What Is Occupancy Rate?

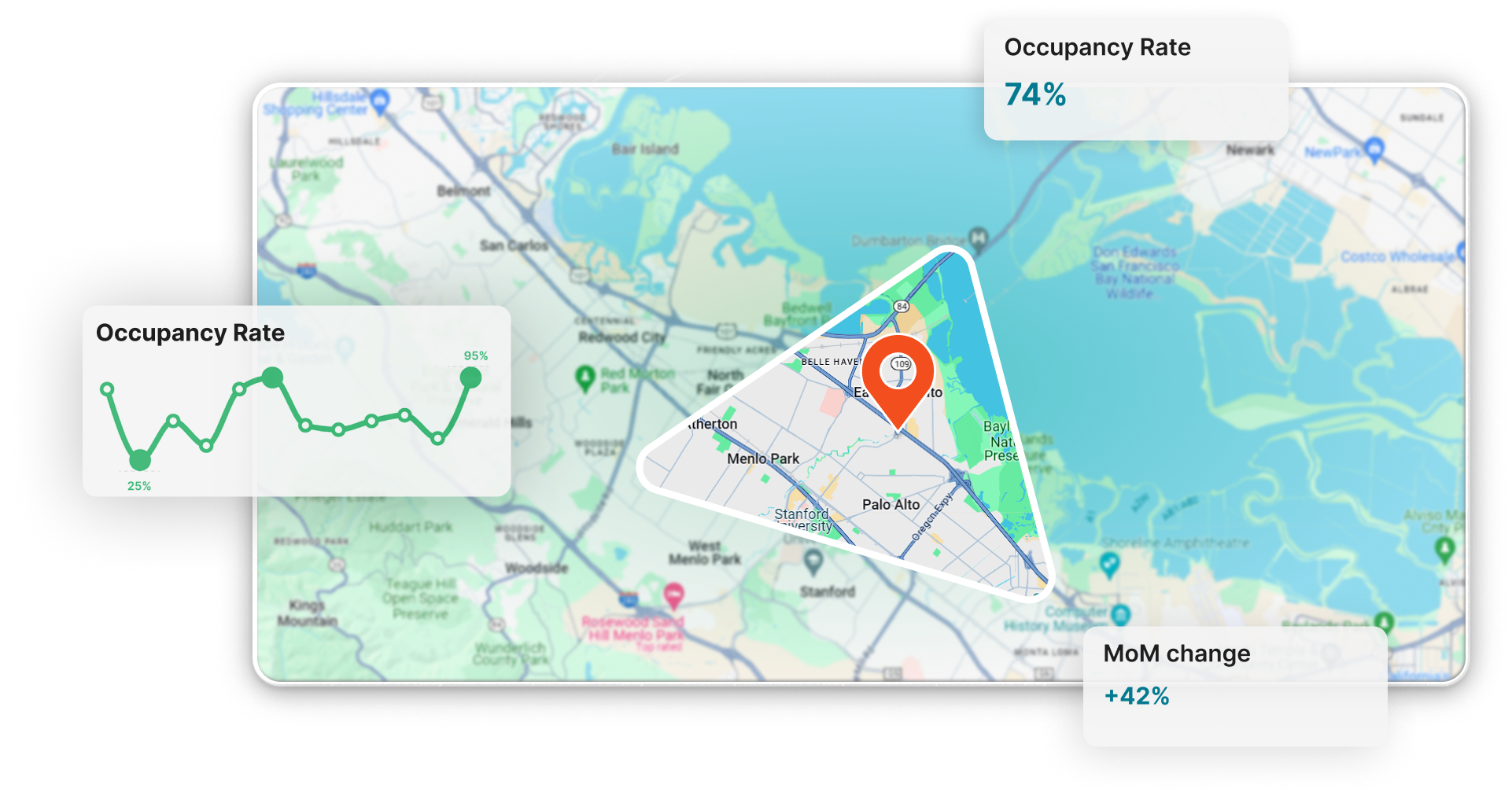

It is the percentage of nights booked among the available nights on an Airbnb listing. How can you find the average occupancy rate of your market?

How to find Airbnb Occupancy Rates?

Simply enter an address above, and it'll show you the average occupancy rate of any address in the world for free! The average occupancy rate is calculated by 10–20 similar listings around the input addresses.

How does Airbtics collect this data?

As a short-term rental data company, we've been tracking Airbnb listing occupancy rates and bookings since 2019. This allows us to have comprehensive Airbnb statistics at listing level.

Those statistics includes:

- Average Length of Stay (ALOS)

- Average Daily Rate

- Revenue per bedroom

- Average Daily Rate (ADR)

- Guest Demographics

- Neighbourhood Analysis heatmap

- Average Airbnb Booking Rate

- Airbnb Vacancy Rates

- Airbnb Statistics by city

- Airbnb Occupancy Rate Map

The average occupancy rate by Country highlights profitability of short-term rentals across each country, primarily focus on active short-term rental listed on Airbnb.

We average data from 3 to 8 major cities using active airbnb listings to reflect market conditions.

The data is updated every 3-6 months to track market trends. For detailed occupancy rate by city, select your country of interest.

| Country Name | Occupancy Rate | Grade |

|---|---|---|

| Albania | 62% | Moderate |

| Argentina | 53% | Poor |

| Armenia | 62% | Moderate |

| Aruba | 76% | Excellent |

| Australia | 62% | Moderate |

| Austria | 73% | Good |

| Belgium | 62% | Moderate |

| Belize | 50% | Poor |

| Brazil | 42% | Poor |

| Bulgaria | 57% | Moderate |

| Canada | 60% | Moderate |

| Chile | 46% | Poor |

| Columbia | 38% | Poor |

| Costa rica | 57% | Moderate |

| Croatia | 71% | Good |

| Cuba | 51% | Poor |

| Cyprus | 63% | Moderate |

| Czechia | 74% | Good |

| Denmark | 66% | Good |

| Dominican republic | 50% | Poor |

| Ecuador | 42% | Poor |

| Egypt | 45% | Poor |

| Estonia | 67% | Good |

| Fiji | 62% | Moderate |

| Finland | 63% | Moderate |

| France | 55% | Moderate |

| Georgia | 58% | Moderate |

| Germany | 64% | Moderate |

| Greece | 72% | Good |

| Guatemala | 55% | Moderate |

| Hong kong | 65% | Good |

| Hungary | 76% | Excellent |

| Iceland | 76% | Excellent |

| India | 39% | Poor |

| Indonesia | 46% | Poor |

| Ireland | 76% | Excellent |

| Israel | 50% | Poor |

| Italy | 55% | Moderate |

| Japan | 64% | Moderate |

| Kazakhstan | 50% | Poor |

| Kenya | 47% | Poor |

| Latvia | 66% | Good |

| Luxembourg | 70% | Good |

| Madagascar | 46% | Poor |

| Malaysia | 43% | Poor |

| Malta | 84% | Excellent |

| Mexico | 41% | Poor |

| Mongolia | 49% | Poor |

| Montenegro | 59% | Moderate |

| Morocco | 52% | Poor |

| Namibia | 55% | Moderate |

| Nepal | 34% | Poor |

| Netherlands | 81% | Excellent |

| New zealand | 67% | Good |

| Nigeria | 45% | Poor |

| Norway | 65% | Good |

| Paraguay | 61% | Moderate |

| Peru | 38% | Poor |

| Philippines | 46% | Poor |

| Poland | 62% | Moderate |

| Portugal | 71% | Good |

| Puerto rico | 70% | Good |

| Romania | 56% | Moderate |

| Saint kitts and nevis | 50% | Poor |

| Saudi arabia | 38% | Poor |

| Serbia | 58% | Moderate |

| Singapore | 52% | Poor |

| South africa | 52% | Poor |

| South korea | 50% | Poor |

| Spain | 54% | Poor |

| Sweden | 61% | Moderate |

| Switzerland | 62% | Moderate |

| Taiwan | 45% | Poor |

| Tanzania | 44% | Poor |

| Thailand | 64% | Moderate |

| Trinidad and tobago | 42% | Poor |

| Tunisia | 53% | Poor |

| Turkey | 44% | Poor |

| Ukraine | 51% | Poor |

| United arab emirates | 65% | Good |

| The united kingdom | 61% | Moderate |

| The united states | 59% | Moderate |

| Uruguay | 56% | Moderate |

| Vietnam | 42% | Poor |

Note: For countries that don't have cities with more than 3,000 active Airbnb listings, we calculate the average occupancy rate using all available Airbnb listings across the country.