best places to invest in tasmania

Key Takeaways

- Tasmania’s financial situation, reasonable housing prices with good rental returns, and strong tourist market have allowed hosts to earn a nice passive income through rental properties.

- Learn the main benefits that real estate investors can look forward to when investing in rental properties in Tasmania.

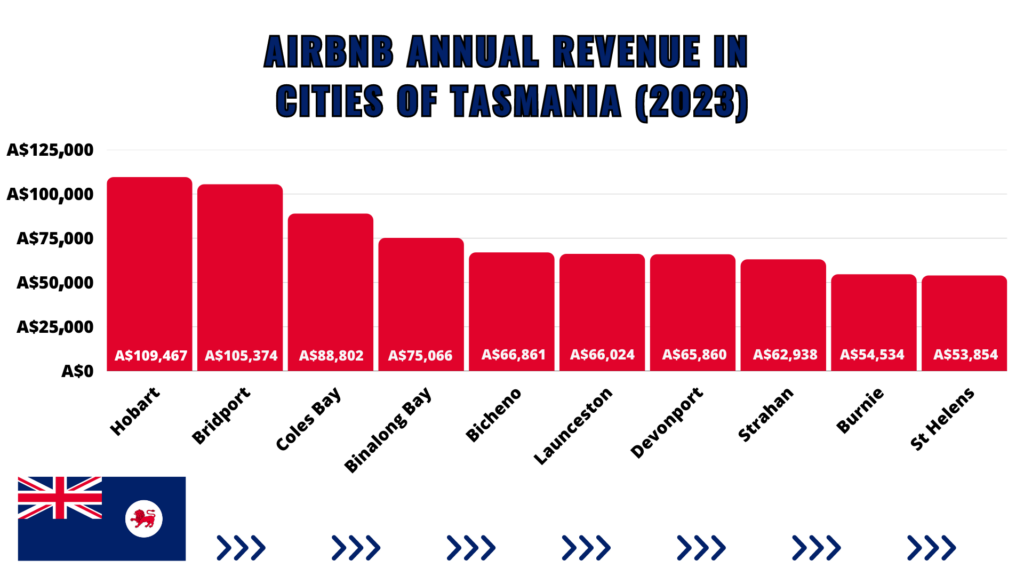

- Get to know the top 10 lucrative locations for real estate investments around Tasmania along with their respective Airbnb data.

Introduction

Situated between the Great Australian Bight and the Tasman Sea, we can find the only Australian state that is not located on the mainland, Tasmania. This picturesque state is popular for its charming cities & towns, breathtaking natural landscapes, and unique wildlife like the Tasmanian devil. Tasmania’s landscape features mountain ranges, forests, and moorlands with many plant species exclusive only to the region.

Tasmania not only has the best natural resources, but it’s also one of the top economic leaders in Australia. Moreover, its state capital Hobart attracts a large flow of tourists annually. This makes the Tasmanian state capital one of the 5 best Airbnb cities in Australia according to our previous blog!

Wondering which cities in Tasmania offer the best property investment opportunities? Allow us to help you!

In this blog, we reveal the best places to invest in Airbnb properties in Tasmania and what expectations to have for real estate investments here. Continue reading to learn more.

Why should you consider buying an investment property in Tasmania?

Tasmanian cities are an interesting market to invest in from the perspective of property investors if we consider the many advantages it offers. Check out some of the major reasons why rental properties in Tasmania can be a profitable idea:

Reasonable housing price

One of the top reasons for investing in Tasmania is that its real estate market offers reasonable prices! While the housing market in the state still suffers a shortage of stock, this situation has continued to improve and become more and more stable in recent years.

The housing market values in Tasmania have skyrocketed over the past few years, but they still remain affordable with a variety of options at reasonable prices. For instance, the average property price in Hobart is A$705K, A$700K in Launceston, and A$469k in Devonport as confirmed by realestate.com.au.

Thriving economy

Tasmania’s economy has performed exceptionally well in recent years. The state has a GSP of $36.7B a growth rate of 3.5% as of 2022. Thanks to this, Tasmania is considered one of the top-performing economies in Australia according to CommSec.

Among the key industries of Tasmania are mining, agriculture, forestry, fishing, and tourism. Furthermore, the state is a hub for Antarctic logistics, science, and research.

Abundance of nature & recreational options

It’s a given fact that Tasmania is a small piece of natural paradise – thanks to its marvelous landscapes, picturesque coastal towns and cities with special charm. These, together with the friendly and welcoming community, make the island draw a great flow of overnight visitors yearly. Considering this, Tasmania can be deemed as an attractive market to investors who are looking to cater to tourist accommodations.

Tasmania opens the doors to a plethora of recreational activities with the most beautiful beaches, impressive mountains, rivers & forests, fascinating wildlife, as well as breathtaking starry nights.

Regarding the cultural scene, Tasmania also offers plenty of options in its cities such as Hobart! There’s no lack of museums, art galleries, theatres, and great dining options!

Is Airbnb Profitable in Tasmania?

Don’t worry! Airbtics confirms that Airbnb Investment Properties in Tasmanian cities can be a good source of passive income. Still, we must mention that the level of profitability also depends on other factors like the property type and location.

According to Airbtics’ data, an Airbnb host can expect annual revenue of A$87,576 with a steady occupancy rate of 91% for operating a 1 bedroom property in the city of Hobart.

Top Areas to Invest in Rental Properties in Tasmania

Did you know that Tasmania is not only the biggest island in Australia but also the 26th largest island in the world? It comprises over 29 municipalities, each of them divided into a variety of suburbs. Consequently, you can expect that the profitability of rental property in the island will depend on their specific location! So you may wonder, “Where should I invest in an investment property around Tasmania?”.

Check out the best locations in Tasmania that are highly recommended for purchasing rental property:

1. Hobart

- Total Number of Airbnb Listings: 869

- Best bedroom size: 3 bedrooms

- Median property price (3 bedrooms): A$795,000

- Airbnb Annual revenue: A$109,467

- Gross rental yield: 13.77%

2. Bridport

- Total Number of Airbnb Listings: 68

- Best bedroom size: 4 bedrooms

- Median property price (4 bedrooms): A$820,000

- Airbnb Annual revenue: A$105,374

- Gross rental yield: 12.85%

3. Coles Bay

- Total Number of Airbnb Listings: 125

- Best bedroom size: 3 bedrooms

- Median property price (3 bedrooms): A$930,000

- Airbnb Annual revenue: A$88,802

- Gross rental yield: 9.55%

4. Binalong Bay

- Total Number of Airbnb Listings: 83

- Best bedroom size: 2 bedrooms

- Median property price (2 bedrooms): A$595,000

- Airbnb Annual revenue: A$75,066

- Gross rental yield: 12.62%

5. Bicheno

- Total Number of Airbnb Listings: 237

- Best bedroom size: 3 bedrooms

- Median property price (3 bedrooms): A$730,000

- Airbnb Annual revenue: A$66,861

- Gross rental yield: 9.16%

6. Launceston

- Total Number of Airbnb Listings: 420

- Best bedroom size: 2 bedrooms

- Median property price (2 bedrooms): A$540,000

- Airbnb Annual revenue: A$66,024

- Gross rental yield: 12.23%

7. Devonport

- Total Number of Airbnb Listings: 84

- Best bedroom size: 3 bedrooms

- Median property price (3 bedrooms): A$456,000

- Airbnb Annual revenue: A$65,860

- Gross rental yield: 14.44%

8. Strahan

- Total Number of Airbnb Listings: 74

- Best bedroom size: 1 bedroom

- Median property price (1 bedroom): A$320,000

- Airbnb Annual revenue: A$62,938

- Gross rental yield: 19.67%

9. Burnie

- Total Number of Airbnb Listings: 58

- Best bedroom size: 2 bedrooms

- Median property price (2 bedrooms): A$399,000

- Airbnb Annual revenue: A$54,534

- Gross rental yield: 13.67%

10. St Helens

- Total Number of Airbnb Listings: 76

- Best bedroom size: 2 bedrooms

- Median property price (2 bedrooms): A$470,000

- Airbnb Annual revenue: A$53,854

- Gross rental yield: 11.46%

LOOKING FOR MORE SHORT-TERM RENTAL MARKETS WITH HIGH OCCUPANCY RATES IN AUSTRALIA?

Discover other major cities that offer the highest rental income in Australia.

Conclusion

Tasmanian cities offer a wide array of great investment opportunities to real estate investors. But even if there are many profitable areas that can bring attractive rental yields and annual revenue, we recommended analyzing all your options carefully!

Discovering the best areas to invest in Tasmania is the most appropriate way to start your rental journey! Now, you should take the next step and check out Airbtics’ Airbnb estimator so that you can maximize profitability after making data-based decisions.