Ireland is certainly a popular tourist destination across the globe with competitive attractions & diverse culture. For property investors and hosts to successfully start an Airbnb business in Ireland, it’s important to take the first step by learning about its legality, step-by-step process, and most of all – profitability!

In this article, we featured Airbnb regulations in Ireland, along with the commitments of the Irish government to enforce short-term rental rules. Continue reading and learn more about the Airbnb laws in Ireland.

Is Airbnb legal in Ireland?

To cut the story short, yes – Airbnb is legal in Ireland! Check out the following general information before starting an Airbnb anywhere in Ireland:

- UPCOMING REGULATIONS:

Airbnb recently released an article about a plan to enforce rules & protection for housing in Ireland. In line with this, here are two of the new short-term rental rules that will take effect soon (the date of implementation was not indicated):

1. A single Host will be required to register for Ireland. This would establish a clear system for Hosts to follow and will give authorities the information they need to enforce the rules and take action against property speculators that are damaging communities.

2. Only the hosts with a registration number are able to publish listings on the platform.

How much can I make by running an Airbnb in Dublin, Ireland?

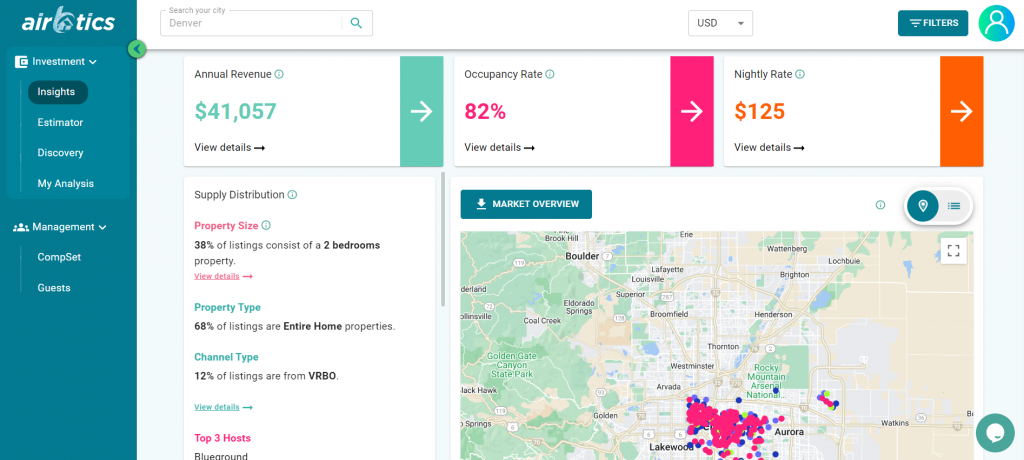

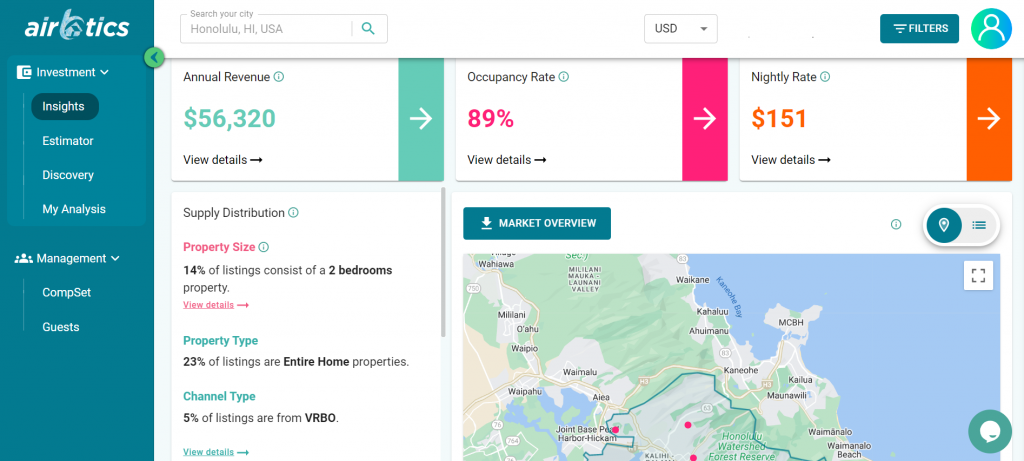

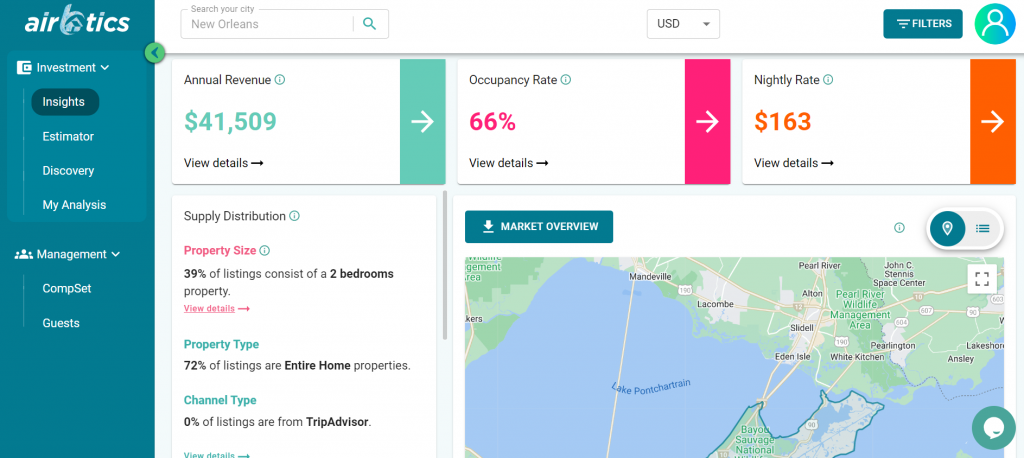

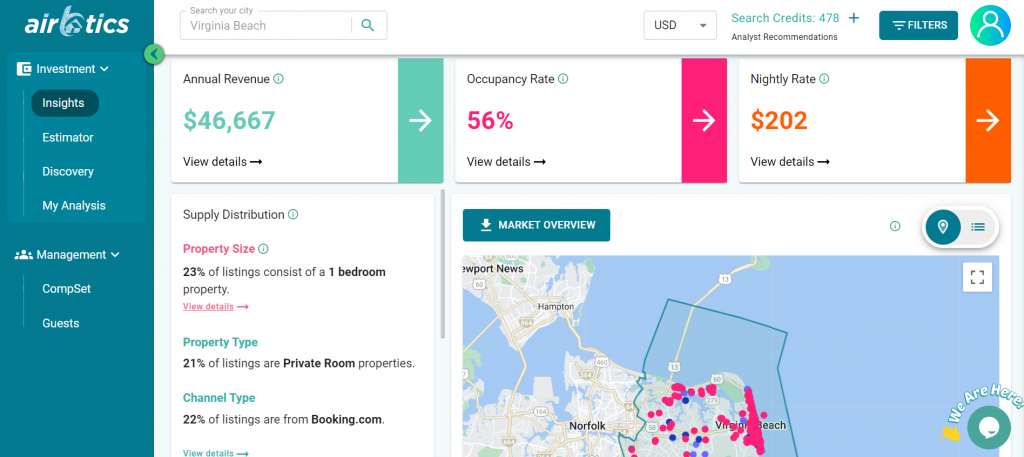

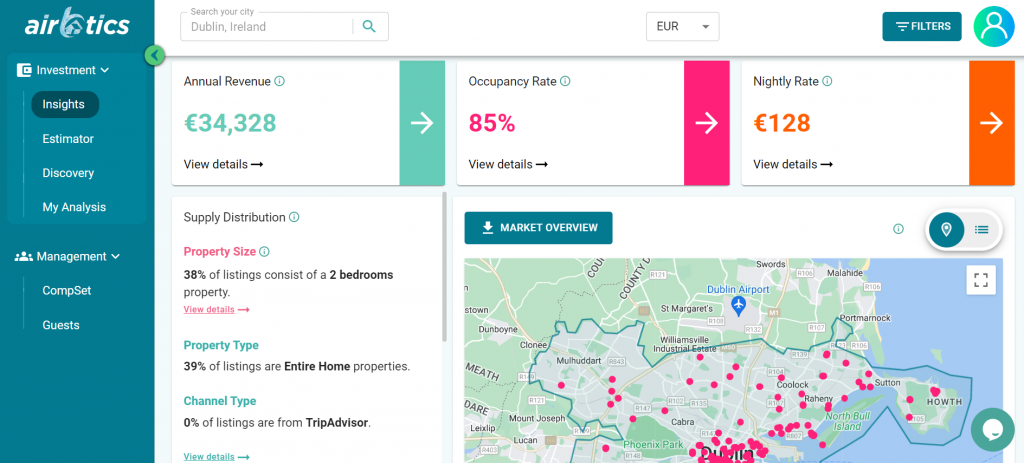

Currently, there are 1,914 Airbnb listings in Dublin, with 50% of entire houses earning up to €4,621 a month. The Average Occupancy Rate in Dublin is 85% and the average daily rate is €128. According to vacation rental market data source Airbtics, a 2-bedroom apartment in Dublin can make up to €76,778 each year. Discover how much you can make with Airbnb by checking out our Short-term Rental Estimator!

Short-term Rental Policy in Ireland

Here are some of the regulations that depend on your property’s location in an RPZ (Rent Pressure Zone):

- “Short-term letting” is defined as the letting of a house or apartment, or part of a house or apartment, for any period not exceeding 14 days.

- If you share a spare room or rooms in your own home (your “Principal Primary Residence” or “PPR”), you can do so all year round but you must register with your local authority annually.

- If you share your entire PPR while you are away, you can do so for up to 90 days of the year, but you must notify your local authority.

- If you share your entire PPR for more than 90 days of the year, you must apply for a change of use planning permission from your local authority.

- If you own a property that is not your PPR, and you use it for short-term letting, you must apply for a change of use planning permission from your local authority.

- If you are not the legal owner of the property, you will need to attach the owner’s consent to use the property for short-term letting.

Conclusion

In my personal opinion, the biggest advantage of running a short-term rental is high return! I’ve talked to hundreds of Airbnb hosts over the past years and frequently met hosts making 15 – 30% gross rental yields, and 10-20% net. It’s also fun to do!