Chicago Airbnb Occupancy Rate

Key Takeaways

♦ Chicago is among the major US cities, making it a profitable market in any field, including short-term rentals. In fact, a two-bedroom Chicago investment property can earn an average annual income of $45,221.

♦ Get insider Chicago real estate investing leads with the help of short-term rental data analytics. This article will provide insights into the average Chicago Airbnb occupancy rate as well as the peak season in its investment property market.

Introduction:

Chicago is home to major global companies. This fact alone already makes it an ideal place for any type of investment. But let’s talk about the viability of the Chicago property market. What are the key indicators that need to be discussed? And how can hosts and investors benefit from short-term rental data analytics?

In this article, we will find out the local Airbnb occupancy rate throughout the year and when can Chicago real estate investors expect a spike in occupancy and revenue. This answers the question of whether or not Chicago is a profitable short-term rental market.

Is Chicago good for rental investment?

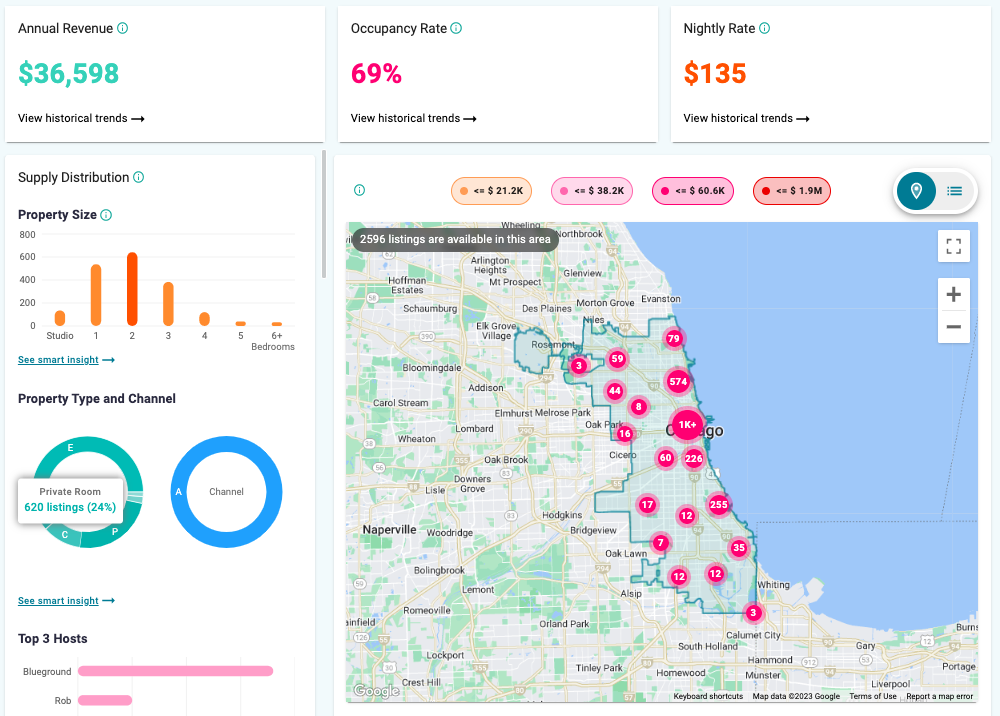

Chicago is indeed a good place for a rental investment like an Airbnb. It is among the top destinations of millions of tourists from around the world. In fact, the numbers also confirm Airbnb’s profitability in the city. According to Airbtics, the 2,596 local Airbnb listings have an average occupancy rate of 69%. With this, hosts can expect around $36,598 in annual revenue.

Is Chicago a good place to start an Airbnb?

You do not have to spend a fortune to gain a bigger one in Chicago real estate. In fact, you can try out the local Airbnb market without actually buying a property investment via rental arbitrage. Of course, you still need some preparation in order to make money. And once you’ve learned the ins and outs of rental arbitrage in Chicago, it is best to know the upcoming events that guarantee high occupancy rates:

1. Shamrock Shuffle

- When: March 26, 2023

- Where: Chicago’s Loop

- Last year’s participants: 32,000

2. Chicago Comic & Entertainment Expo

- When: March 31 – April 2, 2023

- Where: McCormick

- Last year’s participants: 90,000

3. Chicago Blues Festival

- When: June 8 – 11, 2023

- Where: Millennium Park

- Last year’s participants: 500,000

4. Chicago Annual Pride Fest

- When: June 17 – 18, 2023

- Where: Waveland Avenue

- Last year’s participants: 1M+

5. Lollapalooza

- When: August 3 -6, 2023

- Where: Grant Park

- Last year’s participants: 1M+

These events drove the occupancy rate of Airbnb properties in Chicago last year, and even Airbnb confirms this. By using the Airbtics Dashboard, we can see that the 70% median occupancy rate in March peaked at 100% in July. At its peak, the average revenue was $4,781.

What are the best neighborhoods in Chicago for Airbnb?

Using Airbtics’ Custom Market feature, we can zoom into an Airbnb market and study its key metrics. In Chicago Airbnb neighborhoods, the following areas are the best places for a short-term rental investment:

1. Lincoln Park

- Existing Airbnb listings: 235

- Average daily rate: $205

- Airbnb occupancy rate: 71%

- Airbnb annual revenue: $56,980

- Best property size: 2 bedrooms

- Occupancy rate: 75%

- Annual revenue: $69,908

2. Wicker Park

- Existing Airbnb listings: 153

- Average daily rate: $194

- Airbnb occupancy rate: 69%

- Airbnb annual revenue: $52,446

- Best property size: 2 bedrooms

- Annual revenue: $54,007

- Occupancy rate: 79%

3. Logan Square

- Existing Airbnb listings: 292

- Average daily rate: $135

- Airbnb occupancy rate: 74%

- Airbnb annual revenue: $41,131

- Best property size: 2 bedrooms

- Annual revenue: $44,880

- Occupancy rate: 77%

Conclusion:

It is a no-brainer that investing in real estate in Chicago is indeed a wise decision. The city is a profitable Airbnb market all year round because of the tourists who come in and need accommodation. While tourism is already strong in Chicago, hosts can expect higher profits beginning in March due to the world-renowned spring events in the city.

In this article, we have learned the key metrics that can inform hosts and investors as they navigate the local property market. All this is possible with the help of short-term rental data analytics. With this, we are able to find out the average occupancy rate, annual revenue, and the best property size that gives the optimal profit.

Now that you know the benefits of using short-term rental data, try this Airbnb profit calculator for free and maximize your revenue potential.