If you are looking to buy investment properties in the UK, knowing the Airbnb rules in your preferred city is the first step! In this article, we featured Airbnb regulations in Southampton along with short-term let policies, buy to let properties, things to consider in property investment, and more. Continue reading and learn more about the Airbnb rules in Southampton!

Is Airbnb legal in Southampton?

Don’t worry, Airbnb is legal in Southampton! This modern and lively city possesses one of the largest & most frequented seaports in England. Southampton offers endless places where tourists can shop, eat and entertain themselves as well as many natural spots to relax after exploring the city’s intriguing history!

Here is a little proof! As of May 2022, there are 6,282 nights available in Southampton from Airbnb alone. Gaia manages 32 listings, Town or Country and Atanas operate 20 and 15 respectively.

How much can I make by running an Airbnb in Southampton?

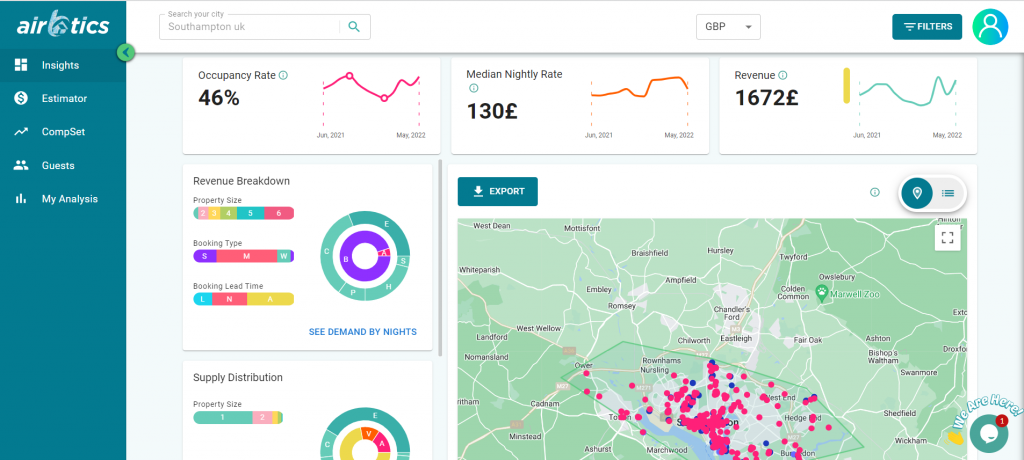

Currently, there are 326 Airbnb listings in Southampton, with 42% of entire houses earning up to £2,501 a month. The Average Occupancy Rate in Southampton is 46% and the average daily rate is £130. According to vacation rental market data source Airbtics, a 2-bedroom apartment in Southampton can make up to £32,552 each year. Check out our Short-Term Rental Calculator!

Short-term rental policy in Southampton

- If you are a landlord renting out a property the responsibility for paying the Council Tax bill depends on what sort of letting arrangement you have. Usually, the tenants pay the Council Tax but, in some cases, the owner or landlord will pay the Council Tax bill even though there are tenants living there.

- The property is let on a multi-tenancy basis rather than a single tenancy.

- The rent agreed was in respect of a room (or part) of the property only.

- Tenants sharing a property don’t have a tenancy for the same period.

- The tenancy agreement states an individual rent each rather than a collective rent (where there is more than one occupant).

Southampton Investment

Before investing in a property in Southampton, you have to consider the major determinators for success. This includes the average price, population, nearby landmarks or attractions, and rental yields to expect – among the rest. Here are some of the most recommended areas in Southampton that you can look into & consider purchasing:

| Area | Population | Average House Price | Average Rent Price (pcm) | Average Airbnb Revenue | Yields |

|---|---|---|---|---|---|

| City Centre and Ocean Village | 8,000 | £292,410 | £915 | £2,630 | An apartment bought at a good price might offer a 6% yield. |

| Northam | 18,800 | £201,886 | £615 | £1,131 | Investors could expect around a 6% yield. |

| Shirley | 14,425 | £217,460 | £650 | £1,402 | Shirley property offers a steady yield of around 4%. |

Buy to Let Property Southampton

Having a buy-to-let property in Southampton is an ideal investment because it is one of the most important maritime cities in the country. This city contributes around £1 billion to the economy because of the numerous employment opportunities associated with Europe’s largest cruise ship terminal.

If you are looking to start an Airbnb business in the UK, particularly in Southampton, you have to consider which areas are the most profitable. Whether it is located in the city centre or in the port, knowing your estimated annual revenue and high-return investment opportunities is important. Using an accurate Airbnb calculator, it shouldn’t be a difficult task at all!

Conclusion

In my personal opinion, the biggest advantage of running a short-term rental is high return! I’ve talked to hundreds of Airbnb hosts over the past years and frequently met hosts making 15 – 30% gross rental yields, and 10-20% net. It’s also fun to do!