Don’t know yet if buying a beach rental property could be worth your investment? Here’s an in-depth analysis of the Best Places to Buy a Beach House with Free Airbnb Data

Home > Resources > Airbnb Investment >

Don’t know yet if buying a beach rental property could be worth your investment? Here’s an in-depth analysis of the Best Places to Buy a Beach House with Free Airbnb Data

- Last updated January 31, 2024

KEY TAKEAWAYS

- A beach house is a worthy investment in Airbnb. But you do not have to spend so much to ensure the highest return. In fact, topping this list is the least expensive market for a beach house but with the highest gross rental yield!

The Beachfront Living

The sound of waves, the salty sea breeze, and the sun painting the sky with hues of orange and gold as it sinks into the horizon all come with beachfront living! But the idea of buying a beach rental property is more than just a dreamy escape. In fact, it can be a wise investment strategy that savvy investors are increasingly exploring.

In this article, we’ll take you on a journey beneath the sun-soaked surface to explain the benefits and offer a few heads-ups about buying a beach house for rental income. We’ll show you how data-backed insights can be your compass in navigating the shimmering waters of this exciting investment. Let’s embark on this coastal journey to financial prosperity by covering the following:

- The cost of a beach property

- Why investing in a beach house is profitable

- What to consider when buying a beach rental property

- 20 Best places to buy a beach house

- Buying a beach house or a beach condo

- What is the best number of bedrooms for a beach property

- Enjoying the beachfront bliss with rental analytics

How Much Does a Beach House Cost?

Just like any other property type, the price of a beach house can vary depending on its attributes. Factors that contribute to the final price are the location and size of the property.

We relied on Redfin for the average prices of beach houses on this list. They range from $300,000 to over $3 million. Remember that these are just average prices. Meaning, you can definitely find a property that costs lower than the average property price.

Why Buying A Beach Rental is a Good Idea?

Investing in a beach house can be a profitable endeavor for the following reasons:

1. Higher Rental Income – Beachfront properties stand as the investors’s dream, offering an irresistible allure to beach-going guests. Your target customers are willing to pay a premium for the unique experience of a beach vacation. This means a continuous flow of rental income that can surge during peak holiday seasons.

2. Appreciation and Portfolio Diversification – Diversity is key when it comes to real estate investments. These coastal gems not only strengthen your financial security but also promise long-term benefits. Aside from generating income, beach rentals also appreciate over time. Buying a beach rental property can make an irresistible addition to your strategic investment portfolio.

3. Natural Beauty and Healthy Lifestyle – This may be the reason why investors and guests opt for a beach location. A beach property is not just an investment, it is a gateway to an exceptional lifestyle. The unparalleled natural beauty and a wide range of recreational activities just a few steps from the ocean are major crowd-pleasers. Dive into a world where every day feels like a vacation, a world that is coveted by both guests and investors.

4. Personal Use and Enjoyment – Owning a beach rental is not just about running a business. This can also mean that you can enjoy the property for your own and your loved ones’ pleasure. You can have a paradise where investment potential meets personal relaxation. This only makes beach rentals a legacy of joy and prosperity for you and your family.

5. Retirement Planning – A beach house can also be a strategic step toward securing your dream retirement. By acquiring a slice of coastal paradise today, you’re not just locking in your future retirement home. You are also taking advantage of its income-generating potential in the meantime. Imagine the peace of mind knowing that your retirement is secure as you collect rental income.

What to Consider When Buying A Beach Rental Property

To ensure the profitability of a beach rental, here are some things to consider:

1. Set Your Budget

Buying a beach rental property demands setting a budget. As this type of property may come with a hefty price, your budget can dictate the feasibility of this investment endeavor.

Through budgeting, you will know how much capital you can comfortably channel into buying a beach rental property without putting your financial stability at risk. You can use your savings or take out a loan, but use your budget as a compass for a sustainable investment in the long run.

2. In-Demand Location

Now that you have set your budget, let’s invest this in the most profitable location. But how can you find them? In Airbnb, location can be your guiding light for the best investment areas. In this case, invest where the beachgoers go! This means don’t just invest in any property close to a body of water. But go for a market that has a high rental demand for beach property.

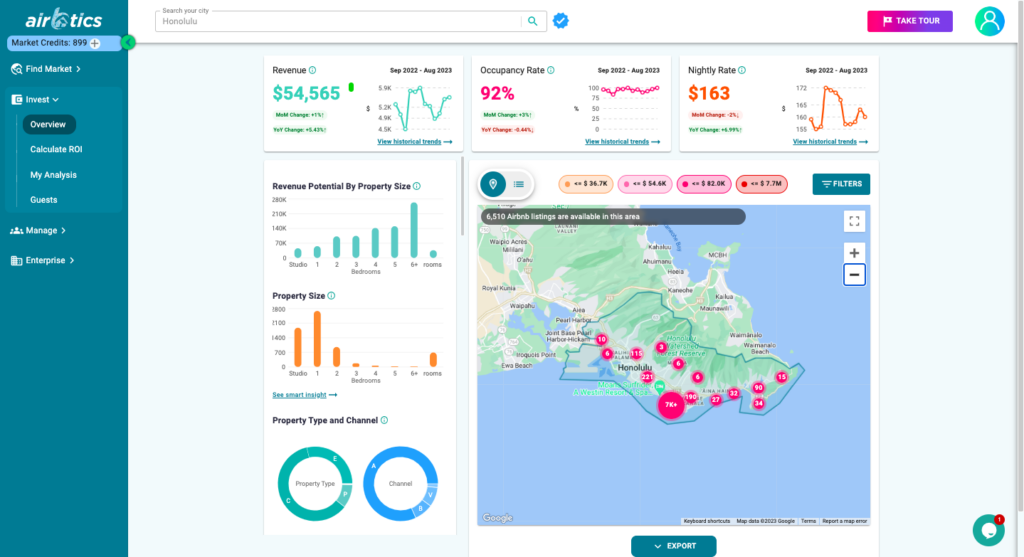

You can use the Airbtics Dashboard to check the market’s booking capacity via its occupancy rate. Simply type in the name of the city in the search bar, and you will instantly see its key investment metrics such as:

- Occupancy Rate

- Nightly Rate

- Annual Revenue

- Active Airbnb Listings

- Seasonality

In our example, Honolulu’s Airbnb market has an average occupancy rate of 92%. That is exceptionally high, considering that hosts should aim for at least a 50% occupancy rate.

3. High Gross Rental Yield

Let’s say that you have already found a market with a high Airbnb demand. Now let’s check if buying a beach rental property is a sound investment decision. In real estate, one of the stape measures of a good investment is by calculating the gross rental yield of a property.

Market’s Gross Rental Yield =

(Average Airbnb Annual Revenue / Average Property Price)

According to Redfin, the average property price in Honolulu is $680,000. Let’s now divide the average Airbnb annual revenue ($54,565) by that cost.

|

|||

|---|---|---|---|

| Annual Revenue | Average Property Price | Gross Rental Yield | |

| $54,565 | $680,000 | 8.02% | |

An 8% gross rental yield can be considered good. But if you want to go higher, then you will need to buy a property that has a lower price than the average in Honolulu. Later on, you will also see other strategies to increase the gross rental yield in Honolulu or in any other beach market.

20 Best Places to Buy a Beach House 2023

Savvy investors should always balance the affordability of properties and the level of short-term rental demand in an Airbnb market. This balance is crucial in making informed decisions and optimizing returns, especially in a niche real estate investment like a beach rental. So, here are the best beach markets that balance both:

1. Hampton, VA

- Number of Airbnb Listings: 482

- Annual Revenue: $37,876

- Average Property Price: $304,700

- Gross Rental Yield: 12.43%

- Seasonality: 50%

2. Myrtle Beach, SC

- Number of Airbnb Listings: 5,968

- Annual Revenue: $36,488

- Average Property Price: $312,249

- Gross Rental Yield: 11.69%

- Seasonality: 72%

3. Virginia Beach, VA

- Number of Airbnb Listings: 1,921

- Annual Revenue: $51,377

- Average Property Price: $450,000

- Gross Rental Yield: 11.42%

- Seasonality: 66%

4. Cape May, NJ

- Number of Airbnb Listings: 307

- Annual Revenue:$113,460

- Average Property Price: $995,000

- Gross Rental Yield: 11.40%

- Seasonality: 77%

5. Gulf Shores, AL

- Number of Airbnb Listings: 3,741

- Annual Revenue: $53,121

- Average Property Price: $495,750

- Gross Rental Yield: 10.72%

- Seasonality: 68%

6. Panama City Beach, FL

- Number of Airbnb Listings: 7,672

- Annual Revenue: $48,720

- Average Property Price: $464,100

- Gross Rental Yield: 10.50%

- Seasonality: 72%

7. Clearwater, FL

- Number of Airbnb Listings: 2,245

- Annual Revenue: $43,996

- Average Property Price: $422,500

- Gross Rental Yield: 10.41%

- Seasonality: 54%

8. South Padre Island, TX

- Number of Airbnb Listings: 2,767

- Annual Revenue: $53,011

- Average Property Price: $537,000

- Gross Rental Yield: 9.87%

- Seasonality: 66%

9. Ocean City, MD

- Number of Airbnb Listings: 4,501

- Annual Revenue: $51,307

- Average Property Price: $524,000

- Gross Rental Yield: 9.79%

- Seasonality: 66%

10. New Port, OR

- Number of Airbnb Listings: 246

- Annual Revenue: $49,665

- Average Property Price: $510,000

- Gross Rental Yield: 9.74%

- Seasonality: 61%

11. Hilton Head Island, SC

- Number of Airbnb Listings: 4,530

- Annual Revenue: $53,541

- Average Property Price: $598,250

- Gross Rental Yield: 8.95%

- Seasonality: 61%

12. Palm Bay, FL

- Number of Airbnb Listings: 311

- Annual Revenue: $25,803

- Average Property Price: $311,995

- Gross Rental Yield: 8.27%

- Seasonality: 56%

13. Destin, FL

- Number of Airbnb Listings: 2,850

- Annual Revenue: $60,250

- Average Property Price: $749,000

- Gross Rental Yield: 8.04%

- Seasonality: 66%

14. Kiawah Island, SC

- Number of Airbnb Listings: 546

- Annual Revenue: $91,064

- Average Property Price: $1,200,000

- Gross Rental Yield: 7.59%

- Seasonality: 59%

15. Port Saint Lucie, FL

- Number of Airbnb Listings: 981

- Annual Revenue: $33,646

- Average Property Price: $445,000

- Gross Rental Yield: 7.56%

- Seasonality: 54%

16. Canno Beach, OR

- Number of Airbnb Listings: 236

- Annual Revenue: $72,573

- Average Property Price: $995,000

- Gross Rental Yield: 7.29%

- Seasonality: 60%

17. Keywest, FL

- Number of Airbnb Listings: 1,184

- Annual Revenue: $92,942

- Average Property Price: $1,275,000

- Gross Rental Yield: 7.29%

- Seasonality: 49%

18. Miami Beach, FL

- Number of Airbnb Listings: 5,857

- Annual Revenue: $46,058

- Average Property Price: $649,950

- Gross Rental Yield: 7.09%

- Seasonality: 46%

19. Monterey, CA

- Number of Airbnb Listings: 1,897

- Annual Revenue: $73,679

- Average Property Price: $1,295,000

- Gross Rental Yield: 5.69%

- Seasonality: 46%

20. Malibu, CA

- Number of Airbnb Listings: 397

- Annual Revenue: $189,943

- Average Property Price: $3,700,000

- Gross Rental Yield: 5.13%

- Seasonality: 42%

Buying A Beach Rental Property: A House or A Condo

You have already solved which market to invest your money in, now let’s discuss what beach property is better. Investing in a beach house or a condo can be a puzzle that Airbnb investors need to grapple with. So, let’s discuss the factors that you need to consider.

Beach House

1. Higher Initial Investment – Beach houses come with a higher initial price tag compared to condos in the same locale. Some potential investors might see the pricier entry point of beach houses as a challenge.

2. More Space – With ample room to roam, beach houses are an ideal choice for larger groups or families. This extra space can lead to increased rental income, especially during peak seasons.

3. Higher Maintenance Costs – Owning a beach house entails higher maintenance expenses. This may include landscaping, preserving exterior paint, and roof maintenance, among others.

4. Higher Capital Growth – Beach houses have a higher potential to appreciate over time. Owners can expect not only higher rental income but also long-term financial gains, provided that these properties are well-maintained over the years.

Beach Condo

1. Lower Price Point – Condos generally come with a more affordable price tag. This makes this property more accessible to investors with less capital.

2. Lower Maintenance Costs – Condo associations typically shoulder the maintenance and repair costs of common areas. While this lightens the load for the condo owners, they need to pay monthly association fees.

3. Cozier Spaces – Condos offer a more compact living space. This limits the number of guests that you can accommodate. However, condos can cater to couples and smaller groups of guests.

4. Potential for higher yield – Due to their lower purchase price and consistent Airbnb bookings, beach condos often yield a higher gross rental income compared to houses.

Comparing Gross Rental Yields of A Beach House and A Beach Condo

The choice of which beach rental property type to buy will depend on the market. While most markets will offer higher gross rental yields from beach condos, that is not always the case.

|

||||

|---|---|---|---|---|

| City Name | Property Type | Annual Revenue | Average Property Price | Gross Rental Yield |

| Hampton, VA | Beach Condo | $42,363 | $284,750 | 14.88% |

| Beach House | $43,064 | $319,400 | 13.48% | |

| Myrtle Beach, SC | Beach Condo | $37,607 | $228,450 | 16.46% |

| Beach House | $37,045 | $427,005 | 8.68% | |

| Virginia Beach, VA | Beach Condo | $48,334 | $457,500 | 10.56% |

| Beach House | $58,450 | $515,000 | 11.35% | |

| Cape May, NJ | Beach Condo | $89,167 | $849,000 | 10.50% |

| Beach House | $117,560 | $1,249,000 | 9.41% | |

| Gulf Shores, AL | Beach Condo | $48,310 | $425,000 | 11.37% |

| Beach House | $53,277 | $764,900 | 6.97% | |

City Name

Dataset

- Property Type: Beach Condo

- Annual Revenue: $42,363

- Average Property Price: $284,750

- Gross Rental Yield: 14.88%

- Property Type: Beach House

- Annual Revenue: $43,064

- Average Property Price: $319,400

- Gross Rental Yield: 13.48%

- Property Type: Beach Condo

- Annual Revenue: $37,607

- Average Property Price: $228,450

- Gross Rental Yield: 16.46%

- Property Type: Beach House

- Annual Revenue: $37,045

- Average Property Price: $427,005

- Gross Rental Yield: 8.68%

- Property Type: Beach Condo

- Annual Revenue: $48,334

- Average Property Price: $457,500

- Gross Rental Yield: 10.56%

- Property Type: Beach House

- Annual Revenue: $58,450

- Average Property Price: $515,000

- Gross Rental Yield: 11.35%

- Property Type: Beach Condo

- Annual Revenue: $89,167

- Average Property Price: $849,000

- Gross Rental Yield: 10.50%

- Property Type: Beach House

- Annual Revenue: $117,560

- Average Property Price: $1,249,000

- Gross Rental Yield: 9.41%

- Property Type: Beach Condo

- Annual Revenue: $48,310

- Average Property Price: $425,000

- Gross Rental Yield: 11.37%

- Property Type: Beach House

- Annual Revenue: $53,277

- Average Property Price: $764,900

- Gross Rental Yield: 6.97%

In the top 5 of the 20 Best Places to Buy a Beach House 2023, Virginia Beach deviates from this. Although the difference may seem small, this can be significant to investors who want to maximize every bit of their investments.

The best property type in each Airbnb market should be taken into consideration in the investor’s property search. Read our article “What is the Best Type of Property for Airbnb?” to guide you on whether you should buy a beach house or beach condo in your prospective Airbnb market.

Optimize Your Beach Rental with the Best Number of Bedrooms

Beach rental properties generally cater to families going on vacation. However, the highest number of bedrooms does not mean higher return. While you can charge a higher nightly rate for a 5-bedroom beach property, a smaller property size may give you consistent booking and income stream.

|

||||

|---|---|---|---|---|

| Property Size | Airbnb Listings | Annual Revenue | Average Property Price | Gross Rental Yield |

| Studio | 1,881 | $46,244 | $425,000 | 10.88% |

| 1 Bedroom | 2,685 | $56,364 | $399,250 | 14.12% |

| 2 Bedrooms | 959 | $102,756 | $631,000 | 16.28% |

| 3 Bedrooms | 178 | $105,280 | $1,330,000 | 7.92% |

| 4 Bedrooms | 66 | $142,756 | $1,795,000 | 7.95% |

| 5 Bedrooms | 29 | $150,710 | $2,189,500 | 6.88% |

Property Size

Dataset

Studio

- Airbnb Listings: 1,881

- Annual Revenue: $46,244

- Average Property Price: $425,000

- Gross Rental Yield: 10.88%

1 Bedroom

- Airbnb Listings: 2,685

- Annual Revenue: $56,364

- Average Property Price: $399,250

- Gross Rental Yield: 14.12%

2 Bedrooms

- Airbnb Listings: 959

- Annual Revenue: $102,756

- Average Property Price: $631,000

- Gross Rental Yield: 16.28%

3 Bedrooms

- Airbnb Listings: 178

- Annual Revenue: $105,280

- Average Property Price: $1,330,000

- Gross Rental Yield: 7.92%

4 Bedrooms

- Airbnb Listings: 66

- Annual Revenue: $142,756

- Average Property Price: $1,795,000

- Gross Rental Yield: 7.95%

5 Bedrooms

- Airbnb Listings: 29

- Annual Revenue: $150,710

- Average Property Price: $2,189,500

- Gross Rental Yield: 6.88%

This proves to be true in Honolulu Airbnb market, where 2-bedroom beach rentals have almost 3 times higher gross rental yield compared to 5-bedroom Airbnb properties. Get your own market’s best number of bedrooms to maximize the returns of your beach rental!

The Beachfront Bliss Starts with Airbtics

Buying a beach rental property can result in numerous benefits. These include higher rental income, portfolio diversification, and retirement planning. However, making the best investment decision in this niche Airbnb market is crucial.

Airbtics provides data-backed insight that can be your compass in navigating the intricate world of beach rental investments. The Airbtics Dashboard allows you to access key Airbnb market metrics such as occupancy rates, nightly rates, number of active Airbnb listings, and seasonality.

Armed with this information, you can make informed decisions about which Airbnb beach market to invest in, ensuring that you choose one with high rental demand and growth potential. So, whether you’re looking for a slice of coastal paradise or securing your financial future, you can achieve both with Airbtics!

Got a beach property in mind and wondering about its profitability? Then check its income potential with the legitimate Airbnb Profit Calculator!

Short-Term Rental Data

Short-Term Rental Data

-

Quick Links

Top Property Management Companies New orleans united states

Top 14 Property Managers in New orleans, United states Top 14 Property Managers in New orleans, United states Last updated on: 5th July, 2024 This …

Investing in Property for Sale: How to Buy A Profitable Property for Airbnb in Nashville

airbnb property for sale Nashville Hometown of country music, rock, and bluegrass? In Nashville, there’s so much more to discover. With over 1.8 million travelers …

Annual Airbnb Revenue in Moorpark california, USA

Moorpark, California| Airbnb Market Data & Overview | USA Moorpark, California Airbnb Market Data & Overview USA Is it profitable to do Airbnb in Moorpark, …

Annual Airbnb Revenue in Cherokee iowa, USA

Cherokee, Iowa| Airbnb Market Data & Overview | USA Cherokee, Iowa Airbnb Market Data & Overview USA Is it profitable to do Airbnb in Cherokee, …

Annual Airbnb Revenue in Swindon, UK

Swindon| Airbnb Market Data & Overview | UK Swindon Airbnb Market Data & Overview UK Is it profitable to do Airbnb in Swindon, UK? What …

Annual Airbnb Revenue in Tonbridge and malling, UK

Tonbridge and Malling| Airbnb Market Data & Overview | UK Tonbridge and Malling Airbnb Market Data & Overview UK Is it profitable to do Airbnb …