Learn about the Airbnb restrictions & rules in Charlottesville, VA. Check out the occupancy rates, annual revenue and more in Charlottesville

Home > Resources > Airbnb Rules >

Learn about the Airbnb restrictions & rules in Charlottesville, VA. Check out the occupancy rates, annual revenue and more in Charlottesville

- Last updated on

- August 7, 2023

Are you looking to invest in an Airbnb property in Virginia? If you are targetting Charlottesville in particular, then you’re on the right track.

There are various cities with high occupancy rates which gives assurance to property investors that their target area is profitable in the long run. Relatively, Charlottesville is one of the recommended cities to invest in as the tourism levels continue to rise this 2022.

Continue reading to learn more about Airbnb rules in Charlottesville and check out the profitability in this city.

Is Airbnb legal in Charlottesville?

Let’s spill the beans: Yes, Airbnb is certainly legal in Charlottesville. The tourism revenue of Charlottesville has made over $277million over the past 4 years. The tourist attractions include the Monticello, Downtown Mall, Trump Winery, and more.

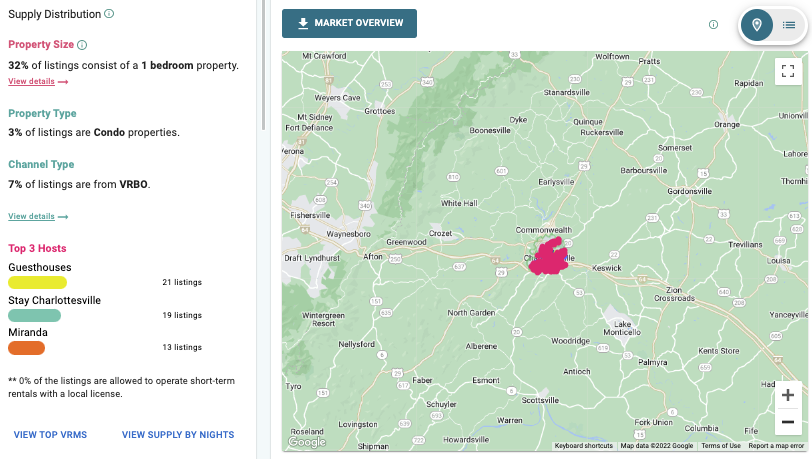

Here is a little proof! As of July 2022, there are 6,345 nights available in Charlottesville from Airbnb alone. Guesthouses manages 21 listings, while Stay Charlottesville and Miranda operate 19 and 13 respectively.

How much can I make by running an Airbnb in Charlottesville?

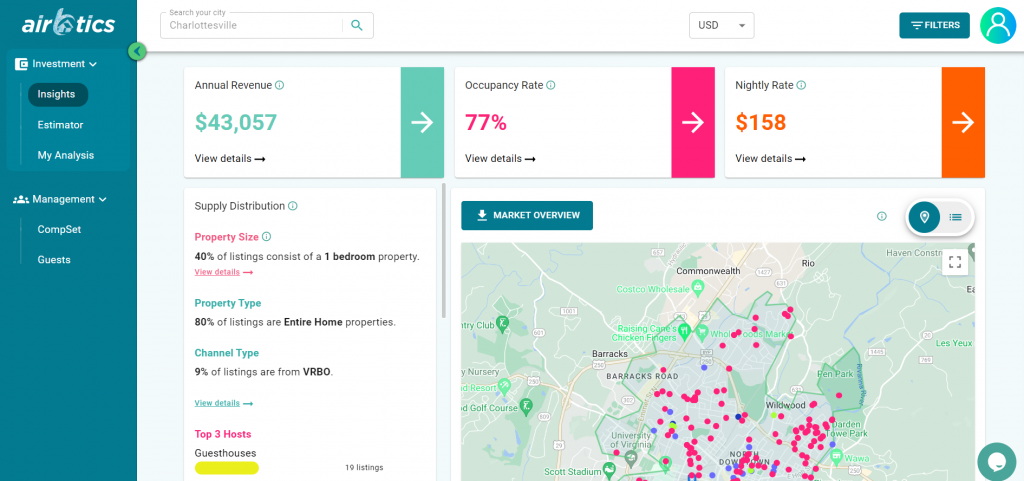

Currently, there are 359 Airbnb listings in Charlottesville, with 83% of entire houses earning up to $3,922 a month. The Average Occupancy Rate in Charlottesville is 77% and the average daily rate is $158. According to short-term rental market analytics source Airbtics, a 2-bedroom apartment in Charlottesville can make up to $55,911 each year. Check out our Airbnb Income Estimator!

What Are The Short-term Rental Accommodation Policies in Charlottesville?

- Every person engaging in the business of short-term rental of tangible personal property shall file annually an application for a certificate of registration with the commissioner of revenue.

- The certificate issued is not assignable and shall be valid only for the person in whose name it is issued and the place of business designated.

- Continuous rentals that last 30 days or longer are exempt from transient occupancy tax. For those who are claiming exempt rentals, documentation including a copy of the short-term lease or the recap spreadsheet from the online rental platform (AirBnB, VRBO, etc…) is required.

Is Charlottesville A Profitable Area to Invest In?

By using an accurate short-term rental calculator, you’ll be able to confirm if Charlottesville is a good place for investment! In the digital era, it’s easy to discover your estimated annual revenue and high-return investment opportunities in Charlottesville.

Airbnb metrics are important in order to expect potential revenue and avoid losing hard-earned money. Before starting an Airbnb business, getting to know your preferred area’s occupancy rates, average daily rates, and annual revenue is important to achieve success.

Source: Airbtics Dashboard

Charlottesville Rental Market 2022

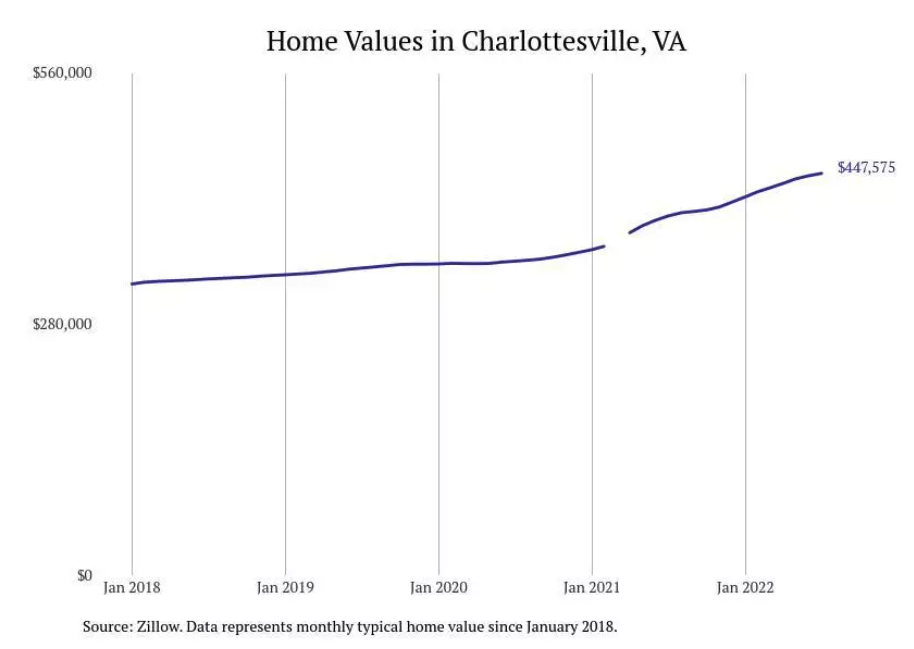

Based on a recent report on the cities & towns of Charlottesville, the typical home value has up by 19.8%, similar to the median rent which increased by 2.3%.

Source: Home Values in Charlottesville

Profitable Neighborhoods in Charlottesville

Here are some of the most recommended neighborhoods that you can look into & consider purchasing based on Airbtics estimator:

| Suburbs | Average House Price (2bd apartments) | Average Rent Price | Average Airbnb Revenue |

|---|---|---|---|

| Belmont | $799,000 (1,342 sqft) | $1,673 | $4,185 |

| North Downtown | $770,000 (1,240 sqft) | $2,200 | $5,573 |

| Fifeville | $400,000 (2,172 sqft) | $1,700 | $3,851 |

Source for Property Price: Properties in Charlottesville

Conclusion

In general, considering the Airbnb rules & regulations in Charlottesville will help your Airbnb business to run smoothly! Aside from the fact that this is a passive income for various hosts, starting an Airbnb business is also a way to enjoy life and connect with new people from all over the world. Try Airbtics now and make the wisest investment decisions!

Short-Term Rental Data

-

Quick Links

Annual Airbnb Revenue in East los angeles california, USA

East Los Angeles, California| Airbnb Market Data & Overview | USA East Los Angeles, California Airbnb Market Data & Overview USA Is it profitable to …

NYC Airbnb Occupancy Rate: Top Events Airbnb Hosts Should Know

nyc airbnb occupancy rate Key Takeaway Learn how much the NYC Airbnb occupancy rate fluctuates when major events are happening. This article offers valuable New …

Annual Airbnb Revenue in Brookline massachusetts, USA

Brookline, Massachusetts| Airbnb Market Data & Overview | USA Brookline, Massachusetts Airbnb Market Data & Overview USA Is it profitable to do Airbnb in Brookline, …

Annual Airbnb Revenue in Frankfort kentucky, USA

Frankfort, Kentucky| Airbnb Market Data & Overview | USA Frankfort, Kentucky Airbnb Market Data & Overview USA Is it profitable to do Airbnb in Frankfort, …

Top Property Management Companies Santa cruz united states

Top 11 Property Managers in Santa cruz, United states Top 11 Property Managers in Santa cruz, United states Last updated on: 5th July, 2024 This …

Annual Airbnb Revenue in Lincoln park michigan, USA

Lincoln Park, Michigan| Airbnb Market Data & Overview | USA Lincoln Park, Michigan Airbnb Market Data & Overview USA Is it profitable to do Airbnb …