Looking to invest in Sydney, Australia? Learn more about Airbnb rules and restrictions in Sydney for short-term rental accommodations.

Home > Resources > Airbnb Rules >

Looking to invest in Sydney, Australia? Learn more about Airbnb rules and restrictions in Sydney for short-term rental accommodations.

- Last updated on

- September 4, 2023

If you are looking to invest in an investment property in the most popular cities for Airbnb in Australia, then Sydney is a great market for you to do so! By considering the primary key metrics for a successful investment including average daily rates, monthly revenue, and occupancy rates in Australia, this beautiful city will definitely be a great source of passive income.

Continue reading to learn more about Airbnb rules in Sydney and learn more about profitability in this city!

Is Airbnb legal in Sydney?

Let’s spill the beans: Yes, Airbnb is certainly legal in Sydney! With a rough number of 4.1 million international visitors annually, this city is undoubtedly a magnet for tourists across the globe. Sydney consistently attracts more tourists to book accommodations to visit the Opera House, Harbour Bridge, Manly Ferry, and see other tourist attractions.

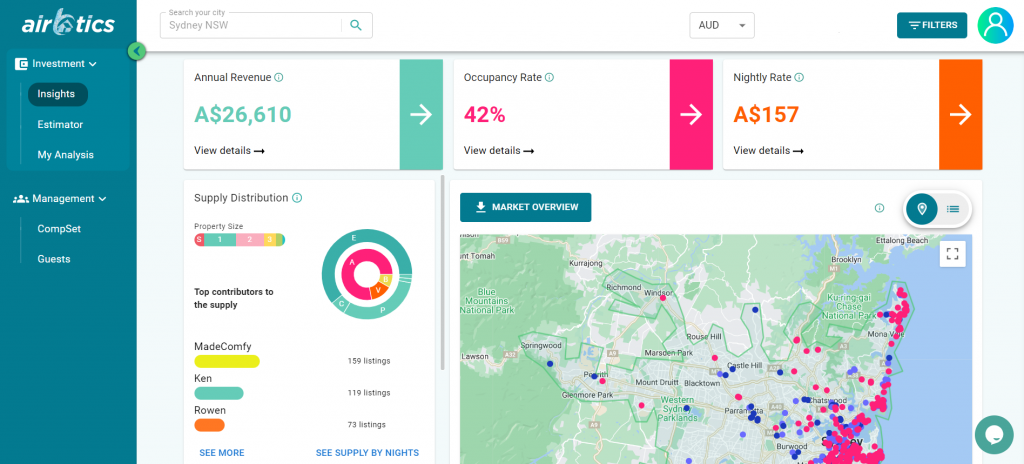

Here is a little proof! As of July 2022, there are 94,792 nights available in Sydney from Airbnb alone. MadeComfy manages 159 listings, while Ken and Rowen operate 119 and 73 respectively.

How much can I make by running an Airbnb in Sydney?

Currently, there are 7,094 Airbnb listings in Sydney, with 55% of entire houses earning up to A$3,816 a month. The Average Occupancy Rate in Sydney is 42% and the average daily rate is A$157. According to short-term rental properties data source Airbtics, a 2-bedroom apartment in Sydney can make up to A$62,780 each year. Want to discover how much profit can you make on Airbnb? Then make sure to check out our Free Airbnb Calculator!

What Are The Short-term Rental Accommodation Policies in Sydney?

- 180-day booking cap (with an exemption for bookings 21 days or longer)

For properties where the host is not present on the premises (non-hosted STRA) and located in Metro/Greater Sydney and several regional local council areas, the dwelling can be rented on a short-term for up to 180 days per year. - Residents can let their premises as a short term rental without the need for council approval, provided they meet the exempt development requirements.

- All hosts must comply with the fire and safety requirements and agree to follow the NSW Fair Trading Code of Conduct for the STRA Industry.

- Hosts are required to pay a registration fee of $65 for the first 12 months and an annual renewal fee of $25.

- Local residents will be restricted on the number of days they can use their premises for short-term lets.

Is Sydney A Profitable Area to Invest In?

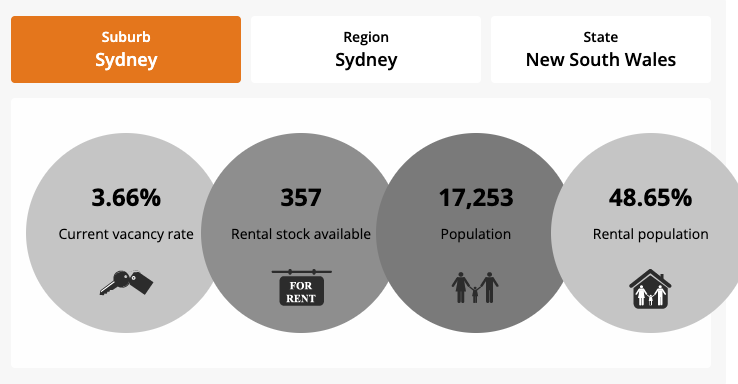

If you’re worried about spending thousands of bucks to purchase a property, the good news is you don’t need to! Property investors and hosts prefer to do rental arbitrage in Australia since this does not require owning a property. Based on statistical data for Sydney, the rental population in this area is 48.65% with a steady rental yield of 3%.

By using an accurate short-term rental calculator, you’ll be able to confirm if Sydney is a good place for investment! It’s important to know your estimated annual revenue and high-return investment opportunities in Sydney – and with Airbtics, it shouldn’t be a difficult task at all!

Source: Property Investment in Sydney

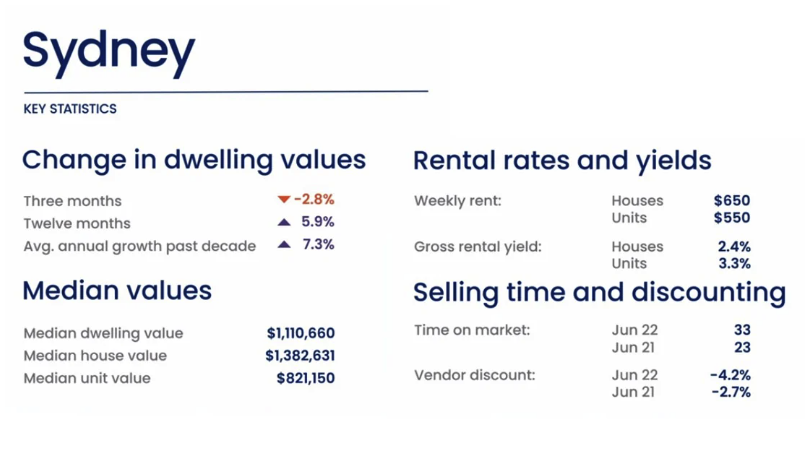

Sydney’s Property Market 2022

According to Sydney’s property market in 2022, this city has one of the strongest and most consistent top-performing markets with a 24% house price growth rate.

Source: Sydney’s Rental Market

Here are some of the most recommended neighborhoods that you can look into & consider purchasing based on Airbtics estimator:

| Suburbs | Price of 2bd Apartments | Average Rent Price | Average Airbnb Revenue |

|---|---|---|---|

| Darlinghurst | A$1.4M (142 sq.m. apartment) | A$3,911 | A$7,066 |

| Redfern | A$1.6M (152 sq.m. apartment) | A$3,259 | A$4,904 |

| Manly | A$2.3M (128 sq.m. apartment) | A$3,802 | A$7,011 |

Suburbs

Airbnb Dataset

- Price of 2BD Apartments: A$1.4M (142 sq.m. apartment)

- Average Rent Price: A$3,911

- Average Airbnb Revenue: A$7,066

- Price of 2BD Apartments: A$1.6M (152 sq.m. apartment)

- Average Rent Price: A$3,259

- Average Airbnb Revenue: A$4,904

- Price of 2BD Apartments: A$2.3M (128 sq.m. apartment)

- Average Rent Price: A$3,802

- Average Airbnb Revenue: A$7,011

Source for Property Price: Properties in Sydney

Conclusion

In general, considering the Airbnb rules & regulations in Sydney will help your Airbnb business to run smoothly! Aside from the fact that this is a passive income for various hosts, starting an Airbnb business is also a way to enjoy life and connect with new people from all over the world. Try Airbtics now and make the wisest investment decisions!

Short-Term Rental Data

Short-Term Rental Data

-

Quick Links

Annual Airbnb Revenue in Albany georgia, USA

Albany, Georgia| Airbnb Market Data & Overview | USA Albany, Georgia Airbnb Market Data & Overview USA Is it profitable to do Airbnb in Albany, …

Annual Airbnb Revenue in Lisle illinois, USA

Lisle, Illinois| Airbnb Market Data & Overview | USA Lisle, Illinois Airbnb Market Data & Overview USA Is it profitable to do Airbnb in Lisle, …

Best Cities to Airbnb in Washington State and Nearby Cities: Airbnb Investment in 2023

Best Cities to Airbnb in Washington State: Get leads on the best cities to Airbnb in Washington State from this article backed by short-term rental …

Rental Arbitrage Texas

Table of Contents Add a header to begin generating the table of contents Introduction Rental arbitrage in Texas is one of the popular ways to …

Annual Airbnb Revenue in Havering, UK

Havering| Airbnb Market Data & Overview | UK Havering Airbnb Market Data & Overview UK Is it profitable to do Airbnb in Havering, UK? What …

Airbnb Rules in Perth

If you are looking to buy an investment property in the most profitable Airbnb markets in Australia, particularly in Perth, this article is for you! …