airbnb property for sale Miami City Centre

The City of Miami has the best of both worlds – from world-class coastlines to shopping districts, perfect for tourists, young professionals, and even for property investors. Here’s an interesting fact: Miami is also one of the best areas for Airbnb in Florida!

It’s certainly important to consider the major costs and revenue before deciding to purchase a property in Miami. While rental arbitrage in Miami is fairly popular and does not require you to purchase a property, it’s still recommended to learn about buying a property for Airbnb in the future and making sure that it’s profitable.

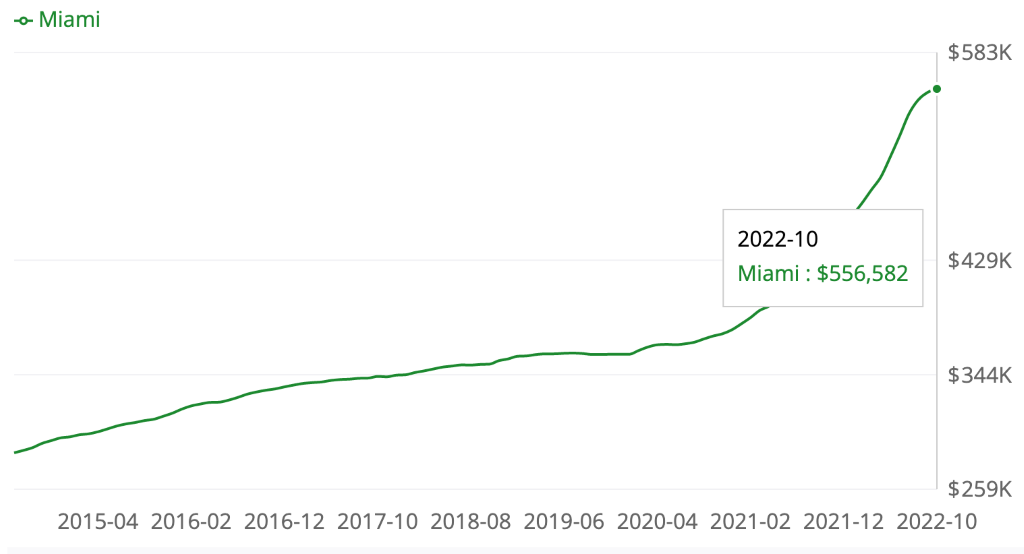

Zillow reports that property prices in Miami have appreciated by almost 27.4% yearly– with a remarkable upward trend.

Source: Home Values in Miami

Airbnb occupancy rates by city state that an average host in Miami can earn up to $45,660 during the peak seasons of December – January. With over 6,588 Airbnb listings in Miami, it’s certainly a catch for property investors.

Aside from looking at a property’s fascinating architectural design, proximity to major tourist areas, and accessibility to the best go-to places, the primary step is to determine profitability. In this article, we’ll discuss the metrics in order to gauge the best property investment.

This includes the best website recommendations for property investment in Miami, property gross rental yield, cash-on-cash return, and annual revenue, along with some of the most ideal and profitable properties according to their location. Stoked to learn more? Continue reading!

Is Property Investment Profitable in Miami City Centre?

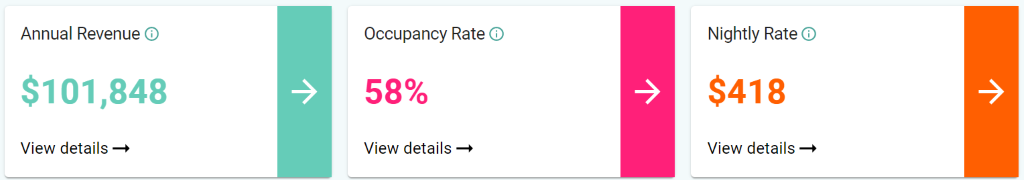

Using a short-term rental calculator, it was discovered that a 2-bedroom property in Miami City Centre can generate an annual revenue of $101,848 with a steady occupancy rate of 58% and a nightly rate of $418.

airbnb property for sale Miami City Centre

Cheap Homes for Sale in Miami

Finding the best properties that have the potential to produce high yields and capital growth are certainly some of the preferences of major investors. It’s always best to ask for assistance from real estate agents to access exclusive and unique properties during the development stage.

At the same time, it’s even better when a property investor like you conducts research about predicted growths and market forecasts. Here are some of the profitable properties in Miami City Centre along with the calculated gross rental yield, cash-on-cash return, and annual revenue:

15610 NE 6th Ave Unit 35D, Miami, FL 33162

1. Studio-type Property for Sale Miami

A minute from Aventura Mall Aventura Hospital and Sunny Isles Beach

Asking Price: $99,500

| GROSS RENTAL YIELD | 24.45% |

| ANNUAL REVENUE | $24,330 |

| CASH ON CASH RETURN | 47.59% |

250 NE 191st St Unit 3001A, Miami, FL 33179

2. 1-Bedroom Property for Sale Miami

A minute from Aventura Mall Aventura Hospital and Sunny Isles Beach

Asking Price: $125,000

| GROSS RENTAL YIELD | 23.43% |

| ANNUAL REVENUE | $29,282 |

| CASH ON CASH RETURN | 44.51% |

498 NW 165th St Rd #D206 Miami, FL 33169

3. 2-Bedroom Property for Sale Miami

1 min. walk from the TR Tri-Rail at the Golden Glades Station stop.

Asking Price: $170,000

| GROSS RENTAL YIELD | 24.45% |

| ANNUAL REVENUE | $41,563 |

| CASH ON CASH RETURN | 47.58% |

19800 SW 180th Ave, Miami, FL 33187

4. 3-Bedroom Property for Sale Miami

60 mins. to Downtown, Richmond West

Asking Price: $232,000

| GROSS RENTAL YIELD | 24.61% |

| ANNUAL REVENUE | $57,089 |

| CASH ON CASH RETURN | 48.05% |

12380 SW 189th St Miami, FL 33177

5. 4-Bedroom Property for Sale Miami

Nearby Eureka Park, Larry and Penny Thompson Memorial Park and Southridge Park

Asking Price: $335,000

| GROSS RENTAL YIELD | 25.60% |

| ANNUAL REVENUE | $85,775 |

| CASH ON CASH RETURN | 51.05% |

Conclusion

Since Airbnb is rapidly increasing and constantly changing for each city in the world, it is crucial to make decisions based on wild guesses. The data points mentioned in this article for Miami such as Airbnb occupancy rates, annual revenue, and average daily rate should be the primary basis before investing in a property.

Hence, if the data presented above has given you ideas to boost your strategic pricing plan for your business, then an Airbnb rental arbitrage calculator is certainly what you need for success in the long run. It’s a fact that some of the STR investors are also considering Airbnb Rental Arbitrage, but they still need to have a reliable data tool on which to base their conclusions!

As we live in a digital era, an accurate data analytics tool can help your business stand out among your surrounding competitors and benchmark your property by tracking the occupancy rates of competing listings in your preferred city.