If you are looking to buy investment properties in Canada, knowing the Airbnb rules in your preferred city is the first step. It’s also important to consider the occupancy rates in Canada in order to have successful investment & long-term profitability! In this article, we featured Airbnb regulations in Whistler along with short-term let policies, rental properties, things to consider in property investment, and more. Continue reading and learn more about the Airbnb rules in Whistler.

Is Airbnb legal in Whistler?

Don’t worry, Airbnb is legal in Whistler! This city is home to skiing and snowboarding in the wintertime & mountain biking during the summer – which is perfect for the majority of vacationers.

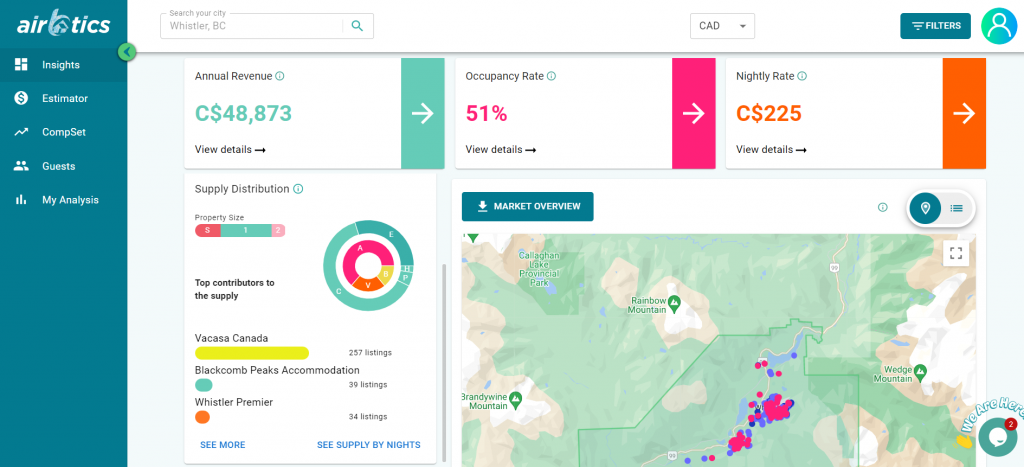

Here is a little proof! As of July 2022, there are 20,727 nights available in Whistler from Airbnb alone. Vacasa Canada manages 315 listings, while Whistler Platinum and Blackcomb Peaks operate 96 and 92 respectively.

How much can I make by running an Airbnb in Whistler?

Currently, there are 1,223 Airbnb listings in Whistler, with 40% of entire houses earning up to C$3,245 a month. The Average Occupancy Rate in Whistler is 51% and the average daily rate is C$225. According to vacation rental properties market data source Airbtics, a 2-bedroom apartment in Whistler can make up to C$84,392 each year. Want to discover how much can you make on Airbnb? Then check out our Airbnb Calculator!

Short-term Rental Policy in Whistler

- It is required to have business licences for all tourist accommodation activity, including the marketing of properties/units. If your unit is rented solely through a property management company, you are covered by their business licence.

- To obtain a business licence and market a property as tourist accommodation, the property’s zoning must list tourist accommodation or temporary accommodation as a permitted use. Properties with residential zoning may not be marketed as available to tourists, for any length of time.

- It is also necessary to give consideration to registered covenants that may affect a property. Development, rental pool and other covenants may place restrictions and obligations on property use.

- In Whistler, “residential” zoning means a fixed place of living, to which a person intends to return when absent. Therefore, regardless of the length of stay, tourist accommodation is not permitted in any residential-zoned area. To advertise and rent your property to tourists, your property’s zoning must state that tourist accommodation or temporary accommodation is a permitted use.

- The new bylaw establishes new contemporary definitions, operational rules and inspection requirements which must be met before opening.

- Under the new bylaw, these licences remain the property of the city and are non-transferrable. In addition, any operator who receives three violation notices will have their licence suspended. Anyone caught operating without a licence would be subject to a chargeable offence.

- The city requires a $65 fee per year for a tourist-home licence. A new annual fee of $500 will be required for a new vacation rental unit or bed and breakfast licence (or change of ownership), and an annual fee of $250 for the renewal of any existing licence.

Rental Demand in Whistler

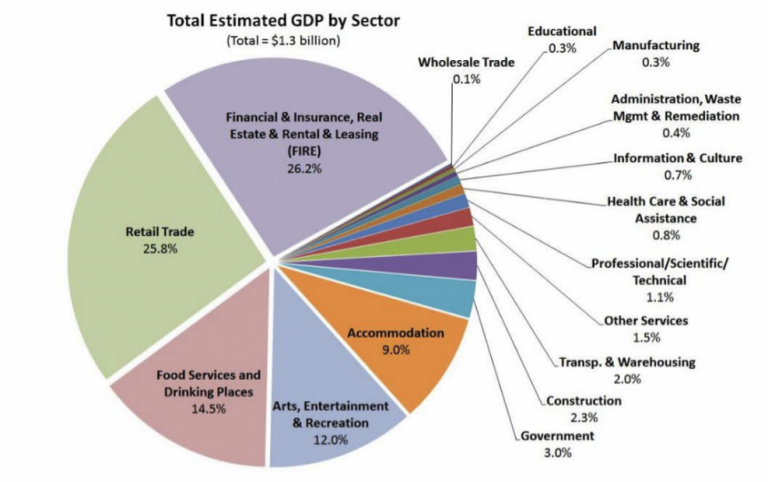

There are many hosts who are doing rental arbitrage in Canada as it does not require you to own a property. Based on the rental demand data in Whistler, rental and leasing have contributed to the largest portion of the area’s GDP at 26.2%.

Source: Whistler BC Economic Data

Property Investment in Whistler

If you are looking to start an Airbnb business in Canada, particularly in Whistler, you have to consider which areas are the most profitable. Whether it is located in the city centre or in the countryside, knowing your estimated annual revenue and high-return investment opportunities is important. Using an accurate short-term rental calculator, it shouldn’t be a difficult task at all!

Rental Properties in Whistler

Once you have decided to buy a property, you have to consider the average price, population, nearby landmarks or attractions, and rental yields to expect – among the rest. It could be a challenge to find rented properties in Whistler, so here are some of the most recommended areas that you can look into & consider purchasing:

| Area | Average House Price | Average Rent Price (pcm) | Average Airbnb Revenue |

|---|---|---|---|

| Whistler Creek | C$999,050 | C$2,200 | C$4,164 |

| Blackcomb | C$1,928,667 | C$1,516 | C$5,136 |

| Nesters | C$685,000 | C$2,040 | C$5,537 |

Conclusion

In my personal opinion, the biggest advantage of running a short-term rental is high return! I’ve talked to hundreds of Airbnb hosts over the past years and frequently met hosts making 15-30% gross rental yields, and 10-20% net. It’s also fun to do!