Travelers are rerouting from NYC to NJ due to the new Airbnb rules in New York. Don’t miss this opportunity! Here’s a complete guide about the Airbnb rules in New Jersey.

Home > Resources > Airbnb Rules >

Travelers are rerouting from NYC to NJ due to the new Airbnb rules in New York. Don’t miss this opportunity! Here’s a complete guide about the Airbnb rules in New Jersey.

- Last updated January 31, 2024

With the new Airbnb rules in New York, it looks like travelers are more inclined to book an Airbnb in New Jersey and make a day tour in NYC. This could mean a breakthrough for Airbnb investors and hosts in New Jersey!

So, if you want to grab this huge opportunity to maximize your Airbnb business, hang on there and read this article! We’ve done in-depth research to help you grow your STR business in New Jersey.

Navigating the Rules and Profitability of Short-Term Rentals in New Jersey

New Jersey is undoubtedly a popular destination and some of its municipalities have become the most attractive locations for short-term rental investments in the US due to its strong economy, consistent rental demand, and solid tourist market.

But before stepping into the Airbnb world, you need to understand the legality of the business, the steps involved in setting up an Airbnb in New Jersey, and most importantly if the investment is worth it!

In this article, we have covered the Airbnb rules in major cities of New Jersey, as well as their level of profitability. Keep reading to learn more about Airbnb laws in New Jersey!

Is Airbnb Legal in NJ?

You may be wondering “is Airbnb legal in New Jersey?” – Let’s come straight to the point so you don’t have to worry anymore: Airbnb is legal in New Jersey State! Yet, it must be considered that each New Jersey municipality has its own particular regulations about short-term rentals. But in general, NJ imposes a state occupancy tax on short-term rentals.

On the other hand, some cities in New Jersey such as Paterson don’t require a business license to operate a short-term rental.

Here are some of the existing STR laws & regulations in major New Jersey municipalities:

Airbnb Regulations in Jersey City

Chapter 255 of the Jersey City Code of Ordinance introduces regulations about short-term rentals within the city. These regulations encompass the following:

- Prohibition of short-term rentals managed by tenants and restrict short-term rentals within rent-controlled units.

- Property owners, who are eligible to share their primary residence, including up to two additional units within the building that they own and in which they live. However, they are limited to sharing their home for no more than 60 nights when they are not on their residence and must apply for a permit through the Division of Housing Preservation.

- Permit applications are available from the Division of Housing Preservation, 342 Martin Luther King Drive, Jersey City, NJ 07305 or online.

Please note that the application process must be completed for each short-term rental, regardless of whether the owner of the rental is the same and/or the rentals are located in the same residence.

Requirements for obtaining a STR permit:

- Registration fee: $250.

- Provide the street address, tax block and lot, and ward of the rental.

- The personal contact information of the owner (name, address, email, and phone number).

- If the owner of the record is not a natural person, the names and personal contact information for all partners, officers, and/or directors of the owner entity.

- Contact information for the STR property Agent as well as for the STRP responsible party, both available 24/7.

- The number and location of all parking spaces available for the STR, including the number of legal off-street parking spaces and on-street parking spaces directly adjacent to the premises.

Documentation required:

- Proof of the owner’s current ownership of the STR unit (i.e. – tax bill).

- Proof of principal residence (i.e. – driver’s license or State ID card).

- Copies of two (2) recent (less than 30 days old) utility bills.

- Proof of general liability insurance in a minimum amount of $500,000.

Find out more about the Jersey City STR ordinance here.

Airbnb Regulations in Newark

In Newark, owners of a STR property must obtain a short-term rental permit from the Department of Engineering, before renting or advertising their listing.

Requirements for STR permits:

- Owner’s contact information (name, address, phone number, and email) and the address of the rental unit.

- A copy of the owner’s driver’s license or State ID confirming the property as their primary residence.

- Contact information for the short-term rental agent as well as the one from the responsible party, both available 24/7.

- Number and location of available parking spaces, with a commitment to minimize on-street parking issues.

- For a condominium STR permit, it’s essential to obtain approval from the Condominium Association.

Other documentation:

- Proof of the owner’s current ownership of the short-term rental unit;

- Proof of general liability insurance in a minimum amount of $500,000;

- Written certifications from the short-term rental property agent and responsible party that they agree to perform all of the respective duties.

Aside from the permit, owners must also make an application for a Certificate of Code Compliance. The permit and certificate of code compliance must be renewed on an annual basis. The renewal registration fee is $250.

Learn more about Newark’s STR regulations here.

Airbnb Regulations in Atlantic City

In Atlantic City, any dwelling units, rooms, or other spaces used for seasonal or transient rentals are required to apply for an annual permit for registration and inspection. To successfully register, property owners must ensure that their taxes, water and sewer charges are up to date, and the property must be free of any maintenance violations.

STR Permit requirements:

- Submit the application for short-term rentals. It includes a $150 mandatory application fee.

- The address of the short-term rental, including block, lot, and unit numbers.

- Owner’s contact information (name, address, telephone number, and email address).

- Contact Information concerning the local contact person, must be available 24/7 This should include their name, address, telephone number, and email address.

- Proof of general liability insurance specifically covering short-term rental activities.

- Land Use Certification.

- Pest Certification.

- Fire Certification.

Learn more about Atlantic City’s short-term rental regulations here.

Airbnb Regulations in Trenton

Landlords who wish to offer their units as short-term rental properties are required to register their properties under the City’s Absentee Owner Program. Registrations are valid for a one-year term and must be renewed on an annual basis.

Requirements for STR permits:

- The address of the short-term rental, including block, lot, and unit numbers.

- Owner’s information (name, address, telephone number, and email address).

- Contact Information concerning the individual representative of the owner, must be available 24/7.

- Specification of the exact number of sleeping rooms contained in the short-term rental. An owner shall include a floor plan of each level of the property.

- A copy of a valid property liability insurance policy for each rental unit must be included with the registration form, covering the entire registration period.

- Proof of compliance with condominium documents, bylaws, or governing documents, if applicable, should be provided for the residential unit used as a short-term rental.

- The City charges a $300 registration fee and a $150 annual renewal fee.

On top of that, owners must maintain records of each renter’s name and contact details for a three-year period, to be provided to the City upon request.

For more detailed information about the STR regulations in Trenton visit this link.

Airbnb Regulations in Elizabeth

In Elizabeth, the owner of a STR property must obtain a short-term rental license from the city Bureau of Central Licensing, before renting or advertising their listing.

Requirements for STR permits:

- Pay out the license application annual fee of $200.

- Provide a rental certificate of occupancy from the Bureau of Planning and Zoning.

- Certificate from the fire prevention bureau.

- Owner’s contact information (names, addresses, phone numbers, and email addresses)

- Address of the short-term rental unit.

- Proof of owner’s principal residence status, such as a driver’s license or state ID.

- 24/7 contact information for the owner.

- Parking details, including efforts to prevent neighborhood parking issues. Also, an agreement limiting renters to one vehicle per two occupants.

Additional documents:

- Proof of current ownership of the short-term rental unit.

- Proof of general liability insurance with a minimum coverage of $500,000.

- Written agreements from the property agent and responsible party to fulfill their specified duties.

- For condominium STR applications, owners must submit a letter of approval from the Condominium Association.

Short-term rental licenses and rental certificates of occupancy must be renewed on an annual basis. Owners must notify the chief license inspector in writing within 30 days if they do not intend to renew their license.

Check out more detailed information about Elizabeht’s short-term rental ordinances here.

Is Property Investment Worth it in New Jersey?

Investing in an Airbnb property in one of the best cities of New Jersey not only allows you to own a vacation home, but you can also turn it into a rental property to earn a nice passive income!

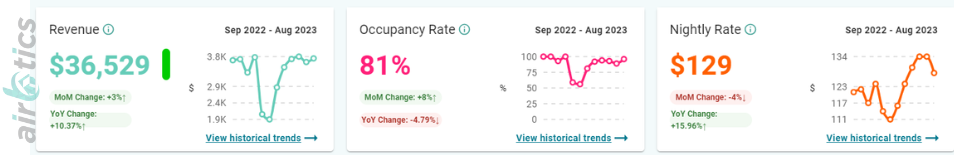

Let’s see some of the Airbnb market metrics of New Jersey – According to Airbtics Dashboard, property investment in most cities of New Jersey is worth it. For instance, an average host in Jersey City can expect to earn $36,529 per year with an occupancy rate of 81% for operating a 1-bedroom property.

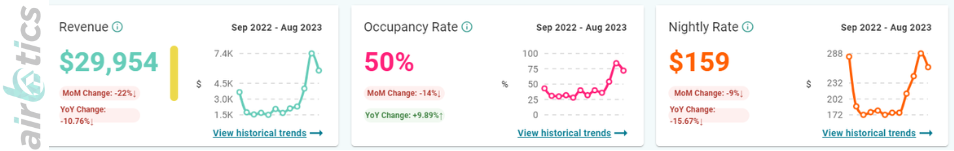

On the other hand, if you’re planning to host guests in Atlantic City, you can generate up to $29,954 annually with a median occupancy rate of 50% for a 1-bedroom property.

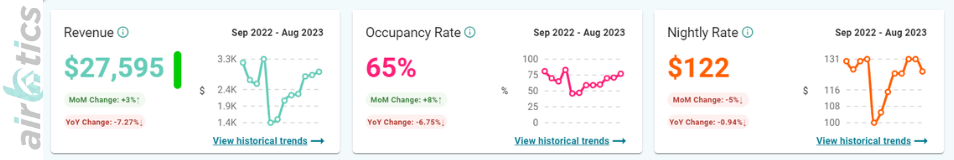

And if you’re targeting Netwark’s Airbnb market, you can make up to $27,595 yearly with an average occupancy rate of 65% for operating a 1-bedroom property! Additionally, you would like to host in Newark, NJ since it’s one of the top STR-friendly cities in the US!

Mastering the New Jersey Airbnb Market: Stay informed to make smarter investment decisions

In conclusion, hosts can secure the smooth operation of their STR business by staying informed about the latest Airbnb regulations in New Jersey as well as targeting the right locations to get the most out of their properties.

Moreover, considering Airbnb’s strict situation in NYC, New Jersey may become a better option for STR listings as some cities are located near New York and tourists would most likely prefer to book here to get a better experience. However, we must take into account that cities like Jersey City have been reinforcing their STR regulations recently, but hopefully, the panorama won’t be intensely affected by it.

As New Jersey’s market continues to experience steady growth in the Airbnb industry, hosts in the city should consider utilizing reliable analytics tools to set and achieve their goals and expectations based on up-to-date metrics for their businesses. Check out how much you can make with Airbnb in your target cities by making use of our Short-term Rental Estimator!

Short-Term Rental Data

Short-Term Rental Data

-

Quick Links

Best Places to Invest in Airbnb in Tenerife: Most Profitable Cities in 2023

best places to Airbnb in Tenerife Key Takeaways • Tenerife’s stable economy, solid tourist market, and high standard of living have helped hosts earn a good …

Top Property Management Companies White plains united states

Top 3 Property Managers in White plains, United states Top 3 Property Managers in White plains, United states Last updated on: 5th July, 2024 This …

Annual Airbnb Revenue in Bowling green kentucky, USA

Bowling Green, Kentucky| Airbnb Market Data & Overview | USA Bowling Green, Kentucky Airbnb Market Data & Overview USA Is it profitable to do Airbnb …

Annual Airbnb Revenue in Wolverhampton, UK

Wolverhampton| Airbnb Market Data & Overview | UK Wolverhampton Airbnb Market Data & Overview UK Is it profitable to do Airbnb in Wolverhampton, UK? What …

Annual Airbnb Revenue In Bali Indonesia

Bali| Airbnb Market Data & Overview | Indonesia Bali Airbnb Market Data & OverviewIndonesia Is it profitable to do Airbnb in Bali, Indonesia? What is …

Is Airbnb property investment profitable in San Antonio, Texas?

airbnb property investment San Antonio San Antonio is commonly known for its Spanish architecture and Hispanic culture, which makes it perfect if you’re also into …