If you are looking to buy investment properties in the UK, knowing the Airbnb rules in your preferred city is the first step! In this article, we featured Airbnb regulations in Leicester along with short-term let policies, buy to let properties, things to consider in property investment, and more. Continue reading and learn more about the Airbnb rules in Leicester!

Is Airbnb legal in Leicester?

Don’t worry, Airbnb is legal in Leicester! This multicultural city is located in the heart of England where one can admire the stunning buildings with Victorian architecture. Leicester is a lively city with a variety of cafes, bars, museums and art galleries.

Here is a little proof! As of May 2022, there are 3,390 nights available in Leicester from Airbnb alone. Miroslav manages 23 listings, Tarun and Mo operates 17 and 15 respectively.

How much can I make by running an Airbnb in Leicester?

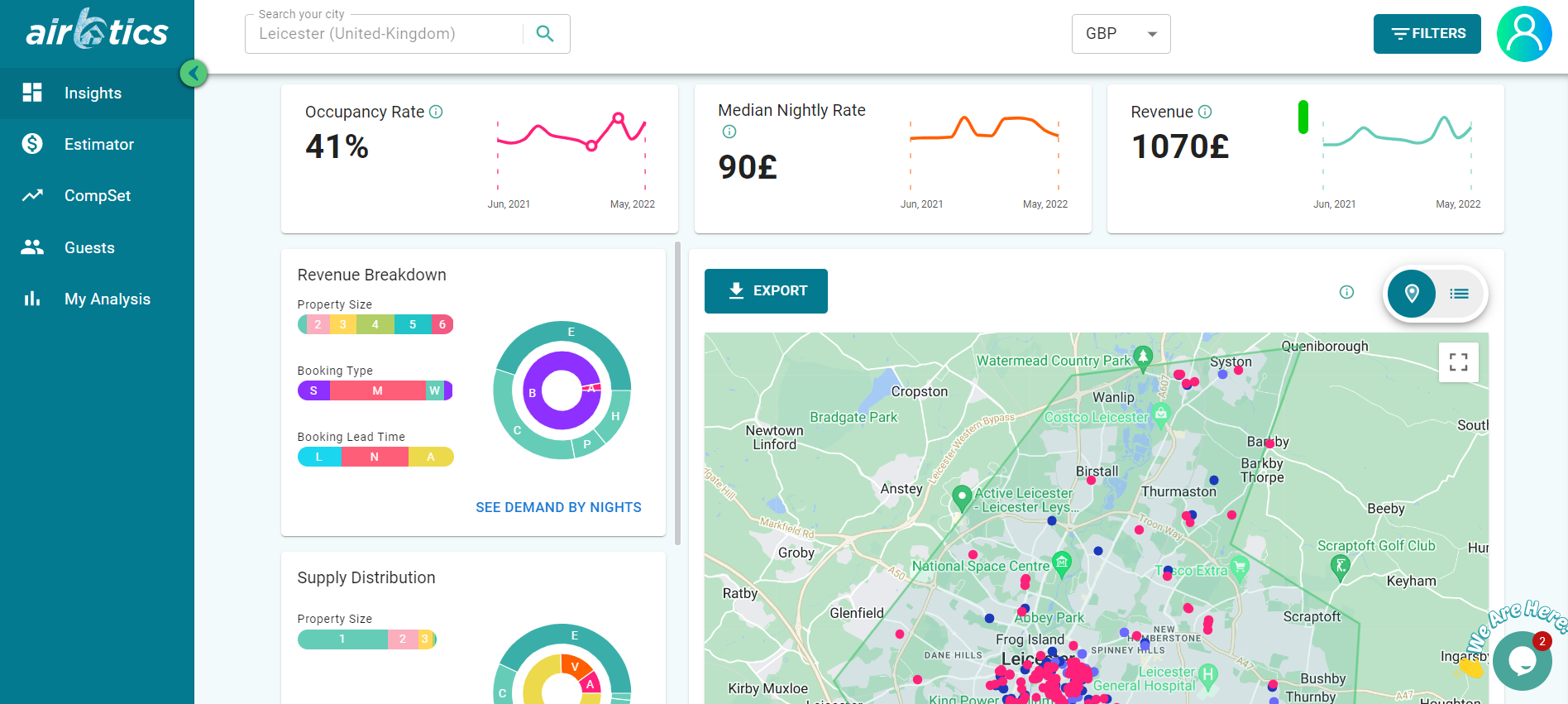

Currently, there are 200 Airbnb listings in Leicester, with 46% of entire houses earning up to £1,622 a month. Average Occupancy Rates in Leicester is 41% and average daily rate is £90. According to short-term rental market data source Airbtics, a 2-bedroom apartment in Leicester can make up to £20,795 each year. Check out our Airbnb Profit Calculator

Short-term rental policy in Leicester

- You must obtain a permit from Leicester City Council before sub-letting part of your property to another person

- It is required to pay a Council tax in Leicester

- Any property with five or more people who form unrelated households, and share amenities such as a kitchen or bathroom, must have an HMO licence

Investment Property in Leicester

Before investing in a property in Leicester, you have to consider the major determinators for success. This includes average price, population, nearby landmarks or attractions, and rental yields to expect – among the rest. Here are some of the most recommended areas in Leicester that you can look into & consider purchasing:

| Citry Centre | Population: 8,500 | Average House Price: £180,300 | LE1 postcode areas investors could expect a healthy 5% yield |

| The Western Suburbs | Population: 98,000 | Average House Price: £200,000-£290,000 | Investors might expect yields here of 4% based on LE3, but less in LE19 with 3% |

| North and North East Leicester | Population: 125,000 | Average House Price: £200,000-£260,000 | Property investors could expect a yield of 3% based on LE5 and 4% based on LE4. |

Source: Buy to Let Leicester

Best Buy to Let Areas in Leicester

If you are looking to start an Airbnb business in the UK, this is your go signal to do so! Since Leicester is UK’s first European sustainable city, it has the most affordable housing available. Depending on your preferred type of property, here is a table of the best area with their average property & rent prices:

| Area | Average Property Price | Average Rent Price (pcm) | Average Airbnb Revenue |

|---|---|---|---|

| Braunstone | £225,647 | £791 | £707 |

| Syston | £240,202 | £574 | £1,618 |

| Glenfield | £288,718 | £776 | £899 |

| Rothley | £328,924 | £760 | £1,132 |

| Oadby | £348,870 | £834 | £746 |

Source: Short-term rental calculator

Properties for Rent in Leicester

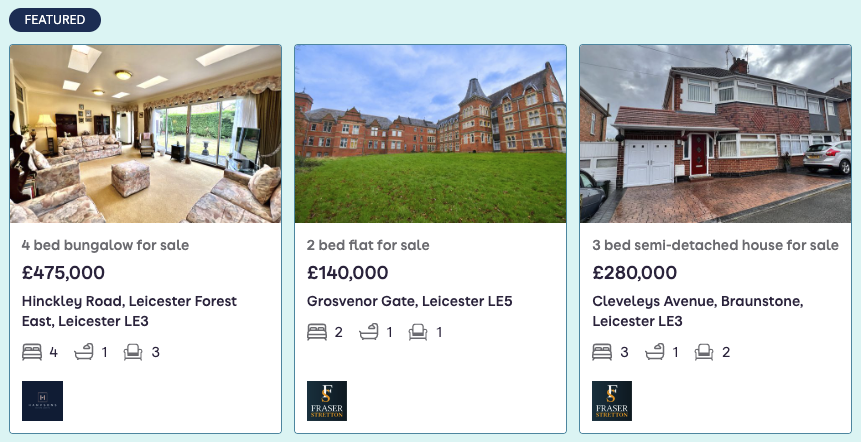

Buying a property in Leicester with an impressive rental yield is an excellent way to have a passive income. Leicester is best known for its modern economy with a strong market for student accommodation. By looking at the following property investment websites such as Right Move and Zoola, you can get a grasp of the various prices in Leicester.

Conclusion

In my personal opinion, the biggest advantage of running a short-term rental is high return! I’ve talked to hundreds of Airbnb hosts over the past years and frequently met hosts making 15 – 30% gross rental yields, and 10-20% net. It’s also fun to do!