Best Suburbs to Invest in Wollongong: Profitable Areas for Short-Term Rentals: Are you an investor looking to invest in real estate? Here, we share some of the best suburbs you’ll want to consider to invest in Wollongong!

Home > Resources > Airbnb Investment >

Are you an investor looking to invest in real estate? Here, we share some of the best suburbs you’ll want to consider to invest in Wollongong!

- Last updated January 10, 2024

Key Takeaways

- Thanks to Wollongong’s robust economic stability, reasonable cost of living and appealing rental returns many property investors can enjoy a nice income stream from their Airbnb properties.

- Delve into the top lucrative suburban areas for real estate investments in Wollongong, including important Airbnb statistics for each location.

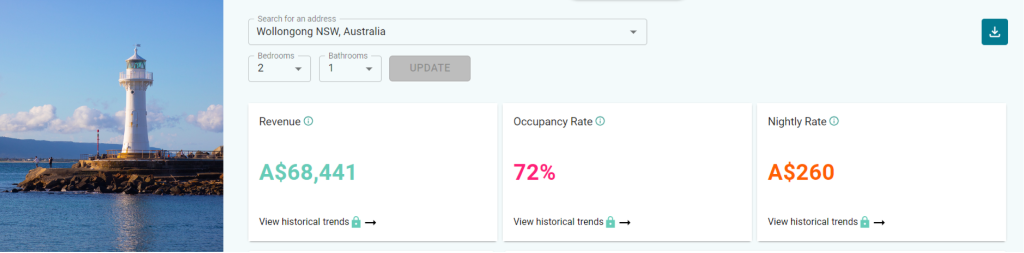

- Airbnb hosts can potentially earn an annual revenue of A$68,441 with an occupancy rate of 72% for a 2-bedroom property in Wollongong.

Wollongong’s Coastal Charm: Your Guide to the Best Suburbs for Property Investments

The coastal city of Wollongong, located in New South Wales, is renowned for its white sandy beaches, scenic landscapes, and vibrant cultural scene. Nestled between the Illawarra escarpment and the Pacific Ocean, the area provides visitors and locals alike with a unique blend of natural beauty and urban amenities!

This welcoming city is quite a popular tourist destination in NSW, not only because it’s located near Sydney but also because of its stunning beaches and lively social scene. Wollongong little by little became an ideal for those looking to escape the urban hustle and bustle! And, as of late, the region has also been drawing the attention of property investors with its attractive investment prospects since it’s one of the top cities to invest in STRs in Australia.

Curious about which suburbs in Wollongong present prime investment opportunities for rental properties? In this article, we unveil the best suburbs to invest in Airbnb in Wollongong and what to anticipate when considering real estate investments in this region. Keep reading to discover more!

Top Reasons to Invest in Wollongong Real Estate

Tasmanian cities are an interesting market to invest in from the perspective of property investors if we consider the many advantages it offers. Check out some of the major reasons why rental properties in Tasmania can be a profitable idea:

Prosperous rental market

Wollongong’s rental market is currently characterized by prosperity and affordability. Due to the region’s attractive coastline location and urban amenities, there continues to be a high demand for rental dwellings. Additionally, Wollongong is relatively cheaper than some of its neighboring cities, so it became a desirable location for both residents and investors. However, it may be quite difficult for investors with a limited budget to find affordable properties near tourist zones.

If you’re looking to cater to vacation accommodations, then you can enjoy this dazzling coastal charm while teaming up with some of the best companies that manage Airbnb Rentals in Australia!

Solid economy with a sustainable development

In the Illawarra region, Wollongong is a major economic hub with a diversified economy with a mix of traditional industries and emerging sectors. The area encompasses a variety of industries like healthcare, tech, education and research, manufacturing, tourism and retail, which all serve as major driving forces that contribute to the region’s economic prosperity.

On top of that, the greater Wollongong area has grown steadily and sustainably over the past few years.

Enticing living conditions

Wollongong offers a high quality of life with a combination of a welcoming community, low pollution and good amenities. The region is known for its friendly environment, welcoming people from diverse cultures, and creating an inclusive and vibrant environment.

Residents and visitors alike can easily explore the region facilitating mobility within the CBD and other areas. It provides a modern and efficient infrastructure, including roads, efficient public transport and rail links.

Additionally, Wollongong is also home to prestigious educational institutions like the University of Wollongong, which is known for its academic excellence and research programs that attract local and international students. This also helps generate a steady demand for student housing and rental properties.

Enjoy this coastal city’s stunning scenery

If you enjoy being surrounded by nature while also getting to experience a vibrant cultural scene, then you will surely love Wollongong!

Nestled between the Illawarra escarpment and the Pacific Ocean, Wollongong offers a unique blend of natural beauty and urban amenities. With its stunning coastal location, the area is blessed with numerous pristine beaches, including Wollongong City Beach, and Port Kembla Beach, making it a popular destination for water activities like swimming and surfing. On the other hand, the Illawarra Escarpment State Conservation Area and the Royal National Park provide ample opportunities for hiking, bushwalking, and birdwatching.

Aside from its natural attractions, Wollong features a diverse range of cultural and recreational activities. The area is known for its lively arts and music scene, with several theaters, galleries, and live music venues showcasing local talent.

Is Airbnb Profitable in Wollongong?

Are you concerned if Wollongong Airbnb investments are worth spending your time and money on? Let us confirm that they are absolutely worthwhile! In fact, Wollongong is ranked among the finest cities in NSW to invest in Airbnb!

Let’s take a quick look at Wollongong’s Airbnb potential – According to Airbtics’ free Airbnb calculator data, an Airbnb host can obtain annual revenue of A$68,441 with a steady occupancy rate of 72% for operating a 2-bedroom property in Wollongong.

If you’re looking to invest in rental properties, then Wollongong certainly is a great place to target, but there are a few things to consider: the number of bedrooms of the property and where you’re located can affect how much income you can obtain.

Rental Properties in Wollongong: Prime Suburbs for Airbnb Investments

Prior to making any hasty decisions, it’s essential to conduct a thorough analysis of Airbnb data to identify the most suitable locations to set up a short-term rental to ensure its success. This is due to the fact that the return on vacation rentals will vary depending on the location, as they’ll generate varying levels of revenue.

Go ahead and check out the best suburbs to invest in Wollongong and are highly recommended for managing an Airbnbl property:

|

|||||

|---|---|---|---|---|---|

| Location | Airbnb Listings | Best Number of Bedrooms | Median Property Price | Airbnb Annual Revenue | GRY |

| Woonona | 36 | 4 bedrooms | A$1,485,000 (4 BR) | A$143,556 | 9.67% |

| Port Kembla | 15 | 3 bedrooms | A$809,000 (3 BR) | A$135,678 | 16.77% |

| Austinmer | 28 | 2 bedrooms | A$970,000 (2 BR) | A$132,311 | 13.64% |

| Thirroul | 43 | 3 bedrooms | A$1,046,500 (3 BR) | A$105,042 | 13.64% |

| Warilla | 22 | 2 bedrooms | A$609,000 (2 BR) | A$57,691 | 9.47% |

| Central Wollongong | 125 | 2 bedrooms | A$670,000 (2 BR) | A$57,117 | 8.52% |

| North Wollongong | 16 | 1 bedroom | A$430,000 (1 BR) | A$54,090 | 12.58% |

| Shellharbour | 25 | 1 bedroom | A$559,000 (1 BR) | A$53,154 | 9.51% |

Location

Airbnb Dataset

- Total Airbnb Listings: 36

- Best Number of Bedrooms: 4 bedrooms

- Median Property Price (4 bedrooms): A$1,485,000

- Airbnb Annual Revenue: A$143,556

- Gross Rental Yield: 9.67%

- Total Airbnb Listings: 15

- Best Number of Bedrooms: 3 bedrooms

- Median Property Price (3 bedrooms): A$809,000

- Airbnb Annual Revenue: A$135,678

- Gross Rental Yield: 16.77%

- Total Airbnb Listings: 28

- Best Number of Bedrooms: 2 bedrooms

- Median Property Price (2 bedrooms): A$970,000

- Airbnb Annual Revenue: A$132,311

- Gross Rental Yield: 13.64%

- Total Airbnb Listings: 43

- Best Number of Bedrooms: 3 bedrooms

- Median Property Price (3 bedrooms): A$1,046,500

- Airbnb Annual Revenue: A$105,042

- Gross Rental Yield: 10.04%

- Total Airbnb Listings: 22

- Best Number of Bedrooms: 2 bedrooms

- Median Property Price (2 bedrooms): A$609,000

- Airbnb Annual Revenue: A$57,691

- Gross Rental Yield: 9.47%

- Total Airbnb Listings: 125

- Best Number of Bedrooms: 2 bedrooms

- Median Property Price (2 bedrooms): A$670,000

- Airbnb Annual Revenue: A$57,117

- Gross Rental Yield: 8.52%

- Total Airbnb Listings: 16

- Best Number of Bedrooms: 1 bedroom

- Median Property Price (1 bedroom): A$430,000

- Airbnb Annual Revenue: A$54,090

- Gross Rental Yield: 12.58%

- Total Airbnb Listings: 25

- Best Number of Bedrooms: 1 bedroom

- Median Property Price (1 bedroom): A$559,000

- Airbnb Annual Revenue: A$53,154

- Gross Rental Yield: 9.51%

Source: Airbtics Dashboard

How to Find High-Yield Rental Markets?

Identifying promising rental markets can be a time-consuming endeavor. That’s why it’s wise to leverage advanced resources available to property investors to hasten this process.

Additionally, you should consider delving into real estate forums and conducting thorough research on search engines to discover which locations are piquing significant interest among investors. This approach will allow you to sort your list and gain a clear understanding of the cities that are worthy of your focus. Plus, we encourage investors like you to utilize analytical tools to identify lucrative Airbnb markets, especially those that can provide dynamic data.

Airbtics Dashboard allows users to explore a city and gain valuable insights to simplify their investment research. This dashboard provides users with precise data sets that showcase metrics such as average revenue, occupancy, nightly rates, seasonality, and more.

But don’t take just our word for it, go ahead and take a look at Simon, a satisfied Airbtics customer, who ventured into a new Airbnb market, ultimately achieving higher profitability than his previous one!

Sometimes, your desired location might not show up in the search results, but there’s no need to fret! You can easily create your own custom market.

Now that you have a clearer perspective of your target market, feel free to experiment with the filters to identify the results that fit your needs. You can use filters to find out what type of property offers the most appealing profit in your chosen area.

One of the greatest advantages of dynamic data is the fact that by moving and zooming in and out of your map, the data will also change accordingly.

You can repeat this process as often as you need to figure out which type of property makes a sound investment choice in your target area. By comparing data across various property types, you can pinpoint the option that aligns best with your preferences and goals.

Wollongong’s Airbnb Market: Smart Suburb Selection and Data-Driven Insights for Savvy Investors

Wollongong’s real estate landscape offers a plethora of investment opportunities for real estate investors, thanks to its growing rental market and affordable cost of living. But, while there are many lucrative areas that can yield high rental returns and annual income, we strongly recommend that you thoroughly explore all available options. This will help you avoid missing out on better opportunities.

To kickstart your rental venture in Wollongong, pinpointing the best suburbs to invest in is a crucial initial step. And now it’s time to take your research to the next level by using cutting-edge analytics tools such as Airbtics. These tools will help you make smart, data-informed investment decisions that will allow you to maximize your return on investment.

Deeper STR Insights. Broader Investment Opportunities.

Want to go deeper, broader, and faster? Supercharge your Airbnb Investment by accessing the most in-depth Airbnb & real estate insights with our exclusive STR report.

- Vital vacation rental data from 40 Markets – Airbnb Occupancy Rate, ADR, Revenue, and Listings! Access 2-year data from June 2021 to June 2023.

- Uncover 5-year real estate investability metrics for 40 markets including population, property prices, income levels, Google travel interest, crime, and unemployment trends 2017 - 2021)!

- All yours in 3 business days!

Short-Term Rental Data

Short-Term Rental Data

-

Quick Links

Annual Airbnb Revenue In Ho Chi Minh City Vietnam

Ho Chi Minh City| Airbnb Market Data & Overview | Vietnam Ho Chi Minh City Airbnb Market Data & OverviewVietnam Is it profitable to do …

Reglas Airbnb en Cordoba

Si es que deseas comprar inversiones inmobiliarias en España, el primer paso que debes realizar es conocer más a fondo las reglas de Airbnb! En …

Airbnb Rules in Southampton

If you are looking to buy investment properties in the UK, knowing the Airbnb rules in your preferred city is the first step! In this …

Annual Airbnb Revenue in Haslett michigan, USA

Haslett, Michigan| Airbnb Market Data & Overview | USA Haslett, Michigan Airbnb Market Data & Overview USA Is it profitable to do Airbnb in Haslett, …

Annual Airbnb Revenue in Lewiston maine, USA

Lewiston, Maine| Airbnb Market Data & Overview | USA Lewiston, Maine Airbnb Market Data & Overview USA Is it profitable to do Airbnb in Lewiston, …

Subarrendamiento en Airbnb en Alicante

Estas interesado en conseguir la independencia financiera por medio de un ingreso pasivo? Te damos un aviso: no necesitas ser dueño de una propiedad como …