How to Calculate Vacation Rental Income?

To calculate vacation rental income, use the following formula:

Vacation Rental Income = Average Daily Rate (ADR) x Booked Nights

Where

ADR is the average nightly price that you charge for your listing

Booked nights is the number of days for which your listing was occupied

For example, if your daily rate averaged $250, and your property was booked for 15 nights:

Vacation Rental Income = $250 x 15 = $3,750

This formula shows that the monthly and annual vacation rental revenue depends on the nightly price and the occupancy rate. However, it is hard to estimate STR income without access to high-quality data and strong analytical tools.

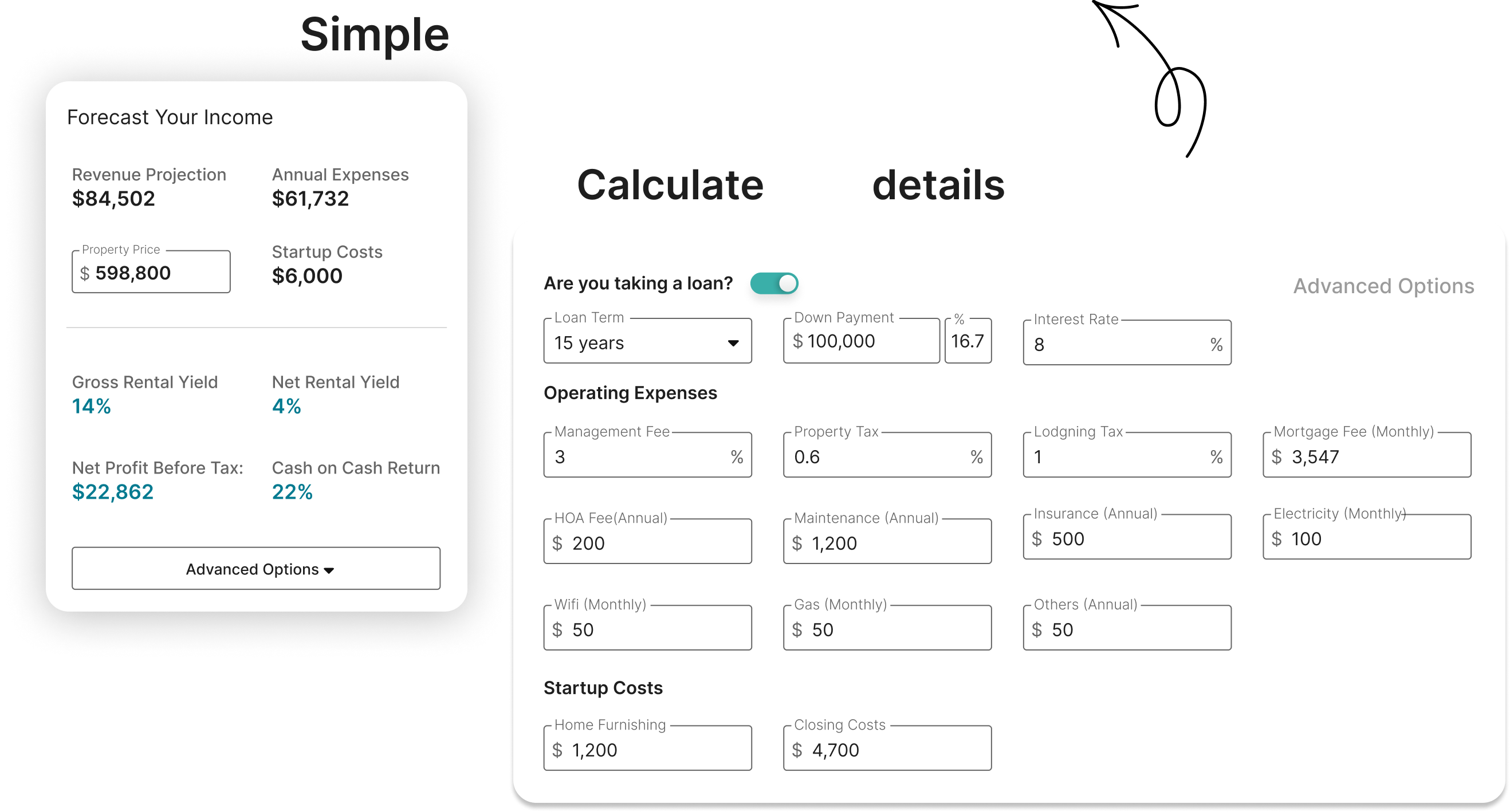

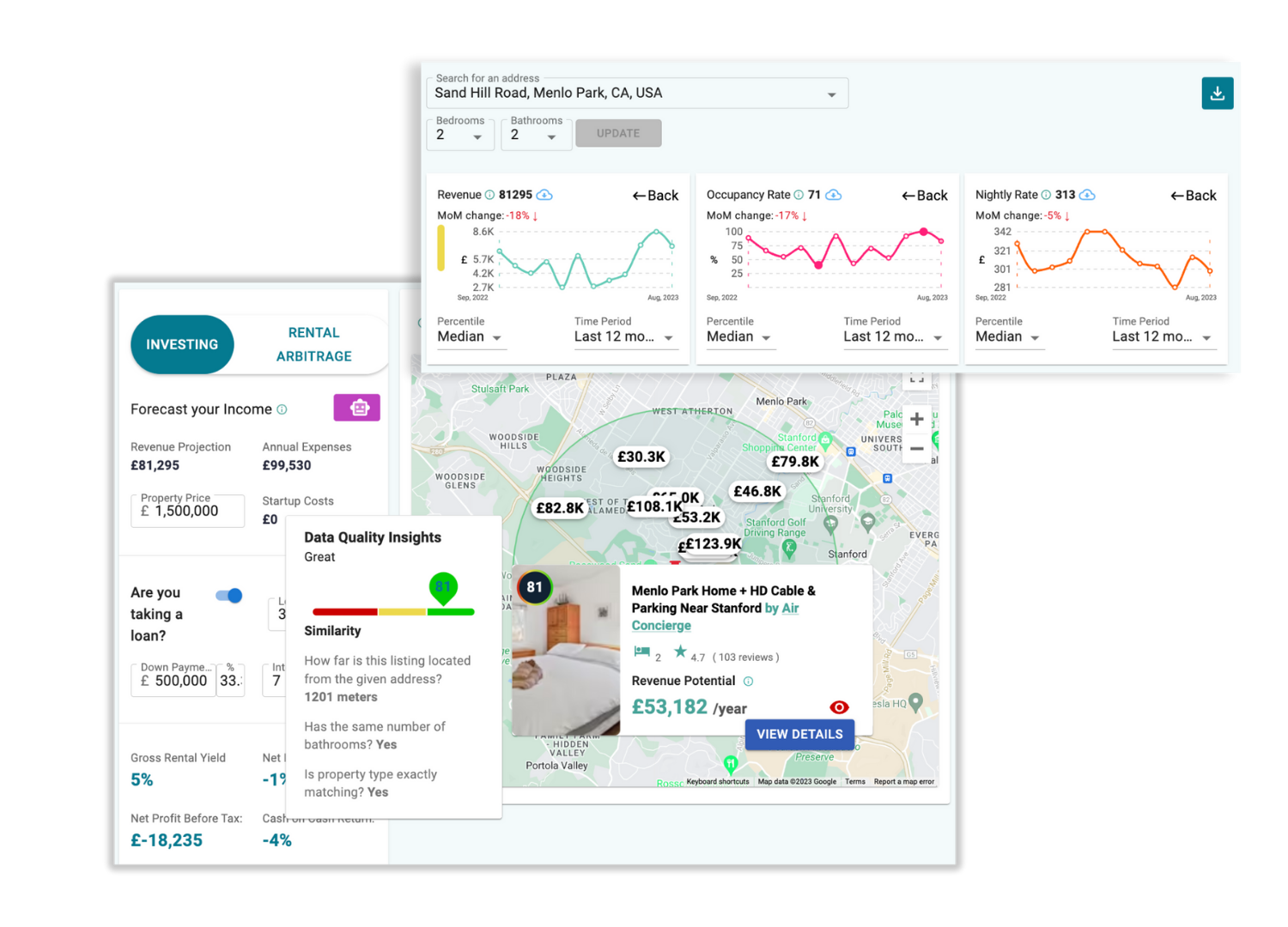

You can use the Airbtics’ short-term rental income calculator to quickly and confidently forecast income even before buying an investment property. This helps make successful real estate investments that maximize profit and minimize risk.

What Is the Best Way to Calculate Rental Income?

The best way to calculate rental income is by using a data-driven vacation rental calculator that accounts for real-time market conditions and the actual performance of rental comps, not just rough estimates. Instead of relying on static averages, tools like Airbtics use live vacation rental data, local demand trends, seasonal fluctuations, and occupancy rates to deliver highly accurate income projections.

Just enter the address, the number of bedrooms and bathrooms, and the availability of a swimming pool to get a reliable prediction of the vacation rental revenue of your property.

What Is the Average Income of Airbnb?

The average Airbnb income varies widely from one market to another and from one property to another. This is because it depends on multiple factors including location, property type and size, amenities, seasonality, management, marketing, and target guest persona.

The average vacation rental income can range from $11K in Cairo, Egypt to $51K in Los Angeles, The United States.

To instantly estimate the income that you can expect from a short-term rental property in a particular market, you can use the Airbtics’ Airbnb calculator. Simply enter the address and the property specifications to get an accurate prediction.

How Is Vacation Rental Income Taxed?

Vacation rental income tax laws vary from one country to another and depend on whether you operate as an individual or a business entity. It is best to consult with a tax professional or a real estate accountant to understand what rates apply and when you need to file and pay Airbnb taxes.

Using a vacation rental calculator can help you estimate annual income to forecast applicable taxes.

How to Maximize Vacation Rental Income?

The first step to maximizing vacation rental income is utilizing a vacation rental cash flow calculator to find a profitable investment market with a strong revenue potential. Second, you need to perform diligent short-term rental property analysis before purchasing a property to select one that can generate above-average earnings.

Once you own a vacation rental, you can enhance income with:

- Upgraded design and well maintained furniture

- Dynamic pricing aligned with market conditions and trends

- Listing on multiple platforms such as Airbnb and Vrbo

- Airbnb SEO optimized listing

- Professional photos

- Actively working towards 5-star guest reviews

How Do I Calculate Cap Rate for a Vacation Rental?

To calculate the cap rate on vacation rentals, use the following formula:

Cap Rate = Net Operating Income (NOI) / Property Purchase Price x 100%

Where Net Operating Income (NOI) = Annual Rental Income - Net Operating Expenses Excluding Mortgage and Property Purchase Price = Total acquisition cost including property price, closing cost, and major repairs

For example, if a property earns $60,000 in net operating income and cost $550,000 to purchase:

Cap Rate = $60,000/$550,000 x 100% = 10.91%

The cap rate is one of the most important metrics of return on investment for vacation rentals. In addition to measuring ROI, it also evaluates the level of risk associated with a short-term rental investment.

A good vacation rental cap rate is considered 8-12% as it is high enough to bring solid returns while keeping risk at a reasonable level.

What Is a Good ROI for a Vacation Rental?

A good return on investment (ROI) for a vacation rental property is usually 8-12% per year. However, it depends on the market and the property. For instance, major cities with high property prices tend to bring lower returns, while smaller markets with more affordable prices and less Airbnb competition might yield higher ROI. Among different property types, single-family homes usually have the highest rate of return.

To calculate ROI for a vacation rental, use this formula:

ROI = Annual Profit / Total Investment x 100%

Where Annual profit refers to the rental income minus annual expenses including mortgage, taxes, fees, etc.

Total investment combines the purchase price, closing costs, repairs, and furnishing

For instance, if a vacation rental generates $50,000 in annual profit and cost a total of $650,000:

ROI = $50,000/$650,000 x 100% = 7.69%

Using Airbtics’ vacation rental calculator helps you calculate a realistic ROI that factors in ADR, occupancy rate, seasonality, and comparable listings before purchasing a property. In this way, you can guarantee a good ROI for your vacation rental from the get go.

How Can I Make More Money from My Vacation Rental?

The first step to making more money from your vacation rental is investing in a high-income potential property in one of the best Airbnb markets globally. To do this, you can use a vacation rental calculator to quickly, easly, and accurately estimate the expected revenue and ROI based on the performance of comparable listings in the local area.

Once you own the property, there are a number of things you can do to reach the full potential of your short-term rental, including using dynamic pricing tools, targeting high-demand seasons, optimizing your listing on Airbnb and Vrbo, and adding value with popular amenities that enhance nightly prices.

How Accurate Is the Airbtics Vacation Rental Data?

The Airbtics vacation rental data has industry-leading accuracy of 97%. This high level of accuracy is the result of the data collection, cleaning, and calculation methods applied by the company. Airbtics scrapes data from 15+ million vacation rental listings on Airbnb and Vrbo. Data is updated weekly to guarantee that it is always up-to-date. Data is verified and validated through rigorous testing and comparison with official sources.

As a result, the Airbtics’ vacation rental calculator provides highly accurate and reliable projections of ADR, occupancy rate, revenue, and return owing to the use of multiple data sources, sophisticated ML models, regular data updates, and manual quality checks.

What Are the Limitations of the Vacation Rental Calculator?

While the vacation rental income calculator is a potent Airbnb analytical tool, it comes with some restrictions. The most significant limitations are that the calculator does not offer a list of Airbnbs for sale and that it doesn’t support dynamic pricing.

To maximize the efficiency and the power of the Airbtics’ calculator, it is recommended to use it in combination with other tools, such as Rabbu and Mashvisor for investment property marketplaces and PriceLabs and Beyond for dynamic pricing.