airbnb property for sale melbourne city centre

Melbourne offers plenty of reasons for one to live in and even start a business! Known for its many laneways and cultural diversity, Melbourne also has excellent dining options for all budgets and portrays amazing street art. It’s also known for being the coffee capital of the world and for being regularly voted as the world’s most livable city.

If you are looking to invest in a property where you can maximize profitability in a particular region, then it’s certainly a must to consider the major things when buying a property for Airbnb. Particularly, Airbnb rules in Melbourne make it easier for those who want to start an Airbnb business because a planning permit is not required. Aside from this, Airbnb rental arbitrage in Melbourne is another option for those who are on a tight budget.

In this article, we’ll discuss the important Airbnb metrics in order to gauge the best property investment in Melbourne, Australia. This includes the best website recommendations for property investment, along with each property’s gross rental yield, cash-on-cash return, and annual revenue.

According to a recent study, vacancy rates for Melbourne apartments remain above +6% in the inner suburbs. With some of these factors easing into 2022, and affordability pressures returning to the housing market, units could become more appealing for many buyers pursuing property investment in Melbourne.

While there are plenty of houses for sale in Melbourne, looking at Airbnb occupancy rates in Australia can also give you a wide overview of profitability in the entire country. Continue reading to learn more about the properties that will generate profit for Airbnb!

Is Property Investment Profitable in Melbourne City Centre?

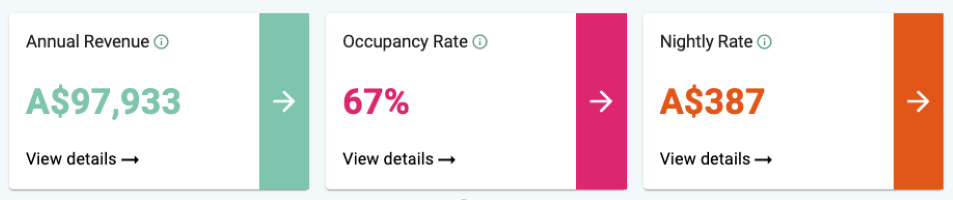

Australia is currently ranked as the top short-term rental market in Oceania with an impressive occupancy rate of 56%. Using an Airbnb calculator, it was discovered that a 3-bedroom apartment in Melbourne City Centre can generate an annual revenue of A$97,933 with a steady occupancy rate of 67% and a nightly rate of A$387.

airbnb property for sale melbourne city centre

Profitable Properties for Sale in Melbourne City Centre

Finding the best properties that have the potential to produce high yields and capital growth are certainly some of the preferences of major investors. It’s always best to ask for assistance from real estate agents to access exclusive and unique properties during the development stage.

At the same time, it’s even better when a property investor like you conducts research about predicted growths and market forecasts. Here are some of the profitable properties in Melbourne City Centre along with the calculated gross rental yield, cash-on-cash return, and annual revenue:

16A/116-130 Main Drive, Macleod, VIC 3085

1. Studio-type Property for Sale Melbourne

Located within Kingsbury Gardens Apartments

Asking Price: A$114,000

| GROSS RENTAL YIELD | 23.53% |

| ANNUAL REVENUE | A$26,825 |

| CASH ON CASH RETURN | 44.82% |

411/42-50 Barry Street, Carlton, VIC 3053

2. 1-Bedroom Property for Sale Melbourne

0.72 km to University High School

Asking Price: A$128,000

| GROSS RENTAL YIELD | 24.83% |

| ANNUAL REVENUE | A$32,030 |

| CASH ON CASH RETURN | 48.72% |

136/325 Nepean Highway, Frankston, VIC 3199

3. 2-Bedroom Property for Sale Melbourne

1.11 km to Kananook Primary School

Asking Price: A$185,000

| GROSS RENTAL YIELD | 24.11% |

| ANNUAL REVENUE | A$44,595 |

| CASH ON CASH RETURN | 46.55% |

3503 Diamond Leaf Ct, Valrico, FL 33594

4. 3-Bedroom Property for Sale Melbourne

Located at City Fridge Arrow Apartments

Asking Price: A$245,000

| GROSS RENTAL YIELD | 23.03% |

| ANNUAL REVENUE | A$56,413 |

| CASH ON CASH RETURN | 43.31% |

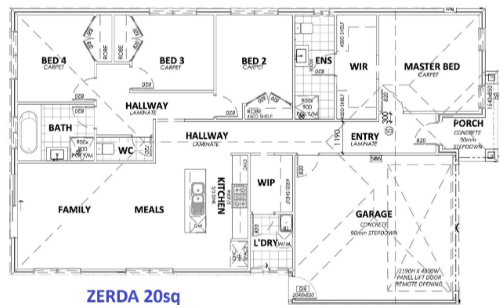

16 Sumac Street, Brookfield, VIC 3338

5. 4-Bedroom Property for Sale Melbourne

1.38 km to Catholic Regional College Melton

Asking Price: A$310,000

| GROSS RENTAL YIELD | 24.07% |

| ANNUAL REVENUE | A$74,602 |

| CASH ON CASH RETURN | 46.43% |

Conclusion

Since Airbnb is rapidly increasing and constantly changing for each city in the world, it is crucial to make decisions based on wild guesses. The data points mentioned in this article for Melbourne such as Airbnb occupancy rates, annual revenue, and average daily rate should be the primary basis before investing in a property.

Hence, if the data presented above has given you ideas to boost your strategic pricing plan for your business, then an Airbnb rental arbitrage calculator is certainly what you need for success in the long run. It’s a fact that some of the STR investors are also considering Airbnb Rental Arbitrage, but they still need to have a reliable data tool on to base their conclusions!

As we live in a digital era, an accurate data analytics tool can help your business stand out among your surrounding competitors and benchmark your property by tracking the occupancy rates of competing listings in your preferred city.