airbnb property investment Orlando

Orlando’s sunny weather and exquisite nightlife provide the best of both worlds for all kinds of tourists. Since this city is recognized for popular theme parks such as Disney World and Universal Studios, you can instantly imagine what the market is like for property investors.

But wait! Before deciding to purchase a property in Orlando, it’s certainly important to consider the major costs and revenue. While rental arbitrage in Orlando is fairly popular and does not require you to purchase a property, it’s still recommended to learn about buying a property for Airbnb in the future and making sure that it’s profitable.

At the same time, it’s also essential to consider the Airbnb rules in Orlando in order to operate an Airbnb business without worrying about breaching the laws.

.

“There are a lot of things that make Orlando one of the best places to invest in Florida. The city is home to many of the country’s top-rated entertainment centers and theme parks, major colleges and universities, and the fastest-growing employment sectors.”

– Lima One Capital on Orlando Multifamily Investment

Airbnb occupancy rates by city state that an average host in Orlando can earn up to $27,828 during the peak season of February. With over 1,109 Airbnb listings in Orlando, it’s certainly a catch for property investors.

Aside from looking at a property’s fascinating architectural design, proximity to major tourist areas, and accessibility to the best go-to places, the primary step is to determine profitability. In this article, we’ll discuss the metrics in order to gauge the best property investment.

This includes the best website recommendations for property investment in Orlando, property gross rental yield, cash-on-cash return, and annual revenue, along with some of the most ideal and profitable properties according to their location. Stoked to learn more? Continue reading!

Pros of buying an Airbnb Property in Orlando

Orlando is a city where you can find legendary themed parks, but not only that because it also offers entertaining activities linked to ecotourism, top-tier restaurants and unique shops. However, there’s more to learn as to why we recommend purchasing a property in this city. Here are some of the major reasons why you should consider buying a property for Airbnb in Orlando:

1. Booming local economy and job market

It’s a given fact that tourism is one of the major contributors to Orlando’s local economy, however, we can forget that the city is also known as a business hub. In addition, Orlando also hosts events and its convention industries also rank high as economy contributors. Thanks to this, the city brings both job opportunities and ongoing investments.

2. Popular tourist destination

Probably one of the first things that come to our minds when we think about Orlando is its fantastic themed parks, right? Walt Disney World, SeaWorld and Universal Studios are some of the major attractions in this city. Thanks to this, Orlando stands out when it comes to tourist destinations that people love to visit. Based on Visit Orlando Website report, the city welcomes nearly 60M tourists annually!

3. Livability and low cost of living

Livability and cost of living also play an important role when you are deciding whether you should invest in a city or not and luckily, Orlando offers a great quality of life. The city cost of living is fairly cheaper than most cities in Florida, in fact, it’s 18% lower according to Zumper.

Cons of buying an Airbnb Property in Orlando

Now that we know the pros of investing in Orlando, let’s take a quick look at some of the cons. It’s always better to look at the two sides of each coin in order to properly set your expectations!

1. Extreme weather conditions

While Florida generally has warm temperatures throughout the year, this doesn’t mean that it’s not prone to face natural disasters. Albeit Orlando is not located in the coastal area, it’s still threatened by the hurricane season that happens from June-November. Hence, investors can expect harsh winds and heavy rains during these months.

2. Tourists everywhere

Of course, being a popular tourist destination is an advantage for your Airbnb investment, but still moving around may be a little difficult in Orlando. Travelers from around the world arrive in Orland each day to experience its thrilling adventures. So you can expect a lot of traffic and large crowds while managing a listing here.

airbnb property investment Orlando

Best Neighborhoods for Airbnb in Orlando

Let’s take a closer look at the important Airbnb key metrics to discover which is the most profitable neighborhood in Orlando. Filtered for a 1-bedroom apartment, here is a brief overview of some of the most recommended and profitable neighborhoods:

1. Florida Center

- Annual Revenue: $37,265

- Occupancy Rate: 90%

- Average Daily Rate: $97

2. Delaney Park

- Annual Revenue: $37,670

- Occupancy Rate: 85%

- Average Daily Rate: $117

3. College Park

- Annual Revenue: $29,874

- Occupancy Rate: 80%

- Average Daily Rate: $98

Is Property Investment Profitable in Orlando City Centre?

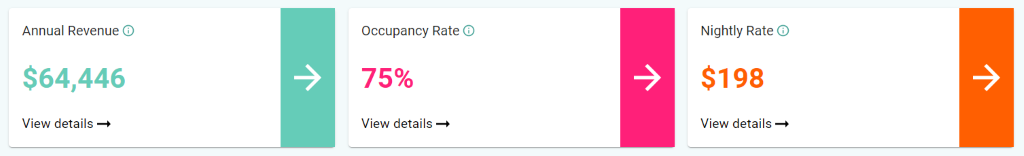

Using an Airbnb income calculator, it was discovered that a 2-bedroom property in Orlando City Centre can generate an annual revenue of $64,446 with a steady occupancy rate of 75% and a nightly rate of $198.

airbnb property investment Orlando

New Homes for Sale in Orlando

Finding the best properties that have the potential to produce high yields and capital growth are certainly some of the preferences of major investors. It’s always best to ask for assistance from real estate agents to access exclusive and unique properties during the development stage.

At the same time, it’s even better when a property investor like you conducts research about predicted growths and market forecasts. Here are some of the new build homes in Orlando City Center along with the calculated gross rental yield, cash-on-cash return, and annual revenue:

7900 S Orange Blossom Trl # 2052, Orlando, FL 32809

1. Studio-type Property for Sale Orlando

- (Home for sale Orlando with pool) Near S Orange Blossom Trl

- Asking Price: $55,900

| GROSS RENTAL YIELD | 28.98% |

| ANNUAL REVENUE | $16,200 |

| CASH ON CASH RETURN | 61.17% |

120 Sherwood Dr Unit 120, Kissimmee, FL 34746

2. 1-Bedroom Type Property for Sale Orlando

- Near W Irlo Bronson Memorial Hwy

- Asking Price: $64,900

| GROSS RENTAL YIELD | 26.80% |

| ANNUAL REVENUE | $17,392 |

| CASH ON CASH RETURN | 54.63% |

2753L B McLeod Rd Unit A , 2753, Orlando, FL 32805

3. 2-Bedroom Type Property for Sale Orlando

- Near l-4 Express (Toll road)

- Asking Price: $95,000

| GROSS RENTAL YIELD | 29.27% |

| ANNUAL REVENUE | $27,807 |

| CASH ON CASH RETURN | 62.04% |

2113 Royal Troon Ct Unit 821, Orlando, FL 32826

4. 3-Bedroom Type Property for Sale Orlando

- Near Pebble Beach Blvd

- Asking Price: $153,000

| GROSS RENTAL YIELD | 26.69% |

| ANNUAL REVENUE | $40,843 |

| CASH ON CASH RETURN | 54.32% |

2883 Canyon Dr Unit 687, Orlando, FL 32822

5. 4-Bedroom Type Property for Sale Orlando

- Near Canyon Dr

- Asking Price: $156,900

| GROSS RENTAL YIELD | 35.08% |

| ANNUAL REVENUE | $55,037 |

| CASH ON CASH RETURN | 79.47% |

Conclusion

Since Airbnb is rapidly increasing and constantly changing for each city in the world, it is crucial to make decisions based on wild guesses. The data points mentioned in this article for Orlando such as Airbnb occupancy rates, annual revenue, and average daily rate should be the primary basis before investing in a property.

Hence, if the data presented above has given you ideas to boost your strategic pricing plan for your business, then an Airbnb rental arbitrage calculator is certainly what you need for success in the long run. It’s a fact that some of the STR investors are also considering Airbnb Rental Arbitrage, but they still need to have a reliable data tool on to base their conclusions!

As we live in a digital era, an accurate data analytics tool can help your business stand out among your surrounding competitors and benchmark your property by tracking the occupancy rates of competing listings in your preferred city.