If you are a savvy host or planning to be one, writing off Airbnb expenses is a game-changer to your rental. Aside from welcoming travelers to your property, you are also running a legitimate business. And like any other business owner, you have the chance to claim various deductions to significantly reduce your taxable income. So, you will learn from this article:

- The complete list of deductible Airbnb expenses

- Tips to keep track of your Airbnb expenses

- Steps in writing off your Airbnb expenses

What Expenses Can I Write Off for Airbnb?

As an Airbnb host, you might be worried about the expenses associated with running a short-term rental. But the good news is that you can declare these expenses! Therefore, not all of your earnings will not be taxable. So here is the list of expenses that you can write off for your Airbnb:

1. Advertising

If you want to optimize your Airbnb, you might consider outsourcing the promotion of your rental. These expenses may include listing fees, photography, and other marketing initiatives to draw a huge number of guests.

2. Auto and Travel Expenses

The cost may include gas or plane ticket expenses for managing your Airbnb property.

3. Cleaning and Maintenance

These are the expenses for keeping your rental in the best shape. These include hiring professional cleaners, buying cleaning supplies, and even doing routine maintenance.

4. Commissions

Any fees or incentives regarding guest reservations paid to property managers or to the Airbnb platform can also be declared.

5. Depreciation

This is the annual tax deduction for the eventual deterioration of your Airbnb property over its useful life.

6. Insurance

Premiums for any insurance coverage on your Airbnb include homeoner’s, short-term rental, commercial liability, and Host insurance.

7. Interest

This includes interest on the expenses on loans or credit card used for Airbnb improvements or other rental-related expenses.

8. Legal and Other Professional Fees

These are the fees for legal advice, taxes, and other professional services related to your short-term rental business.

9. Local Transportation

These are travel expenses within your local area to manage your rental, meet guests, or handle Airbnb tasks.

10. Management Fees

These are the expenses paid to property management companies or people who oversee your rental

11. Mortgage Interest Paid to Banks

This refers to the interest payments made on the mortgage loan for your Airbnb.

12. Points

These are a part of the charges paid or treated as paid when an Airbnb host takes out a loan or a mortgage. These are also called loan origination fees, maximum loan charges, and premium charges.

13. Rental Payment

This includes the rent you pay for office space if you are renting it for your Airbnb business operations.

14. Repairs

These are the expenses for fixing and renovating your Airbnb. This includes the costs for repairing appliances, plumbing, and enhancing structural components.

16. Taxes

These are the property taxes paid on the rental property.

17. Utilities

These include electricity, gas, water, and internet used by the guests during their stay.

How To Keep Track of Airbnb Business Expenses?

1. Have a separate bank account and credit card

This may seem not at the top of your priority list when you are just starting out. But believe us when we say that this will spare you a lot of trouble down the line. Having a personal and business account may appear unnecessary, but it will definitely help you draw a clear line between personal and business expenses.

Having a bank account with a credit or debit card is also wise. Pulling out all your transactions is another advantage that you can capitalize in 2 separate accounts. This way, you can easily track and even categorize your expenses in your business account.

2. Keep receipts

Receipts can prove to tax authorities that your Airbnb is a legitimate business – not just a hobby. They are supporting documents crucial for accurate accounting of tax deductions. So, keep receipts as you go along rather than gather them up before the end of the tax year. Store them in a separate compartment or use binders for proper safekeeping.

Or why not use an app that can digitize your receipts? The good thing is you do not need to keep physical copies of your receipts as proof of your deductions. So, digital copies are enough for IRS tax documentation.

3. Document Your Expenses

Most business owners track their expenses using spreadsheets due to their familiarity. They are user-friendly and can be customized. While hosts have complete control over the level of detail they want to include, it is still best to keep the following headings:

- Date of transaction

- Amount of transaction

- Merchant (They can be a property manager, marketing professional, cleaner, etc.)

- Category of expenses (you can refer to this list)

- Brief description

Using spreadsheets can be a tedious thing, especially if your Airbnb property portfolio scales up. In this case, you may opt for expense-tracking software. This tool can automate the logging and categorizing of expenses. It can also minimize the risk of human error, more prone in manual input in spreadsheets. Some expense-tracking apps can be integrated into your business account. This allows you to synch information just in one place.

4. Hire an accountant

Delegating expense tracking to an accountant is a wise move. Not only can you have more time to scale up your Airbnb business, but hiring professionals can lead you to greater tax savings.

Accountants are trained to identify other expenses eligible for deductions. They can also guide you with financial matters throughout the year, not just during tax season. This proactive approach can help you do some adjustments as needed to ensure larger financial gains.

Steps in Writing off Airbnb Expenses

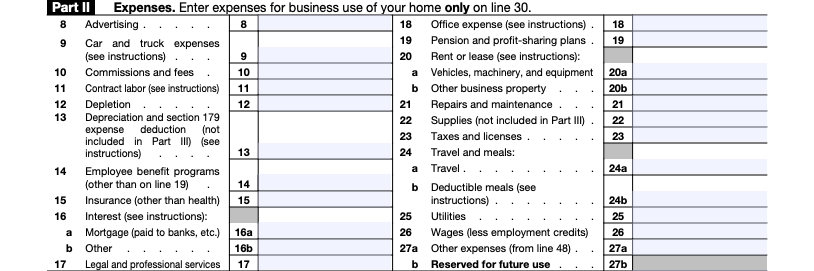

After keeping accurate records of your Airbnb business expenses, fill out PART II of Schedule C. Then, submit the completed form together with your tax return.

This is just the same with other self-employed individuals or sole proprietors. As an Airbnb host, you are essentially running a business. This allows you to claim multiple expenses associated with running a rental to reduce your taxable income.

Unlock the Airbnb Tax Benefits

As you have discovered, writing off Airbnb expenses is a completely legal way to lower your taxable income. You now possess the knowledge to navigate the Airbnb tax landscape with finesse!

Remember that meticulous expense tracking is your best friend throughout this process. So, better make sure to keep those receipts, log your business-related miles, and document all Airbnb business expenses diligently. This makes you avoid stressful situations like tax filing or auditing.

Also, make sure to be abreast of any changes in tax laws. They may evolve, and there may be more or fewer deductions in the future. Make it a habit to stay updated, and don’t be afraid to seek professional help.

Got a property that you’re eyeing for a short-term rental opportunity? Then check its profitability using the most advanced Airbnb Calculator.