Calculating the yearly Airbnb revenue is crucial in the property investment industry to ensure financial success and minimize losses. One important metric to consider is the Cash-on-Cash Return, which measures the annual return on investment properties.

By calculating this rate, investors can assess the potential Airbnb revenue and profit of their investments and determine if their projected earnings and expenses align with their goals.

To target properties with high rental yields and ensure a steady cash flow, it is essential to calculate the Net Rental Yield. This metric quantifies the annual profit generated by a property divided by its price. Additionally, the Gross Rental Yield can be calculated by dividing the annual revenue by the property price.

Net Rental Yield = Annual Profit / Property Price * 100

Gross Rental Yield = Annual Revenue / Property Price * 100

While it is possible to calculate profits on short-term rental properties, this might give you an inaccurate estimation. It’s still highly advisable to use STR analytics tools and leverage its data so you don’t suffer from potential losses.

Let’s go and take a look at how you can calculate the yearly Airbnb revenue in seconds!

Quick steps to calculate yearly Airbnb revenue

Input the property details

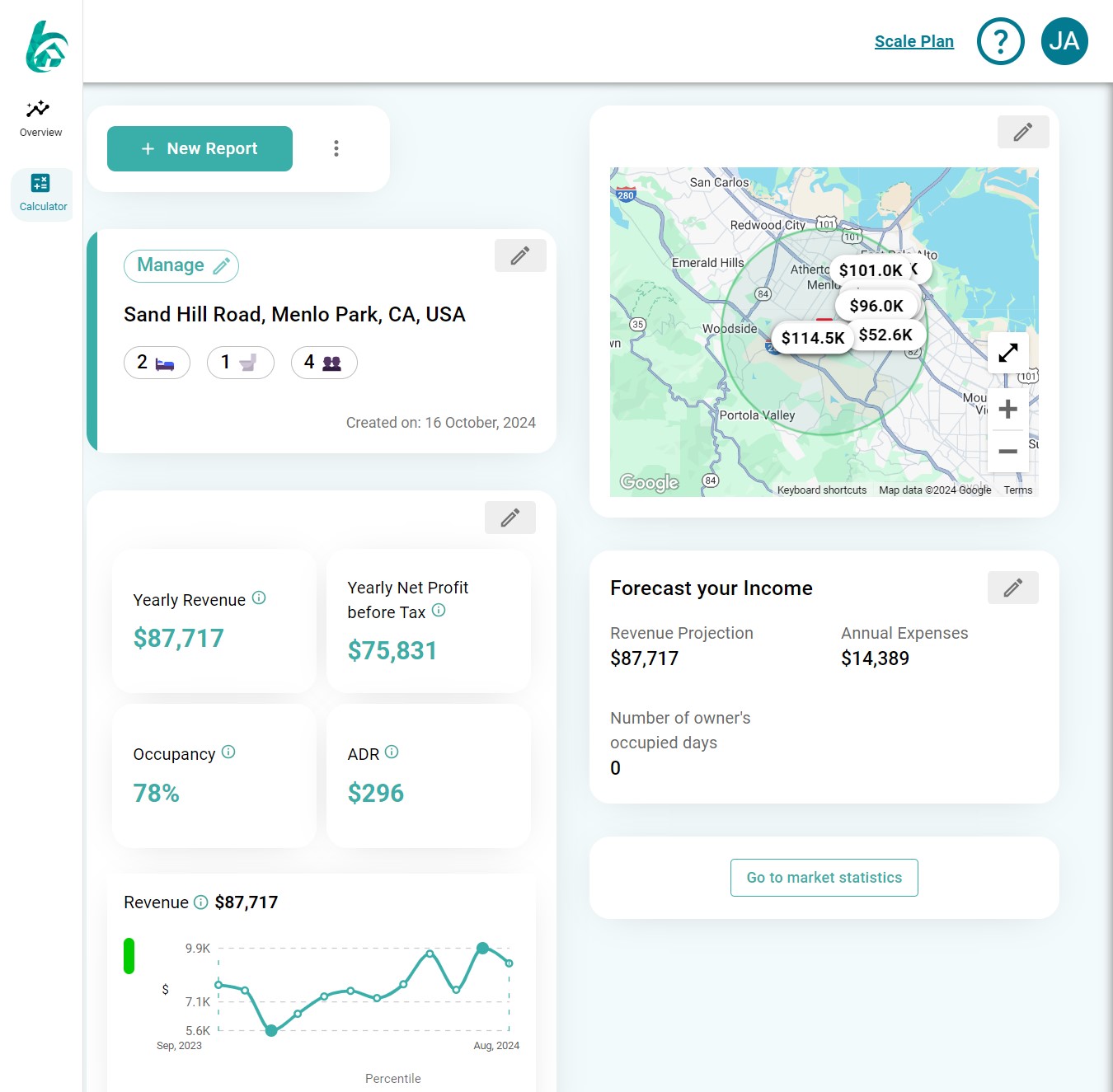

You can quickly calculate your investment returns by using Airbtics’ Estimator Tool.

1. Log in to the Airbtics app and go to the Calculator Tab. Type in the following:

a. The exact address of the property (we suggest you specify the address, however, if you don’t have it yet, then you can also type in the neighborhood or city)

b. Number of bedrooms and bathrooms

c. Property Price

👉 If you don’t have an account yet, please sign up! You can also start with our Airbnb calculator, which will direct you to the app.

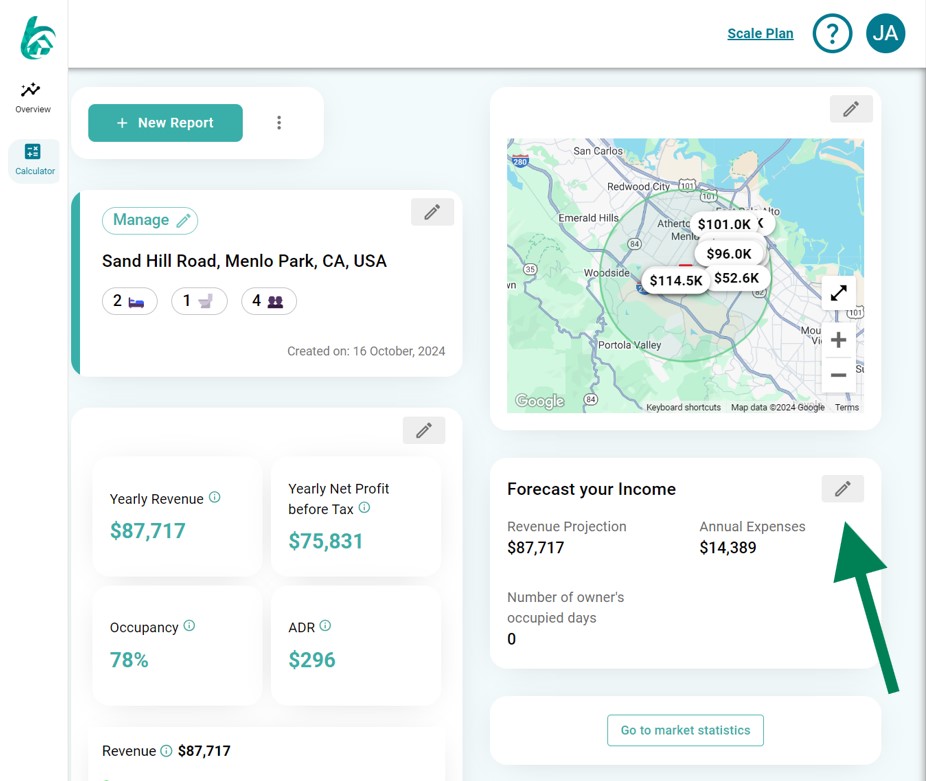

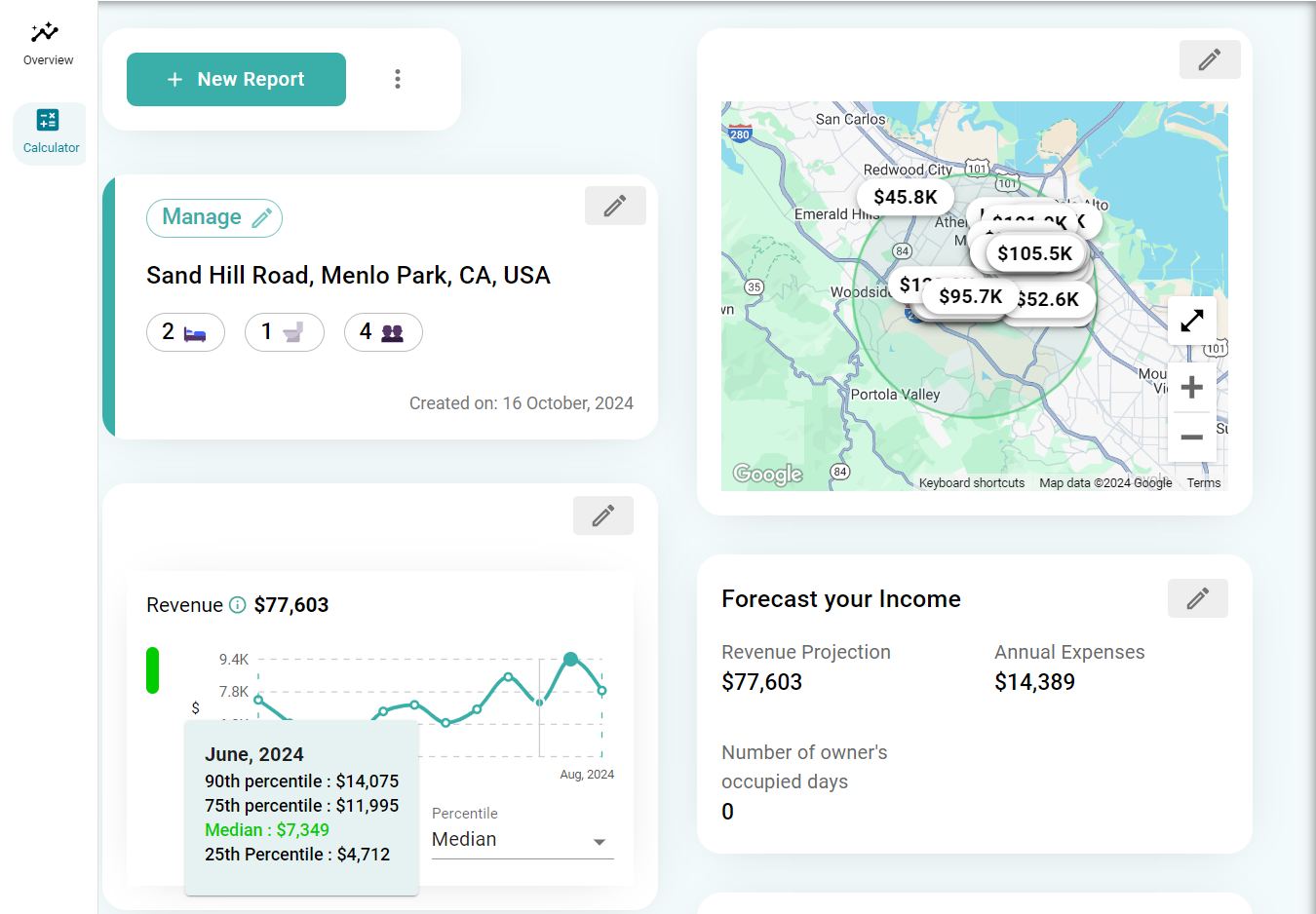

Forecast your Airbnb Revenue

After typing in your address, the app will generate the data for you. Click on “Forecast your Income” to see a projection of your expected revenue.

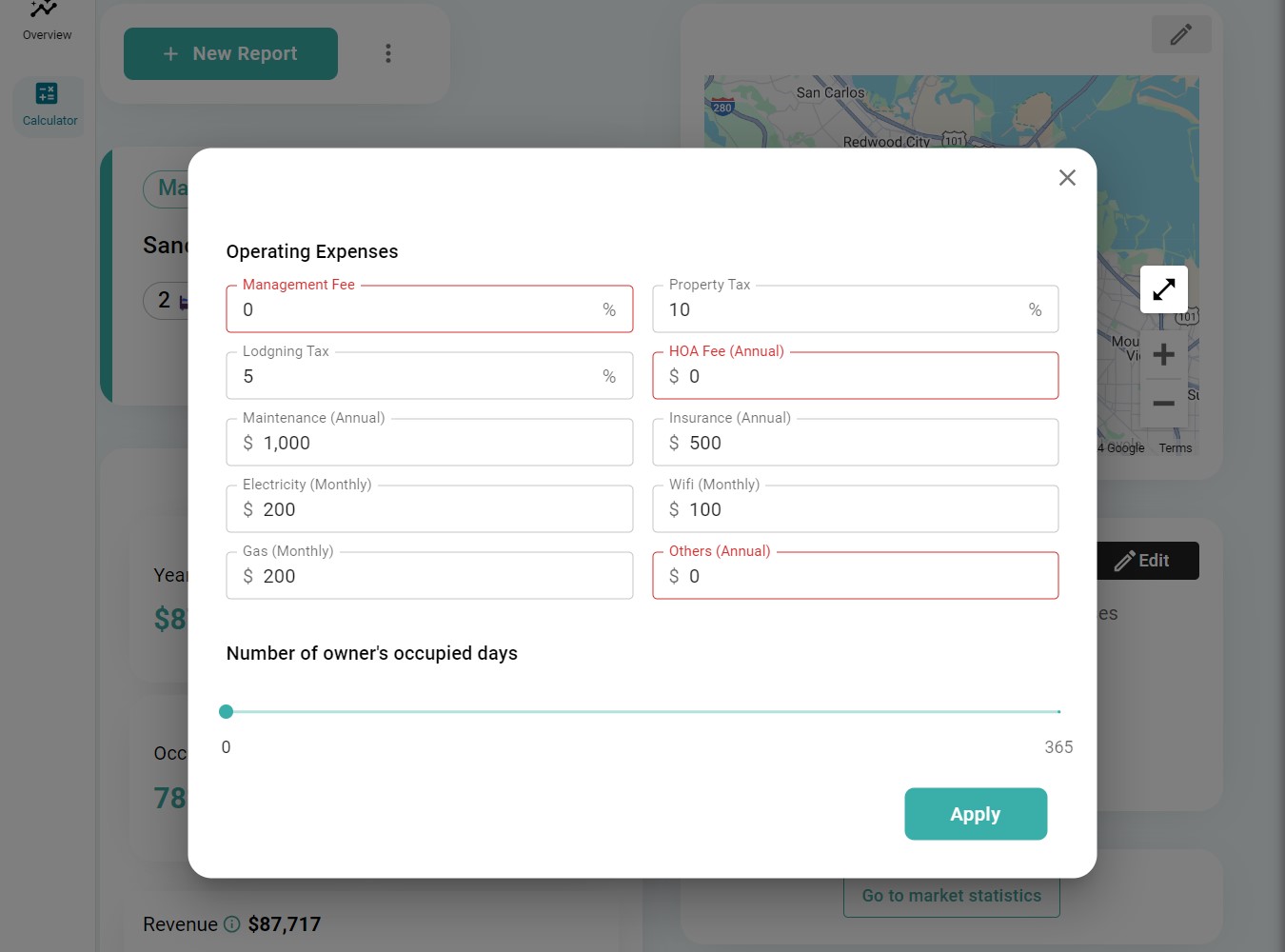

In this section, you will need to indicate your estimated property price, monthly payment to mortgage providers, property transaction and furnishing fees, electric bills, and the like.

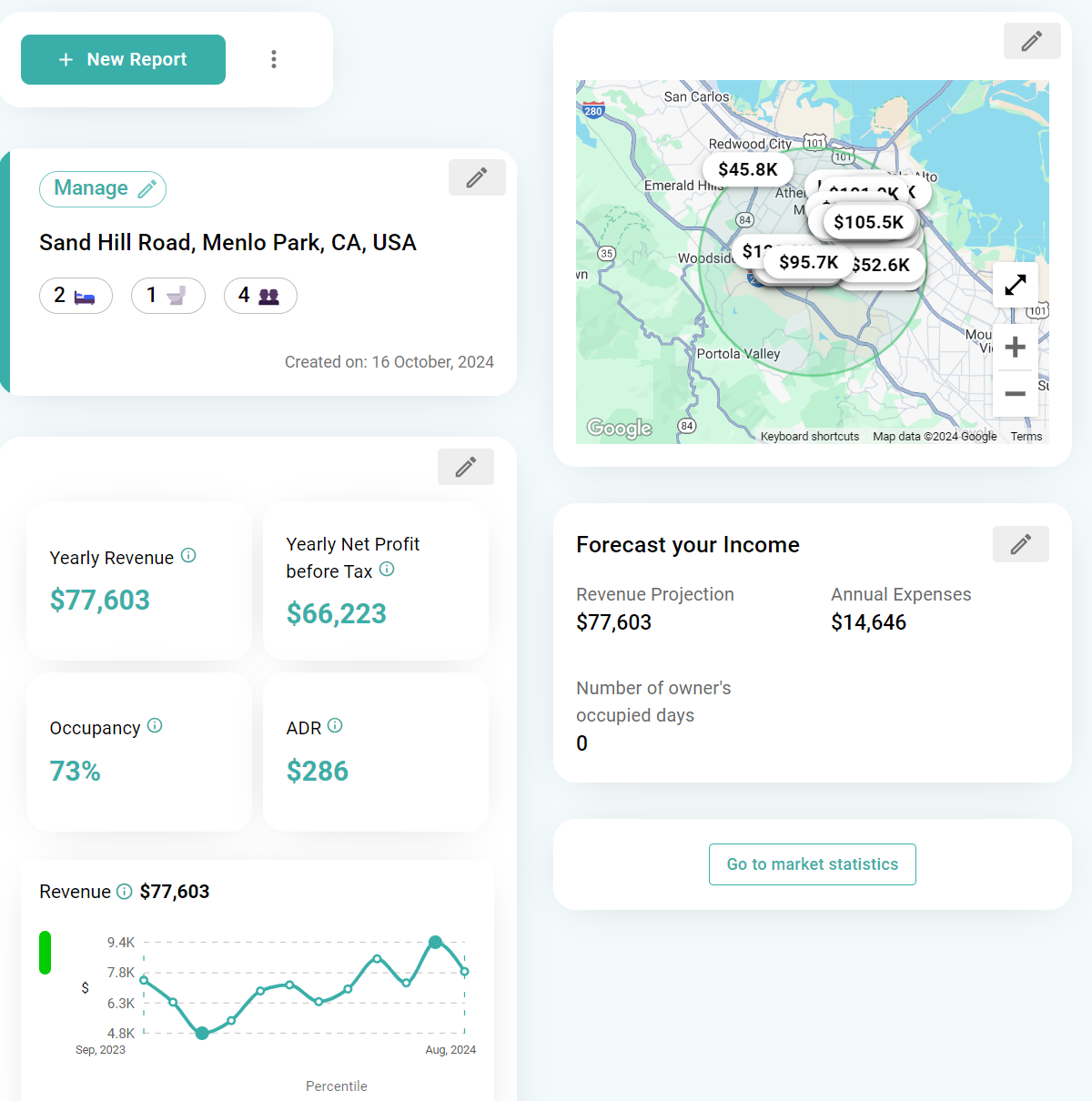

Voila! Simulate your Property ROI in seconds!

Congratulations! 🎉 You now have your property ROI report! It’s time for you to double-check and change the amount of your fees and expenses if needed. The Estimator tool will compute and show the following data points:

• Revenue potential

• Occupancy rate

• Cash on cash return

• Gross and net rental yields

• Rental arbitrage revenue

• Heatmap

• Seasonality

• Top-performing listings

Maximize our data to maximize your ROI

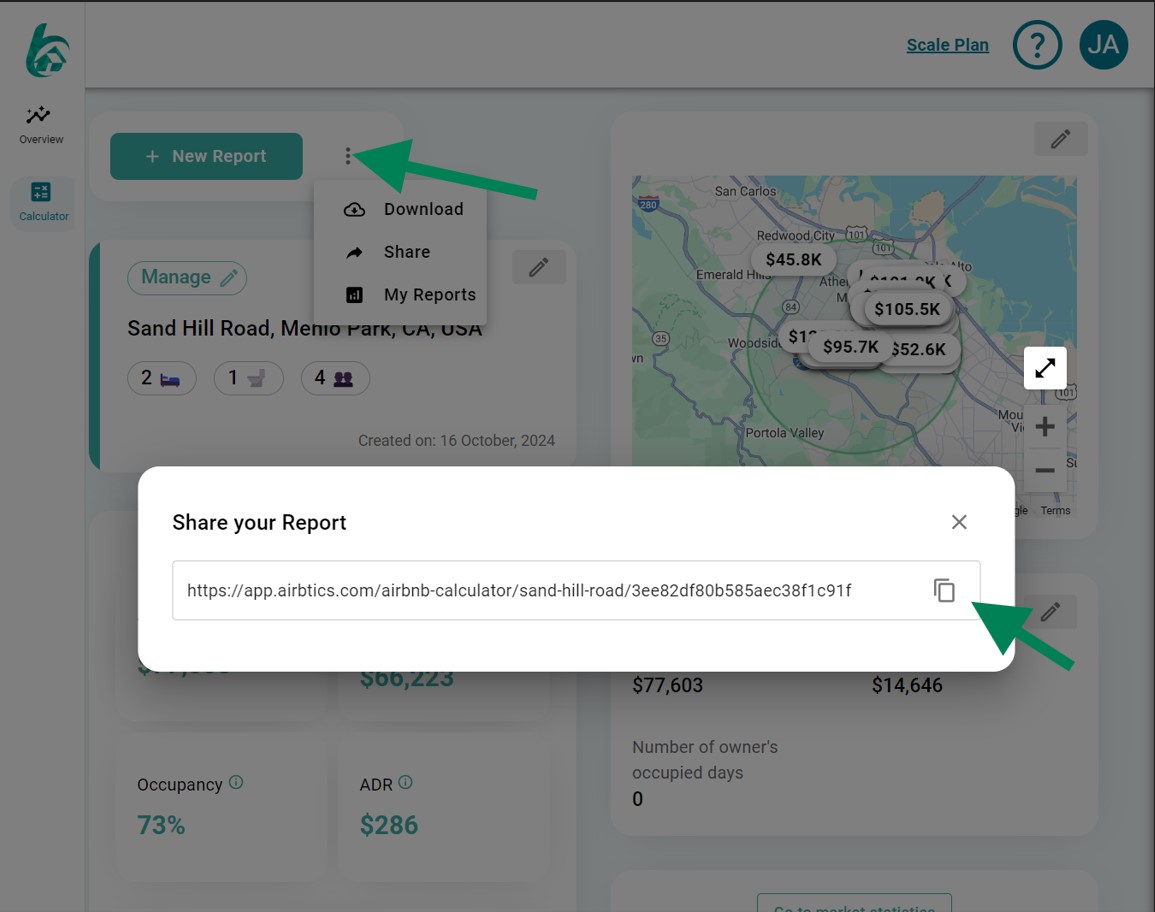

1. Share CSV. Feel free to share a CSV file by copying the link. Download button will be implemented soon.

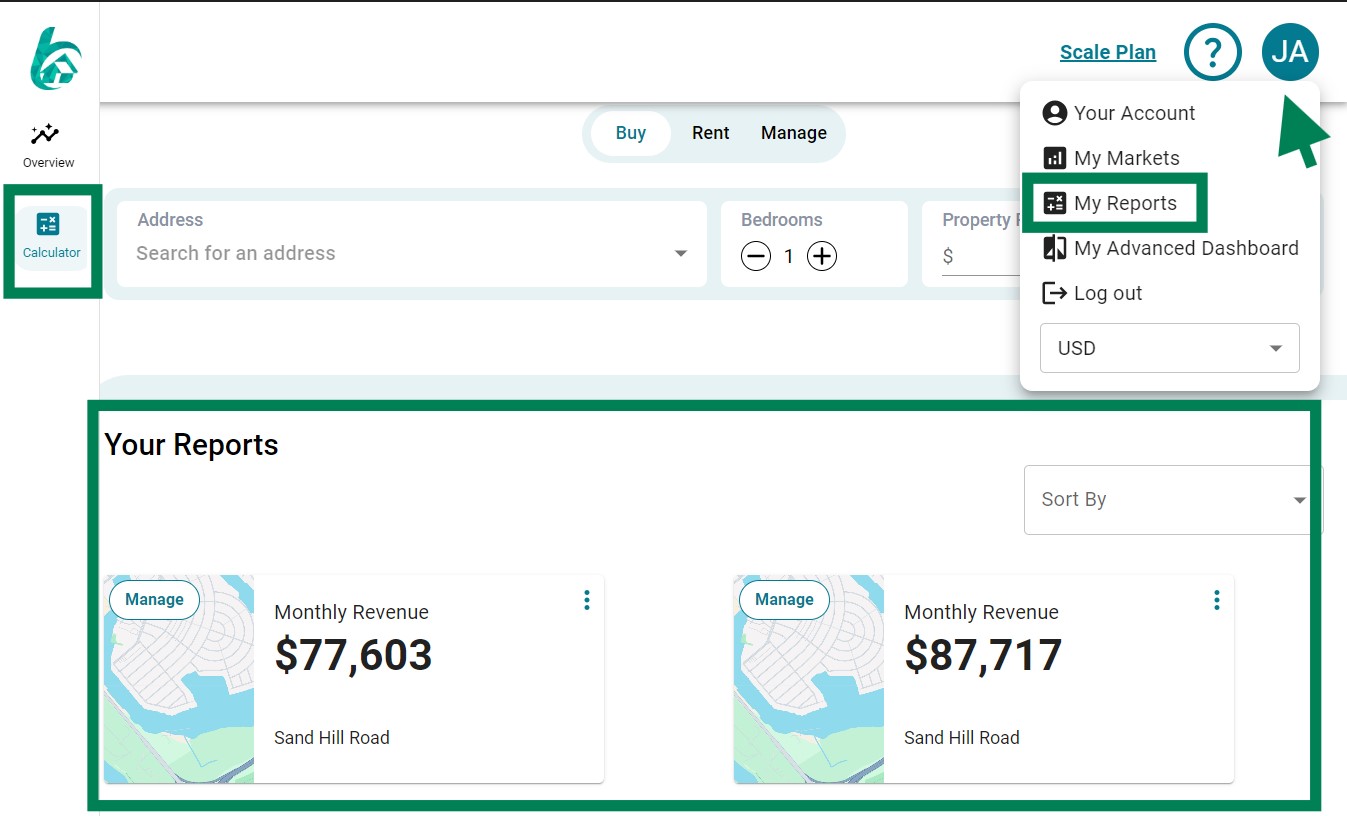

2. My Reports. Reports are save automatically. Just click the Calculator tab located in left corner or you can click initial name located in upper right corner and click My Reports.

3. Revenue historical trends. Another data that you can view in the Airbtics app and also one of the most important to analyze is the historical data. We show last twelve months data for potential revenue so you can analyze the peak and low months and make informed decisions to start your vacation rental business.

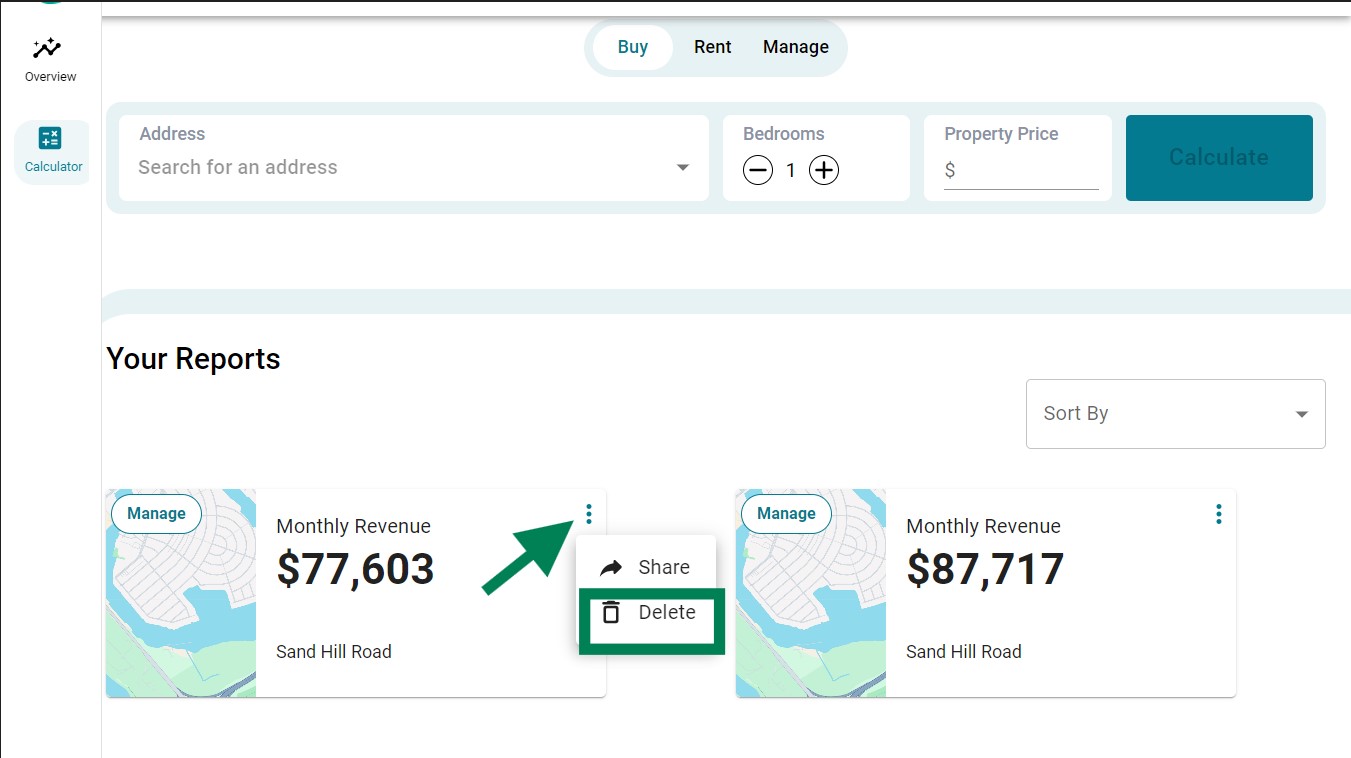

4. Delete Calculator Report. After analyzing and identifying potential markets, you can easily eliminate those that don’t meet your criteria. This streamlined process helps you focus on the most promising opportunities.

By using metrics such as Cash-on-Cash Return, Net Rental Yield, and Gross Rental Yield, investors can evaluate the potential revenue and profit of their investments. However, manually calculating these metrics can be time-consuming and prone to inaccuracies. So, if you’re serious about maximizing your returns and minimizing risks, embrace the power of automation and accurate data – just like smart property investors do.

Here’s a tutorial video to see how our Estimator tool functions: