Airbnb Investment Profitability: Homes for sale in Mexico City, MX: Discover Airbnb investment profitability in Mexico City this 2023 – and homes for sale: from studio to a property of 1,2,3, and 4+ bedrooms!

Home > Resources > Airbnb Investment >

Discover Airbnb investment profitability in Mexico City this 2023 – and homes for sale: from studio to a property of 1,2,3, and 4+ bedrooms!

- Last updated on

- August 17, 2023

The capital of the United Mexican States, Mexico City, also known as CDMX, has a lot to offer to people with its vibrant modern as well as historical environment.

Mexico City has a great diversity of natural resources, and a rich cultural and historical heritage and we cannot also forget to mention its exquisite cuisine is praised worldwide. It is a tourist destination for excellence and in fact, according to El Economista, in 2021, Mexico welcomed close to 7M tourist arrivals!

CDMX is one of the top short-term rental markets in Mexico, this information can be of great help to investors that are still wondering if they should invest in this city or not.

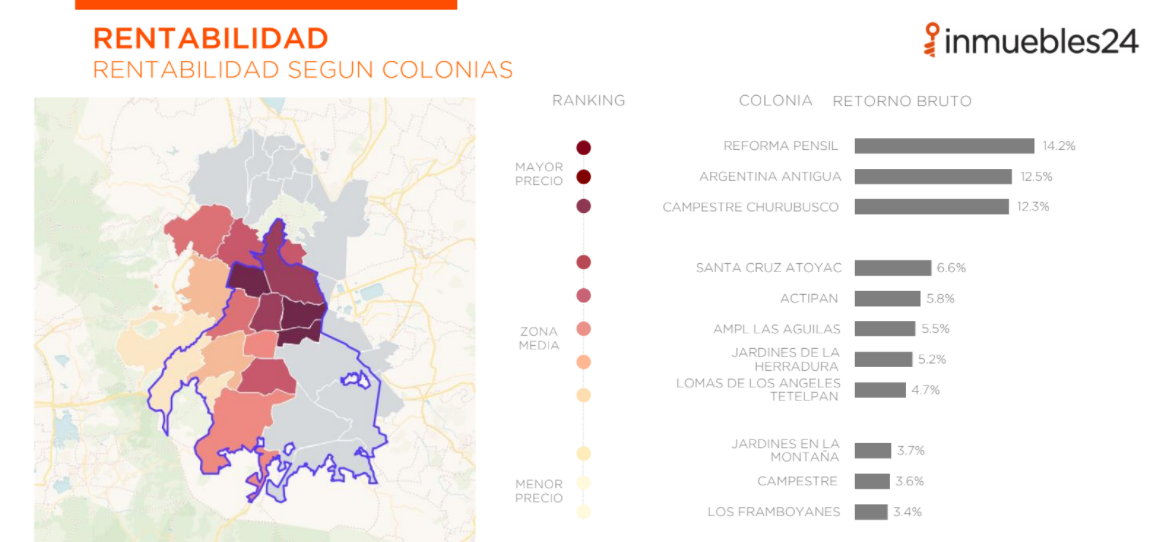

According to Idealista, the city of Mexico has a gross rental yield of 6.34% and for this, it is considered one of the top rental markets in Latin America. Among CDMX’s most profitable districts, we can find Reforma Pensil (14.2%) and Argentina Antigua (12.5%).

Source: Inmuebles24

.

“Mexico City is constantly experiencing the resurgence of some areas that, due to their privileged location, close to workplaces, schools and shops, are an excellent option to invest in real estate since they are ready to emerge, as has happened with several fashionable districts within the city, increasing its value considerably.”

Aside from looking at a property’s fascinating architectural design, proximity to major tourist areas, and accessibility to the best go-to places, the primary step is to determine profitability. In this article, we’ll discuss the metrics in order to gauge the best property investment in Mexico City.

This includes the best website recommendations for property investment, defining property gross rental yield, cash-on-cash return, and annual revenue, along with some of the most ideal and profitable properties according to their location. Stoked to learn more? Continue reading!

Best Neighborhoods for Airbnb in Mexico City

Let’s take a closer look at the important Airbnb key metrics to discover which is the most profitable zone in Mexico City. Filtered for a 1-bedroom apartment, here is a brief overview of some of the most recommended areas in CDMX:

1. Roma

- Annual revenue: $18,822 (371,649 MXN approx.)

- Average daily rate: $63

- Occupancy rate: 88%

2. Colonia Condesa

- Annual revenue: $22,123 (43,6829 MXN approx.)

- Average daily rate: $74

- Occupancy rate: 87%

3. San Rafael

- Annual revenue: $10,973 (216,667 MXN approx.)

- Average daily rate: $41

- Occupancy rate: 77%

Is Property Investment Profitable in Mexico City?

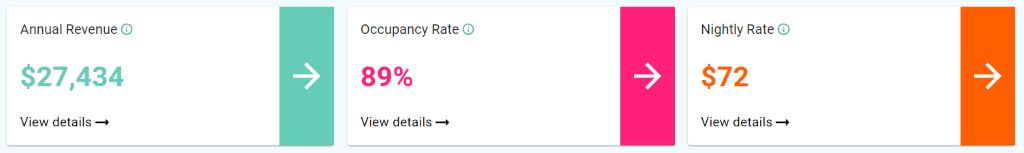

Using a short-term rental calculator, it was discovered that a 2-bedroom apartment in Mexico City can generate an annual revenue of $27,434 (around 541,591 MXN) with a steady occupancy rate of 89% and a nightly rate of $72.

Profitable Homes & Apartments for sale in Mexico City

Finding the best properties that have the potential to produce high yields and capital growth are certainly some of the preferences of major investors. It’s always best to ask for assistance from real estate agents to access exclusive and unique properties during the development stage.

At the same time, it’s even better when a property investor like you conducts research about predicted growths and market forecasts. Here are some of the profitable properties in Mexico City along with the calculated gross rental yield, cash-on-cash return, and annual revenue:

1. Studio-type Property for Sale Mexico City

- Located in the North Zone of the City of Merida

- Asking Price: $62,765

| GROSS RENTAL YIELD | 13.34% |

| ANNUAL REVENUE | $8,373 |

| CASH ON CASH RETURN | 14.25% |

2. 1-Bedroom Property for Sale Mexico City

- A few steps away we find the Boulevard Jardines

- Asking Price: $28,767

| GROSS RENTAL YIELD | 38.39% |

| ANNUAL REVENUE | $11,044 |

| CASH ON CASH RETURN | 89.41% |

3. 2-Bedroom Property for Sale Mexico City

- Near Volkswagen Industrial Park FINSA Puebla Sanctorum

- Asking Price: $41,853

| GROSS RENTAL YIELD | 34.92% |

| ANNUAL REVENUE | $14,616 |

| CASH ON CASH RETURN | 79.00% |

4. 3-Bedroom Property for Sale Mexico City

- 10 minutes from the center of the City of Queretaro

- Asking Price: $94,148

| GROSS RENTAL YIELD | 21.99% |

| ANNUAL REVENUE | $20,707 |

| CASH ON CASH RETURN | 40.21% |

5. 4-Bedroom Property for Sale Mexico City

- Located in Ejército de Oriente

- Asking Price: $112,454

| GROSS RENTAL YIELD | 24.23% |

| ANNUAL REVENUE | $27,242 |

| CASH ON CASH RETURN | 46.91% |

Conclusion

Since Airbnb is rapidly increasing and constantly changing for each city in the world, it is crucial to make decisions based on wild guesses. The data points mentioned in this article for Mexico City such as Airbnb occupancy rates, annual revenue, and average daily rate should be the primary basis before investing in a property.

To make sure that a property can generate a good cash flow, the right neighborhood should be studied and potential revenue should be calculated using an Airbnb income calculator. This is certainly what you need for success in the long run and to stand out among your competitors!

Short-Term Rental Data

Short-Term Rental Data

-

Quick Links

Annual Airbnb Revenue in East ayrshire, UK

East Ayrshire| Airbnb Market Data & Overview | UK East Ayrshire Airbnb Market Data & Overview UK Is it profitable to do Airbnb in East …

Annual Airbnb Revenue in San anselmo california, USA

San Anselmo, California| Airbnb Market Data & Overview | USA San Anselmo, California Airbnb Market Data & Overview USA Is it profitable to do Airbnb …

Annual Airbnb Revenue in Port chester new york, USA

Port Chester, New York| Airbnb Market Data & Overview | USA Port Chester, New York Airbnb Market Data & Overview USA Is it profitable to …

Mejores Zonas para Invertir en Airbnb en Las Palmas de Gran Canaria

mejores zonas para invertir en las palmas Métricas clave • El sólido mercado turístico de Las Palmas, su estable economía y las excelentes condiciones de vida …

Annual Airbnb Revenue in Pittsburg kansas, USA

Pittsburg, Kansas| Airbnb Market Data & Overview | USA Pittsburg, Kansas Airbnb Market Data & Overview USA Is it profitable to do Airbnb in Pittsburg, …

Annual Airbnb Revenue in Mid and east antrim, UK

Mid and East Antrim| Airbnb Market Data & Overview | UK Mid and East Antrim Airbnb Market Data & Overview UK Is it profitable to …