked or not.

Why Airbtics Has the Best RevPAR Calculator Worldwide

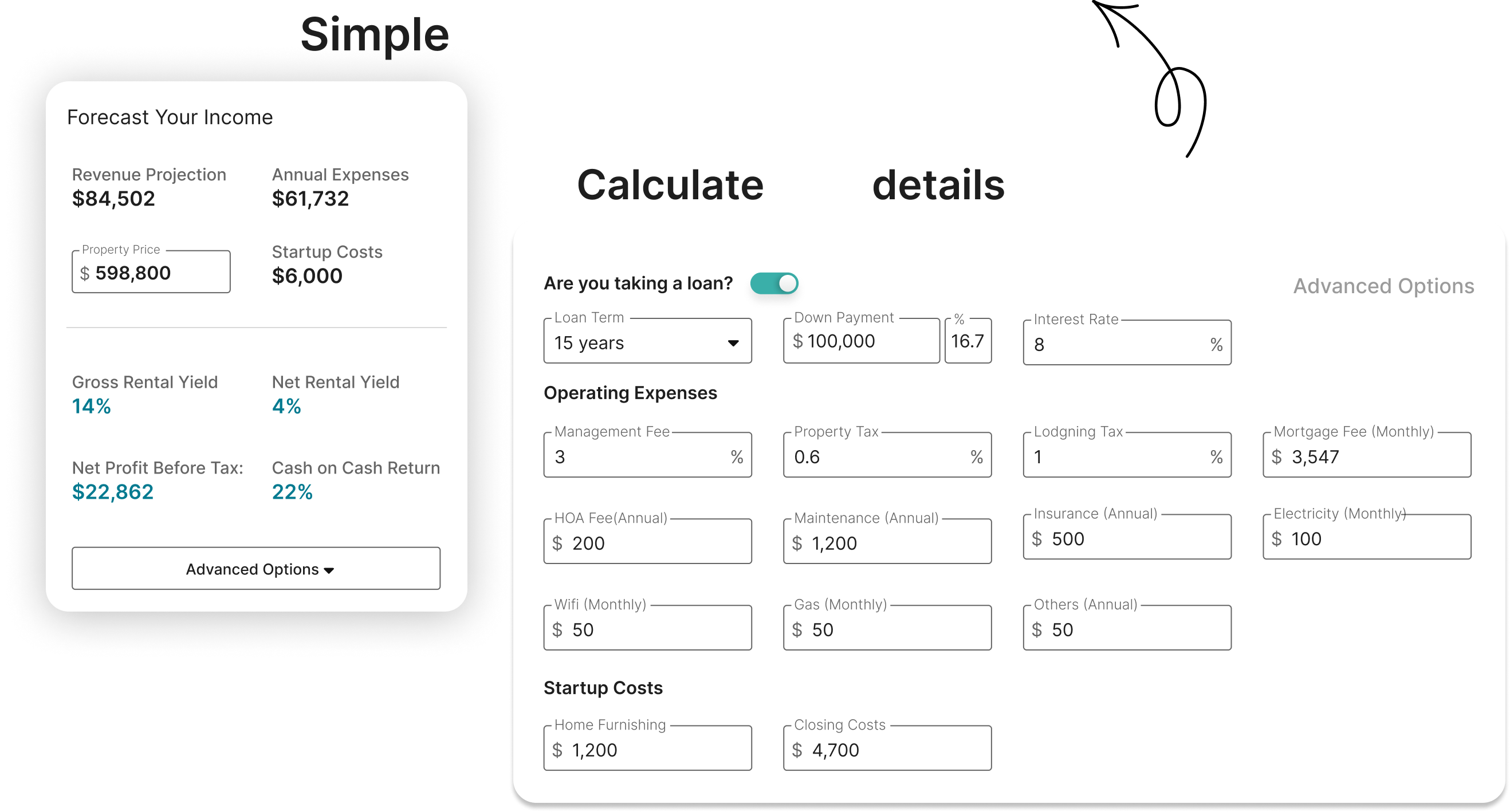

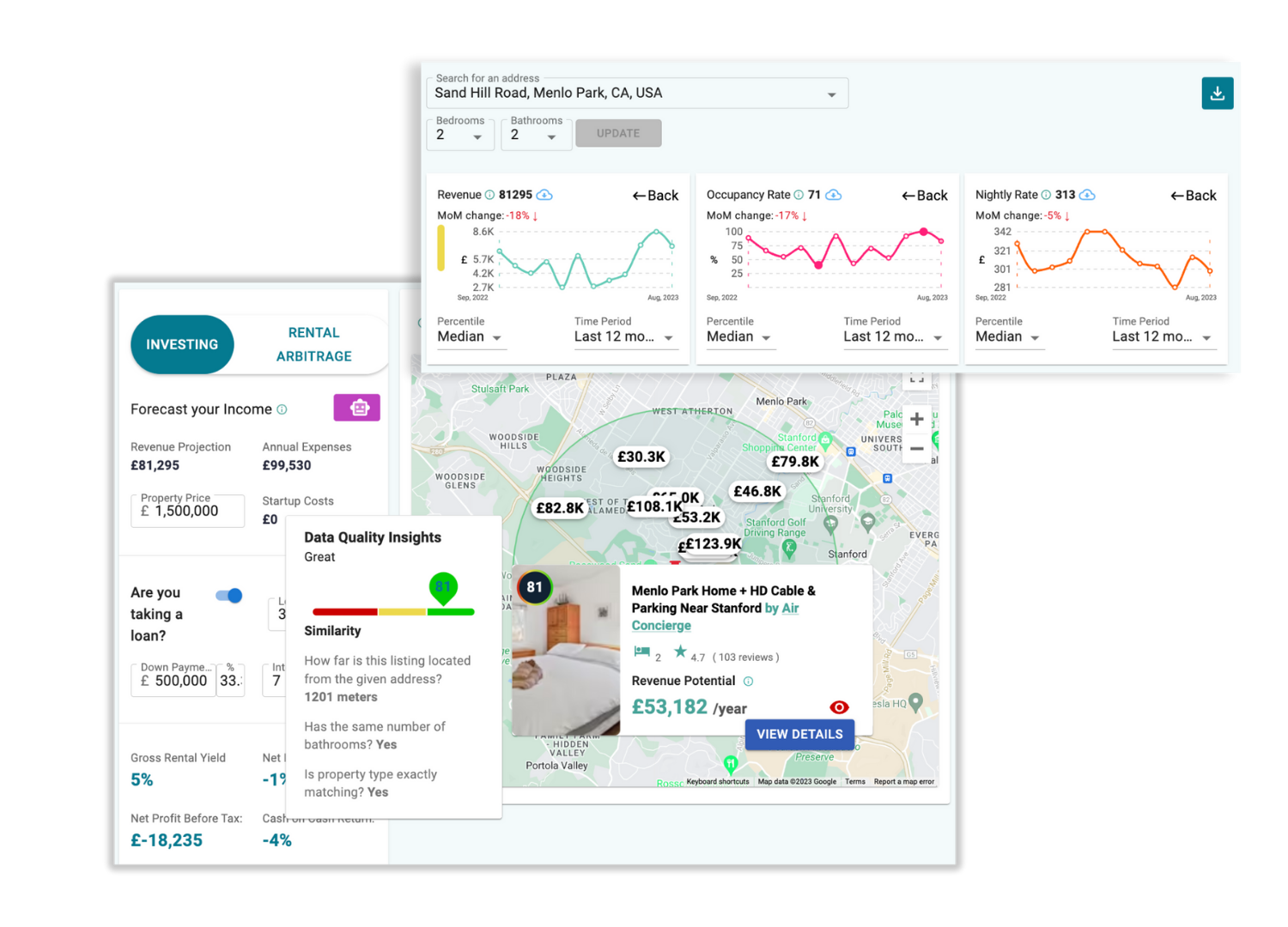

Airbtics offers a comprehensive Airbnb calculator that also pairs as a RevPAR calculator. This is a

must-have tool for STR investors, hosts, and property managers as it eliminates guessing and

error-prone Excel spreadsheets from vacation rental analysis and investment.

Instead, Airbtics’ RevPAR calculator provides instant, reliable estimates of:

- RevPAR

- ADR

- Occupancy rate

- Revenue

- Net operating expenses

- Net operating income (NOI)

- Cash flow

- Breakeven analysis

- Mortgage calculations

- Seasonality impact

- Airbnb rules and

regulations

- Short-term rental comps

- Airbnb rental arbitrage opportunities

How Does the #1 RevPAR Calculator Work?

Using the Airbtics’ RevPAR calculator to quickly and accurately forecast the

performance of any market and property is easy.

Just follow these steps:

- Enter an address anywhere around the globe.

- Enter the number of bedrooms and bathrooms.

- Mark whether the property has a pool or not.

As soon as you provide this info, our calculator will return a comprehensive short-term

rental property analysis based on the performance of similar listings in the area. The

more details that you provide, the more accurate the analysis.

Our RevPAR calculator offers highly accurate and trustworthy predictions about a property’s expected

performance before you even buy it. This allows you to make profitable vacation rental investment

decisions with less manual effort.

Benefits of Using Airbtics’ RevPAR Calculator

The Airbtics’ RevPAR calculator gives investors, hosts, and Airbnb managers a fast and reliable way

to evaluate rental performance without spreadsheets and guesswork.

Here’s why this tool is an absolute game-changer:

- Instant, accurate RevPAR insights: Get real-time RevPAR values based on

actual vacation rental data to find the best Airbnb markets and properties.

- Market-level benchmarking: Compare your listing’s RevPAR to comps to see

how you do and where you need to improve.

- Smarter pricing and marketing strategy: Understand whether RevPAR is low

because of suboptimal pricing, high vacancy, or both. Adjust your pricing and marketing to

boost revenue and overall performance.

- Location-specific data: Perform investment property analysis based on

localized data for accurate estimates.

- User-friendly interface: Access clear visualizations, heatmaps, and

downloadable reports to simplify complex data for money-making Airbnb investments.

How to Improve the RevPAR of Your STR Business

The RevPAR is not set in stone. There are many things a host or property manager can do to

increase their revenue per available rental.

Here are practical tips to boost performance:

- Invest smartly: First off, start by selecting a profitable Airbnb market

and a property with a strong revenue potential. Use proven tools like Airbtics to find the

best opportunities for savvy short-term rental property investors.

- Make your property competitive: Furnish your rental in line with local

trends. Add Airbnb amenities that are in high demand.

- List on multiple channels: Don’t limit yourself to Airbnb only. List your

property on Vrbo and other popular and niche vacation rental websites.

- Optimize your listing: Work on channel-specific SEO strategies. Come up

with a catchy listing title. Write a compelling description. Add high-quality photos showing

the interior and exterior. Highlight amenities. Add house rules. Use a flexible cancellation

policy.

- Apply dynamic pricing: Use a dynamic pricing tool, such as PriceLabs or

Beyond.

- Offer promos and discounts: Consider adding discounted rates for

last-minute reservations and extended stays.

- Monitor market trends: Continue tracking market and comps performance

even after buying your property. Have proactive - rather than reactive - pricing, marketing,

and management strategies.

Maximize Your Vacation Rental’s Revenue Potential with the Airbtics

Calculator

RevPAR is one of the many metrics that you need to take into consideration for a successful, profitable

short-term rental property investment. However, finding the best Airbnb investment opportunity doesn’t

need to take months of research and analysis. With the Airbtics’ RevPAR calculator, top vacation rental

investments are just a few clicks away.