airbnb property for sale Chicago City Centre

Chicago is a beautiful city filled with green spaces around every corner, from charming neighborhood parks to sandy beaches with skyline views. In the heart of the city, Millennium Park and Grant Park are home to lush gardens and this city is also known for its cultural institutions, iconic public art, and popular events.

To begin with, it’s certainly important to consider the major costs and revenue before deciding to purchase a property in Chicago. While rental arbitrage in Chicago is fairly popular and does not require you to purchase a property, it’s still recommended to learn about buying a property for Airbnb in the future and making sure that it’s profitable.

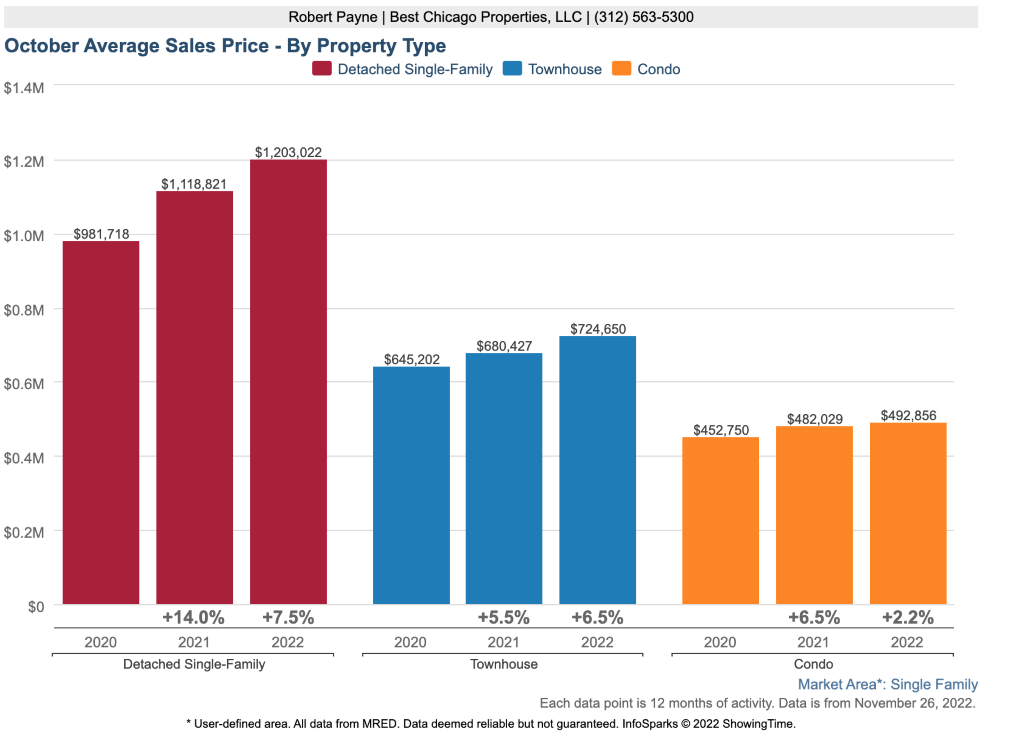

Source: Best Chicago Properties

Chicago can be an excellent investment for plenty of reasons. According to a recent report, there is an increase (3 – 5%) in home prices in Chicago. Not to mention the increase in demand for rental housing!

Airbnb occupancy rates by city also state that an average host in Chicago can earn up to $34,032 during the peak seasons of July – September. With over 4,546 Airbnb listings in Chicago, it’s certainly a catch for property investors.

Aside from looking at a property’s fascinating architectural design, proximity to major tourist areas, and accessibility to the best go-to places, the primary step is to determine profitability. In this article, we’ll discuss the metrics in order to gauge the best property investment.

This includes the best website recommendations for property investment in Chicago, property gross rental yield, cash-on-cash return, and annual revenue, along with some of the most ideal and profitable properties according to their location. Stoked to learn more? Continue reading!

Is Property Investment Profitable in Chicago City Centre?

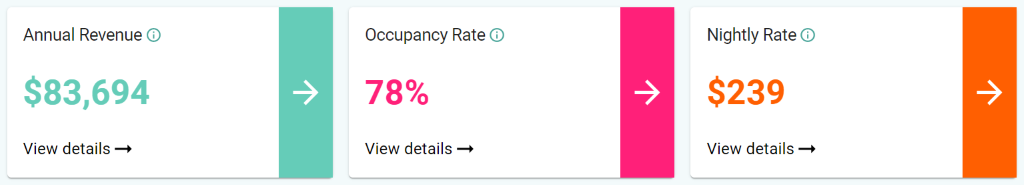

In Chicago, condos have traditionally been a good investment. The city’s robust economy and many desirable neighborhoods have helped to drive up values for the last decade. Using an Airbnb calculator, it was discovered that a 2-bedroom apartment in Chicago City Centre can generate an annual revenue of $83,694 with a steady occupancy rate of 78% and a nightly rate of $239.

airbnb property for sale Chicago City Centre

New Construction Homes for sale in Chicago City Centre

Finding the best properties that have the potential to produce high yields and capital growth are certainly some of the preferences of major investors. It’s always best to ask for assistance from real estate agents to access exclusive and unique properties during the development stage.

At the same time, it’s even better when a property investor like you conducts research about predicted growths and market forecasts. Some of the preferred neighborhoods in Chicago are Garfield Ridge, Norwood Park, and Bridgeport. Here are some of the profitable properties in Chicago City Centre along with the calculated gross rental yield, cash-on-cash return, and annual revenue:

830 Elder Rd #B206, Homewood, IL 60430

1. Studio-type Property for Sale Chicago

1.3 miles to Willow School

Asking Price: $88,500

| GROSS RENTAL YIELD | 24.25% |

| ANNUAL REVENUE | $21,458 |

| CASH ON CASH RETURN | 46.97% |

3808 W Washington Blvd #E3, Chicago, IL 60624

2. 1-Bedroom Property for Sale Chicago

Near East Garfield Park

Asking Price: $99,900

| GROSS RENTAL YIELD | 23.81% |

| ANNUAL REVENUE | $23,786 |

| CASH ON CASH RETURN | 45.66% |

6730 S South Shore Dr APT 206, Chicago, IL 60649

3. 2-Bedroom Property for Sale Chicago

Near South Shore

Asking Price: $135,000

| GROSS RENTAL YIELD | 23.40% |

| ANNUAL REVENUE | $31,591 |

| CASH ON CASH RETURN | 44.43% |

1222 S Millard Ave, Chicago, IL 60623

4. 3-Bedroom Property for Sale Chicago

Very walkable to Lawndale

Asking Price: $165,000

| GROSS RENTAL YIELD | 25.10% |

| ANNUAL REVENUE | $41,419 |

| CASH ON CASH RETURN | 49.54% |

615 N Monticello Ave, Chicago, IL 60624

5. 4-Bedroom Property for Sale Chicago

Near East Garfield Park

Asking Price: $299,900

| GROSS RENTAL YIELD | 24.28% |

| ANNUAL REVENUE | $72,814 |

| CASH ON CASH RETURN | 47.07% |

Conclusion

Since Airbnb is rapidly increasing and constantly changing for each city in the world, it is crucial to make decisions based on wild guesses. The data points mentioned in this article for Chicago such as Airbnb occupancy rates, annual revenue, and average daily rate should be the primary basis before investing in a property.

Hence, if the data presented above has given you ideas to boost your strategic pricing plan for your business, then an Airbnb rental arbitrage calculator is certainly what you need for success in the long run. It’s a fact that some of the STR investors are also considering Airbnb Rental Arbitrage, but they still need to have a reliable data tool on which to base their conclusions!

As we live in a digital era, an accurate data analytics tool can help your business stand out among your surrounding competitors and benchmark your property by tracking the occupancy rates of competing listings in your preferred city.