With the new Airbnb rules in New Orleans, Louisiana, this article explains the regulations & profitability of short-term rentals in the area.

- Last updated on

- August 7, 2023

Louisiana’s beautiful city of New Orleans is not only known for its famous creole & unique dialects, but also for profitability on Airbnb! In this article, we featured Airbnb regulations in New Orleans, along with its profitability based on Airbnb’s key metrics. Continue reading and learn more about the Airbnb laws in New Orleans.

Is Airbnb legal in New Orleans?

To cut the story short, yes – Airbnb is legal in New Orleans! As of August 2022, there are 42,294 nights available in New Orleans from Airbnb alone. Sextant Stays manages 244 listings, while Sonder and Sam operate 66 and 64 respectively.

Airbnb Profitability in New Orleans

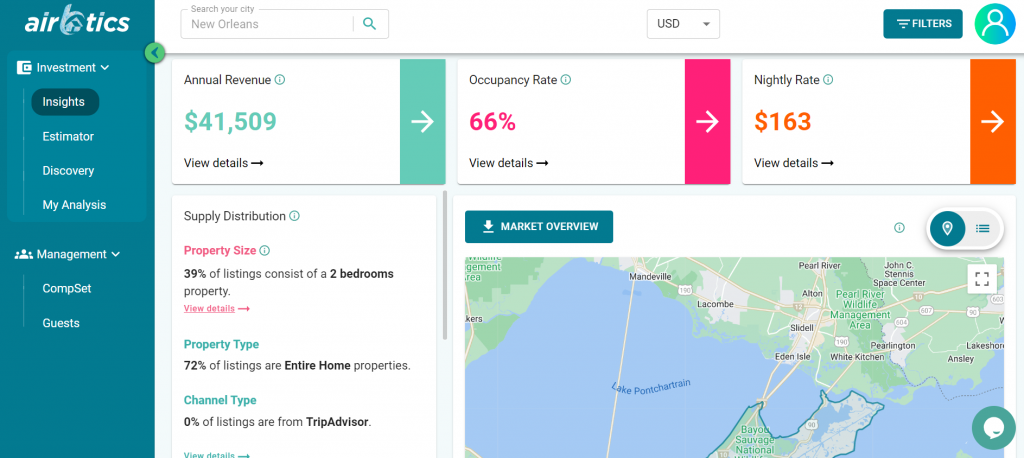

Currently, there are 4,057 Airbnb listings in New Orleans, with 83% of entire houses earning up to $3,769 a month. The Average Occupancy Rate in New Orleans is 66% and the average daily rate is $163. According to short-term rental data source Airbtics, a 2-bedroom apartment in New Orleans can make up to $77,033 annually. Check out our Short-term Rental Estimator to know how much profit you can make with Airbnb!

Short-term Rental Laws in New Orleans

- According to the New Orleans government website, it is necessary to use new application forms and obtain both an Operator permit and Owner permit(s) for the unit(s) you will be renting out if your STR permit was issued before December 1, 2019, and has expired.

- Short-term rentals in New Orleans are allowed to operate depending on zoning areas. STR is prohibited in the Garden District, Riverfront Overlay, Bywater, and Marigny sub-districts.

- Hosts are required to obtain an owner and operator short-term rental license and display their license numbers on their listing page if they want to offer short-term stays (less than 30 consecutive nights at a time).

- If your listing is in a residential zone, you’re the property owner, and you have a valid homestead exemption, you may be eligible for an RSTR license. There are 3 different types of RSTR permits: RSTR-Partial, RSTR-Small, RSTR-Large. The type you’re eligible for depends on how many units and how many rooms you want to rent out.

License types in New Orleans

Based on Airbnb in New Orleans, here are the types of short-term rental (STR) owner licenses divided into two categories: Residential STR (RSTR) and Commercial STR (CSTR).

1. Residential Partial Unit (RSTR- Partial)

- RSTR-Partial licenses allow property owners to rent up to 5 guest bedrooms to up 10 guests in 1 dwelling unit such as a townhouse, single-family home, apartment, or condo.

- Hosts must have a valid homestead exemption in their name and live on the property. Only property owners can get this license. Renters can’t get this license. The fee for this license type is $250. A host is limited to 1 RSTR-Partial license.

2. Residential Small (RSTR – Small)

- RSTR-Small licenses allow property owners to rent up to 5 guest bedrooms to up 10 guests in 1 dwelling with no more than 4 dwelling units (i.e. an apartment building with no more than 4 apartments or a single-family home with a separate mother-in law unit).

- Hosts must have a valid homestead exemption in their name and live on the property. Only property owners can get this license. Renters can’t get this license. The fee for this license type is $500. A host is limited to 1 RSTR-Small license but can have 1 RSTR-Partial license in the same building.

3. Residential Large (RSTR-Large)

- RSTR-Large licenses allow property owners to rent up to 6 guest bedrooms to up 12 guests in 3 dwelling units in a dwelling with more than 4 dwelling units.

- Hosts must have a valid homestead exemption in their name and live on the property. Only property owners can get this license. Renters can’t get this license. The fee for this license type is $500. A host can get up to 3 RSTR-Large licenses.

4. Commercial (CSTR)

- Property owners or renters in non-residential zones can apply for a CSTR license.

- CSTR licenses allow hosts to rent up to 5 guest bedrooms to up to 10 guests in any building where fewer than 25% of the total dwelling units are currently licensed for STRs. The fee for this license type is $1000. There is no limit to how many CSTR licenses a host can get.

Conclusion

In my personal opinion, the biggest advantage of running a short-term rental is high return! I’ve talked to hundreds of Airbnb hosts over the past years and frequently met hosts making 15 – 30% gross rental yields, and 10-20% net. It’s also fun to do!

Short-Term Rental Data

Short-Term Rental Data

-

Quick Links

Annual Airbnb Revenue in Lagrange georgia, USA

LaGrange, Georgia| Airbnb Market Data & Overview | USA LaGrange, Georgia Airbnb Market Data & Overview USA Is it profitable to do Airbnb in LaGrange, …

Annual Airbnb Revenue in Huntingdonshire, UK

Huntingdonshire| Airbnb Market Data & Overview | UK Huntingdonshire Airbnb Market Data & Overview UK Is it profitable to do Airbnb in Huntingdonshire, UK? What …

Annual Airbnb Revenue in Cliffside park new jersey, USA

Cliffside Park, New Jersey| Airbnb Market Data & Overview | USA Cliffside Park, New Jersey Airbnb Market Data & Overview USA Is it profitable to …

Annual Airbnb Revenue in Big bear city california, USA

Big Bear City, California| Airbnb Market Data & Overview | USA Big Bear City, California Airbnb Market Data & Overview USA Is it profitable to …

Annual Airbnb Revenue in Carbondale colorado, USA

Carbondale, Colorado| Airbnb Market Data & Overview | USA Carbondale, Colorado Airbnb Market Data & Overview USA Is it profitable to do Airbnb in Carbondale, …

Annual Airbnb Revenue in Aberdeen washington, USA

Aberdeen, Washington| Airbnb Market Data & Overview | USA Aberdeen, Washington Airbnb Market Data & Overview USA Is it profitable to do Airbnb in Aberdeen, …