If you are looking to buy investment properties in Canada, knowing the Airbnb rules in your preferred city is the first step. It’s also important to consider other key factors like the occupancy rates in Canada as well as researching the high rental income areas in order to have successful investment & long-term profitability!

In this article, we featured Airbnb regulations in Hamilton along with short-term let policies, rental properties, things to consider in property investment, and more. Continue reading and learn more about the Airbnb rules in Hamilton.

Is Airbnb legal in Hamilton?

Don’t worry, Airbnb is legal in Hamilton! With this city’s unique art scene and incredible nature trails, Hamilton is an instant magnet to tourists from all over the world.

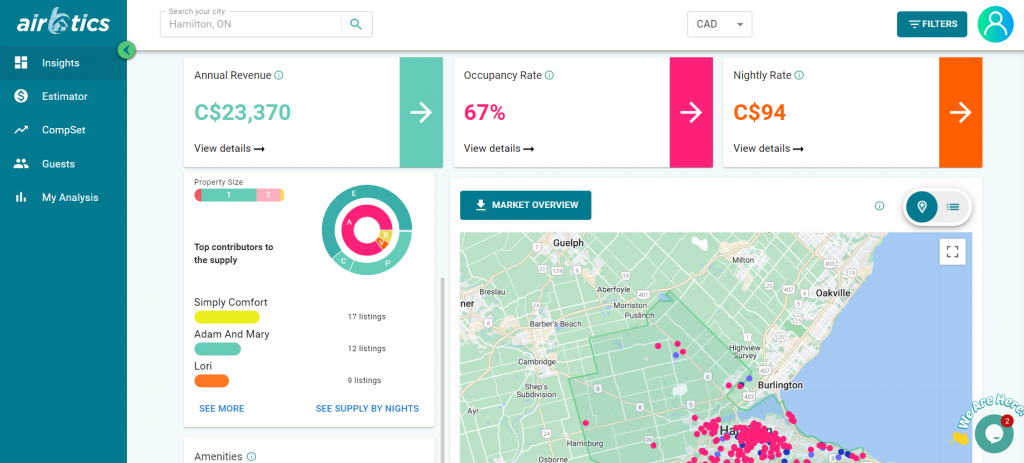

Here is a little proof! As of July 2022, there are 10,584 nights available in Hamilton from Airbnb alone. Simply Comfort manages 55 listings, while Adam And Mary and Lori operates 16 and 9 respectively.

How much can I make by running an Airbnb in Hamilton?

Currently, there are 620 Airbnb listings in Hamilton, with 63% of entire houses earning up to C$2,507 a month. The Average Occupancy Rate in Hamilton is 67% and the average daily rate is C$94. According to vacation holiday rental data source Airbtics, a 2-bedroom apartment in Hamilton can make up to C$31,799 each year. Check out our Airbnb Calculator to know how much profit you can make!

Short-term Rental Policy in Hamilton

- It is required for a property owner intending to rent out a space for less than 28 days to get a city licence.

- A licence is required for rental housing units and buildings or part of buildings with 4 or less self-contained units, detached homes or townhouses, if rented. The program would require property owners of rental housing to apply for a licence for each rented unit.

- A Licensing Compliance Officer will schedule an appointment with the property owner to gain entry to the building for a Property Standards inspection of each unit. Once all inspections are complete, the property is in compliance with municipal by-laws and relevant legislation and the application has been submitted in full a rental housing licence may be issued.

Rental Demand in Hamilton

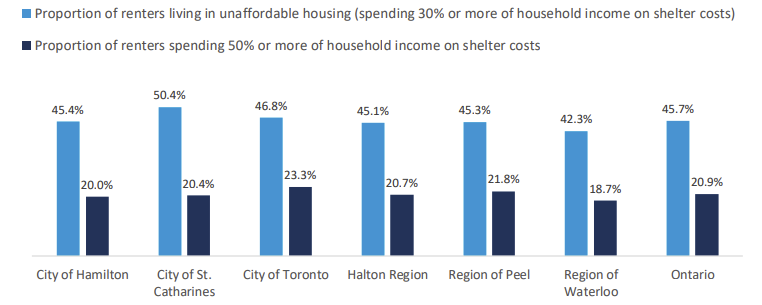

There are many hosts who are doing rental arbitrage in Canada as it does not require you to own a property. Based on a recent rental housing inventory in Hamilton, 46% of the renters are living in unaffordable housing. However, despite this fact, the rental demand in Hamilton is still increasing!

Source: Hamilton Rental Demand

Property Investment in Hamilton

If you are looking to start an Airbnb business in Canada, particularly in Hamilton, you have to consider which areas are the most profitable. Whether it is located in the city centre or in the countryside, knowing your estimated annual revenue and high-return investment opportunities is important. Using an accurate short-term rental calculator, it shouldn’t be a difficult task at all!

Rental Properties in Hamilton

Once you have decided to buy a property, you have to consider the average price, population, nearby landmarks or attractions, and rental yields to expect – among the rest. It could be a challenge to find rented properties in Hamilton, so here are some of the most recommended areas that you can look into & consider purchasing:

| Area | Average House Price | Average Rent Price (pcm) | Average Airbnb Revenue |

|---|---|---|---|

| Strathcona | C$706,684 | C$1,900 | C$3,019 |

| Crown Point West | C$699,000 | C$1,795 | C$2,665 |

| Durand | C$744,187 | C$1,680 | C$2,533 |

Conclusion

In my personal opinion, the biggest advantage of running a short-term rental is high return! I’ve talked to hundreds of Airbnb hosts over the past years and frequently met hosts making 15-30% gross rental yields, and 10-20% net. It’s also fun to do!