airbnb property investment washington utah

Washington is part of the St. George Metropolitan area and has plenty of world class parks that attract a great deal of visitors throughout the year. Aside from various fascinating landscape conformed by red rock cliffs, Washington City also brags its natural surroundings where outdoor activities like gold courses can be enjoyed by tourists!

To name a few top tourist attractions, Washington is located near to ion’s National Park and Bryce Canyon, where locals and visitors alike can explore the fascinating Utah wilderness, do hiking, mountain biking, canyoneering and much more fun recreational activities!

Before deciding to purchase a property in Washington, it’s certainly important to consider the major costs, revenue and average occupancy rates to make sure that it will be profitable. At the same time, it’s also essential to consider the Airbnb rules and polciies in the city in order to operate an Airbnb business without worrying about breaching the laws.

Aside from looking at a property’s fascinating architectural design, proximity to major tourist areas, and accessibility to the best go-to places, the primary step is to determine profitability. In this article, we’ll discuss the metrics in order to gauge the best property investment. Let’s dive in and learn about Airbnb property investment in Washington City and discover whether it’s worth your penny and precious time. Continue reading to learn more.

Pros of buying an Airbnb Property in Washington City, Utah

Located in the southern central part of Utah, Washington City boasts amazing natural surroundings that open the doors to unique experiences. However, there’s more to learn about why we recommend purchasing a property in this city. Here are some of the major reasons why you should consider buying a property for Airbnb in Washington City:

1. The property tax rate is low

Property taxes can give headaches to homeowners from time to time, but don’t worry too much about paying high rates in Utah! Overall, Utah has an average effective property tax rate of 0.52%, which positions the State as the sixth-lowest in the country. Moreover, in Washington County, the rate is 0.61% assessed value.

2. How safe is this city?

While one should always be aware of their surroundings, Washington will let you take a breath away from violent crime issues. The crime rate here is 35% lower than the national average. In addition to this, the property crime rate is 28% lower than in other cities in the state.

3. Don’t worry about natural disasters!

It’s safe to say that property investors will always worry about natural disasters as they can greatly damage their properties. On top of that, insurance can be too expensive with certain damages. But the great news is that you won’t need to worry too much about these problems. According to Dwellics, in Washington, the city is not prone to natural disasters such as tornadoes, hurricanes and wildfires.

What to Expect When Purchasing a Property in Washington City?

Now that we know the pros of investing in Washington City, let’s take a quick look at some of the cons. It’s always better to look at the two sides of each coin in order to properly set your expectations!

Real estate in Washington City: Is it affordable?

Washington is, without a doubt, an attractive city to invest in, however, investors with a limited budget will have a difficult time finding affordable houses here as the prices are above other cities in the US. The average housing price in Washington City is $650K with a 1-year change value of 12.6% according to Realtor.

airbnb property investment washington utah

Is Property Investment Profitable in Washington, Utah?

Using an Airbnb income calculator, it was discovered that a 2-bedroom apartment in Washington can generate an annual revenue of $98,376 with a steady occupancy rate of 79% and a nightly rate of $293.

airbnb property investment washington utah

Homes for Sale in Washington City, Utah

Finding the best properties that have the potential to produce high yields and capital growth are certainly some of the preferences of major investors. It’s always best to ask for assistance from real estate agents to access exclusive and unique properties during the development stage.

At the same time, it’s even better when a property investor like you conducts research about predicted growths and market forecasts. Here are some of the Washington City properties for sale along with the calculated gross rental yield, cash-on-cash return, and annual revenue:

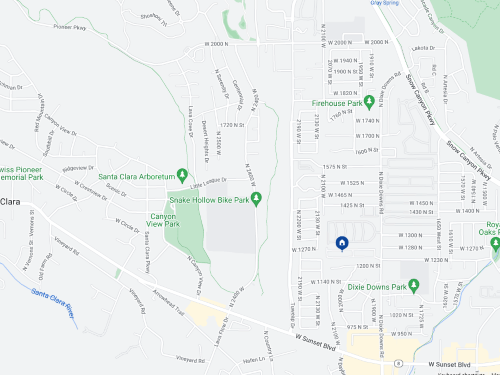

1225 N Dixie Downs Rd UNIT 164, Saint George, UT 84770

1. Studio-type Property for Sale Washington

- 3.6 miles Red Mountain School

- Asking Price; $119,000

| GROSS RENTAL YIELD | 18.36% |

| ANNUAL REVENUE | $21,845 |

| CASH ON CASH RETURN | 29.30% |

180 N 1100 E Unit 154, Washington, UT 84780

2. 1-Bedroom Type Property for Sale Washington

- 2.3 miles to Pine View High School

- Asking Price: $120,000

| GROSS RENTAL YIELD | 18.63% |

| ANNUAL REVENUE | $22,352 |

| CASH ON CASH RETURN | 30.11% |

448 E Telegraph St Trlr 61, Washington, UT 84780

3. 2-Bedroom Type Property for Sale Washington

- 0.6 miles to Washington School

- Asking Price: $100,000

| GROSS RENTAL YIELD | 21.30% |

| ANNUAL REVENUE | $21,303 |

| CASH ON CASH RETURN | 38.14% |

1360 N Dixie Downs Rd Unit 9, Saint George, UT 84770

4. 3-Bedroom Type Property for Sale Washington

- 0.7 miles to Snow Canyon High School

- Asking Price $150,000

| GROSS RENTAL YIELD | 30.04% |

| ANNUAL REVENUE | $45,059 |

| CASH ON CASH RETURN | 64.35% |

5013 Escapes Drive Dr N Unit 303, Saint George, UT 84770

5. 4-Bedroom Type Property for Sale Washington

- 3.7 miles to Diamond Valley School

- Asking Price: $138,000

| GROSS RENTAL YIELD | 36.19% |

| ANNUAL REVENUE | $49,946 |

| CASH ON CASH RETURN | 82.81% |

Conclusion

Before investing in a property is certainly important to conduct market research for accuracy, so you won’t be wasting your time and money in a location that won’t generate profit. With the various natural attractions and recreational activities in Washington, it can generate a nice cash flow for property investors as long as the right neighborhood is targeted and potential revenue is calculated using an Airbnb rental arbitrage calculator. Yet, investors with a limited budget may find it hard to find an affordable property here, but there are still many other cities in Utah that they can target!