airbnb property investment Sedona

Sedona is a fascinating city with various outdoor activities for all ages! From hiking to mountain biking, this city offers an exquisite view of red rock formations in Arizona which is a must-see for all kinds of travelers.

If you are looking to invest in a property where you can maximize profitability in Sedona, then now is the right time to do so! To begin with, the major costs and potential revenue are one of the few factors that should be considered before deciding to purchase a property. Another excellent option is to do Airbnb rental arbitrage since it’s fairly popular and does not require you to purchase a property as a start.

Here’s an interesting fact: Sedona is also one of the best places to Airbnb in Arizona!

.

“The number of home sales and homes that came on the market for the Sedona real estate market saw increases over those seen in September. Despite decreases in home sales when compared to last year, inventory levels are still showing a Seller’s market.”

– Angelo Davis Realtor on Sedona’s Real Estate Housing

Aside from looking at a property’s fascinating architectural design, proximity to major tourist areas, and accessibility to the best go-to places, the primary step is to determine profitability. In this article, we’ll discuss the metrics in order to gauge the best property investment.

This includes the best website recommendations for property investment, defining property gross rental yield, cash-on-cash return, and annual revenue, along with some of the most ideal and profitable properties according to their location. Stoked to learn more? Continue reading!

Pros of buying an Airbnb Property in Sedona

Sedona is one of the most beautiful destinations in Arizona, as it’s nestled amid stunning red rock mountains and canyons, without a doubt it offers amazing landscapes to everyone who visits it! However, there’s more to learn as to why we recommend purchasing a property in this city. Here are some of the major reasons why you should consider buying a property for Airbnb in Sedona:

1. Vibrant tourist destination

Did you know that Sedona is the second city in Arizona that attracts the most tourists annually? Thanks to its picturesque and unique views, the variety of leisure activities that offers and its lively atmosphere, this city draw nearly 3M visitors per year! This certainly sounds great to investors who want to cater to tourist accommodations.

2. Close to major cities

Sedona has a great location in Arizona since it’s located near major cities such as Flagstaff, Jerome and Prescott. In addition to this, it’s just 2 hours drive from Phoenix (around 187km).

3. Low crime rate

Safety is certainly something investors should have in mind when looking for a place to invest it. The great news here is that, compared to other cities in Arizona, Sedona has a low crime rate the overall is 12 per 1,000 residents, making it fairly safe for both locals and visitors. According to Areavibes, the crime rate in Sedona is 56% more than the national average.

What to Expect When Purchasing a Property in Sedona?

Now that we know the pros of investing in Sedona, let’s take a quick look at some of the cons. It’s always better to look at the two sides of each coin in order to properly set your expectations!

1. High cost of living

Sadly, Sedona is quite expensive if we talk about the cost of living because it’s 35% higher than the national average. Aside from that, the housing market prices are also pretty high as it’s 98% higher than the national average (the median property price is $944K)

Best Neighborhoods for Airbnb in Sedona

Let’s take a closer look at the important Airbnb key metrics to discover which is the most profitable neighborhood in Sedona. Filtered for a 1-bedroom apartment, here is a brief overview of some of the most recommended and profitable neighborhoods:

airbnb property investment Sedona

1. Red Rocks Estates

- Annual Revenue: $63,912

- Occupancy Rate: 90%

- Average Daily Rate: $172

2. South West Sedona

- Annual Revenue: $57,500

- Occupancy Rate: 92%

- Average Daily Rate: $151

3. Uptown Sedona

- Annual Revenue: $65,026

- Occupancy Rate: 83%

- Average Daily Rate: $202

Is Property Investment Profitable in Sedona City Centre?

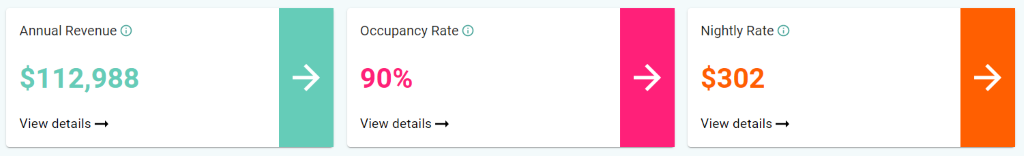

Using an Airbnb income calculator, it was discovered that a 2-bedroom apartment in Sedona City Centre can generate an annual revenue of $112,988 with a steady occupancy rate of 90% and a nightly rate of $302.

airbnb property investment Sedona

Property for Sale in Sedona, Arizona

Finding the best properties that have the potential to produce high yields and capital growth are certainly some of the preferences of major investors. It’s always best to ask for assistance from real estate agents to access exclusive and unique properties during the development stage.

At the same time, it’s even better when a property investor like you conducts research about predicted growths and market forecasts. Here are some of the houses for sale in Sedona (AZ) City Centre along with the calculated gross rental yield, cash-on-cash return, and annual revenue:

17550 S Munds Ranch Rd Spc 306, Munds Park Pinew, AZ 86017

1. Studio-type Property for Sale Sedona

- Near Arizona Veterans Hwy

- Asking Price: $118,000

| GROSS RENTAL YIELD | 27.71% |

| ANNUAL REVENUE | $32,701 |

| CASH ON CASH RETURN | 57.37% |

1630 E Coconino St #24, Cottonwood, AZ 86326

2. 1-Bedroom Type Property for Sale Sedona

- Near Old Town General Dentistry & Denture Lab

- Asking Price: $138,000

| GROSS RENTAL YIELD | 26.73% |

| ANNUAL REVENUE | $36,891 |

| CASH ON CASH RETURN | 54.43% |

7 Maroon Mountain Dr Unit D02, Sedona, AZ 86336

3. 2-Bedroom Type Property for Sale Sedona

- Near Maroon Mountain Dr

- Asking Price: $235,000

| GROSS RENTAL YIELD | 25.53% |

| ANNUAL REVENUE | $59,999 |

| CASH ON CASH RETURN | 50.83% |

345 S El Rancho Bonito Rd, Cornville, AZ 86325

4. 3-Bedroom Type Property for Sale Sedona

- 0.5 miles Oak Creek School

- Asking Price: $399,000

| GROSS RENTAL YIELD | 23.17% |

| ANNUAL REVENUE | $92,429 |

| CASH ON CASH RETURN | 43.73% |

740 E Trout Creek Rd, Munds Park, AZ 86017

5. 4-Bedroom Type Property for Sale Sedona

- Near Trout Creek Rd

- Asking Price: $525,000

| GROSS RENTAL YIELD | 25.39% |

| ANNUAL REVENUE | $133,272 |

| CASH ON CASH RETURN | 50.39% |

Conclusion

Investing in a property is certainly a huge step that one needs to not only think about – but also conduct market research for accuracy. Sedona can generate a nice cash flow for property investors, as long as the right neighborhood is targeted and potential revenue is calculated using an Airbnb rental arbitrage calculator. While there are many other cities to invest in Arizona aside from Sedona, it’s definitely worth the time & effort to speak with a short-term rental expert to make the wisest decision for property investment.