Short-Term Rental Insurance

Is it worth it?

Buying a short-term rental property can be a lucrative option, as it gives you the benefit of owning a residential property with a high return, just like running a business. What stops most people from starting an Airbnb hosting business is the “what ifs.” What if guests fire my home? What if guests don’t leave the property? There are many other ifs.

Don’t worry! Just like running any other business, there are ways for you to protect yourself from a huge liability in the worst-case scenario. Yes, short-term Rental insurance is more expensive than traditional property insurance. Roughly 30-60% more expensive. However, it provides much better coverage for short-term rental-specific liability issues.

🏡 Short-term rental insurance vs traditional property insurance

If your home is often shared by guests, there is a good chance any claims you make to your traditional property insurance company will be rejected. That’s the primary reason you should consider STR insurance if you are doing this. Next, the two most important aspects the STR insurance will cover are guest liability and home damage.

Guest liability: Consider this case: your guest stayed at your home, fell down a staircase, and sued you. This won’t be covered by traditional insurance but Airbnb insurance will do.

Home Damage: Unpredictable events like natural disasters and fires will be covered by Airbnb insurance as well.

Other than these, some providers will cover various issues, such as squatters, business revenue, pest infestation, and so on.

⚖️ Which insurance do you recommend?

If you already have property insurance and like it, call them first. There is a good chance that they also have STR insurance and will upgrade your plan to cover guest liability and other STR-specific issues. Here are some insurance that’s often used by hosts we are working with.

Proper Insurance

Their main business focus is short-term rental insurance, which makes them stand out among others. They even have a special program for “rental arbitrage business owners,” which shows their willingness to work with short-term rental-specific cases.

Safely

Is another short-term rental focus insurance company. They have covered over $60 billion worth of liability since 2015.

USAA

CBIZ

📈Are you starting an Airbnb hosting?

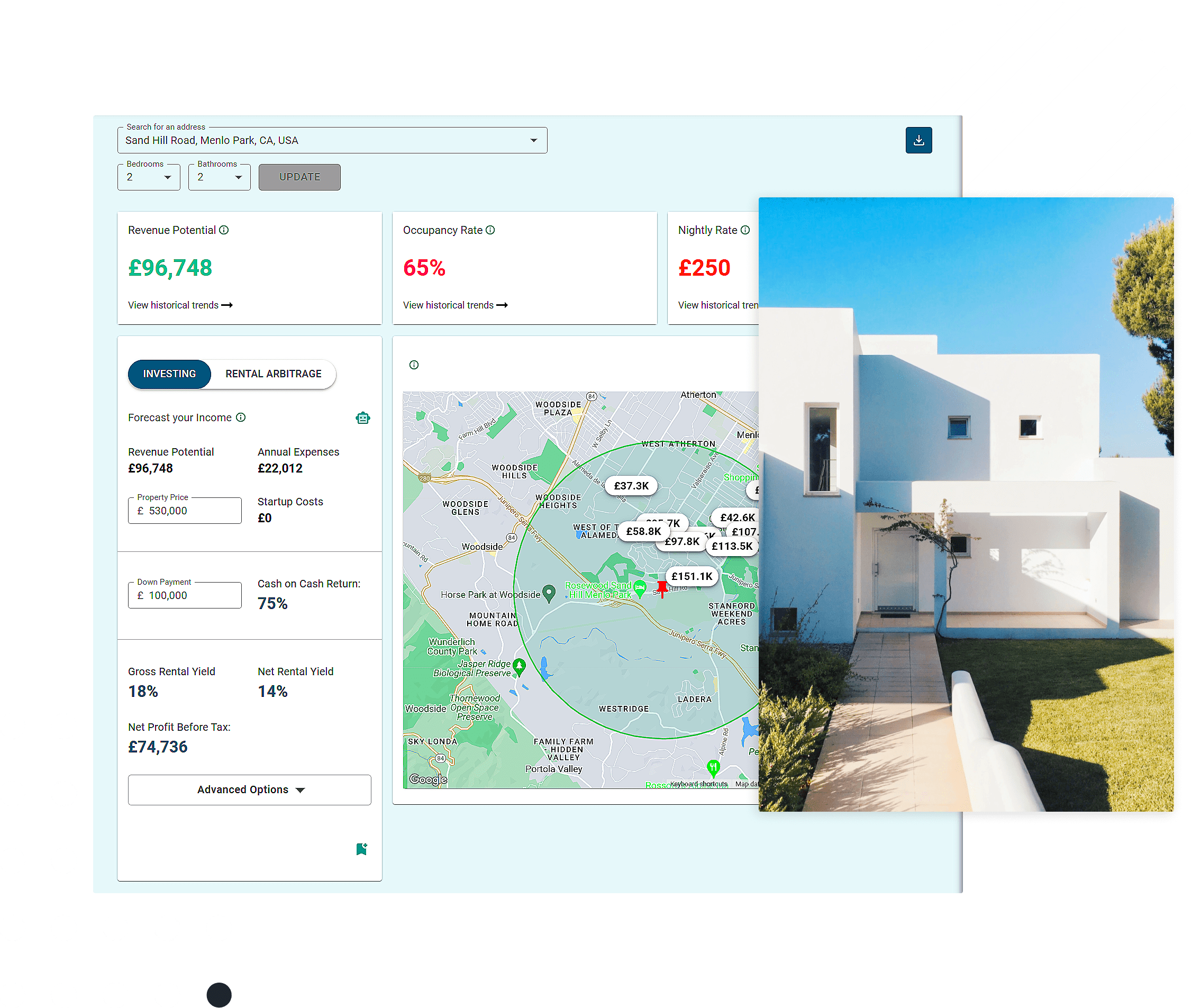

Find out how much you can make on Airbnb with our free Airbnb calculator.

Airbnb Calculator

Instantly see your Airbnb’s estimated revenue with the leading Airbnb profit calculator in the short-term rental industry. Discover your Airbnb earnings potential.