airbnb property investment San Antonio

San Antonio is commonly known for its Spanish architecture and Hispanic culture, which makes it perfect if you’re also into Tex-Mex cuisine. Some of the tourist attractions in San Antonio include The Alamo, Market Square, and Mission San Jose. If you are looking for a sign to invest in a property where you can maximize profitability, then San Antonio is the right answer!

Did you know that San Antonio is also one of the best cities to start Airbnb? Despite this fact, it’s certainly important to consider the major costs and revenue before deciding to purchase a property in San Antonio.

.

“Investors have been flocking to San Antonio and it’s no surprise. Considering the incredible weather and vibrant community San Antonio has to offer, it’s a great place to live as well as invest.”

While rental arbitrage in San Antonio is fairly popular and does not require you to purchase a property, it’s still recommended to learn about buying a property for Airbnb in the future and making sure that it’s profitable.

Airbnb occupancy rates by city state that an average host in San Antonio can earn up to $24,720 during the peak seasons of June – July. With over 3,525 Airbnb listings in San Antonio, it’s certainly a catch for property investors!

Here’s an interesting fact: upon comparing the Airbnb occupancy rates in Texas cities, San Antonio ranked the occupancy rate at 64%.

Not yet convinced? Listen to one of the Airbnb hosts featured in our podcast, Into The Airbnb, who shares her hosting experience in San Antonio. Listen for more Airbnb hosting tips in San Antonio:

Aside from looking at a property’s fascinating architectural design, proximity to major tourist areas, and accessibility to the best go-to places, the primary step is to determine profitability. In this article, we’ll discuss the metrics in order to gauge the best property investment.

This includes the best website recommendations for property investment, defining property gross rental yield, cash-on-cash return, and annual revenue, along with some of the most ideal and profitable properties according to their location. Stoked to learn more? Continue reading!

Why Should You Consider Buying An Airbnb in San Antonio?

Some of the attractive features that San Antonio has to offer include many famous architectural monuments, a varied list of entertaining leisure activities and delicious gastronomy! Aside from the fact that San Antonio is fairly affordable compared to other cities, it’s certainly perfect for a property investor who wants to enjoy these rewards while earning a passive income through Airbnb. Not yet convinced? Here are some of the major reasons why you should consider buying a property for Airbnb in San Antonio :

1. Affordable housing market

The real estate market is an important factor to consider when looking to buy an Airbnb property. Investors will surely find San Antonio’s market attractive because it is fairly affordable. Based on Zillow index, the median house price is $299K and it’s trending up 13% yearly.

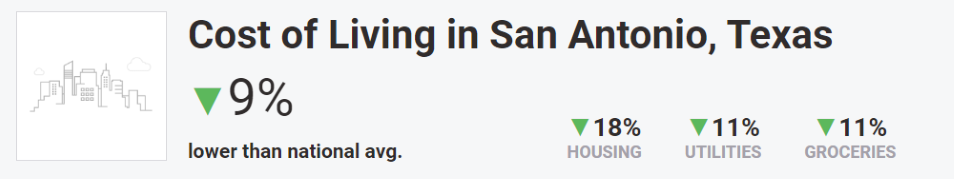

2. Low cost of living

Aside from having an affordable housing market, San Antonio also has an appealing cost of living, which 9% less expensive than the national average.

Source: PayScale

3. The tourist market is great!

It’s a given fact that San Antonio has something for everyone and many travelers arrive in this city looking to experience the city’s vibrant atmosphere. According to San Antonio report, the city welcomes around 31,7M annually.

What are the cons of buying an Airbnb property in San Antonio?

Now that we know the advantages of investing in San Antonio, let’s move on and take a quick look at the cons. It’s always better to look at the two sides of each coin in order to properly set your expectations!

1. High property taxes

While there’s no State income tax in San Antonio, the property tax bills are among the highest in the nation. The average tax rate in Bexar County is 2.35%, which is above the national average of 0.99%

2. High crime rate in specific areas

Safety is a factor of great importance that you should consider when looking for a place to invest it. One of the downsides of San Antonio is that, like any other big city, it also experiences a high crime rate which is 62% higher compared to other cities in Texas. In addition to this, the chance of becoming a victim of a property crime is one in 24 according to NeighborhoodScout, thus, you should consider also looking for a reliable home security system.

Best Neighborhoods for Airbnb in San Antonio

Let’s take a closer look at the important Airbnb key metrics to discover which is the most profitable neighborhood in San Antonio. Filtered for a 1-bedroom apartment, here is a brief overview of some of the most recommended and profitable neighborhoods:

airbnb property investment San Antonio

1. Vista Verde South

- Annual Revenue: $46,032

- Occupancy Rate: 80%

- Average Daily Rate: $142

2. Highland Hills

- Annual Revenue: $24,679

- Occupancy Rate: 79%

- Average Daily Rate: $78

3. Stone Oak

- Annual Revenue: $28,279

- Occupancy Rate: 76%

- Average Daily Rate: $91

airbnb property investment Niagara Falls

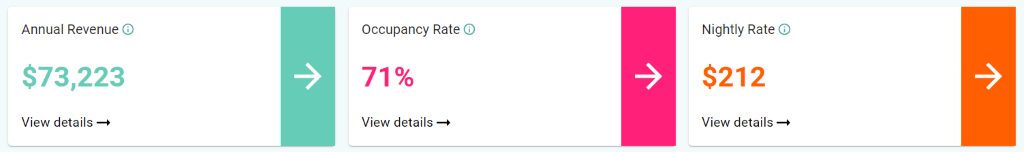

Is Property Investment Profitable in San Antonio City Centre?

Using a short-term rental calculator, it was discovered that a 3-bedroom apartment in San Antonio City Centre can generate an annual revenue of $73,223 with a steady occupancy rate of 71% and a nightly rate of $212.

airbnb property investment San Antonio

Profitable Properties for Sale in San Antonio City Centre

Finding the best properties that have the potential to produce high yields and capital growth are certainly some of the preferences of major investors. It’s always best to ask for assistance from real estate agents to access exclusive and unique properties during the development stage.

At the same time, it’s even better when a property investor like you conducts research about predicted growths and market forecasts. Here are some of the profitable properties in San Antonio City Centre along with the calculated gross rental yield, cash-on-cash return, and annual revenue:

1 Towers Park Ln Apt 1704, San Antonio, TX 78209

1. Studio-type Property for Sale San Antonio

- Near Harry Wurzbach Rd

- Asking Price: $55,000

| GROSS RENTAL YIELD | 30.87% |

| ANNUAL REVENUE | $16,981 |

| CASH ON CASH RETURN | 66.86% |

1 Towers Park Ln Apt 2203, San Antonio, TX 78209

2. 1-Bedroom Type Property for Sale San Antonio

- Near Harry Wurzbach Rd

- Asking Price: $60,000

| GROSS RENTAL YIELD | 28.70% |

| ANNUAL REVENUE | $17,218 |

| CASH ON CASH RETURN | 60.32% |

1 Towers Park Ln Apt 1206, San Antonio, TX 78209

3. 2-Bedroom Type Property for Sale San Antonio

- Near Harry Wurzbach Rd

- Asking Price: $83,000

| GROSS RENTAL YIELD | 26.25% |

| ANNUAL REVENUE | $21,788 |

| CASH ON CASH RETURN | 52.98% |

7494 Golf Vista Blvd Lot 234, San Antonio, TX 78244

4. 3-Bedroom Type Property for Sale San Antonio

- Near Woodlake Trail

- Asking Price: $109,995

| GROSS RENTAL YIELD | 26.82% |

| ANNUAL REVENUE | $29,502 |

| CASH ON CASH RETURN | 54.70% |

5751 Broken Lance St, San Antonio, TX 78242

5. 4-Bedroom Type Property for Sale San Antonio

- Near Broken Lance St

- Asking Price: $150,000

| GROSS RENTAL YIELD | 28.69% |

| ANNUAL REVENUE | $43,040 |

| CASH ON CASH RETURN | 60.31% |

Conclusion

Conducting market research in San Antonio is helpful for accuracy and knowing the potential profitability. With its low cost of living, lively atmosphere and great activities that attract many people to San Antonio and an affordable housing market, it can certainly generate a nice cash flow for property investors.

As long as the potential revenue is calculated using an Airbnb profit calculator, it’s definitely worth the time & effort to invest and speak with a short-term rental expert to make the wisest decision for property investment that you won’t regret.