Airbnb vs Renting: Which is Right for YOU?: Curious if the grass is greener on the other side? Decide for yourself between Airbnb vs Renting renting by considering a variety of factors.

Home > Resources > Hosting Tips >

Curious if the grass is greener on the other side? Decide for yourself between Airbnb vs renting by considering a variety of factors.

- Last updated January 17, 2024

Airbnb vs Renting: Which is Right for YOU?

If you own rental properties, you might have thought about this – how can I generate more income from my properties? Turning your rental property into an Airbnb could be a way. Airbnb-ing has become a more and more popular option. In 2024, there are about 10 million active Airbnb listings. About 2% of US rental units are short-term rentals [1].

The most significant benefit of Airbnb-ing is higher rental income. It is common to make twice as much rental income with Airbnb. Another advantage is having more freedom with your rental. You can use your property once a year as your vacation home or to let your friends visiting your town sleep.

The biggest downside of Airbnb is that you need to engage more in managing your properties. You will spend the most time communicating with guests and cleaning the properties after each booking. Although these activities can be delegated to a cleaner and a virtual assistant. Another disadvantage is unpredictability. Demand for short-term rentals fluctuates for various reasons.

Other considerations are laws, wear & tear, and upfront costs.

Pros: Rental income

Undoubtedly, short-term rentals generate more rental income. It depends on the market you are in and how good you are as an Airbnb host. Here’s my story:

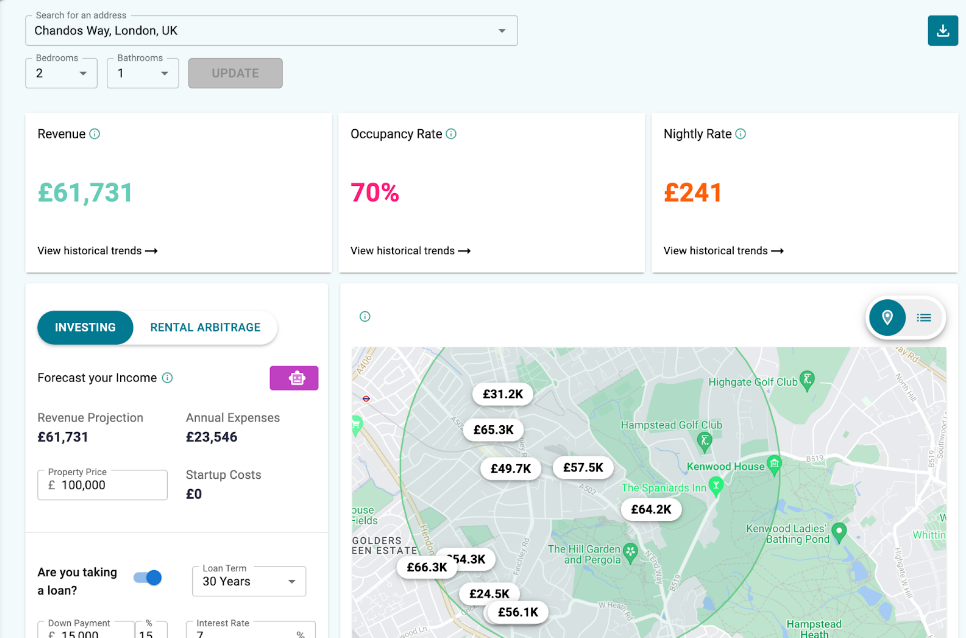

I rented this 2-bedroom property in London at £1,600/mo with a 1-year lease. When I put this on Airbnb, I made £3,800/mo on average. This is a whopping 2.4 times more income if I was the landlord. I charged £200 per night for this property. After taking out Airbnb’s service fee, it is £180 per night. I just needed to rent it out for 8 nights a month for me to break even. I charged £50 cleaning fees from guests, and I used this to pay for cleaners. This isn’t an uncommon story, and this is exactly why many landlords are considering short-term rentals.

You can use this Airbnb Calculator to estimate how much you can make by running on Airbnb.

Cons: Passive-ness

If you have properties and would like to make more from it, doing short-term rentals can really work. If your market has a good demand, all you need is to be an excellent Airbnb host to get more bookings. But what does it really take? How many hours a week do I need to spend?

I spent about 1-2 hours a month managing an Airbnb property. However, it took me a while to set up a system for my Airbnb listing. For a well-performing Airbnb listing, you will receive 4 to 8 bookings a month. Self-check-in is a popular option these days, so you won’t need to spend time on this. Guests may ask you some questions, yet you’ll find out repeating questions. Then, you can create a FAQ or video instructions for specific questions. Once you find a trustworthy cleaner, you just need to message them for each booking. Then, they will handle cleaning the property and set it up for the next guest according to your instructions.

The majority of the effort is to establish the system, such as

- Checking-in instruction

- Guest handbook

- Creating a checklist for cleaners

- Furnishing your Airbnb

- Finding cleaners

- Re-fill supplies

There are some exceptions, though. You may encounter some unexpected situations, like someone damaging your furniture. In my case, a neighbor started doing construction work, and it caused noise to my guests. I gave my guests a 50% discount with a sincere apology, and they happily accepted.

Pros: Flexibility

Once you rent out your property on a yearly lease, you can’t really do anything about your property during that period. It’ll just generate income for you. What if you want to use your properties once in a while? Doing short-term rentals give you back this freedom to you. When my family visited London, I was able to let them stay in this Airbnb listing. It wouldn’t have been possible if it was rented out on a long-term basis.

Cons: Predictability

The flexibility of using your own property comes with some risks. Here are some events that can affect your Airbnb income.

- A bad review from a guest

- Seasonal demand change

- Natural disaster, pandemic

Other considerations

Startup cost

Having decent furnishing is a distinct feature of Airbnb. Unlike traditional rentals, Airbnb rentals should be ready for immediate occupancy with all necessary furnishings. However, furnishing does come with a cost. This includes not only the basics like beds and cabinets but also kitchenware and linens, among others.

✅ Winner: renting

Laws

Short-term rental regulations have become a fact of life in Airbnb hosting. For many Airbnb hosts, navigating this complex regulatory landscape has become a skill in itself. These regulations vary depending on the city. To add another layer of complexity, rules are often changing. Common Airbnb regulations include imposing zoning restrictions and limiting the number of available nights.

✅ Winner: renting

Eviction

It is a lot easier to evict a short-term rental guest than a long-term tenant. Quite often, you just need to call the police, and this will be sorted out on the same day.

✅ Winner: Airbnb

Tenants not paying rent

This can be a serious problem with your rental. But you wouldn’t need to worry about this if you are renting it out through Airbnb because guests have to pay first before using your property.

✅ Winner: Airbnb

Wear and Tear

This is tricky. Short-term rentals have more frequent guest turnover with varied usage patterns. The more frequent the turnover, the more accelerated the wear and tear on the property. However, you can check your property frequently, like after each booking. If you see some damages, you can charge guests for them through Airbnb host damage protection.

For long-term tenants, you get a fixed amount of deposit, which you can use for damages. However, some guests may cause severe damage over time, such as blocking the pipe, modifying your property, and so on.

✅ Winner: Airbnb, Renting

Give Airbnb hosting a go

If you already have rental properties and your market has good demand, why don’t you try? Airbnb made it very easy for you to get bookings. If you already have a property available for long-term tenants, you might be able to start receiving bookings today. It’s that easy. The commitment is relatively small. You can always change it back to long-term rental if it’s not for you. You just need to put some extra furniture, take nice pictures, and list it on Airbnb.

[1] According to https://data.census.gov/, there are 48.2 million individual rental units in the US as of 2022. According to Airbtics, there are 1.4 million Airbnb listings in the US as of January 2024.

Short-Term Rental Data

Short-Term Rental Data

-

Quick Links

Mashvisor Review: Is It Still useful in 2023?

Mashvisor is one of the data analytics tool software in the market which was launched in 2014. Its major purpose is to help real estate …

Airbnb Rental Arbitrage in York

Are you interested in achieving financial independence through passive income? Here’s a disclaimer: you don’t need to own a property to start the Airbnb rental …

Annual Airbnb Revenue in Port huron michigan, USA

Port Huron, Michigan| Airbnb Market Data & Overview | USA Port Huron, Michigan Airbnb Market Data & Overview USA Is it profitable to do Airbnb …

Annual Airbnb Revenue in Waco texas, USA

Waco, Texas| Airbnb Market Data & Overview | USA Waco, Texas Airbnb Market Data & Overview USA Is it profitable to do Airbnb in Waco, …

Reglas Airbnb en Cadiz

Si es que deseas comprar inversiones inmobiliarias en España, el primer paso que debes realizar es conocer más a fondo las reglas de Airbnb! En …

Best Airbnb Markets in District of columbia

Best Airbnb Markets in District of Columbia Best Places to Buy an Airbnb in District of Columbia Last updated on: 12th May, 2024 USA / …