airbnb property investment Fort Lauderdale

Fort Lauderdale is not only known for its beautiful coastlines and historic events but also for being the Venice of America. While many travelers consider this city on their travel bucket list, it’s most certainly a thrill for property investors too!

To begin with, the major costs and potential revenue should be considered before deciding to purchase a property. Another excellent option is to do rental arbitrage since it’s fairly popular and does not require you to purchase a property as a start.

Here’s an interesting fact: Fort Lauderdale is one of the best places to Airbnb in Florida!

Based on Airbnb analysis on Florida East Coast beaches in 2021, an average host in Fort Lauderdale can earn a monthly revenue of $2,774 respectively.

Aside from looking at a property’s fascinating architectural design, proximity to major tourist areas, and accessibility to the best go-to places, the primary step is to determine profitability. In this article, we’ll discuss the metrics in order to gauge the best property investment.

This includes the best website recommendations for property investment in Fort Lauderdale, property gross rental yield, cash-on-cash return, and annual revenue, along with some of the most ideal and profitable properties according to their location. Stoked to learn more? Continue reading!

Why Should You Consider Buying An Airbnb in Fort Lauderdale?

Situated just one hour from Miami, Fort Lauderdale is one of the favorites vacations destinations in the United States! Whether you’re looking for a relaxing getaway or enjoying exciting activities, Fort Lauderdale and its beautiful beaches will surely have something for you. Here are some of the major reasons why you should consider buying a property for Airbnb in Fort Lauderdale:

1. Vacationers love Fort Lauderdale!

Fort Lauderdale is a popular destination for vacationers, thus, the tourism & hospitality industries are strong in this city! Around 10M visitors arrive in the city each year to enjoy the tropical weather and warm ocean water. This surely would attract investors who are interested in tourist accommodations!

2. Great location

Fort Lauderdale is a charming coastal destination located along the Atlantic Ocean that offers stunning views, but in addition to this, the city also enjoys a great location as it’s close to other major cities such as Miami, Hollywood and Davie! Thanks to this, locals and visitors alike can enjoy the best of the best of popular cities of Florida.

What are the cons of buying an Airbnb property in Fort Lauderdale?

Now that we know the advantages of investing in Fort Lauderdale, let’s move on and take a quick look at the cons. It’s always better to look at the two sides of each coin in order to properly set your expectations!

1. Expensive real estate market

If you’re looking for an affordable house market, then maybe you should think twice about Fort Lauderdale because its average property value is higher than other cities in Florida. Based on Redfin, the median housing value here is more than $625K and is trending up 13.8% year-over-year.

2. High cost of living

In addition to its housing market, another downside in Fort Lauderdale is also the cost of living, which is 17% higher than the national average and 18% more expensive than other cities in the state.

Best Neighborhoods for Airbnb in Fort Lauderdale

Let’s take a closer look at the important Airbnb key metrics to discover which is the most profitable neighborhood in Fort Lauderdale. Filtered for a 1-bedroom apartment, here is a brief overview of some of the most recommended and profitable neighborhoods:

airbnb property investment Fort Lauderdale

1. Galt Mile

- Annual Revenue: $65,126

- Occupancy Rate: 90%

- Average Daily Rate: $169

2. Victoria Park

- Annual Revenue: $45,251

- Occupancy Rate: 88%

- Average Daily Rate: $141

3. Harbordale

- Annual Revenue: $34,873

- Occupancy Rate: 78%

- Average Daily Rate: $106

Is Property Investment Profitable in Fort Lauderdale?

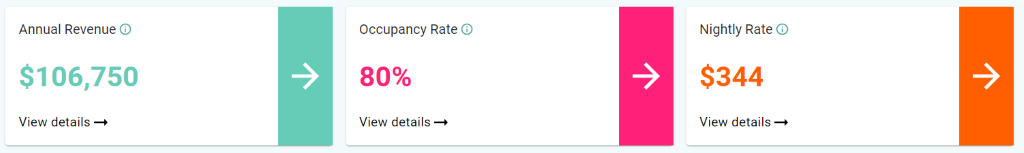

Using a short-term rental calculator, it was discovered that a 3-bedroom apartment in Fort Lauderdale can generate an annual revenue of $106,750 with a steady occupancy rate of 80% and a nightly rate of $344.

airbnb property investment Fort Lauderdale

Cheap Waterfront Homes for Sale in Fort Lauderdale

Finding the best properties that have the potential to produce high yields and capital growth are certainly some of the preferences of major investors. It’s always best to ask for assistance from real estate agents to access exclusive and unique properties during the development stage.

At the same time, it’s even better when a property investor like you conducts research about predicted growths and market forecasts. Here are some of the profitable properties in Fort Lauderdale along with the calculated gross rental yield, cash-on-cash return, and annual revenue:

5198 SW 32nd St #10-01, Fort Lauderdale, FL 33314

1. Studio-type Property for Sale Fort Lauderdale

- 1.5 miles to Davie Elementary School

- Asking Price: $85,000

| GROSS RENTAL YIELD | 30.21% |

| ANNUAL REVENUE | $25,680 |

| CASH ON CASH RETURN | 64.87% |

2124 NE 56th Ct APT 205, Fort Lauderdale, FL 33308

2. 1-Bedroom Type Property for Sale Fort Lauderdale

- 1.1 miles to Mcnab Elementary School

- Asking Price: $110,000

| GROSS RENTAL YIELD | 25.00% |

| ANNUAL REVENUE | $27,498 |

| CASH ON CASH RETURN | 49.23% |

1306 NW 9th Ave #1306, Fort Lauderdale, FL 33311

3. 2-Bedroom Type Property for Sale Fort Lauderdale

- 0.1 miles to Thurgood Marshall Elementary School

- Asking Price: $185,000

| GROSS RENTAL YIELD | 21.72% |

| ANNUAL REVENUE | $40,180 |

| CASH ON CASH RETURN | 39.39% |

2110 NW 28th Ter, Fort Lauderdale, FL 33311

4. 3-Bedroom Type Property for Sale Fort Lauderdale

- 0.8 miles Rock Island Elementary School

- Asking Price: $249,900

| GROSS RENTAL YIELD | 26.93% |

| ANNUAL REVENUE | $67,052 |

| CASH ON CASH RETURN | 55.02% |

5. 4-Bedroom Type Property for Sale Fort Lauderdale

- 0.2 miles to Riverland Elementary School

- Asking Price: $405,000

| GROSS RENTAL YIELD | 25.29% |

| ANNUAL REVENUE | $102,405 |

| CASH ON CASH RETURN | 50.09% |

Conclusion

In summary, Fort Lauderdale is a nice place to live and invest in Airbnb property. However, it’s not recommended for property investors with a limited budget as the cost of living and housing market are more expensive than in other cities in Florida. Still, it’s always best to speak to a real estate agent or expert to reassure you about any further questions you may have regarding your preferred property type. To make sure that a property can generate a nice cash flow, the right neighborhood should be studied and potential revenue should be calculated using an Airbnb calculator.