STR friendly cities

Starting a short-term rental business can be an excellent source of income. However, it can also be difficult when a city has strict laws and regulations for operating one. Not to mention how time-consuming it is to go through permits and registration requirements!

If you want to learn about short-term rental friendly cities in the USA, it’s all in this article. We’ll uncover the following:

- Key Considerations for Short-Term Rental friendly Cities

- Top 11 STR friendly cities in the US with their revenue potential and occupancy rate

- How to find lucrative opportunities in the top STR friendly cities in 2023

Key Considerations for Short-Term Rental Friendly Cities

If you want to become an Airbnb host, you definitely can! But before you do, you have to understand the local laws and regulations based on your jurisdiction. Here are some of the legal requirements you need to look out for:

- Property Eligibility: In some US cities like Los Angeles, only owner-occupied residences can be rented on Airbnb. Non-owner-occupied rentals are not allowed, so be mindful of this when investing.

- Licenses: Major cities such as Seattle and New York City require business licenses before you can operate an STR. You can take a look at your local government’s official website and learn more about the requirements. You may have to fill out a form and pay a certain amount when applying for a business license.

- Zoning Restrictions: There are certain cities that allow short-term rentals but have zoning restrictions. For instance, in Orlando City, standard residential zoning districts prohibit short-term rentals. A property needs to be zoned as an R-3 transient residential before it can be leased for 30 days or less.

- Permits: Apart from business licenses and registration, you may also need to apply for an STR permit. This will entirely depend on your city’s requirements. For instance, in Sacramento City, all short-term rental operators need to apply for an STR permit or a conditional use permit from Community Development.

- Taxes: Several cities require STR operators to collect tax for each overnight stay. The easiest way to learn about collecting taxes in your city is to reach out to your local government.

Smooth and non-hectic local rules and regulations for short-term rental businesses have the biggest impact on what makes a location STR-friendly. Start reading blogs that provide accurate information on these top STR-friendly cities in 2023. You may begin with the Airbtics blog where we’ve written several useful articles.

Top 11 STR Friendly Cities in the US

Ensure you understand the local regulations and potential challenges before venturing into short-term rentals. Here are the Top 11 Airbnb-friendly cities in the US that offer a hassle-free experience and lenient laws and regulations.

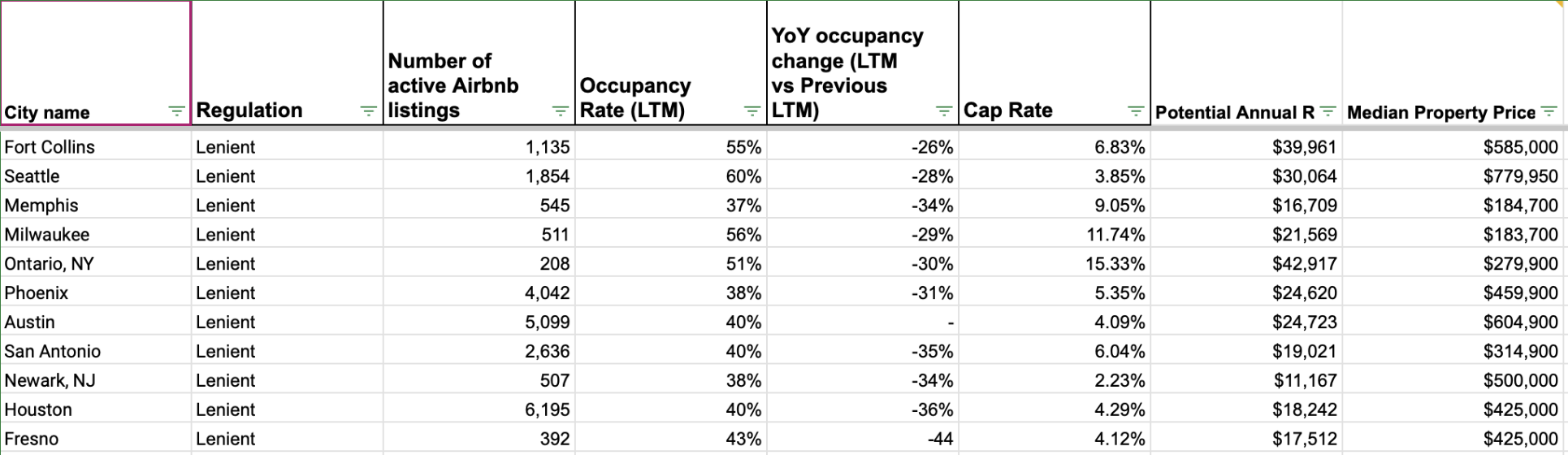

However, it’s important to note that these cities might have smooth processing, yet they may not be the best places to invest. The location’s profitability still depends on its occupancy rate, revenue potential, and other key factors. To help you with decision-making, here’s the breakdown of the Top 11 STR-friendly cities in the US with their data fully updated as of August 2023.

1. Fort Collins, Colorado

Registering your STR business in Fort Collins is relatively easy. On their government website, you can simply download the STR application checklist, view the zoning map, and apply for an STR license online. However, contact them to verify if your building type is approved as STRs are permitted in single-family dwellings, including property townhomes but not in multi-family buildings.

2. Seattle, Washington

In Seattle, Short-Term Rental (STR) Operator Licenses must be renewed annually and operators must have both a business license tax certificate and an STR regulatory license. The STR ordinance limits operators to two units, including the primary residence and a secondary unit.

3. Memphis, Tennessee

Just recently, Memphis introduced a new ordinance to regulate short-term rentals, requiring property owners to obtain a permit to rent out their residential properties. The move aims to distinguish proper use from improper use, as some properties are being used for disruptive events. Renters may unknowingly break zoning laws.

Existing short-term rental owners are not required to register unless the property changes hands or hasn’t been used for short-term rentals in 30 months. The permit costs $300 upfront and requires a $150 annual renewal. Start obtaining your STR permit at their government site.

4. Milwaukee, Wisconsin

To begin with, the city of Milwaukee does not have any Airbnb rules that restrict short-term rentals. However, you will need to pay state and local taxes. This includes Sales Tax, County Tax, and Basic Room Tax.

5. Ontario, New York

A permit is required if you want to register your STR business in Ontario, New York. In their STR regulations, the maximum occupancy and parking space standards are defined, along with the display and compliance of permits. Violations can lead to permit suspension or revocation, and enforcement proceedings may incur costs for property owners.

6. Phoenix, Arizona

The Airbnb regulations in Phoenix require owners of vacation rentals to register in the city, providing specific information about the property. Violations, such as nonresidential use or failure to display required information, are prohibited and subject to civil sanctions.

7. Austin, Texas

In Austin, TX, obtaining or renewing a Short-Term Rental (STR) license requires a $733.80 fee, proof of property insurance, payment of hotel occupancy taxes, a certificate of occupancy, and driver’s license information. On the other hand, the renewal fee is $412.00, and changes in ownership or property details necessitate a new application.

8. San Antonio, Texas

A permit is necessary to operate an STR in San Antonio, Texas. The city also collects Hotel Occupancy Tax on behalf of Bexar County. There are two categories of STR permits that depend on the property owner’s status. The good news here is that STR permits in San Antonio are good for three years! Learn how Rental Arbitrage works in San Antonio.

9. Newark, New Jersey

The City of Newark has adopted an ordinance to regulate short-term rentals (STRs). Only specific types of properties, like condominiums, single-family residences with owner occupancy, and certain multi-family units, are allowed to operate as STRs. Owners must obtain a yearly STR permit, meet certain requirements, and follow operational guidelines. Violations may result in fines of up to $2,000 per day.

10. Houston, Texas

Just this March 2023, Houston’s Council Member Alcorn conducted an RNA committee meeting to discuss short-term rentals (STRs) and “party homes” in the city. Airbnb presented its trust and safety tools, complaint reporting system, and measures to enforce the global party house ban. Houston First also provided information on STR hotel occupancy tax agreements.

11. Fresno, California

The City of Fresno, California passed an ordinance last 2019 regarding short-term rentals (STRs). The purpose is to create a permitting process for dwelling units rented for transient use of 30 days or less. Owners must secure a permit, comply with tax requirements, prevent nuisance activities, and adhere to existing regulations. Violations may lead to penalties, revocation of permits, or even misdemeanor charges.

LOOKING FOR THE BEST RENTAL MARKETS OUTSIDE THE US?

Find out the Airbnb key metrics in top cities in Australia!

How to find lucrative opportunities in Top STR friendly cities in 2023

Now that you have a glimpse of the friendliest cities for short-term rental business, it’s time to check if there’s a golden opportunity to invest in their neighborhoods. By using Airbtics Insights Tool, you can effortlessly find useful information about these cities and their neighborhoods.

Here are 5 simple steps:

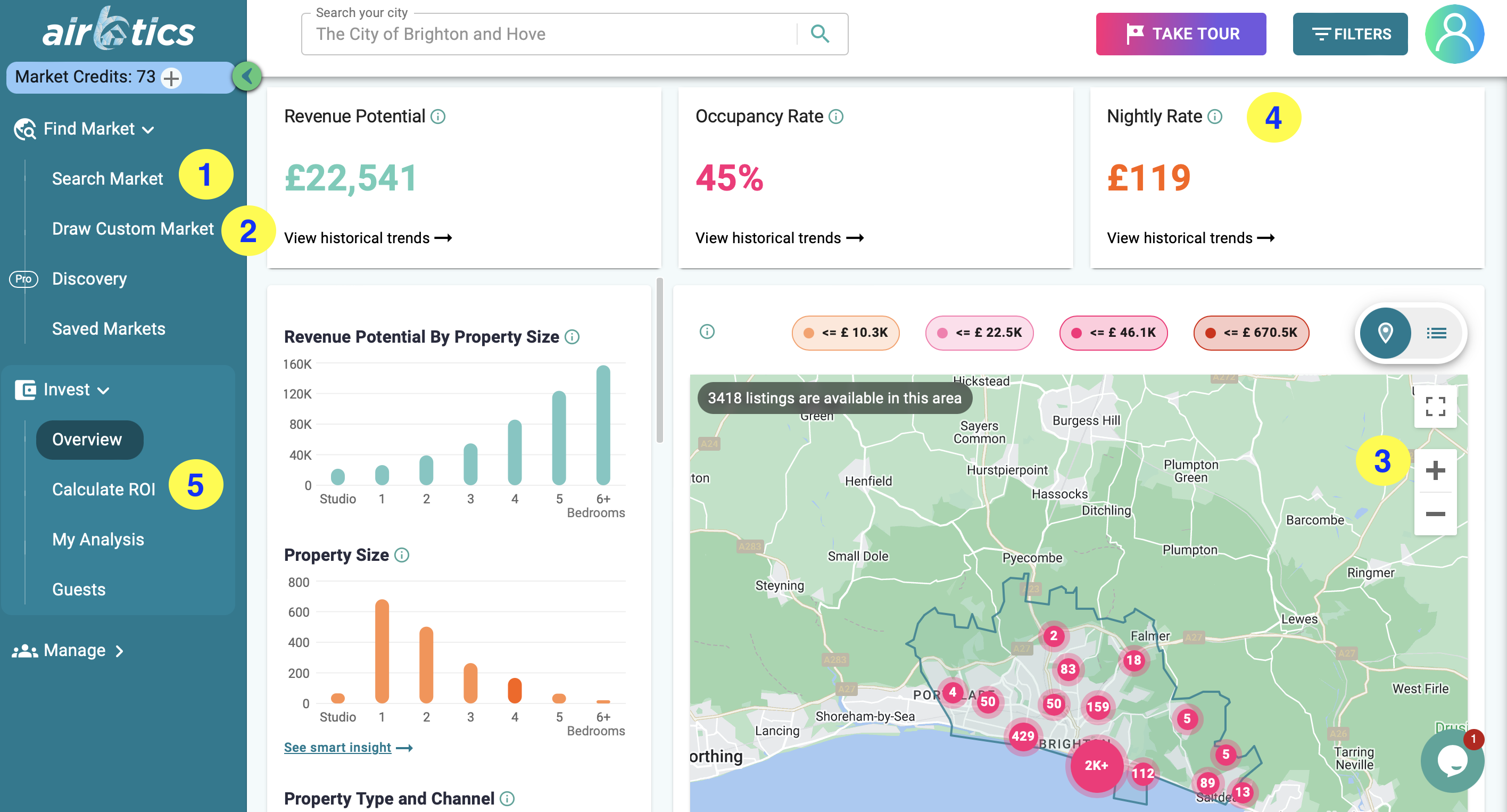

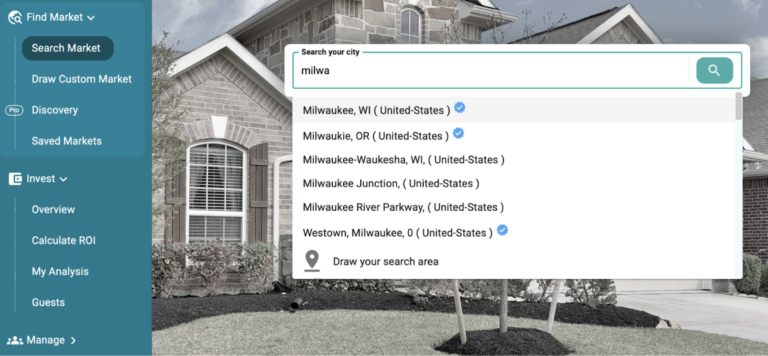

1. Search a city, neighborhood, or region

2. Draw a custom market to get more granular data

3. Zoom in to search for the best neighborhood

4. Get granular data on occupancy rate, potential revenue, and ADR

5. Calculate your potential revenue with an Airbnb income calculator

Search a city, neighborhood, or region.

If you have chosen your preferred cities from these top 11, you can type it in the search bar.

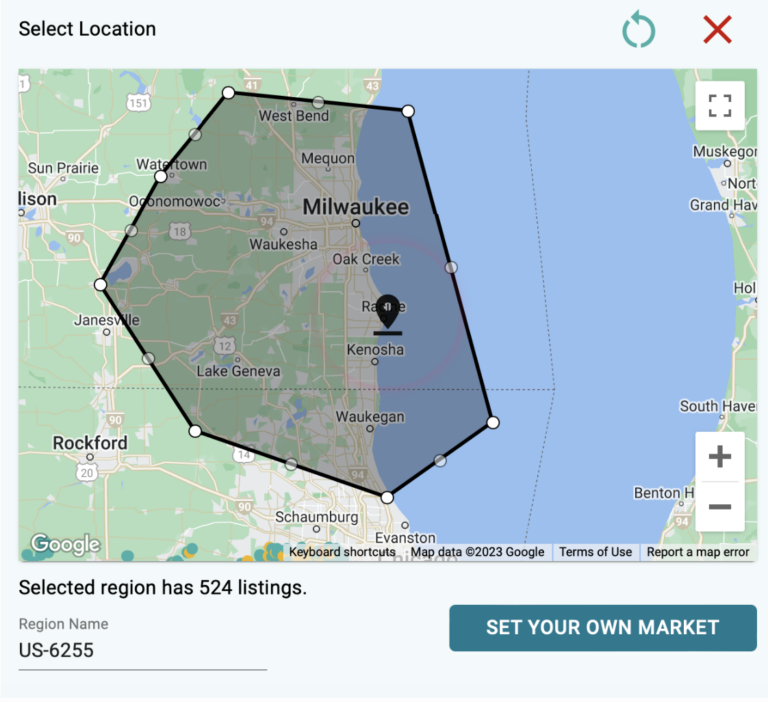

Draw a custom market to get more granular data

Do you want to add that nearby lake but the map isn’t including it in the search? Then feel free to customize your search by drawing your market.

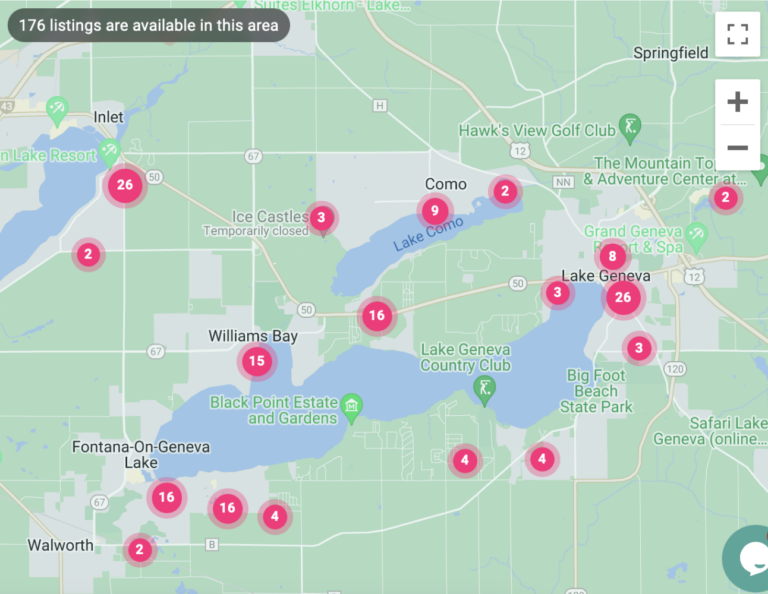

Zoom in to search for the best neighborhood

Zoom in and out and scroll left and right to find a neighborhood

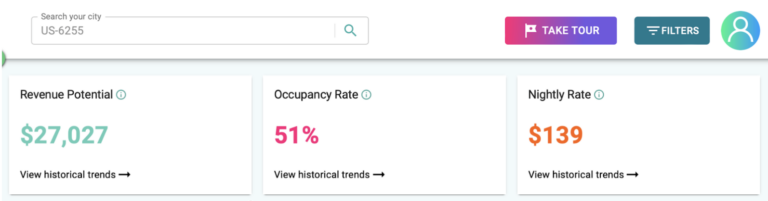

Get granular data on occupancy rate, potential revenue, and ADR

Remember that when you zoom in and out of the map, the occupancy rate, revenue potential, and nightly rate will change depending on what the map is showing.

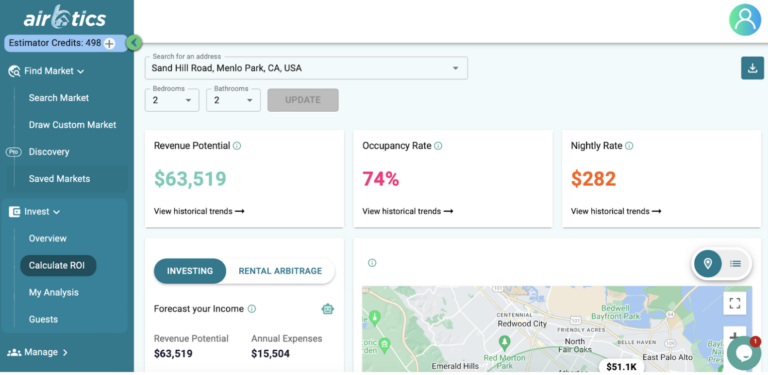

Calculate your potential revenue with an Airbnb income calculator

Once you have seen a potential neighborhood and property to invest in, you can go to Airbtics Calculate ROI. Input a specific address of a property or a neighborhood, then it will generate the potential revenue accordingly.

Bottomline

Starting a short-term rental business can be a lucrative venture, but it requires careful consideration of local regulations and challenges. Aside from that, it’s crucial to remember that profitability depends on factors like occupancy rates and revenue potential, so thorough research and due diligence are essential before investing in any location.

With the valuable insights provided above, any first-time, aspiring, or long-term Airbnb hosts and investors can think smarter about where they should invest their money and resources.

We hope that this information can help you to start a successful STR business this 2023!