Should I Invest in a Short-Term Rental?

Investing in a short-term rental property can be an excellent way to generate additional income, especially in popular tourist destinations and business hubs. Compared to long-term (monthly) rentals, STRs usually offer higher returns, more flexibility, and faster investment payback. Moreover, by hiring a professional Airbnb management company, you can turn vacation rental revenue into a source of passive income.

However, success depends on multiple factors, such as location, property type and size, seasonal demand, occupancy rates, average daily rates, local regulations, and management style.

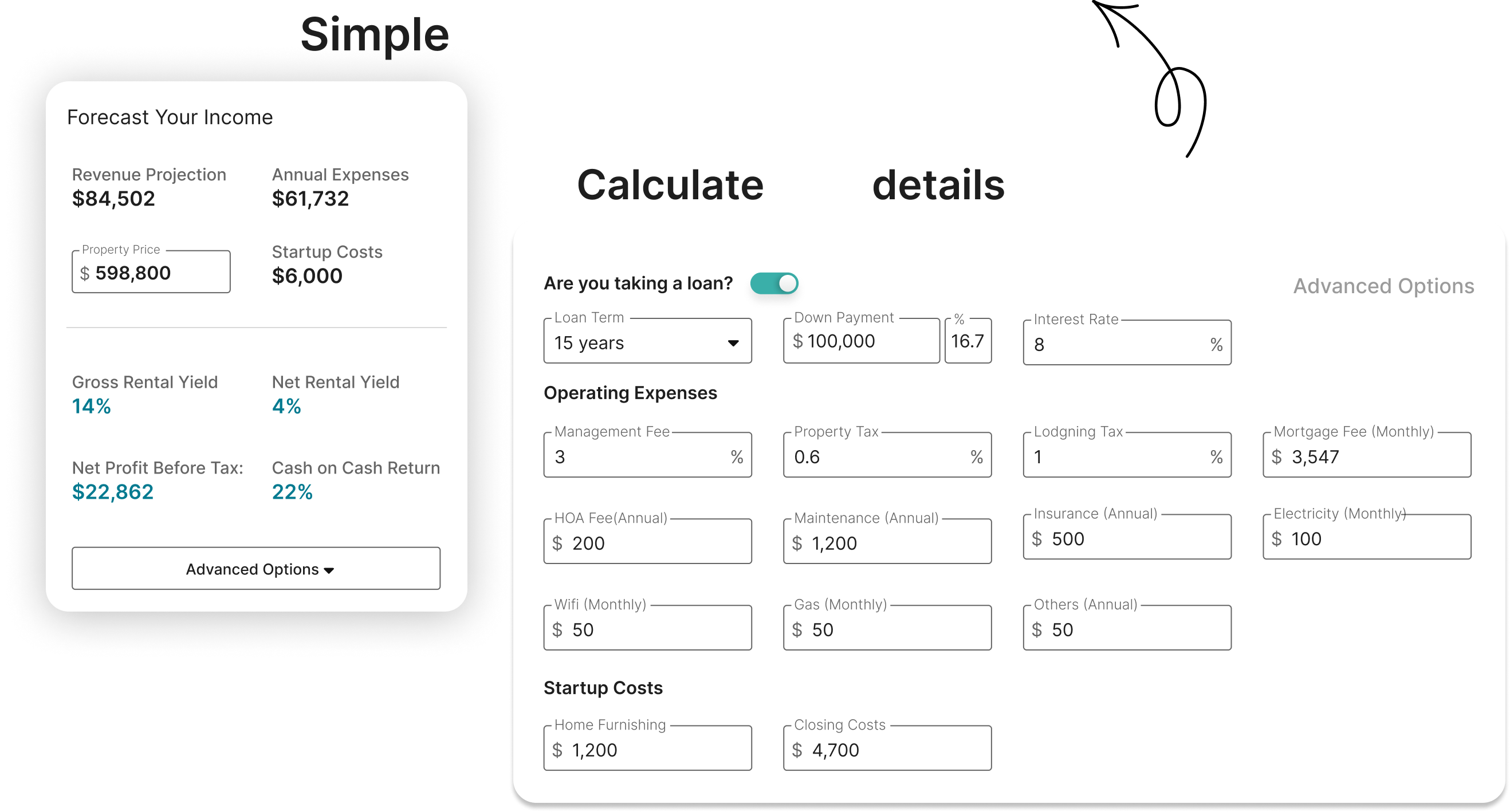

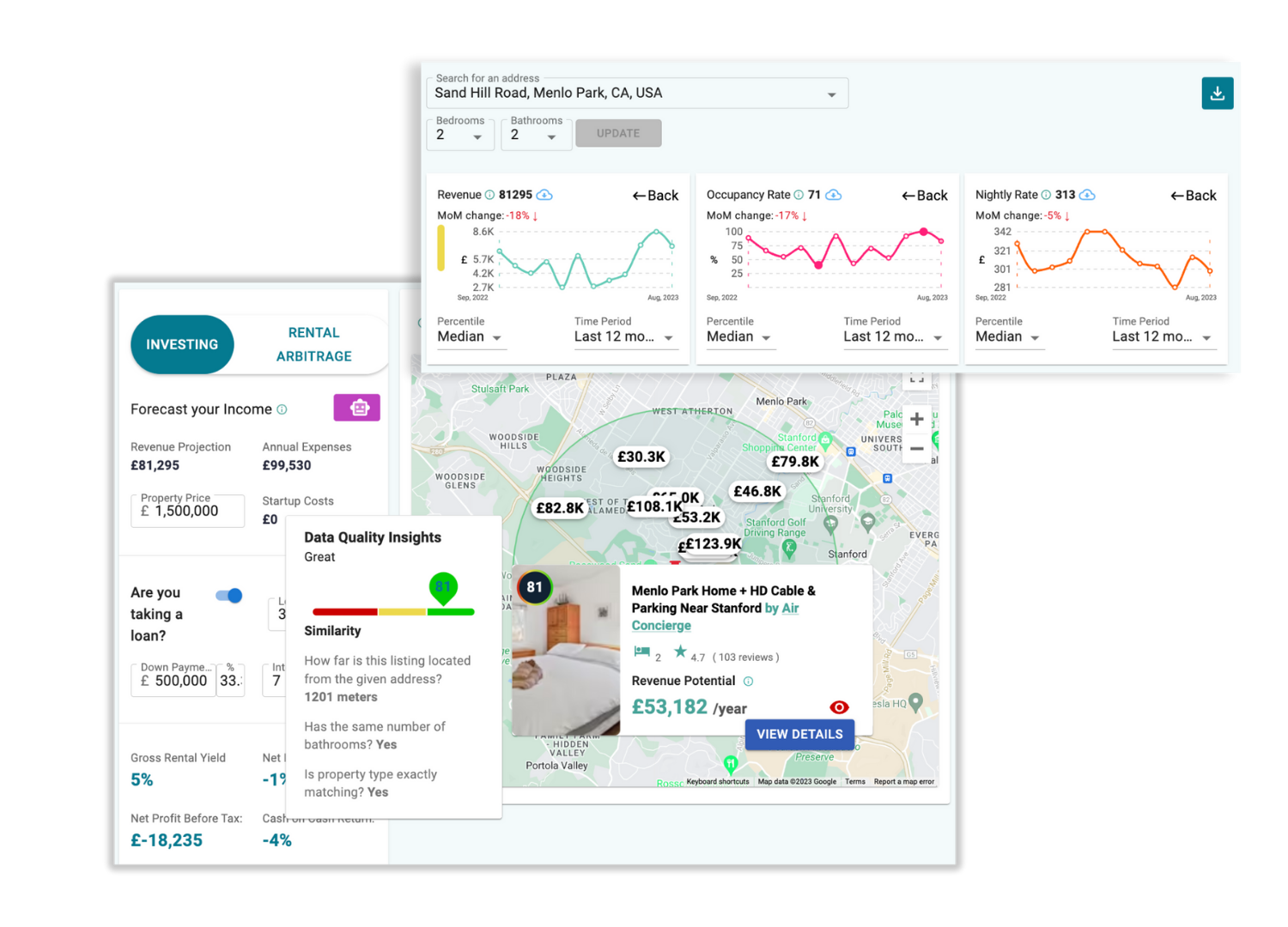

Using a short-term rental calculator like Airbtics helps you analyze market data, estimate revenue, and evaluate ROI before committing to an investment property. This boosts profitability and lowers the investment risk.

Can You Really Make Money with Airbnb?

Yes, many hosts generate significant earnings with Airbnb - as a main stream of income or to supplement their income from other sources. Some even make enough to replace a full-time salary.

Nevertheless, profitability depends on a number of factors, like the market, the property specifications, the pricing strategy, the seasonality impact, the occupancy rates, and the strictness of the Airbnb rules.

Generally speaking, high-demand areas with strong tourism or business travel tend to yield the best results for short-term rental property investors.

The Airbtics’ short-term rental property income calculator helps you estimate your potential revenue, understand associated costs, estimate net operating income (NOI), and forecast ROI. In this way, you can make money with Airbnb with greater confidence and zero guesswork.

Is Airbnb Still Profitable in 2025?

Yes, Airbnb rentals remain profitable in 2025, but performance and results depend on the local market conditions and your strategy. Despite growing competition from short-term rental property investors and tightening legal regulations in many locations, vacation rental owners can still make significant profit if they invest in the right market, price their listing well, and manage it efficiently.

The first step in a profitable Airbnb investment is choosing a market with high demand, strong daily rates, lenient STR regulations, weak seasonality impact, and reasonable competition. The best way to evaluate the earning potential of an area is to use the free short-term rental cash flow calculator provided by Airbtics. You can instantly assess and compare nightly prices, occupancy, and seasonal demand across markets to select the best one. Then Airbnb can still deliver solid returns in 2025.

How to Calculate Short-Term Rental Income?

To calculate short-term rental income, use this formula:

Monthly STR Income = Average Daily Rate (ADR) x Booked Nights

Where ADR is the typical price you charge per night. Booked nights is the number of days for which your property is rented per month.

For example, if you charge $200/night on average, and your property is booked for 22 nights:

Monthly STR Income = $200 x 22 = $4,400

Meanwhile, you can calculate short-term rental profit with the following formula:

Estimated Profit = Short-Term Rental Income - Monthly Expenses

For instance, if you spend $1,500 on operating expenses per month:

Profit = $4,400 - $1,500 = $2,900

As you see, you need a lot of data to calculate STR revenue, which is hard to predict before buying an investment property, unless you are an experienced short-term rental host in the specific market.

A faster, more efficient, and more accurate way to calculate short-term rental income is to use the Airbtics’ Airbnb short-term rental calculator.

How to Calculate the ROI on a Short-Term Rental Property?

To calculate the return on investment (ROI) on a short-term rental, use the following formula:

ROI = Net Annual Profit / Total Investment Cost x 100%

Where Net Annual Profit = Gross Annual Income - Annual Expenses and Total Investment Cost = Purchase Price + Closing Costs + Repairs + Furnishing.

Short-Term Rental Calculation Example:

Gross annual income: $55,000, Annual expenses: $18,000, Total investment: $450,000.

Net Annual Profit = $55,000 - $18,000 = $37,000.

ROI = $37,000/$450,000 x 100% = 8.22%.

To calculate the ROI on a short-term rental property more easily and more efficiently, you can use a vacation rental calculator like Airbtics. Our tool uses real-time data from millions of STR listings around the globe to forecast returns accurately.

What Is a Good ROI for a Short-Term Rental?

A good ROI for a short-term rental property typically ranges between 8% and 12%. However, it depends on the location, the property type, and the management style. In high-demand markets with year-round tourist activities, the return on single-family homes can exceed 20%.

Meanwhile, in an overly saturated Airbnb market with skyrocketing property prices, a good return on investment might barely reach 5%.

Here is a general benchmark to lead STR investors:

- Below 5%: Generally too low to justify an investment.

- 5-7%: Fair return; consider the appreciation rate to decide if an investment is worth it.

- 8-12%: Good return providing strong cash flow.

- 12%+: Excellent return, usually seen in hot markets with above-average occupancy rate.

The Airbtics’ short-term rental calculator can help you estimate ROI based on local occupancy rates, average daily rate, and expenses so that you can confidently identify high-performing investments.

How to Calculate My Short-Term Rental Vacancy Rate?

To calculate the vacancy rate of a short-term rental property, use this formula:

Vacancy Rate = Unbooked Nights / Total Number of Available Nights x 100%

For instance, if your listing was available for 20 nights and booked for 15:

Unbooked Nights = 20 - 15 = 5.

Vacancy Rate = 5/20 x 100% = 25%.

The STR vacancy rate is the opposite of the Airbnb occupancy rate, or the percentage of time for which your property is booked compared to the time for which it is available for booking.

A lower vacancy rate means higher occupancy and better profitability unless you are pricing your listing too low.

You can use Airbtics to track average occupancy and vacancy rates in the local short-term rental market and forecast the values you can expect for a property before purchasing it.

Where Do Short-Term Rentals Make the Most Money?

In general, short-term rentals make the most money in locations with high demand from tourists and business travelers, limited hotel supply, little seasonality impact, and host-friendly Airbnb regulations.

The best places to invest in a STR typically include:

- Major cosmopolitan cities

- Vacation hotspots and resorts

- Business hubs

- Scenic rural areas

- Secluded nature escapes

When choosing the top location for your vacation rental property, you should focus on the following factors:

High ADR, Strong occupancy rate (low vacancy rate), Low operating costs, Affordable property prices, Lenient short-term rental regulations.

You can benefit from the Airbtics’ short-term rental calculator to compare Airbnb revenue potential and operating expenses by city, neighborhood, and zip code to find the most profitable STR markets.

How Accurate Is the Airbtics Short-Term Rental Data?

The Airbtics short-term rental data delivers industry-leading accuracy at 97% as a result of the data collection, cleaning, and calculation methods applied by the team. Airbtics scrapes data from 15+ million short-term rental listings. Data is updated on a weekly basis to ensure that it is always up-to-date. Data is verified and validated via rigorous testing and comparison with official sources.

All this means that the Airbtics’ short-term rental calculator is one of the most accurate investment analysis tools in the Airbnb space thanks to the use of multiple data sources, refined ML models, frequent updates, and manual quality checks.

As a result, the tool provides reliable forecasts on average daily rate, occupancy, revenue, and ROI.

Are There Any Limitations to the Short-Term Rental Property Calculator?

The short-term rental calculator is a powerful tool that has the potential to help investors instantly and accurately estimate the earnings they can expect to generate in a market. However, there are some limitations that Airbnb investors need to consider when using the calculator, including:

- The calculator does not provide a list of Airbnb properties for sale. In other words, it doesn’t work as a property marketplace. To maximize their investment decisions, investors can use Airbtics together with marketplaces like Rabbu and Mashvisor.

- The calculator does not offer Airbnb dynamic pricing, so hosts need to use another tool, such as PriceLabs or Beyond, after purchasing a property with a strong revenue potential in a top-performing market.

The short-term rental property calculator uses accurate data from trustworthy sources to provide reliable estimates based on numerous factors that can affect the outcomes of an Airbnb rental property investment. Investors can use Airbtics to facilitate, augment, and improve their market research and investment analysis.