airbnb property investment Charleston

If you’re a property investor who’s into the 1600s architecture filled with vintage horse carriages in the modern era, then Charleston is a city that must be discovered! According to Roofstock’s real estate market report, the population growth and a robust job market are the 2 major reasons why the housing market in Charleston, SC, is so strong.

Here’s a fact: Charleston is one of the best areas for Airbnb in South Carolina!

For property investors who are planning to invest in a property in this area, it’s highly recommended to learn about buying a property for Airbnb in order to make sure that it’s profitable. To begin with, it’s certainly important to consider the major costs and revenue before deciding to purchase a property in Charleston. Another excellent option is to do rental arbitrage in Charleston as it’s fairly popular and does not require you to purchase a property.

.

“Charleston, South Carolina, is not only an excellent place to put down roots and live but also to invest in real estate. There’s a healthy balance of all types of people in Charleston, from retirees and families to temporary residents. In fact, 40% of Charleston’s residential properties are renter-occupied.”

– Southern Bell Living on Charleston Property Investments

Aside from looking at a property’s fascinating architectural design, proximity to major tourist areas, and accessibility to the best go-to places, the primary step is to determine profitability. In this article, we’ll discuss the metrics in order to gauge the best property investment.

This includes the best website recommendations for property investment in Charleston, property gross rental yield, cash-on-cash return, and annual revenue, along with some of the most ideal and profitable properties according to their location. Stoked to learn more? Continue reading!

Top reasons for buying an Airbnb Property in Charleston

It’s a given fact that Charleston is one of the most beautiful cities in the Southern United States because of its dynamic and vibrant atmosphere that draws visitors from around the world. However, there’s more to learn as to why we recommend purchasing a property in this city. Here are some of the major reasons why you should consider buying a property for Airbnb in Charleston:

1. Charleston’s real estate market

The housing market value in east coast cities may make you think twice when planning to invest in a property for Airbnb because the prices are considerably high. However, you will like to know that compared to other coastal cities located, Charleston is certainly cheaper! With a median property price of $532k, this city offers a wide variety of housing options, so you won’t run out of options if you are looking for something cheaper.

2. The economy in Charleston is steadily growing!

Charleston’s economy is strong and continues and growing steadily throughout the years with major companies settled here as well as startups, this aspect of the city doesn’t disappoint. In fact, the unemployment rate here is 2.2% which is lower than the national average of 6.0%. On top of that, it is worth mentioning that the main economic activities in Charleston are based around the tourism, technology, healthcare and education sectors.

3. Charming and safe city

Safety is always something that concerns investors when looking for a place to invest. While crime is always something you need to be aware of, Charleston is considered a safe city as its crime rate is lower than the national average (13% lower). In addition to this, the hospitality in Charleston is something that captures your heart as you get to enjoy its slow pace of life.

What are the cons of buying an Airbnb property in Charleston?

Now that we know the pros of investing in Charleston, let’s take a quick look at some of the cons. It’s always better to look at the two sides of each coin in order to properly set your expectations!

Severe storms risks

It’s always devastating news to hear when people experience natural disasters in their local area and this can turn into a real concern to investors. While Charleston weather can be pleasant most of the year, it also gets pretty extreme at times. This charming city is threatened by severe storms, flooding risk and even hurricanes and tornadoes.

Best Neighborhoods for Airbnb in Charleston

Let’s take a closer look at the important Airbnb key metrics to discover which is the most profitable neighborhood in Charleston. Filtered for a 1-bedroom apartment, here is a brief overview of some of the most recommended and profitable neighborhoods:

airbnb property investment Charleston

1. Cannonborough Elliotborough

- Annual Revenue: $106,415

- Occupancy Rate: 92%

- Average Daily Rate: $301

2. North-Central

- Annual Revenue: $79,182

- Occupancy Rate: 92%

- Average Daily Rate: $250

3. South of Broad

- Annual Revenue: $71,726

- Occupancy Rate: 88%

- Average Daily Rate: $208

Is Property Investment Profitable in Charleston, SC?

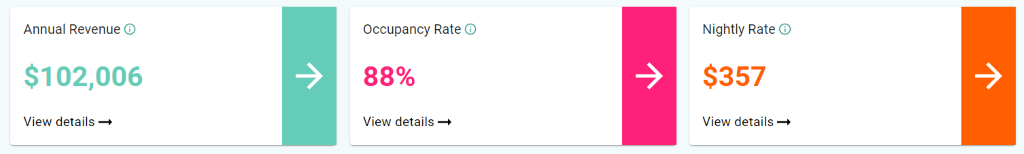

Using an Airbnb estimator, it was discovered that a 2-bedroom apartment in Charleston City Center can generate an annual revenue of $102,006 with a steady occupancy rate of 88% and a nightly rate of $357.

airbnb property investment Charleston

Properties For Sale in Charleston, SC

Finding the best properties that have the potential to produce high yields and capital growth are certainly some of the preferences of major investors. It’s always best to ask for assistance from real estate agents to access exclusive and unique properties during the development stage.

At the same time, it’s even better when a property investor like you conducts research about predicted growths and market forecasts. Here are some of Charleston South Carolina houses along with the calculated gross rental yield, cash-on-cash return, and annual revenue:

9556 Koester Rd, Ladson, SC 29456

1. Studio-type Property for Sale Charleston

- 0.1 miles to Ladson Elementary School

- Asking Price: $148,900

| GROSS RENTAL YIELD | 25.26% |

| ANNUAL REVENUE | $37,608 |

| CASH ON CASH RETURN | 50.00% |

188 Midland Pkwy Apt 222, Summerville, SC 29485

2. 1-Bedroom Type Property for Sale Charleston

- 1.8 miles Oakbrook Middle School

- Asking Price: $164,900

| GROSS RENTAL YIELD | 24.39% |

| ANNUAL REVENUE | $40,226 |

| CASH ON CASH RETURN | 47.42% |

519 Parkdale Dr Apt E, Charleston, SC 29414

3. 2-Bedroom Type Property for Sale Charleston

- 0.3 miles to Oakland Elementary School

- Asking Price: $229,900

| GROSS RENTAL YIELD | 25.46% |

| ANNUAL REVENUE | $58,531 |

| CASH ON CASH RETURN | 50.61% |

45 Sycamore Ave Apt 222, Charleston, SC 29407

4. 3-Bedroom Type Property for Sale Charleston

- 0.8 miles St. Andrews School Of Math And Science

- Asking Price: $335,000

| GROSS RENTAL YIELD | 25.35% |

| ANNUAL REVENUE | $84,915 |

| CASH ON CASH RETURN | 50.28% |

121 Sea Cotton Cir, Charleston, SC 29412

5. 4-Bedroom Type Property for Sale Charleston

- 1.4 miles to James Island Elementary School

- Asking Price: $525,000

| GROSS RENTAL YIELD | 25.13% |

| ANNUAL REVENUE | $131,920 |

| CASH ON CASH RETURN | 49.62% |

Conclusion

Since Airbnb is rapidly increasing and constantly changing for each city in the world, it is crucial to make decisions based on accurate data. While it’s a fact that Charleston, SC is certainly an attractive destination with a rich history, it’s best to discover a property’s profitability and calculate the potential revenue using an Airbnb rental arbitrage calculator. before taking the next step so that you can succeed in the long run!